The Q3 earnings season is in full swing, and obviously that is all everyone can talk about (or at least that’s what we want to talk about!) This week’s newsletter looks at analyst consensus estimates to see what could happen in Q3 results. Our Trendlyne Forecaster is here to help.

In this week’s Analyticks:

- The cement sector’s foggy winter

- Upcoming Q3 gainers and losers according to Forecaster’s consensus estimates

- Screener: Stocks gaining ahead of earnings

Let’s get into it.

Cement sector’s near-term outlook softens as government spending slows

Although top cement companies gave a positive growth outlook for H2FY22, analyst estimates for Q3 earnings results suggest a different story altogether. Interestingly, the average stock returns from the top seven listed cement companies are a meagre 0.1% for the last three months. Brokerages are positive on the cement sector from a medium-term perspective, but investor interest seems to be waning.

After posting dismal results in Q2FY22, cement companies like Dalmia Bharat and JK Cement anticipated higher demand in the next two quarters. This expectation was on the back of higher infrastructure spending by the central government. However, the actual capital expenditure numbers published by the Controller General of Accounts are quite lacklustre.

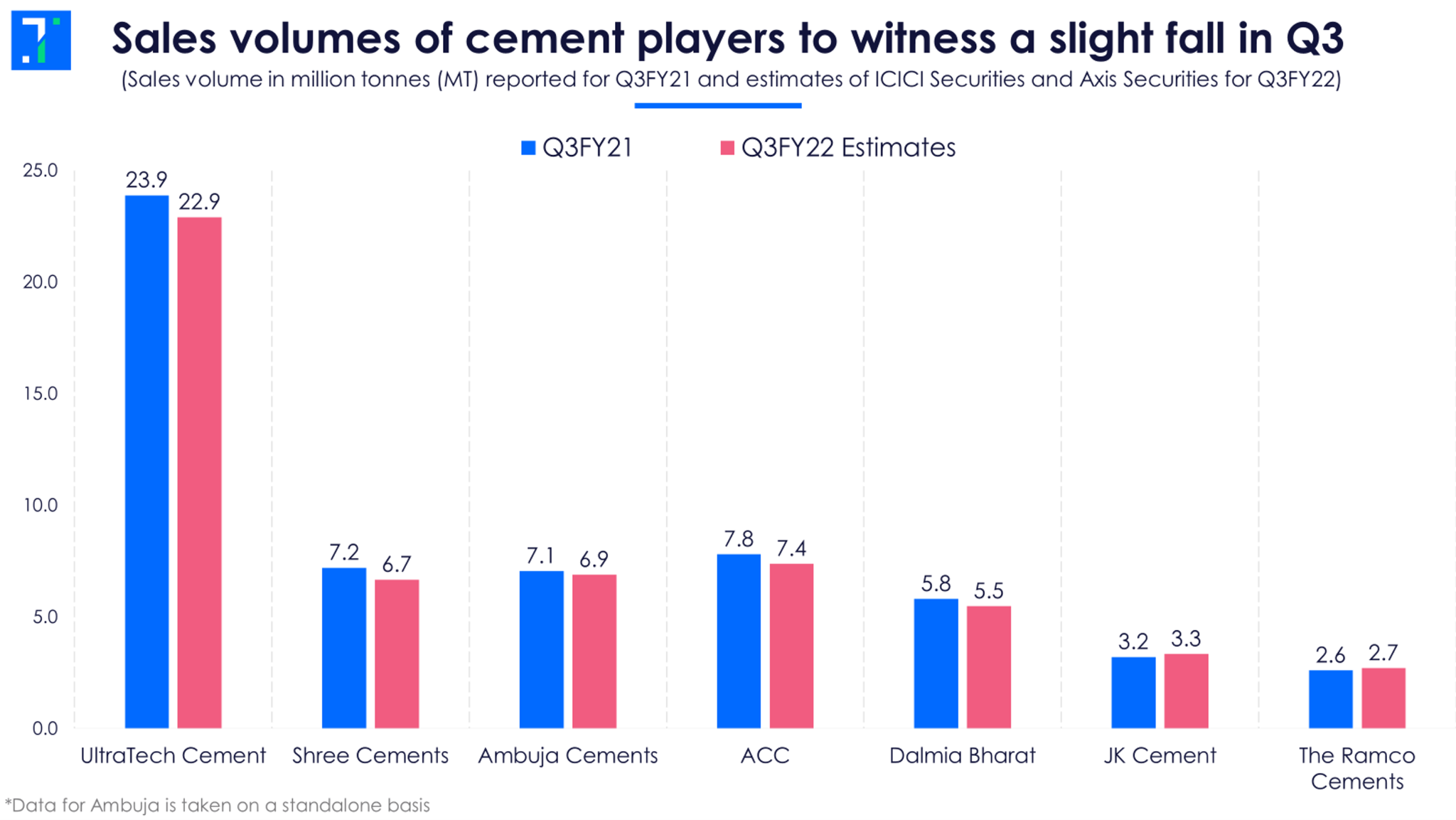

The Centre’s capex fell 24% YoY to Rs 23,919 crore in October 2021 and 54% YoY to Rs 20,360 crore in November 2021. If we talk about the year-to-date numbers (April-November 2021), the government managed to spend only 49% of its budgeted capex estimate of Rs 5.54 lakh crore. Accordingly, top brokerages such as ICICI Securities and Axis Securities expect sales volumes of top cement players to fall by an average of 2.4% in Q3FY22.

Notably, analysts are not anticipating a major fall in Q3 sales volumes. According to their respective channel checks, volumes did recover in December 2021 as the monsoon season finally receded from India.

Another factor is that the price hikes by cement players on cement bags in October 2021 got completely reversed in the following months. According to channel checks by ICICI Securities, the eastern and southern regions of India witnessed the highest price corrections in Q3 due to a fall in demand on delayed withdrawal of the south-west monsoon and a transporters strike. However, the saving grace here is that the pan-India prices are still up by close to 5% YoY at the end of Q3FY22.

With a marginal fall in quarterly sales volumes and a sub-par rise in realisations, revenues of cement players are likely to stay flat in Q3FY22 on a YoY basis.

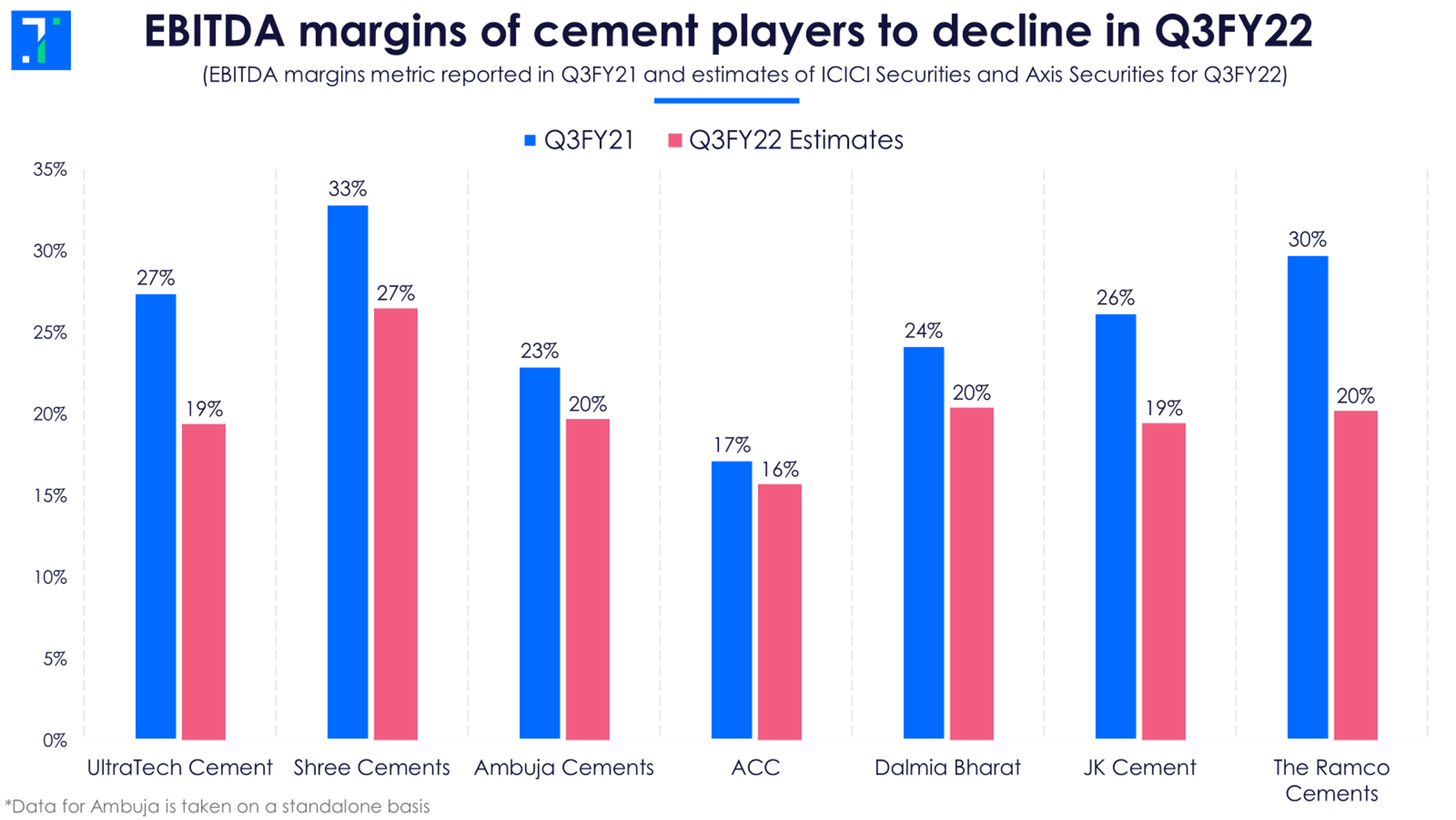

The flat trend in quarterly revenues does not bode well for cement players especially when input costs are likely to see a spike on an YoY basis. Analysts expect the cost/tonne metric to rise 14% YoY for the top 13 cement companies led by a jump in fuel prices. As a result, EBITDA/tonne for companies is set to fall nearly 15% YoY on an average. Ramco Cements’ EBITDA/tonne is likely to fall 30% YoY to Rs 1,067 as the company derives roughly 75% of its sales from the southern region.

Prabhudas Lilladher sees a 520 bps fall in EBITDA margins of market leader UltraTech Cement. A possible reason could be a large exposure (36% share in sales) to the eastern and southern regions. Although Dalmia Bharat derives 60% of its topline from the eastern region, brokerages have a divergent view on its likely operating performance. Axis Securities expects a 130 bps erosion in its EBITDA margins while HDFC Securities sees a 440 bps fall in its margins.

As a consequence of flat revenues and lower margins led by high input costs, net profit of the top players is set to decline in double digits for Q3FY22. Interestingly, ACC is set to report a 17% YoY rise in its Q3 net profits based on the bullish view of HDFC Securities.

While investors are in for yet another disappointing quarter, power and fuel costs for cement players are likely to normalize in Q4FY22. International coal and pet coke prices fell from their all-time highs in November first week. This provides some breather to companies. According to IIFL Securities, cement dealers are hopeful of a demand revival in January 2022 as the peak construction season kicks in. However, the rapid spread of omicron may put brakes on the Centre’s capex plans and may snap the chances of a meaningful recovery in cement demand. All in all, the outlook for the cement sector in H2FY22 looks quite blurry this winter.

Forecaster Consensus: Slowing sales may dent Maruti’s Q3FY22 profit, Dr Reddy’s may shine

The big boys—Tata Consultancy Services, Infosys, and Wipro—were the first ones among the Nifty 50 to announce their Q3FY22 earnings on Wednesday. Wipro’s earnings per share for Q3FY22 was largely flat at Rs 5.43 per share, but missed Trendlyne’s Forecaster’s average consensus estimate (Rs 5.40 per share). Wage hikes and high attrition dented the company’s margins which came in at 17.6%.

Although TCS’ Q3FY22 EPS of Rs 26.4 per share was marginally below the average consensus estimate (Rs 26.9 per share), the company’s stellar growth in revenues helped IT bellwether cross $25 billion in revenues in 2021.

The standout performer till now is Infosys which posted stellar earnings with an EPS of Rs 13.9 per share, which is above the consensus estimate of Rs 13.4 per share. The company’s Q3 performance led the management to upgrade its revenue guidance to 19.5%-20% in FY22, up from 16.5%-17.5%.

Now that the earnings season is in full flow, we decided to look at Trendlyne Forecaster’s average of consensus estimates to find out the top five companies that analysts expect to post good and bad earnings in Q3FY22.

Dr Reddy’s Q3FY22 profits may get a base effect boost

In Q3FY21, Dr Reddy’s Laboratories suffered an impairment loss on inventory and other intangible assets to the tune of nearly Rs 600 crore led to a fall in its net profit. This resulted in its standalone EPS coming in at around Rs 1.70 per share. This low base, in case there is no recurring impairment charge, may see the company post a rise in its earnings in Q3FY22.

The average consensus estimate expects Bajaj Finance to post stellar earnings in Q3FY22. According to Trendlyne Forecaster’s estimate, the company’s EPS may more than double during the quarter. This may happen on the back of a 26.3% rise in the company’s assets under management to Rs 1,81,300 crore in Q3.

Maruti’s slowing wholesale dispatches and retail sales expected to bite in Q3FY22

The auto industry is reeling under supply-chain issues, and high fuel costs aren’t helping the sector’s cause either. Market leader in the Indian passenger vehicle market—Maruti Suzuki had to resort to multiple production cuts as it curbed dispatches to dealers during Q3FY22. The company’s wholesale dispatches to dealers and exports fell 13.2% YoY to 4,30,668 units during the quarter. This is despite the company’s retail sales picking up in Q3 from October onwards after falling for three consecutive months. This is bound to dent the company’s EPS in Q3.

Similarly, Hero MotoCorp and Bajaj Auto may also see a dent in their Q3 earnings. It’s not surprising that the top five companies that may see the highest fall in EPS (according to Trendlyne Forecaster’s estimates) are from the automotive industry. The one-two punch of poor rural demand and supply chain issues is bearing heavily on the sector’s prospects.

Screener: Stocks swinging ahead of their Q3FY22 results

With another earnings season underway, investors will be hoping the hype priced into stocks pays off. The third wave has not yet played spoilsport, with the benchmark Nifty 50 hovering above 18,000 levels. The earnings announcements will be the next trigger for many companies, but some stocks are trading higher ahead of results being announced.

This screener shows there are 53 companies among the Nifty 500 as of Wednesday that saw a weekly rise in their share price ahead of their results being announced. Some companies like Asian Paints and Tanla Platforms touched their 52-week high ahead of their Q3FY22 results. This suggests that investors hoping for a bite of the cherry before the stock potentially surges post results. This screener also shows the 1-year high price along with its current market price.

Financial services companies like ICICI Bank, HDFC Bank, Bajaj Finance, Cholamandalam Investment & Finance Company, Housing Development Finance Corporation, and Axis Bank are gaining momentum. HDFC Bank and Bajaj Finance recently announced their operational update for Q3FY22 which showed decent growth in business.

Other companies’ shares that are rising are from the paints, specialty chemicals, IT services, and pharmaceuticals industries, including Kansai Nerolac, HCL Technologies, GlaxoSmithKline Pharmaceuticals, Atul and BASF India. IT stocks have been on a high since the second week of December 2021. A news report suggests that IT companies generally have a slow season in Q3FY22, but this financial year could be an exception as Covid related lockdowns and restrictions have led to a rise in demand for digital transformation spending for even mid-cap companies.

You can find more expert screeners here.