Trendlyne Analysis

Indian markets slumped today. Nifty 50 closed at 17,757.00 (-181.4, -1.0%) , BSE Sensex closed at 59,464.62 (-634.2, -1.1%) while the broader Nifty 500 closed at 15,361.10 (-111.4, -0.7%)

Market breadth is neutral. Of the 1,850 stocks traded today, 899 were gainers and 915 were losers.

Carborundum Universal, Sundaram Finance, Crisil, and Kansai Nerolac Paints are trading with higher volumes as compared to Wednesday.

Mahindra & Mahindra ties up with Naveen Munjal's Hero Electric through which the latter will manufacture its Optima and NYX at M&M's facilities. This partnership will also entail joint product development and knowledge sharing and electrification of Peugeot motorcycles.

ICICI Securities maintains ‘Buy’ on Larsen & Toubro Infotech with a target price upside of 19.5%. The company’s Q3FY22 revenues rise 9.2% QoQ with manufacturing (17% QoQ) and banking and financial segments (32.8% QoQ) rising the most. EBIT margins improve by 70 bps QoQ to 17.9% and net sales by 8.6% to $553 million.

AGS Transact Technologies’ Rs 680-crore IPO gets bids for 1.42X of the available 2.86 crore shares on offer on the second day of bidding. Retail investors quota of 1.43 crore shares is oversubscribed by 2X. The IPO is entirely an offer for sale by selling shareholders

La Opala RG is trading with more than nine times its weekly average trading volume. Just Dial and CEAT are trading at more than five times their weekly average trading volumes

Mastek's Q3FY22 net profit rises marginally by 2.4% QoQ to Rs 83.5 crore and revenues by 3.4% to Rs 551.9 crore. Health and life sciences as well as data automation and Cloud services segments lead revenue growth in Q3. The company also announces an interim dividend of Rs 7 per share

CEAT posts a loss of Rs 20 crore in Q3FY22 as against a profit of Rs 132 crore in Q3FY21 led by a sharp spike in raw material costs. Revenue's rise 8% YoY to Rs 2,413 crore but fall sequentially owing to subdued demand both in the replacement and original equipment manufacturing segment.

PTC India Financial Services falls as three independent directors-Kamlesh Shivji Vikamsey, Thomas Mathew T, and Santosh B Nayar--resign citing corporate governance issues at the company. Their resignation is effective immediately.

JSW Energy's Q3FY22 net profit jumps 162% YoY to Rs 324 crore and revenues rise 17.7% YoY to Rs 1,984 crore. Increase in sales realisations as well as rise in hydro and short-term power generation aid the revenue and earnings growth in Q3.

Rakesh Jhunjhunwala sells 0.67% stake in Steel Authority of India (SAIL) in Q3FY22 bringing his holding down to 1.09% in the company.

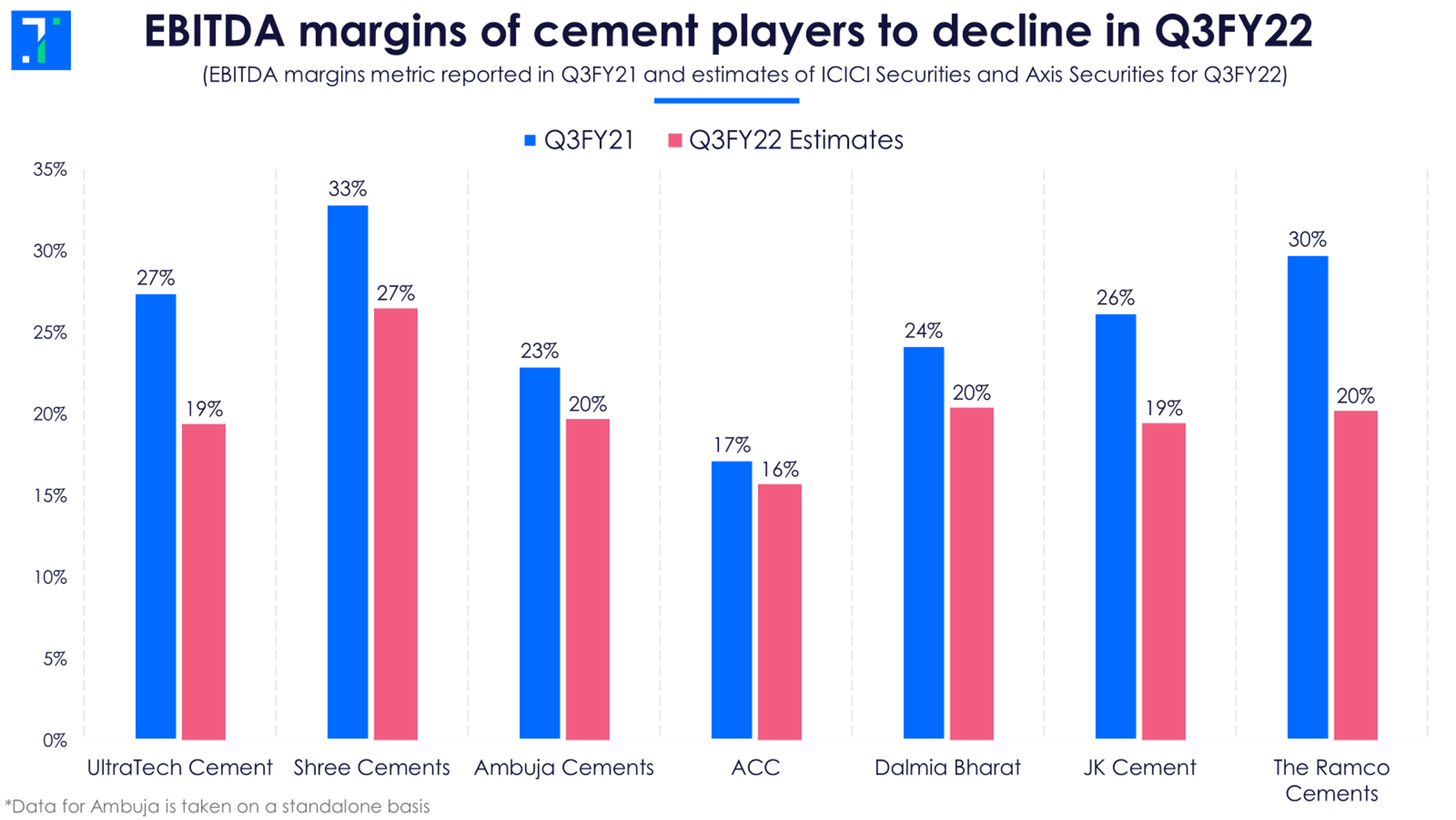

Bajaj Auto’s Q3FY22 net profit declines 17% YoY to Rs 1,430 crore as total volumes across all categories fell 10% YoY to 11.8 lakh units. The company’s revenues grew marginally by 1.3% YoY to Rs 9,021 crore aided by price hikes for its two-wheeler models. Operating profit fell 20% YoY to Rs 1,405 crore on rising material costs which led to a 420 bps fall in EBITDA margins fell to 15.6%.

Riding High:

Largecap and midcap gainers today include Tata Elxsi Ltd. (7,430.45, 6.50%), Cholamandalam Investment & Finance Company Ltd. (649.15, 6.05%) and Power Grid Corporation of India Ltd. (214.65, 4.89%).

Downers:

Largecap and midcap losers today include Oracle Financial Services Software Ltd. (3,698.65, -7.44%), Tata Communications Ltd. (1,449.80, -4.84%) and Bajaj Finserv Ltd. (17,258.95, -4.53%).

Crowd Puller Stocks

22 stocks in BSE 500 are trading on high volumes today.

Top high volume gainers on BSE included Just Dial Ltd. (924.40, 13.41%), La Opala RG Ltd. (414.55, 7.65%) and Cholamandalam Investment & Finance Company Ltd. (649.15, 6.05%).

Top high volume losers on BSE were Hikal Ltd. (387.25, -12.85%), Mastek Ltd. (2,854.40, -11.32%) and PTC India Ltd. (100.50, -10.94%).

Ceat Ltd. (1,134.50, -0.06%) was trading at 7.5 times of weekly average. Oracle Financial Services Software Ltd. (3,698.65, -7.44%) and Syngene International Ltd. (608.00, 2.38%) were trading with volumes 7.0 and 6.0 times weekly average respectively on BSE at the time of posting this article.

BSE 500: highs, lows and moving averages

16 stocks overperformed with 52-week highs, while 7 stocks tanked below their 52-week lows.

Stocks touching their year highs included - IDFC Ltd. (63.85, -1.39%), Lakshmi Machine Works Ltd. (10,720.05, -2.11%) and Procter & Gamble Hygiene & Healthcare Ltd. (15,988.95, -0.04%).

Stocks making new 52 weeks lows included - Ceat Ltd. (1,134.50, -0.06%) and Gillette India Ltd. (5,206.55, -0.39%).

16 stocks climbed above their 200 day SMA including Just Dial Ltd. (924.40, 13.41%) and MMTC Ltd. (50.40, 5.00%). 15 stocks slipped below their 200 SMA including PTC India Ltd. (100.50, -10.94%) and Rallis India Ltd. (277.30, -6.08%).