By Deeksha Janiani

The textile industry in India has been overwhelmed in the past year with rising cotton prices, global retailers canceling orders as a result of stockpiling, and some importers facing a foreign exchange crisis. However, the industry rebounded in the past month on hopes of a recovery, posting gains of over 15%, led by Welspun India and Raymond. Corporate actions announced by these companies helped drive their stellar returns.

Since the start of FY23, the textiles industry has had to put out fires everywhere. For instance, you had a home goods giant like Bed, Bath & Beyond running into a cash crunch, before finally declaring bankruptcy. Egypt returned India’s yarn consignment due to a lack of dollars. But things are starting to look up again as cotton prices have corrected by close to 40% from their highs, and retailers are almost done with their destocking cycle.

The government is also taking structural initiatives to boost the industry through its mega textile parks scheme. The states of Tamil Nadu and UP have recently signed MoUs with the Centre to set up two of the seven sanctioned parks.

Dipali Goenka, Managing Director at Welspun, is seeing green shoots of demand from big retailers, especially in the US. But is there a pan-India level recovery underway?

India’s readymade exports stay steady but yarn and fabric exports nosedive

India’s readymade garment (RMG) exports picked up during the holiday season in key markets from November 2022. However, RMG exports were almost flat in FY23. This is still encouraging for the Indian textile industry, given the global slowdown and shift in consumer focus towards necessities.

While the ready-to-wear category has cushioned the blow for the Indian textile industry, exports of cotton and man-made textiles, which include yarn, fabrics and made-ups, suffered a double-digit decline in FY23.

The effect of poor export demand was reflected in domestic production as well. Textile output remained in a slump throughout the past year, but apparel production picked up post November in tandem with the wedding season in India and festivities in the west, when everyone is doing their best to look good.

Commenting on the drop in cotton textile exports, Piyush Goyal, Minister of Commerce, India, said, “The rise in readymade garments and finished value-added products is really the strength that we want to encash. If at all the yarn export reduces, it’s a good sign.”

While it is a welcome change that India seeks to move higher in the value chain, the decline in yarn and fabric exports is significant, and Goyal’s spin hides some big problems. India is facing stiff competition in textiles from other Asian nations. A country which was second only to China a decade ago is now vying with Vietnam and Bangladesh for a higher share in the textile exports market. In fact, readymade exports have decreased by nearly 7% between FY17 and FY23, indicating that the industry is not making significant progress in this category either.

Vietnam and Bangladesh are racing past India in textile exports

Despite sluggish growth in world textile trade between 2011 and 2021, Vietnam and Bangladesh have emerged as the No. 2 and No. 3 exporters, respectively, leaving India behind.

Vietnam doubled its market share to 5% by 2021, while Bangladesh displaced India from its coveted position by gaining nearly 2% of the overall market.

Vietnam has a population of less than 100 million, while Bangladesh has 173 million. Whoever said that size matters most, has not taken a close look at the competition in the global textile market.

These countries owe their success to lower manufacturing costs from cheaper labor and power, ease of doing business and custom duty concessions. India’s higher cotton prices have also worked to their advantage.

In the earnings call of Q3FY23, the management of Vardhman Textiles noted that Vietnam was importing cotton and exporting the yarn in 2022, much to India’s detriment. India’s prices were trending much higher than the international levels.

Most textile players have blamed their slower growth in FY23 on the global downturn. This suggests an ostrich-like unwillingness to confront the problem – India’s biggest trading partners, the US and EU, actually registered healthy growth in their textile imports. Imports by the US rose 9.4% YoY in 12 months ending February 2023, and Vietnam and Bangladesh yet again grew their exports by over 20%.

But it’s not all gloom and doom. Recent results of big players suggest that some respite may finally be in sight.

Textile players post mixed results in Q4FY23

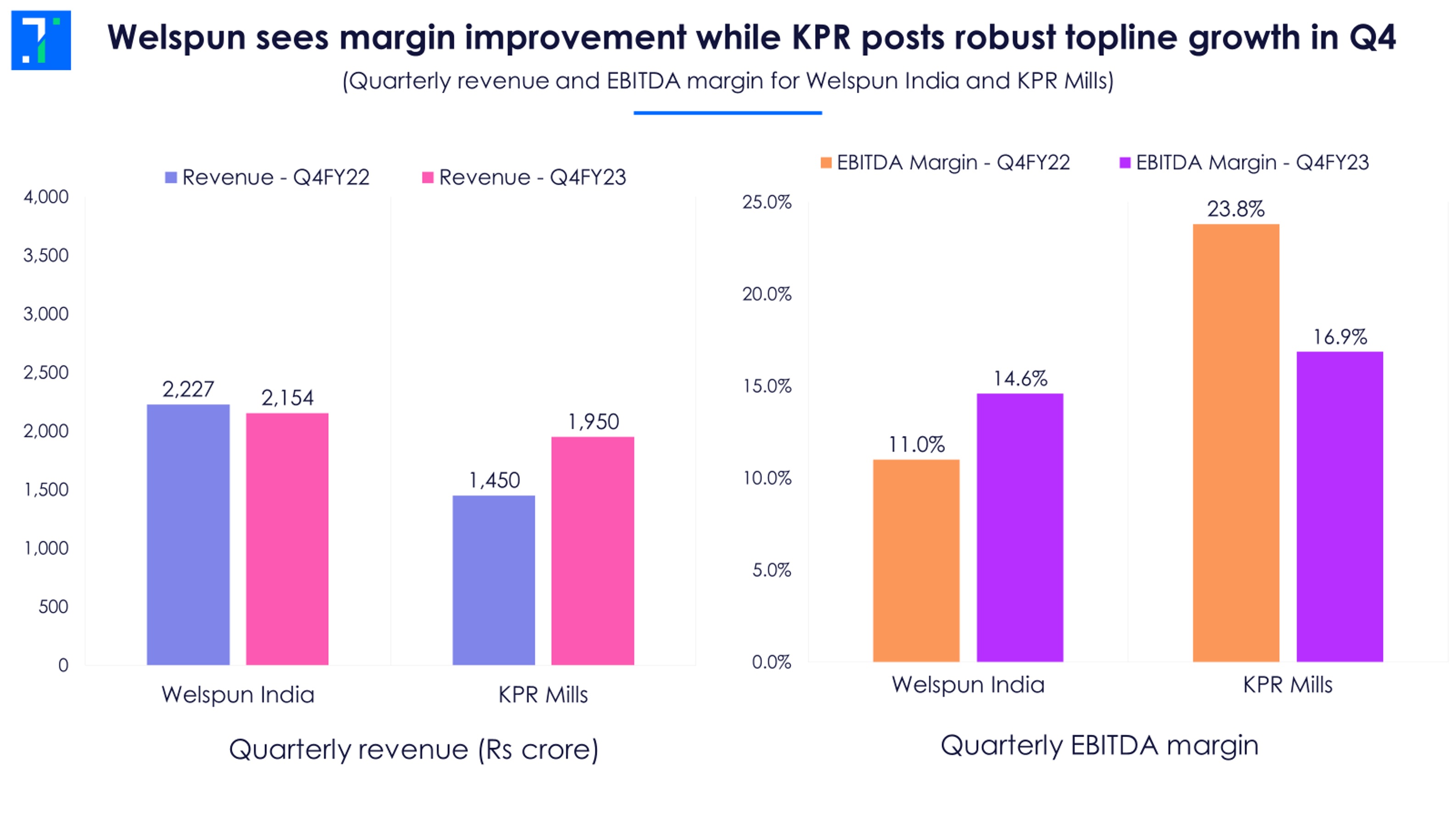

Welspun India reported lower revenues in Q4 due to sluggish global business, but its net profits more than doubled on margin expansion, lifting its stock prices as well as the spirits of investors. Lower input and freight costs helped margin growth in Q4.

Although Welspun’s global business underperformed in FY23, the company did see good sequential improvement, with branded global business growing much faster than its flagship B2B business in Q4.

However, the capacity utilization for bath linen is yet to improve, while bed linens and rugs and carpets showed a QoQ rise. Notably, the utilization levels were around 75%-90% in FY22. In contrast, the company used only 50%-60% of its capacity for basic home textiles in FY23, signaling a significant reduction in export orders.

KPR Mill saw robust revenue growth in Q4 but a continued decline in its EBITDA margins. The company’s revenue growth was entirely driven by its garments segment, as the yarn segment posted a flat performance. Higher realizations drove the growth in garment revenues.

Demand conditions set to improve, but industry needs a deeper fix

The management of Welspun India is positive about the demand conditions in the US, Australia, Gulf countries, and India. But sentiments are still weak in European markets. The company anticipates demand to bounce back strongly in H1FY24, but cost uncertainties persist.

Despite cotton prices being off their highs, a report on commodities by Moneycontrol suggests that cotton prices may rise again by 15%-16% towards June, owing to lower agricultural production but resilient demand.

Barring these intermittent hiccups, the tide is set to turn for the textiles sector in FY24. Consensus estimates of analysts see a modest revenue growth for top textile players but anticipate a big rebound in their FY24 net profits.

Still, the Indian textile industry cannot ignore their larger problems. A structural boost is the need of the hour. Although the government is setting up textile parks which will act as “one-stop shops” for spinning, weaving, dyeing, printing and stitching activities, this is not a fresh idea.

An integrated textile parks scheme was also launched in 2005, but only 26 out of 98 textile parks were completed by Feb-2022, according to a CAG report. Additionally, 42 textile park projects were canceled due to delays in obtaining clearances and land allotments.

The leisurely pace of policy implementation in India and poor ease of doing business are lacunas which India needs to fix, not just in the textile industry but in manufacturing overall.

Despite its wealth of experience - the Indian textile industry is over 200 years old - Vietnam and Bangladesh have overtaken India in a relatively short time. Competition from young upstart nations is intensifying as under-developed Asian countries crowd the lower end of the value chain and offer significant cost advantages.

The time is ripe for India to do the hard work needed to cement its position in finished and advanced textile segments, where it can compete beyond cost. A clear focus, technological investments, better execution and large-scale efforts are required to address the industry's shortcomings. And the cumbersome regulatory processes that bedevil India’s manufacturing, discouraging investment and hiring, is something India needs to tackle fast, if it doesn’t want to be left behind.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.