By Shreesh BiradarSmart money moves: Which stocks did mutual fund managers buy in March 2023?

The month of March saw benchmark indices Nifty 50 and Nifty 500 stay flat at 0.32% and -0.27% respectively. Markets were dealing with the aftermath of regional bank failures in the US, and the liquidity crisis in Credit Suisse. Indian banks also faced some selling pressure, but their strong balance sheets gave confidence to investors. As a result, fund managers picked up fundamentally sound stocks with good growth trajectories.

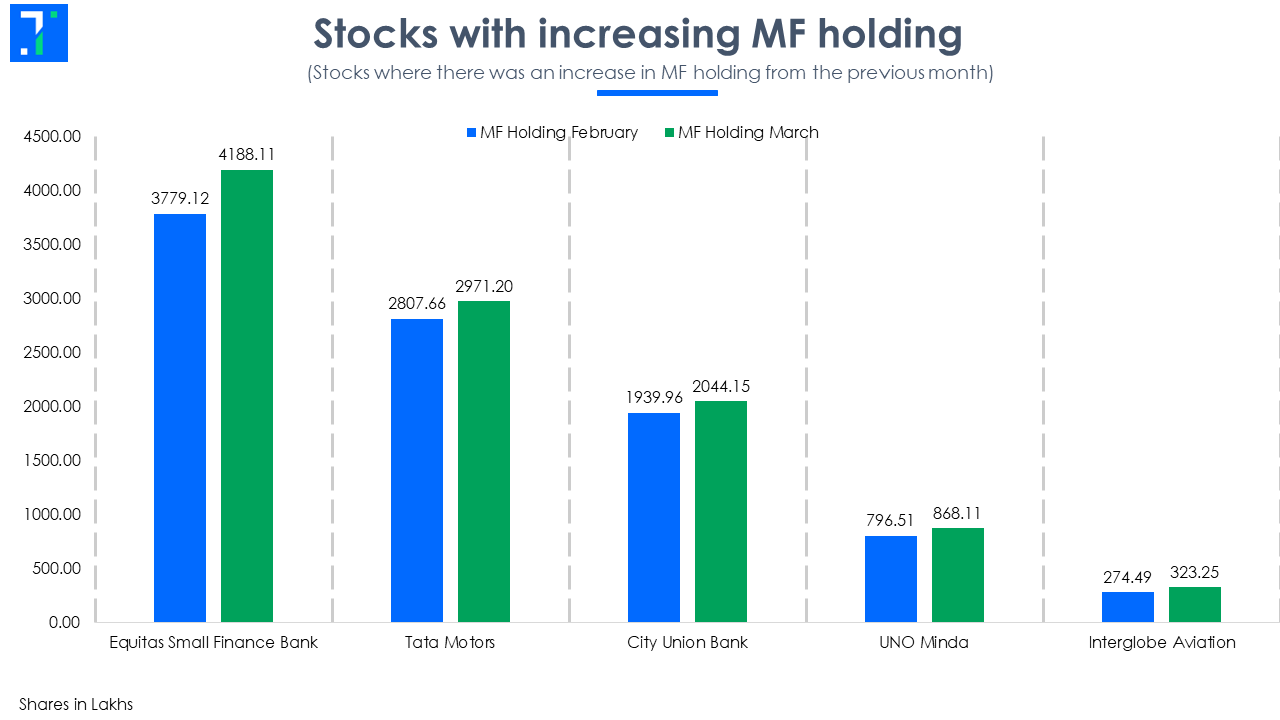

Equitas Small Finance Bank – Personal finance to help growth in loan book

Equitas Small Finance Bank (EQUITASBNK) is in the retail banking business, with a focus on micro-finance, commercial vehicle finance, home loan, loan against property and financing solutions for individuals and micro and small enterprises (MSEs) that are underserved by formal financing channels.

Following its reverse merger with its parent firm, it has eliminated the overhang of operational costs, and its small size enables it to navigate through changing interest rate cycles. The bank has reported a return on asset (ROA) of 2.2%, which is significantly higher than the industry average of 0.7%. It is expanding rapidly and venturing into new products like credit cards, personal loans and used vehicle finance. Its NPA slippages are low, and the CASA ratio is maintained at 45%, leading to an increase in the bottom line.

Fund managers who bought shares of Equitas Small Finance Bank

Fund managers who added shares of Equitas Small Finance Bank to their portfolios include R Srinivasan and Mohit Jain forSBI Small Cap Fund and Murthy Nagarajan and Rahul Singh for Tata Multicap Fund. Fresh buys were done by Pranav Gupta and Haresh Mehta forAditya BSL Nifty SmCp 50 Idx Fund, Jinesh Gopani forAxis Nifty Smallcap 50 Index Fund, and Laukik Bagwe and Atul Bhole forDSP Dynamic Asset Alloc Fund.

Tata Motors – Pent-up demand boosts recovery in sales

Tata Motors (TATAMOTORS) designs, manufactures and sells a wide range of automotive vehicles, including passenger vehicles, premium luxury vehicles (including the iconic Jaguar and Jaguar Land Rover) and commercial vehicles. JLR contributes nearly 63% of the revenue, followed by commercial vehicles at 18%.

Tata Motors reported the highest-ever passenger vehicle annual sales in FY23, supported by post covid pent-up demand and the launch of new vehicles in the past two years. The company has consolidated its position in domestic EVs, with a market share of 70%.

The commercial vehicle segment has also seen an uptick in demand due to an increase in mining activity and the scaling up of the e-commerce sector. JLR is in recovery mode and working on cost optimizations and building its e-mobility portfolio.

Fund managers who bought shares of Tata Motors

Fund managers who added additional shares of Tech Mahindra to their schemes include Dinesh Balachandran and Dinesh Ahuja forSBI Balanced Advantage Fund, Kunal Sangoi and Dhaval Joshi forAditya BSL Focused Equity Fund, Dinesh Balachandran and Mohit Jain for SBI Contra Fund, and Rahul Baijal and Priya Ranjan for HDFC Top 100 Fund. New buys were made by Ashish Naik and Vinayak Jayanath forAxis Business Cycles Fund.

Uno Minda – Electric mobility and new verticals to guide growth trajectory

UNO Minda (UNOMINDA) manufactures auto components including lighting, alloy wheels, horns, seating systems, seatbelts, switches, sensors, controllers, handlebar assemblies and wheel covers. It holds a 66% market share in the switch business.

UNO Minda’s growth has been fueled by growth in segments like switches, lighting and acoustics. Its core business grew at 28% in Q3FY23. The firm has been consistently increasing the number of products per vehicle to enhance its kit value per vehicle. It has executed a joint venture agreement with Buehler Motor & Tach-S for the supply of traction motors for electric two-wheelers. The company has allocated Rs 175 crore for airbag development to meet the upcoming regulatory requirements, out of its total capex of Rs 700 crore.

Fund managers who bought shares of Uno Minda

Additional shares of UNO Minda were bought by Vinit Sambre and Jay Kothari forDSP Midcap Fund, and Shreyash Devalkar and Vinayak Jayanath for Axis Midcap Fund and Taher Badshah and Dhimant Kothari forInvesco India Contra Fund. New buys were done by Pankaj Tibrewal and Arjun Khanna forKotak Emerging Equity Fund and Murthy Nagarajan and Rahul Singhfor Tata Multicap Fund.

City Union Bank – Higher credit costs and NIM contraction may bottleneck PAT growth

City Union Bank (CUB), one of India’s oldest private sector banks, has around 750+ branches and is headquartered in Kumbakonam, Tamil Nadu. It specializes in micro, small and medium enterprises (MSME) loans and has a loan book of Rs 43,000 crore.

City Union Bank is diversifying its loan book to build its asset quality. While traditionally focused on MSME loans, CUB is now shifting its focus towards gold loans. The bank's cost of capital has increased due to higher credit costs and a lower deposit base. Management has revised its loan growth expectations downwards by 200 bps, from an earlier projection of 15-18%. However, even with this adjustment, the bank’s loan growth is still higher than the industry average of 10-11% for FY24.

Fund managers who bought shares of City Union Bank

Additional shares were bought by Kayzad Eghlim and Nishit Patel for ICICI Pru Nifty Private Banks ETF and R Srinivasan and Mohit Jain for SBI Small Cap Fund. Fresh buys were done by Murthy Nagarajan and Rahul Singh for Tata Multicap Fund, Pranav Gupta and Haresh Mehta for Aditya BSL Nifty SmCp 50 Idx Fund, and Jinesh Gopani for Axis Nifty Smallcap 50 Index Fund.

Interglobe Aviation – Increased domestic demand and higher fleet size to drive top line

Interglobe Aviation (INDIGO) is in the air transportation business which includes passenger and cargo services, and provides allied services such as in-flight sales. The firm mainly operates in domestic circuits, covering 77 domestic and 26 international destinations. It has operated around 1,800 flights on a daily basis in the past three months.

The firm’s huge order of 500 aircraft for Boeing and Airbus made news recently. The increased number of airports and the government's push towards aviation infrastructure have increased passenger footfalls over the years. Indigo, with its low cost and extensive connectivity, has the highest market share of domestic passengers at 54%. It plans to double its fleet size from 300 to 600 by 2030, boosting connectivity and passenger footfalls, and resulting in double-digit growth in the medium term.

Fund managers who bought shares of Interglobe Aviation

Fresh buys were done by Sachin Relekar and Manish Gunwani for Bandhan Flexi Cap Fund. Additional shares were bought by R Srinivasan and Dinesh Ahuja for SBI Equity Hybrid Fund, Sankaran Naren and Dharmesh Kakkad ICICI Pru Value Discovery Fund, Samir Rachh and Kinjal Desai for Nippon India Small Cap Fund and Manish Gunwani for Bandhan Core Equity Fund.

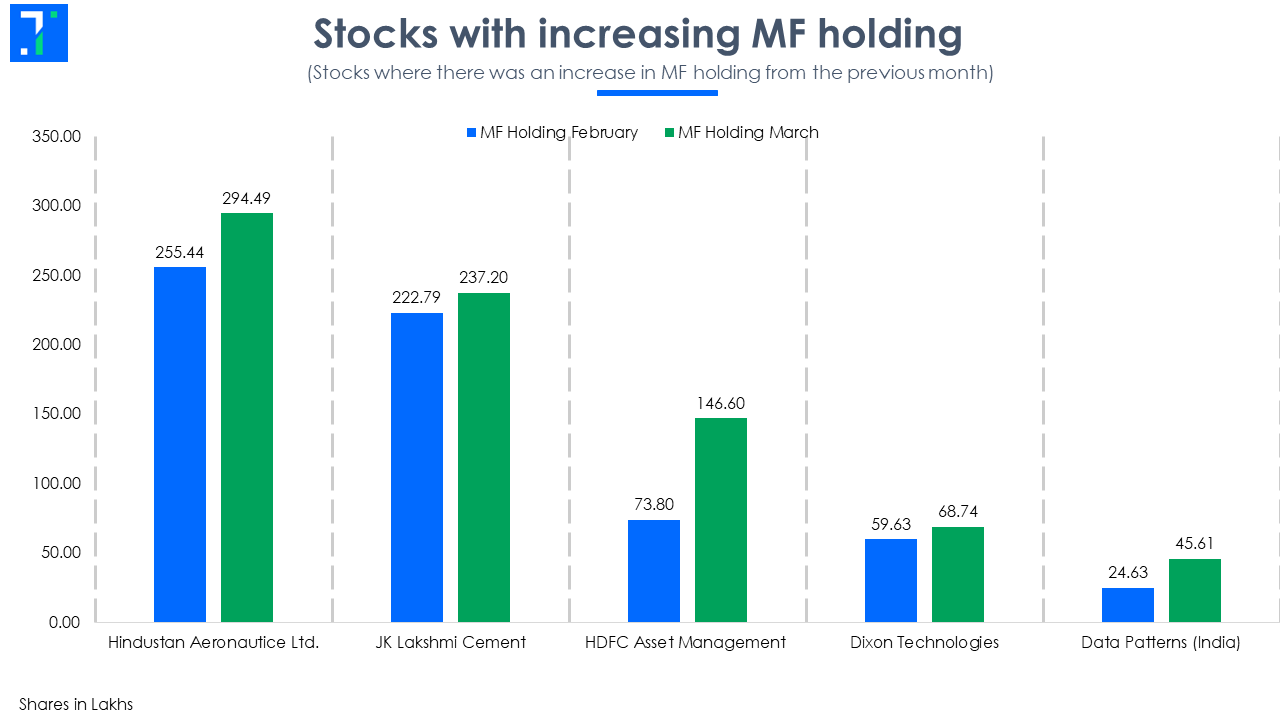

Hindustan Aeronautics Limited – Flying high with strong order book and margins

Hindustan Aeronautics Limited (HAL) is engaged in the design, development, manufacture, and end to end servicing of aircraft, helicopters, aero-engines, etc.

HAL has an orderbook of Rs 82,000 crore, consisting mainly of 70 HTT aircraft, 6 Do-228 aircraft and PSLV launch vehicles, among others. Another Rs 50,000 crore worth of orders are expected in the next two years. HAL is expected to see a significant jump in its revenue from the start of FY25. The margins are expected to increase by 200 bps to 24.5% in FY24, thanks to export orders and new products in the pipeline.

Fund managers who bought shares of Hindustan Aeronautics

Additional shares were bought by Roshi Jain and Priya Ranjan for HDFC Flexi Cap Fund, Vaibhav Dusad and Sharmila D’mello for ICICI Pru Technology Fund and Sankaran Naren and Rajat Chandak for ICICI Pru Balanced Adv Fund. Fresh buys were done by Anand Radhakrishnan and R Janakiraman for Franklin India Flexi Cap Fund and Taher Badshah and Dhimant Kothari for Invesco India Contra Fund.

JK Lakshmi Cement – Expanding capacity, and benefits from infra boost

JK Lakshmi Cement (JKLAKSHMI) is a cement manufacturer with plants in Rajasthan, Haryana, Chhattisgarh, Orisa and Gujarat. The company has a total production capacity of 13.9 million tonne (MT) and also operates 117 MW power plants, which fulfill 75% of its energy requirements.

JK Lakshmi Cement has seen increased volume production and capacity utilization due to higher spending on Infra projects. Also, a decrease in prices of petcoke and coal has led to margin expansion. The firm is currently adding a capacity of 2.5 MT at a cost of Rs 1,650 crore, which is expected to be completed by FY25. It also plans to take the total capacity to 30 MT by the end of FY30.

Fund managers who bought shares of JK Lakshmi Cement

Additional shares were bought by Shridatta Bhandwaldar and Ajay Khandelwal for Canara Robeco Small Cap Fund, Shiv Chanani and Miten Vora for Baroda BNP P Mid Cap Fund, Manish Lodha and Abhinav Khandelwal for Mahindra Manulife Small Cap Fund and Pranav Gokhale and Taher Badshah for Invesco India Smallcap Fund. Fresh buys were done by Samir Rachh and Kinjal Desai for Nippon India Small Cap Fund.

HDFC Asset Management – A market leader and consistent performer

HDFC Asset Management (HDFCAMC) is the largest mutual fund in India with an AUM of Rs 4,44,800 crore and a market share of 11%. The firm has 228 branches and is aided by more than 75,000 distribution partners. HDFC is its parent firm and owns nearly 53% stake in the AMC.

The AMC is taking steps to rationalize costs by reducing the number of distribution partners. It recently launched the Business Cycle Fund, which saw a subscription of Rs 2,340 crore during its new fund offer (NFO) and also introduced debt index funds that have generated high interest. HDFC AMC has consistently maintained a market share of 11.8% in equity funds, 13.5% in debt funds and 14.9% in liquid funds, and has grown in line with industry averages.

Fund managers who bought shares of HDFC AMC

Fresh buys were made by SR Srinivasan and Dinesh Ahuja for SBI Equity Hybrid Fund, Vinay Paharia and Puneet Pal for PGIM India Midcap Opps Fund, Dinesh Balachandran and Dinesh Ahuja for SBI Balanced Advantage Fund, Sailesh Raj Bhan and Ashutosh Bhargava for Nippon India Multi Cap Fund and Rohit Shimpi and Mohit Jain for SBI Dividend Yield Fund.

Dixon Technologies India – Acquisitions and growing LNG consumption to boost growth

Dixon Technologies (Dixon) manufactures products in consumer durables, lighting and mobile phones. Its product portfolio includes consumer electronics like LED TVs and mobile phones, home appliances like washing machines and CCTV, lighting products like LED bulbs and tube lights, downlights and CFL bulbs.

Dixon Technologies has seen its revenue get hit by lower discretionary spending by end users, due to higher interest rates. As a result, the firm has cut down its FY23 revenue guidance by 26% to Rs 125 billion.

However, the correction in input raw material prices, cost-cutting measures, and a better revenue mix will contribute to margin expansion, and help the company mitigate the adverse impact on the bottom line.

Fund managers who bought shares of Dixon Technologies

Additional shares of Dixon Technologies were added by Chirag Setalvad and Priya Ranjan forHDFC Mid-Cap Opportunities Fund, Sailesh Raj Bhan and Ashutosh Bhargava for Nippon India Large Cap Fund and Rupesh Patel and Dhrumil Shah Nippon India Growth Fund. Fresh buys were done by Niket Shah and Ankush Sood for Motilal Oswal Midcap 30 Fund and Sonam Udasi for Tata India Consumer Fund.

Data Patterns (India) Ltd – Huge order book to give good revenue visibility

Data Patterns India (DATAPATTNS) is into manufacturing electronic boards and systems for the aerospace and defence sectors. The firm also provides electronic solutions for processors, power, radio frequencies, and embedded software.

As of January 2023, the company’s order backlog stands at Rs 1,014 crore, with development orders comprising 56%, production at 38%, and the rest from the services segment. The management expects Rs 2,000-3,000 crore worth of orders in the pipeline for the next three to four years.

It has maintained a revenue guidance of 25-30% growth, with a gross margin of 65% and EBITDA margin of 40% for the next two years.

Fund managers who bought shares of Data Patterns (India) Ltd.

Additional buys were made by Shreyash Devalkar and Vinayak Jayanath for Axis Small Cap Fund. Fresh buys were done by Samir Rachh and Kinjal Desai for Nippon India Small Cap Fund, Harsha Upadhyaya for Kotak Tax Saver Fund, Ashish Naik and Vinayak Jayanath for Axis Business Cycles Fund and R Janakiraman and Sandeep Manam for Franklin India Smaller Comp Fund.