Tracking superstar investors’ portfolio changes provides investors with useful clues about market trends and potential investment strategies. Their stock and sector choices tell us where they are optimistic or cautious, helping other investors decide on their approaches.

Some superstars see their net worth fall after Q4FY24

Previously, we looked at the key superstar buys in Q4FY24. Now, let's analyse their sells. Most superstars went on a selling spree this quarter as markets grew volatile. The chart shows their biggest sells during this period.

Biggest sells by superstars in Q4FY24

RARE Enterprises adjusts holdings in key sectors

Rakesh Jhunjhunwala’s portfolio, currently managed by Rekha Jhunjhunwala and investment firm RARE Enterprises, reduced stakes in multiple companies in Q4FY24. The portfolio’s net worth fell 9.5% to Rs 46,822.89 crore after Q4FY24.

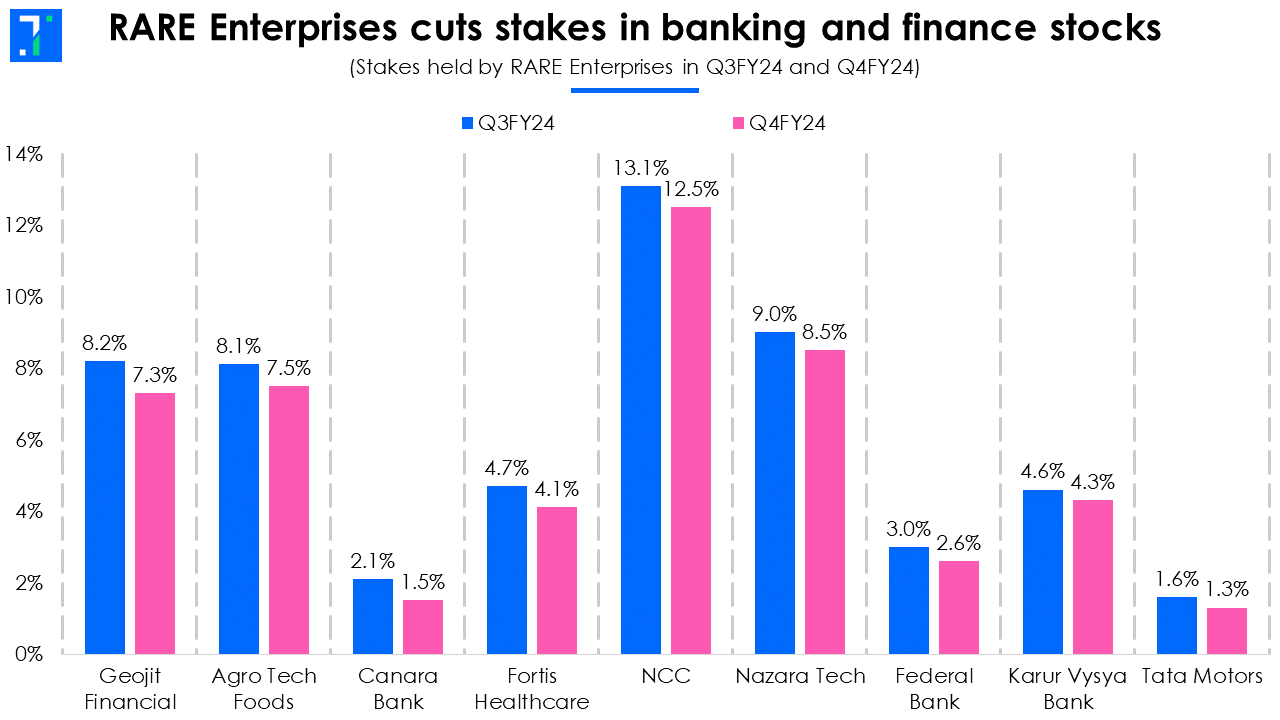

RARE Enterprises cuts stakes in banking and finance stocks

In the January-March quarter, the late big bull’s portfolio cut a 0.9% stake in capital markets company Geojit Financial Services. Its share price rose by 139.1% in the past year, underperforming its industry by 31.6 percentage points. RARE now holds a 7.3% stake in the firm. RARE also reduced stakes in bank stocks — Canara Bank, Federal Bank, and Karur Vysya Bank by 0.6%, 0.4%, and 0.3% respectively.

RARE Enterprises cut a 0.6% stake each in construction company NCC, edible oils maker Agro Tech Foods, and healthcare facilities firm Fortis Healthcare in Q4FY24, reducing its holding to 12.5%, 7.5%, and 4.1% respectively. It also sold a 0.5% stake in internet software company Nazara Technologies, and 0.3% in cars & utility vehicles maker Tata Motors.

During Q4, Jhunjhunwala’s portfolio also trimmed its stake in Tata Communications by 0.3%. It now holds a 1.6% stake in the telecom services company. It cut a 0.2% stake in pharmaceuticals company Wockhardt, taking the holding to 1.9%. It also reduced its holding in other industrial goods firm Raghav Productivity Enhancers to 5.1% during the quarter.

Ashish Kacholia cuts stakes in four small-cap companies to below 1%

Ashish Kacholia’s net worth rose by 2.4% to Rs 2,991 crore after Q4FY24. He reduced his stakes in Likhitha Infrastructure to below 1% from 1.8% in Q3FY24. The construction & engineering company’s share price rose by 20.4% in the past year underperforming its industry by 59.6 percentage points.

In addition, Kacholia cut his stake in La Opala RG (houseware company) and Best Agrolife (agrochemicals company) to below 1% from previous stakes of 1.7% and 1.4% in Q3. La Opala RG and Best Agrolife fell by 14.8% and 46% over the past year. Kacholia also cut stake in packaged foods manufacturer ADF Foods to below 1%.

Kacholia cuts stakes in four companies to below 1%

The ace investor also sold 0.9% of his stake in Shankara Building Products, leaving him with a 1.1% holding in the iron and steel company. He reduced his stake in Garware Hi-Tech Films, a containers and packaging company, to 3.4%. He also sold a 0.4% stake in Repro India (publishing) and a 0.3% stake in Genesys International Corp (IT consulting and software), now holding 2.8% and 1.3%.

Kacholia sold a 0.2% stake each in Universal Autofoundry (auto parts manufacturer), Ador Welding (industrial goods), Xpro India (containers and packaging company), and Safari Industries (apparel and accessories). He now holds 8.3%, 4.2%, 3.7%, and 1.9%, respectively, in them. He reduced his stakes in apparel and accessories company Vaibhav Global to 1.1%, specialty retail company Aditya Vision to 1.9%, and education company NIIT Learning Systems to 2.1%.

In H2FY24, Kacholia sold a 2.8% stake in Virtuoso Optoelectronics. He now holds 2.6% in the consumer durables firm.

Sunil Singhania’s Abakkus Fund goes on a selling spree in Q4

Sunil Singhania’s Abakkus Fund saw its net worth fall -5.3% to Rs 2,680.9 crore after Q4FY24. The fund reduced its stake in Dreamfolks Services to below 1% during the quarter, after holding a 1.5% stake in the travel support services company in Q3FY24. Its share price rose by 20.9% over the past year underperforming its industry by 49.4 percentage points. It also cut its stake in AGI Greenpac and CMS Info Systems to below 1%. It held 1.1% in the containers and packaging firm and 1% in the financial services company in Q3FY24. Their prices increased by 43.8% and 37.7% over the past year.

Singhania trims stakes three companies to below 1%

Singhania’s fund also trimmed its stake in Siyaram Silk Mills by 0.2%, now holding 1.6% of the textile company. It sold a 0.14% stake in Route Mobile and now holds 2.44% in the internet software and services company.

Abakkus cut 0.1% each in Carysil (household products manufacturer), Mastek (IT consulting firm), and DCM Shriram Industries (sugar producer). It now holds 5.8%, 3.1%, and 2.9%, respectively. It also reduced its stake in Sarda Energy & Minerals and Ion Exchange (India). It now holds 2.1% in the iron and steel products manufacturer and 2% in the utilities company.

Vijay Kedia cuts stakes in four companies

Vijay Kedia’s net worth has risen 30.5% to Rs 1,622 crore. In Q4, he slashed his stake in Neuland Laboratories by 0.2% and now holds 1.1% in the pharma company. The company's share price rose by 262.9% in the past year outperforming its industry by 199.5 percentage points. He also sold a 0.13% stake in Elecon Engineering during Q4FY24. He now holds a 1.34% stake in the industrial machinery company.

Kedia sells stakes in Neuland Labs, Om Infra, Elecon Engineering

Kedia also cut his stake in Om Infra to 2.5% by selling a 0.1% stake in the construction and engineering company. He sold a 0.1% stake in Siyaram Silk Mills and now holds 1% in the textiles firm.

Dolly Khanna cuts stakes in two companies to below 1%

Dolly Khanna reduced her holdings in multiple companies in Q4FY24, including two where her stakes fell below 1%. Her net worth has increased by 10.7% to Rs 543.1 crore since the end of Q4FY24. During the quarter, she reduced her stakes in KCP (a cement & cement products manufacturer) and Simran Farms to below 1%, from the 1.1% and 1% held in Q3. This marks the fifth consecutive quarter where she has reduced her stake in the packaged foods company. Over the past year, KCP has risen by 56.6%, underperforming its industry by 24.3 percentage points.

Dolly Khanna pares stakes in multiple companies

The ace investor cut a 1.1% stake in Pondy Oxides & Chemicals and now holds 1.3% in the non-ferrous metals company. She had a 2.4% stake in Q3. Khanna also trimmed her stake in plastic products company Prakash Pipes by 0.27% to take her holding to 2.87%. She sold a 0.2% stake in Chennai Petroleum Corp and currently holds 1.1% in the refineries/ petro-products company.

The investor also reduced her holding in textiles company Deepak Spinners to 1.77% during the quarter.

Mohnish Pabrai reduces stakes in three mid-cap companies

Mohnish Pabrai’s net worth fell by 54.5% to Rs 483.1 crore after Q4FY24. During the quarter, he reduced his holding in Rain Industries to below 1%, from 4.4% in Q3. The petrochemical company’s share price has risen by 6.3% over the past year but underperformed its industry by 46.3 percentage points.

Pabrai cuts stakes in three companies

Pabrai cut his stake in Sunteck Realty by 4.5% during the quarter. He now holds a 2.2% stake in the realty company. He also reduced his stake in Edelweiss Financial Services to 5.1% by selling a 2.6% stake in the financial services provider.

Porinju Veliyath cuts stakes in three companies

Porinju V Veliyath’s net worth increased by 17.3% to Rs 224.2 crore after Q4FY24. During the quarter, he reduced his stakes in three companies, with holdings in one dropping below 1%.

Porinju cuts stakes in Arrow Greentech, Duroply, RPSG Ventures

Porinju also cut his stake in Arrow Greentech to below 1%. Porinju had added the company to his portfolio in Q2FY24, buying 1.1%. The company’s share price has risen by 93.5% over the past year outperforming its industry by 22 percentage points.

The ace investor also sold a 0.91% stake in forest products company Duroply Industries, taking his holding to 5.54%. During the quarter, he cut a 0.2% stake in RPSG Ventures and now holds 1.4% in the IT consulting & software company.