By Abhiraj PanchalThe top three companies by market cap in the US - Apple, Microsoft and Alphabet - were all started by first-generation entrepreneurs. In India however, two of the top three companies by market cap - Reliance and TCS - are part of family conglomerates. This pattern continues as we go down the list of Indian businesses.

Tata, Birla and Ambani are well-known names and family-run Indian conglomerates with a significant share of the economy. But do these family-owned businesses do better or worse than average, in financial performance? Do companies whose top management are all in the family, see different outcomes?

Here we take a look at India’s largest family-run businesses, and how they perform compared to the overall industry.

To do this comparison, we looked at the Return on Capital Employed (ROCE). The ROCE is a ratio used to evaluate a company’s capital efficiency and profitability, is an effective parameter to compare the performance of companies. It helps us understand how good a company is at generating profits from its capital.

Investors prefer stocks with stable and rising ROCE (above 20%) over stocks with weak and volatile ROCE (below 10%). Another advantage with the ROCE ratio is that unlike return on equity (ROE), which analyses only profitability on equity, it considers debt along with equity. The companies in focus are capital-intensive and ROCE therefore, offers better insights.

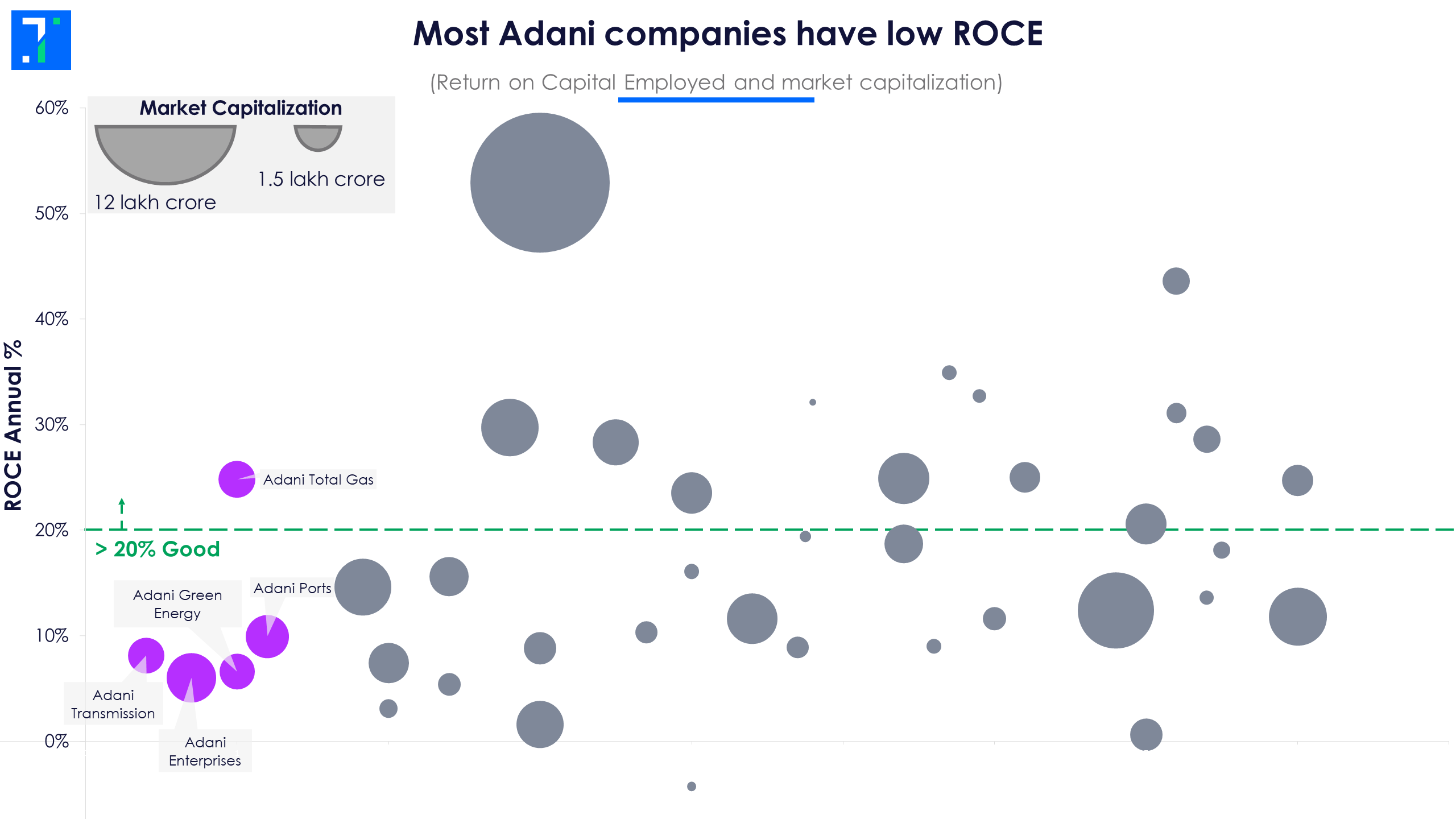

The chart above depicts the ROCE percentage on the Y-axis. The bubble size is linked to the market cap of the company. Five major companies from each family group have been chosen and analysed. 20% ROCE, which is considered a good ratio, has been highlighted on the chart so that we can see which companies perform better or worse.

We also checked how family groups perform as compared to their sector’s average ROCE.

Fertilizers, software and services and FMCG are among the sectors with strong ROCE ratios.

Murugappa Group companies log high ROCE

Murugappa Group, founded in 1900, has a presence in auto, sugar, fertilizers, etc. The Tamil Nadu based group is headed by M M Murugappan and currently has the fourth generation of the Murugappa family on the board.

Most companies in the group, except for Carborundum Universal (18.1%), have very strong returns. Companies with high returns are Cholamandalam Investment & Finance (24.7%), Tube Investments of India (28.6%) and CG Power and Industrial Solutions (43.6%). All three companies have also outperformed their respective sectors by a minimum of 15%. Coromandel International has a high ROCE of 31.1% but did not outperform the fertilizer sector.

Adani Group struggles in ROCE, Adani Total Gas is the outlier

Founded by Gautam Adani in 1988 for trading commodities, the Adani Group has over the decades, turned into a multinational conglomerate involving multiple businesses. Their meteoric rise has been attributed to the rapid increase in debt the group has taken on, and their closeness to the current government. However, the recent Adani-Hindenburg row made investors cautious about the group.

As seen in the chart, four of the top five companies have weak ROCE values and underperform their respective sectors. Adani Total Gas is the only company with a high ROCE of 24.8%, and that has outperformed its sector, utilities (by 12.1%). Adani Enterprises, Adani Ports & Special Economic Zone, Adani Transmission and Adani Green Energy have ROCE lower than 10%.

Aditya Birla Group: UltraTech Cement, Aditya Birla Sun Life outperform sector ROCE

Aditya Birla group, founded by Seth Shiv Narayan Birla in 1857, is currently chaired by Kumar Mangalam Birla. The group is engaged in sectors like metals, cement and telecom. The major five stocks under the Birla Group have ROCE on the lower spectrum. Hindalco and UltraTech Cement have fairly high returns of 15.6% and 14.6% respectively. UltraTech’s ROCE has outperformed the cement and construction sector by 1.8%.

Aditya Birla Sun Life AMC, which is not in the top five companies in terms of market cap, outperformed its sector with a strong ROCE of 39.4%.

Tata Group performs better than its sectors

Established by Jamsetji Tata in 1868, Tata group is India's largest conglomerate. It is currently looked after by the parent company, Tata Sons. Key people in Tata Sons are Ratan Tata and Natarajan Chandrasekaran, among others.

With strong returns, three of the top five companies in the Tata group have outperformed their respective sectors. Tata Consultancy Services, an IT behemoth, has a ROCE of 52.9%, higher than its sector’s 37.6%, which in itself is a strong percentage. Titan and Tata Steel also have high returns of 29.7% and 28.3% respectively, whereas Tata Motors’s is very low at 1.6%.

Mahindra Group’s Mahindra Lifespace Developers has negative ROCE

Mahindra & Mahindra, incorporated as Mahindra & Mohammed in 1945 by Jagdish Chandra Mahindra and Kailash Chandra Mahindra, is currently chaired by Anand Mahindra. Besides auto, the Mahindra group is also engaged in IT and finance businesses. Mahindra & Mahindra, Mahindra & Mahindra Financial Services and Mahindra CIE Automotivehave returns above 10% but below 20%.

Tech Mahindra has a strong ROCE of 23.5%, yet underperformed the software and services sector by 14.1%. On the other hand, Mahindra Lifespace Developers has a negative ROCE of -4.3%, even though it has a positive ROE of 8.6%. The company logged below zero returns on capital as it had negative EBIT for the past three years.

Most stocks from the Godrej Group underperform their sectors

Godrej Group was founded by Ardeshir Godrej and Pirojsha Burjorji Godrej in 1897. Its current chairman is Adi Godrej. Only one of the listed companies in the group - Astec Lifesciences - has outperformed its respective sector with strong returns. The other four have returns lower than 20%. The only stock with a high ROCE is Astec Lifesciences (32.1%), a chemicals manufacturer, and it has outperformed its sector by 9.1%. Godrej Agrovet and Godrej Consumer Products come close to the 20% mark with 19.4% and 18.7% respectively.

Most companies in the Jindal Group have strong returns

The Jindal group was founded in 1952 by B C Jindal for the manufacture of steel pipes and pipe fittings. Since then, it has diversified into packaging films, power generation, etc. Most companies under Jindal have strong returns. JSW Steel, Jindal Steel & Power, Jindal Stainless and Jindal Stainless (Hisar) stand at 24.9%, 25%, 34.9% and 32.7% respectively. But only the latter two have outperformed the metal and mining sector (26.9%). JSW Energy has a ROCE of 11.6%.

Bajaj Group’s Bajaj Auto manages to make the cut above 20%

Bajaj Group, founded by Jamnalal Bajaj in 1926, is currently headed by Niraj Bajaj, Rahul Bajaj and Madhur Bajaj, among others. The group is involved in automobiles, home appliances, insurance, travel and finance. Three of its top five companies have outperformed their sectors.

Bajaj Auto is the only stock that managed to cross the 20% ROCE threshold. It also outperformed the auto sector by 7%. Bajaj Finance (12.4%) and Bajaj Finserv (11.8%) did better than their sectors by 3.9% and 2% respectively. Bajaj Holdings & Investment has a very low ROCE of 0.6%.

Murugappa Group performs better than other family conglomerates

Among all the groups in focus, Murugappa Group has performed the best in terms of ROCE with most of its companies logging high returns on capital, and also outperforming their sectors. Among the rest, Tata and Jindal group companies have stronger returns on capital, unlike Birla. Adani, Godrej, Mahindra and Bajaj.