SYNCOM FORMULATIONS (INDIA) LTD.-$ - 524470 - Pursuant To The Regulation 30 Of SEBI (LODR) Regulations, …

PTC INDIA LTD. - 532524 - Announcement under Regulation 30 (LODR)-Change in Directorate

Industrial companies are not a much talked about sector - but there are signs that it came out of the shadows in FY23. The S&P BSE Industrials index has been steadily growing, despite ongoing economic setbacks since 2020. Its growth story gained momentum in early 2021, and the index has more than doubled since then.

Over the past year, it has ranked among the top five outperformers and surpassed benchmark returns in the past quarter.

What changed the game? Consecutive hikes in capex budgets made by the Centre to spur post-Covid growth has played a key role. The private sector also joined the party in 2022. Companies in the metals, cement and energy sectors unveiled fresh investment plans, sensing robust demand from the infrastructure space.

India’s #capex cycle is led strongly by the central govt, pvt sector following selectively and states yet to join, Siemens India MD & CEO Sunil Mathur tells @latha_venkatesh. Here’s more on Siemens’ stellar results in the March qtr and the #India capex story. (1/2) pic.twitter.com/yQSlZtys1u

— CNBC-TV18 (@CNBCTV18News) May 16, 2023

Fueled by this positive momentum, FY23 proved to be a landmark year for the capital goods sector and the electrical equipment industry. Notably, heavy electrical equipment is the largest sub-sector within capital goods, and will be our main focus area here.

Companies in this industry manufacture equipment ranging from motors, drives, turbines, generators, compressors, waste heat recovery plants, transformers, switchgears, boilers, and chillers. Most players in this industry saw record order inflows and a robust pace of execution in FY23. The cooling off in commodity prices was the icing on the cake.

But will this growth juggernaut continue to roll in FY24?

Electrical goods makers post an impressive performance in Q4FY23

Players clocked over 15% revenue growth in Q4 across the board, driven by a strong pace in order book execution. Triveni Turbine, a relatively smaller player, grew the fastest among the pack, led by robust momentum in its exports market and aftermarket sales.

Companies following the Indian fiscal year - CG Power, Thermax and Triveni - closed the financial year with robust top-line growth of more than 25%. Triveni, a manufacturer of steam turbines, outshined others on this count yet again.

Electrical goods manufacturers also saw their EBITDA margins improve YoY in Q4, led by lower input costs, operating efficiencies and better price realizations. CG Power stood out with a margin uptick of over 3.5 percentage points, the highest among its peers. This margin expansion enabled companies to register over 30% growth in their quarterly EBITDA.

Domestic growth takes the lead, exports business stays muted

Domestic markets have been the primary growth driver for equipment makers in both Q4 and FY23. Apart from Triveni, other players generated less than 25%-26% of their sales from exports, indicating a relatively small portion of their business.

Commenting on the company’s export segment, Ashish Bhandari, Managing Director at Thermax, said, “The overall export piece has been soft for some time. For whatever reason, even on the large projects, we have seen a bit of a slowdown.”

The subdued growth in exports may have a deeper reason beyond just a demand slowdown. For instance, consider India’s market share in global electrical machinery and electronics exports. It has stayed largely flat between 2011 and 2021. In contrast, Vietnam has won nearly 4% share and became the sixth largest exporter in just 10 years.

Interestingly, India has gained market share in segments like electrical gensets, electrical ignitions, steam turbines, and power transmission equipment. But overall progress has been limited, highlighting our poor competitiveness on the international stage.

Factors like slower customs clearance, higher import duties on components, lack of deep-sea ports, and products not meeting international standards are working against us.

Take the case of higher duties on parts used in mobile phones. According to a report from India Cellular and Electronics Association, the Centre increased duties on circuit boards, camera modules and connectors to 2.5% from 0% in the FY22 budget. Such a step increases the cost of production for companies and hampers their prospects in the export market.

Rail and metro projects propel order inflows for big players in Q4

In terms of order inflows, Siemens stole the show by winning a large multi-year contract of Rs 25,460 crore to make electric locomotives for the Indian Railways. Even after adjusting for this contract, Siemens’ orders grew by a commendable 8% in Q4FY23.

According to Roland Busch, President at Siemens AG, Siemens India will continue to bid aggressively for railway tenders in the near future. The company’s mobility division (which houses its rail business) has expanded rapidly in the past couple of quarters. Given the company’s goals, this segment does hold a lot of growth potential.

Another major player, ABB India, saw strong growth of over 35% in its Q4 order inflows. The orders were mostly for the short-cycle business, with strong contributions from ABB’s electrification and motion segments. Notably, order wins from railways and metro segments propelled the overall growth within the motion segment.

Among the top players, only Thermax saw a fall in Q4 order bookings due to a slowdown in the oil refining and petrochemicals sectors. However, the company anticipates a gradual recovery in the order pipeline for waste heat recovery and biomass projects.

Equipment makers upbeat about Centre’s infra push and rise of new-age sectors

Companies are optimistic about the demand prospects in India. Roland Busch, President at Siemens AG, sees India as the multinational’s fastest-growing market. Themes like de-carbonization, energy efficiency, and digitalization are emerging as key growth drivers.

Regarding the de-carbonization theme, Busch explained, “Going renewable means you have to invest in transmission and distribution grids, but you want to do it in a smart way so that they can manage the peak demand well. This is where Siemens is a market leader; we help in automating such grids.”

The management of ABB India sees the call for energy efficiency as a big growth driver. Sanjeev Sharma, Country Managing Director at ABB, in a recent earnings call, said, “New buildings and hotels which are coming up are demanding our building management system. The system allows you to reduce 25% to 35% of your energy footprint.”

Equipment makers foresee a good pipeline in new-age industries like data centres, logistics and electric vehicles. ABB offers robotic solutions for EV manufacturing and identifies this as a high-growth area. CG Power also aims to leverage this opportunity by doubling its motors capacity in the next 2-3 years with a special focus on EVs and exports.

Additionally, the Centre’s infrastructure push will drive demand in core industries like metals and cement. Thermax and Triveni Turbine expect healthy order inflows for waste heat recovery systems from the upcoming steel and cement capacities.

Railways also hold importance in the infrastructure plan, with many electrification and signaling projects underway. These projects can bolster the order books of Siemens, ABB and CG Power.

Robust growth to continue in FY24, but is it worth the price?

Given the encouraging demand trends, Analysts anticipate top electrical equipment manufacturers to achieve strong double-digit topline growth. They also expect a slight moderation in growth due to the high base of FY23.

Of the players with Indian promoters, Triveni may grow the fastest in FY24. For the Indian arms of foreign MNCs, Siemens may outpace ABB India. But the key concern lies in the high valuations of these stocks. The industry itself now trades at a whopping PE multiple of 70X, and none of the key stocks are in the buy zone currently. Investors should ideally wait for good entry points.

The heavy electrical industry is closely tied to the growth in domestic manufacturing and capital investments. As the current government accelerates spending in the last year of its term, this industry is set to continue its stellar run.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.

Trendlyne Analysis

Nifty 50 closed at 18,069.00 (-186.8, -1.0%), BSE Sensex closed at 61,054.29 (-695.0, -1.1%) while the broader Nifty 500 closed at 15,278.60 (-126.9, -0.8%). Of the 1,943 stocks traded today, 657 showed gains, and 1,223 showed losses.

Indian indices extended their losses and closed over 1% lower, with the volatility index, India VIX, rising by over 5%. However, the benchmark Nifty 50 index rose 0.8% in the past week. United Breweries fell over 2% after its Q4 net profit fell 94% YoY to Rs 981 crore.

Nifty Midcap 100 and Nifty Smallcap 100 closed in the red, following the benchmark index. However, Nifty Auto and Nifty FMCG closed higher than their Thursday levels. According to Trendlyne’s sector dashboard, telecommunications equipment was the top-performing sector of the day and also the week.

European indices traded in the green, taking cues from the US indices futures, which also traded higher. Major Asian indices closed higher, except for India’s BSE Sensex and China’s Shanghai SE Composite Index, which closed in the red. Brent crude oil futures traded over 1.5% higher but crude oil prices are still down 8% in the past week.

Federal Bank sees a short buildup in its May 25 future series as its open interest rises 61.2% with a put-call ratio of 0.44.

Mahindra & Mahindra Financial Services touches its 52-week high of Rs 289.2 today. It has risen over 20% in the past month. The company features in a screener of stocks where brokers have upgraded their recommendations or target prices in the past three months.

Symphony is falling as its Q4FY23 net profit plunges by 74.6% YoY to Rs 16 crore and its revenue drops by 19.8% YoY due to a 22% YoY decline in the air-cooling segment. The stock shows up in a screener for companies with decreasing cash flows from operations over the past two years.

Cholamandalam Financial Holdings and Sapphire Foods India rise 20.7% and 10.1% over the past week, ahead of their results on May 12.

KFIN Technologies is plunging as its revenue declines by 2.7% QoQ to Rs 183.1 crore in Q4FY23. However, its EBIDTA margin improves by 290 bps QoQ, aiding the net profit to grow 6.8% QoQ. The company shows up in a screener of stocks with increasing net profit and profit margin (YoY).

Telecommunications equipment, hotels, restaurants & tourism, forest materials and commercial services & supplies sectors rise more than 4% in the past week.

Federal Bank is plunging despite its net profit growing by 67% YoY to Rs 902.6 crore in Q4FY23. Its asset quality improves as gross and net NPAs decline by 44 bps YoY and 27 bps YoY. However, the bank witnesses a 55% YoY increase in provisions.

NMDC, HDFC Bank, Dabur India, IndusInd Bank and United Breweries are trading below their third support or S3 level.

Bharat Forge is falling as its Q4FY23 net profit declines 42.5% YoY due to higher raw material costs, finance costs and other expenses. Its revenue marginally rises by 1.6% YoY. The stock shows up in a screener for companies with declining cash flows from operations over the past two years.

According to reports, one of Spicejet’s lessors, Aircastle, files a case at the National Company Law Tribunal (NCLT) to initiate an insolvency process against the airline for non-payment of dues. The first hearing of this case is set to take place on Monday at the Delhi bench of NCLT.

Securities and Exchange Board of India (SEBI) plans to issue directives to brokers and mutual funds to limit the use of financial influencers in their advertising and marketing campaigns, according to reports. SEBI is worried about the rise in influencers sharing financial advice on social media, which could mislead retail investors.

- Mohit Malhotra, CEO of Dabur India, says the company aims to achieve an EBITDA margin of around 19-19.5% in FY24. He adds that Dabur's revenue growth could be in the low double-digit.

#OnCNBCTV18 | #FY24 volume growth seen in mid-high single digit. EBITDA margin will be in the range of 19-19.5%. Expect low double-digit value growth next year, says Mohit Malhotra of #Daburpic.twitter.com/kk2k7hua28

— CNBC-TV18 (@CNBCTV18Live) May 5, 2023 Manappuram Finance's Managing Director VP Nandakumar, in a statement today, clarifies that the ED probe is not related to the company but a now non-existent private entity called Manappuram Agro Farms. The enforcement actions are against the promoter and not the company, he adds.

KRChoksey maintains its ‘Buy’ rating on Kotak Mahindra Bank with a target price of Rs 2,330. This implies an upside of 19%. The brokerage remains positive about the bank’s prospects due to its improving asset quality, strong brand value, healthy credit growth and rising market share. It expects the company’s net profit to grow at a CAGR of 12.7% over FY23-25.

United Breweries is falling as its net profit declines 94% YoY to Rs 981 crore in Q4FY23. The rise in employee benefits expense, cost of raw materials and other expenses has caused the EBITDA margin to plunge by 5.9 percentage points YoY to 1.6%. The company features in a screener of stocks with declining profits for the past three quarters.

Media stocks like Zee Entertainment Enterprises, Sun TV Network, PVR and Network 18 Media & Investment are falling in trade. The broader sectoral index Nifty Media is also trading in the red.

R Dilip Kumar, CFO of Sundram Fasteners, says the company targets to improve its margin to 17% in FY24. He adds that it expects to generate 15% revenue from the EV segment.

ET NOW Exclusive | Sundram Fasteners' growth roadmap

— ET NOW (@ETNOWlive) May 5, 2023

What are the numbers it is targetting for FY24? How are exports, margins & capex likely to pan out for the company?

R Dilip Kumar, the CFO of the co, speaks on their performance & outlook @_anishaj#SundramFastenerspic.twitter.com/0G79KMTCUkJammu & Kashmir Bank's Q4FY23 profit rises 297.7% YoY to Rs 472.6 crore, aided by good recoveries. Its revenue also increases by 21.2% YoY. The bank shows up on a screener of stocks with low debt.

Blue Star is rising as its Q4FY23 net profit nearly triples YoY to Rs 225.3 crore, aided by realising a gain of Rs 170.8 crore from the sale of land. Revenue also increases by 16.7% YoY, driven by growth across all its business segments. The company’s board has approved the issue of bonus equity shares in the ratio of 1:1.

Apollo Tyres, Castrol India and Westlife Foodworld's weekly average delivery volumes rise ahead of their Q4FY23 results on Tuesday

Tech Mahindra acquires an additional 29% stake in Tech Mahindra Arabia, its joint venture with Midad, for a cash consideration of $11.1 million ( approximately Rs 90.7 crore). TechM now holds an 80% stake in TechM Arabia, while Midad holds 20%.

- Anant Goenka, Vice Chairman of Ceat, says the company targets to generate 25-30% of revenue from the international market in the near term. He adds that Ceat plans to improve growth in the two-wheeler and PV segments.

LIVE | Ceat posts five-fold jump in profit in Q4

— ET NOW (@ETNOWlive) May 5, 2023

Anant Goenka, the Vice Chairman of the company speaks about the quarterly results, investment roadmap and more @nikunjdalmia@AyeshaFaridi1@_anishaj@CEATtyreshttps://t.co/trir1np4UE Manappuram Finance falls as the Directorate of Enforcement freezes assets worth Rs 143 crore of its Managing Director VP Nandakumar under the Prevention of Money Laundering Act, 2002. The assets include 19 crore equity shares in the company.

Adani Enterprises' Q4FY23 profit rises 137.4% YoY to Rs 722.5 crore. Its revenue also grows 26.2% YoY on the back of positive performance by the integrated resources management and airports business segments. The company shows up in a screener for stocks with consistently high returns over five years.

Hero MotoCorp is rising as its net profit improves by 37% YoY to Rs 859 crore in Q4FY23. Its revenue also grows by 12% YoY on the back of improvement in volume sold during the quarter. The company shows up in a screener of stocks with increasing profit for the past three years.

Macquarie maintains its ‘Outperform’ rating on TVS Motor with a target price of Rs 1,354. The brokerage says the company is its top pick in the two-wheeler space. It also raises PAT estimates for FY24E to 5%.

Brokerage Radar | @Macquarie on @tvsmotorcompany: Maintain Outperform; EBITDA beat led by better-than-expected margins #Macquarie#TVSMotor#StockMarketpic.twitter.com/pZ638EAniu

— ET NOW (@ETNOWlive) May 5, 2023TVS Motor Co is rising as its consolidated Q4FY23 net profit increases 21.1% YoY to Rs 336.1 crore, and its revenue grows by 22% YoY. The healthy performance is driven by a premium product mix, falling commodity prices, and easing semiconductor supply constraints. The stock shows up in a screener for companies with consistently high returns over the past five years.

Tata Power’s Q4FY23 net profit rises 54.6% YoY to Rs 777.7 crore, aided by higher other income. Its revenue improves 4.1% YoY, with the transmission & distribution segment growing by 16.4% YoY. The stock shows up in a screener for companies with high TTM EPS growth.

Indian markets slumped today. Nifty 50 was trading at 18,153.35 (-102.5, -0.6%) , BSE Sensex was trading at 61,163.10 (-586.2, -1.0%) while the broader Nifty 500 was trading at 15,359.60 (-45.9, -0.3%)

Market breadth is highly positive. Of the 1,699 stocks traded today, 1,133 were in the positive territory and 475 were negative.

Riding High:

Largecap and midcap gainers today include Cholamandalam Investment & Finance Company Ltd. (991.85, 4.38%), TVS Motor Company Ltd. (1,214.95, 3.93%) and MRF Ltd. (9,8614.05, 3.68%).

Downers:

Largecap and midcap losers today include Federal Bank Ltd. (127.75, -8.36%), HDFC Bank Ltd. (1,625.65, -5.91%) and Housing Development Finance Corporation Ltd. (2,702.30, -5.58%).

Volume Shockers

24 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Restaurant Brands Asia Ltd. (107.95, 9.32%), ITI Ltd. (105.60, 8.64%) and Hitachi Energy India Ltd. (3,729.80, 7.60%).

Top high volume losers on BSE were Manappuram Finance Ltd. (105.55, -11.49%), Federal Bank Ltd. (127.75, -8.36%) and IndusInd Bank Ltd. (1,073.30, -5.40%).

HLE Glasscoat Ltd. (623.85, 4.49%) was trading at 18.1 times of weekly average. Happiest Minds Technologies Ltd. (871.45, 5.13%) and Symphony Ltd. (941.10, -5.27%) were trading with volumes 12.6 and 10.4 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

21 stocks overperformed with 52-week highs, while 3 stocks hit their 52-week lows.

Stocks touching their year highs included - Apollo Tyres Ltd. (368.90, 2.54%), Bharat Petroleum Corporation Ltd. (365.45, -0.79%) and Carborundum Universal Ltd. (1,100.25, -2.06%).

Stocks making new 52 weeks lows included - V-Mart Retail Ltd. (2,067.45, -1.26%) and TeamLease Services Ltd. (2,028.50, -2.79%).

14 stocks climbed above their 200 day SMA including ITI Ltd. (105.60, 8.64%) and HLE Glasscoat Ltd. (623.85, 4.49%). 15 stocks slipped below their 200 SMA including Manappuram Finance Ltd. (105.55, -11.49%) and IndusInd Bank Ltd. (1,073.30, -5.40%).

The textile industry in India has been overwhelmed in the past year with rising cotton prices, global retailers canceling orders as a result of stockpiling, and some importers facing a foreign exchange crisis. However, the industry rebounded in the past month on hopes of a recovery, posting gains of over 15%, led by Welspun India and Raymond. Corporate actions announced by these companies helped drive their stellar returns.

Welspun India share price today: Stock spurts 15 per cent as Street cheers buyback announcement | Welspun India Buyback Price 2023, Record Date, Dividend Announcement#Welspun#Buyback#Dividend#StockMarkethttps://t.co/jYo0kav9yZ

— ET NOW (@ETNOWlive) May 2, 2023

Since the start of FY23, the textiles industry has had to put out fires everywhere. For instance, you had a home goods giant like Bed, Bath & Beyond running into a cash crunch, before finally declaring bankruptcy. Egypt returned India’s yarn consignment due to a lack of dollars. But things are starting to look up again as cotton prices have corrected by close to 40% from their highs, and retailers are almost done with their destocking cycle.

The government is also taking structural initiatives to boost the industry through its mega textile parks scheme. The states of Tamil Nadu and UP have recently signed MoUs with the Centre to set up two of the seven sanctioned parks.

All talks nothing on ground.

— Mayur Kanth ???????? (@MayurKanth6) April 9, 2023

Vietnam and Bangladesh have beaten India in textile exports.

China does $260Billion+ of just textile exports Vs $30-35Billion of India.

Indian textile exports ARE STAGNANT since 2010.

Dipali Goenka, Managing Director at Welspun, is seeing green shoots of demand from big retailers, especially in the US. But is there a pan-India level recovery underway?

India’s readymade exports stay steady but yarn and fabric exports nosedive

India’s readymade garment (RMG) exports picked up during the holiday season in key markets from November 2022. However, RMG exports were almost flat in FY23. This is still encouraging for the Indian textile industry, given the global slowdown and shift in consumer focus towards necessities.

While the ready-to-wear category has cushioned the blow for the Indian textile industry, exports of cotton and man-made textiles, which include yarn, fabrics and made-ups, suffered a double-digit decline in FY23.

The effect of poor export demand was reflected in domestic production as well. Textile output remained in a slump throughout the past year, but apparel production picked up post November in tandem with the wedding season in India and festivities in the west, when everyone is doing their best to look good.

Commenting on the drop in cotton textile exports, Piyush Goyal, Minister of Commerce, India, said, “The rise in readymade garments and finished value-added products is really the strength that we want to encash. If at all the yarn export reduces, it’s a good sign.”

While it is a welcome change that India seeks to move higher in the value chain, the decline in yarn and fabric exports is significant, and Goyal’s spin hides some big problems. India is facing stiff competition in textiles from other Asian nations. A country which was second only to China a decade ago is now vying with Vietnam and Bangladesh for a higher share in the textile exports market. In fact, readymade exports have decreased by nearly 7% between FY17 and FY23, indicating that the industry is not making significant progress in this category either.

Vietnam and Bangladesh are racing past India in textile exports

Despite sluggish growth in world textile trade between 2011 and 2021, Vietnam and Bangladesh have emerged as the No. 2 and No. 3 exporters, respectively, leaving India behind.

Vietnam doubled its market share to 5% by 2021, while Bangladesh displaced India from its coveted position by gaining nearly 2% of the overall market.

Vietnam has a population of less than 100 million, while Bangladesh has 173 million. Whoever said that size matters most, has not taken a close look at the competition in the global textile market.

These countries owe their success to lower manufacturing costs from cheaper labor and power, ease of doing business and custom duty concessions. India’s higher cotton prices have also worked to their advantage.

In the earnings call of Q3FY23, the management of Vardhman Textiles noted that Vietnam was importing cotton and exporting the yarn in 2022, much to India’s detriment. India’s prices were trending much higher than the international levels.

Most textile players have blamed their slower growth in FY23 on the global downturn. This suggests an ostrich-like unwillingness to confront the problem – India’s biggest trading partners, the US and EU, actually registered healthy growth in their textile imports. Imports by the US rose 9.4% YoY in 12 months ending February 2023, and Vietnam and Bangladesh yet again grew their exports by over 20%.

But it’s not all gloom and doom. Recent results of big players suggest that some respite may finally be in sight.

Textile players post mixed results in Q4FY23

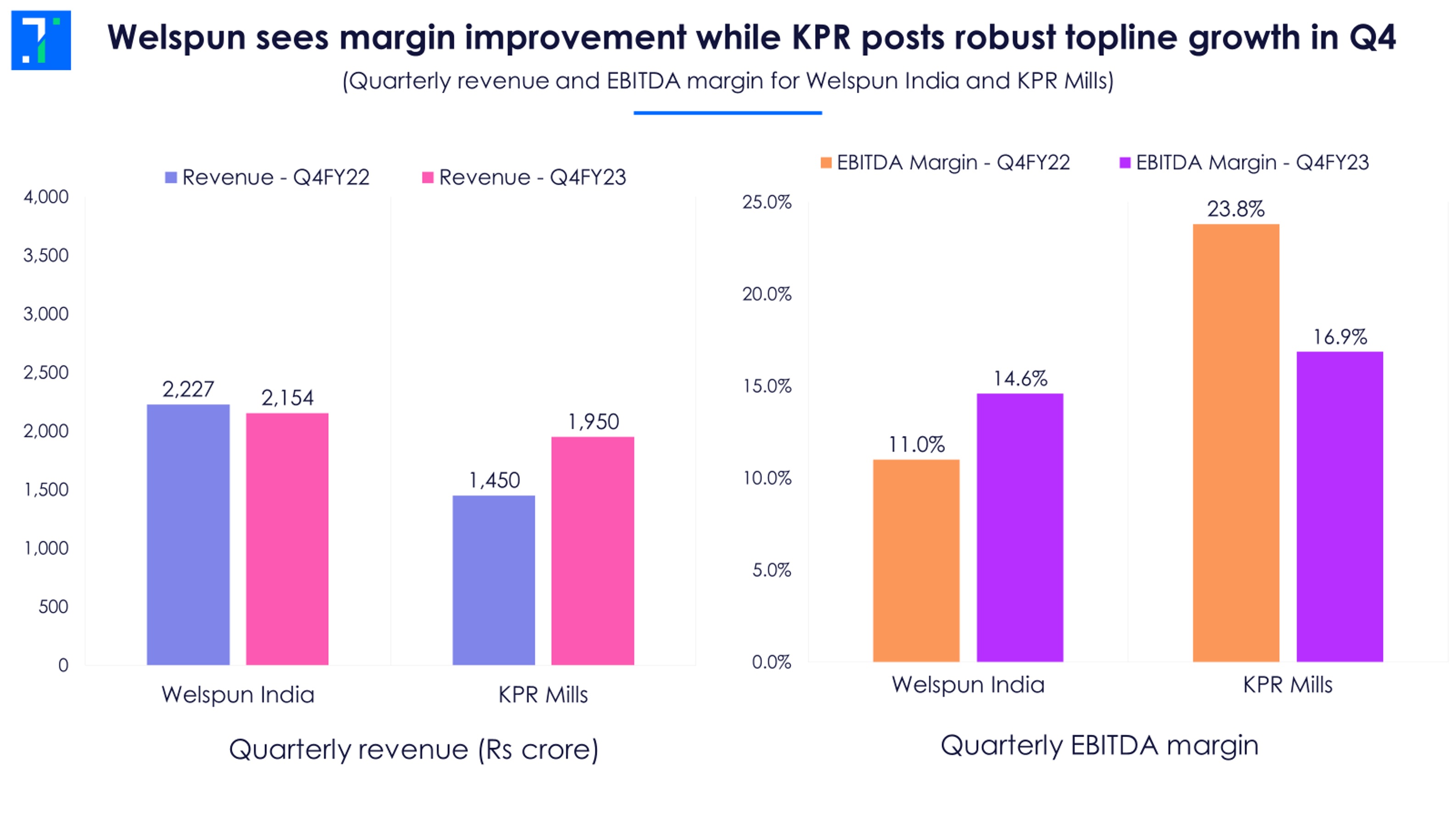

Welspun India reported lower revenues in Q4 due to sluggish global business, but its net profits more than doubled on margin expansion, lifting its stock prices as well as the spirits of investors. Lower input and freight costs helped margin growth in Q4.

Although Welspun’s global business underperformed in FY23, the company did see good sequential improvement, with branded global business growing much faster than its flagship B2B business in Q4.

However, the capacity utilization for bath linen is yet to improve, while bed linens and rugs and carpets showed a QoQ rise. Notably, the utilization levels were around 75%-90% in FY22. In contrast, the company used only 50%-60% of its capacity for basic home textiles in FY23, signaling a significant reduction in export orders.

KPR Mill saw robust revenue growth in Q4 but a continued decline in its EBITDA margins. The company’s revenue growth was entirely driven by its garments segment, as the yarn segment posted a flat performance. Higher realizations drove the growth in garment revenues.

Demand conditions set to improve, but industry needs a deeper fix

The management of Welspun India is positive about the demand conditions in the US, Australia, Gulf countries, and India. But sentiments are still weak in European markets. The company anticipates demand to bounce back strongly in H1FY24, but cost uncertainties persist.

Despite cotton prices being off their highs, a report on commodities by Moneycontrol suggests that cotton prices may rise again by 15%-16% towards June, owing to lower agricultural production but resilient demand.

Barring these intermittent hiccups, the tide is set to turn for the textiles sector in FY24. Consensus estimates of analysts see a modest revenue growth for top textile players but anticipate a big rebound in their FY24 net profits.

Still, the Indian textile industry cannot ignore their larger problems. A structural boost is the need of the hour. Although the government is setting up textile parks which will act as “one-stop shops” for spinning, weaving, dyeing, printing and stitching activities, this is not a fresh idea.

An integrated textile parks scheme was also launched in 2005, but only 26 out of 98 textile parks were completed by Feb-2022, according to a CAG report. Additionally, 42 textile park projects were canceled due to delays in obtaining clearances and land allotments.

The leisurely pace of policy implementation in India and poor ease of doing business are lacunas which India needs to fix, not just in the textile industry but in manufacturing overall.

Despite its wealth of experience - the Indian textile industry is over 200 years old - Vietnam and Bangladesh have overtaken India in a relatively short time. Competition from young upstart nations is intensifying as under-developed Asian countries crowd the lower end of the value chain and offer significant cost advantages.

The time is ripe for India to do the hard work needed to cement its position in finished and advanced textile segments, where it can compete beyond cost. A clear focus, technological investments, better execution and large-scale efforts are required to address the industry's shortcomings. And the cumbersome regulatory processes that bedevil India’s manufacturing, discouraging investment and hiring, is something India needs to tackle fast, if it doesn’t want to be left behind.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.