The slump in car and bike sales is leading to a fall in automotive insurance premiums collected by listed insurance players, an analysis of monthly data from regulator IRDA shows. But health insurance premiums rose YoY in October and November 2021, helping insurance companies cushion the blow.

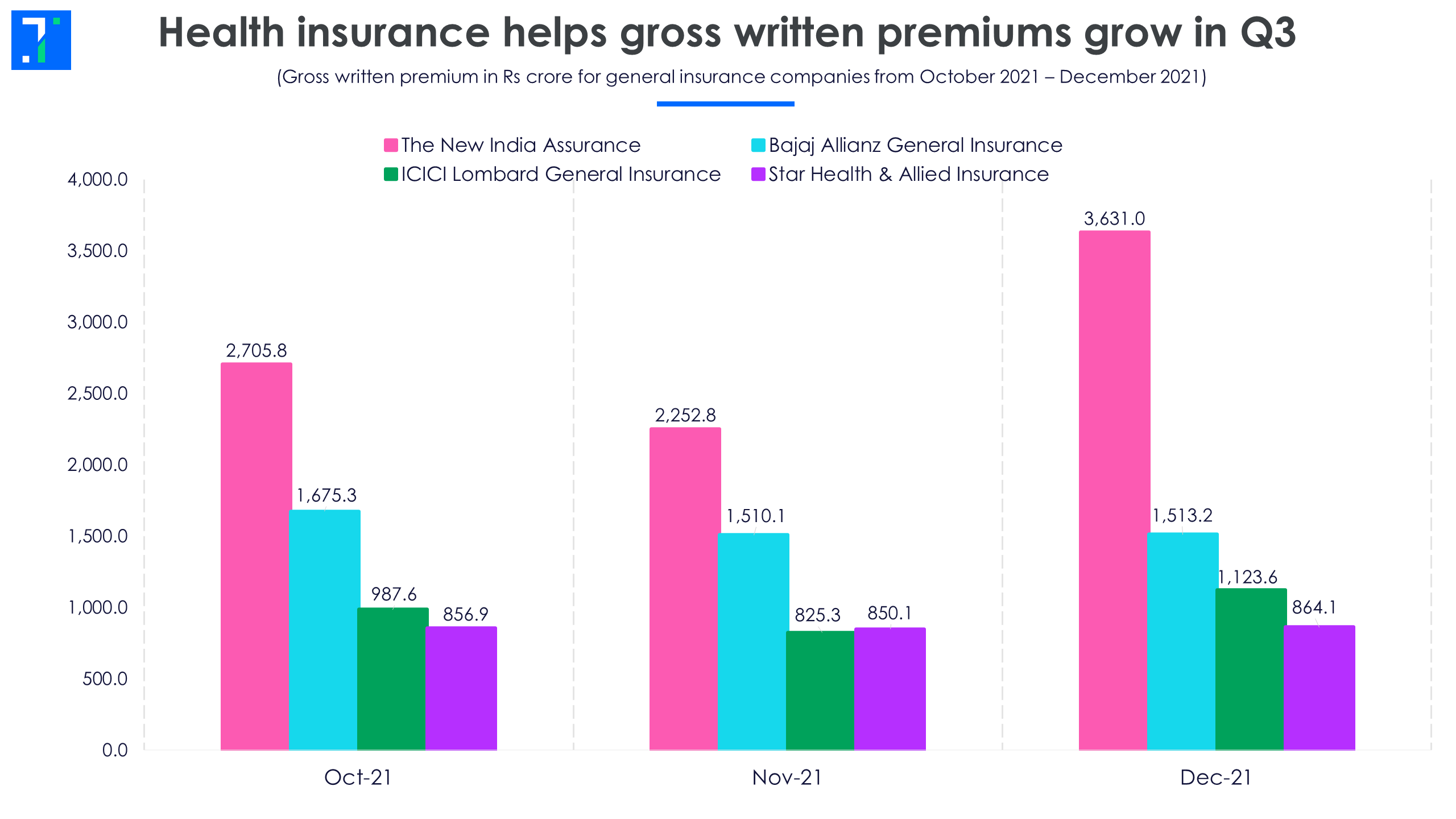

Although the December 2021 segment data for general insurers is not out yet, October and November 2021 numbers point to an impact of falling auto sales on Bajaj Finserv’s subsidiary Bajaj Allianz General Insurance, ICICI Lombard General Insurance, and The New India Assurance Company. Pure play health insurance player Star Health and Allied Insurance’s 20% YoY premium growth in October-December 2021 shows that the health insurance business continues to grow for the industry as a whole. Bajaj Allianz, ICICI Lombard, and The New India Assurance’s written health insurance premiums rose 26%, 37%, and 19% YoY, respectively in November 2021.

New India Assurance’s total motor insurance written premiums fell on a YoY basis in October 2021 and November 2021. Similarly, Bajaj Allianz’s motor insurance premiums also fell in those two months. Although ICICI Lombard’s total motor insurance premiums rose marginally in the two months, the own damage insurance premium fell, while third-party insurance premium (legally required for motorists) rose for both months.

But health insurance written premiums for Bajaj Allianz, ICICI Lombard and New India Assurance rose on a YoY basis in October and December, while Star Health’s rose in all three months of Q3FY22. Essentially, the health insurance premium might save the quarter.