The collapse of Silicon Valley Bank (SVB), First National Bank, Credit Suisse, and First Republic Bank has cast a spotlight on financial institutions. As these failures reverberated across the US and Europe, the markets reacted – the US Dow Jones Bank Index has dropped 18%, and the Europe 600 Bank Index has decreased by 10.2% since the start of the SVB crisis. In contrast, Indian banks have shown remarkable resilience, with the Nifty Bank surging 3.94% since the crisis began on March 3, 2023.

Private Banks in India command higher valuations despite having smaller loan and deposit books compared to PSU banks. Private banks accounted for nearly 33% of the turnover of Indian banks as of Q3FY23. They have also been the preferred investment choice for FIIs in the Indian banking sector. HDFC Bank, Axis Bank, ICICI Bank and IndusInd Bank are the star performers, while Yes Bank's fall from grace has pushed it to the sidelines.

All these banks have released their Q4FY23 earnings reports in the past 10 days.

Kotak Mahindra Bank released its Q4FY23 earnings on 29th April. The bank increased its Q4FY23 net profit by 26% and its net interest income (NII) by 35%. Net interest margins (NIM) stood at 5.75% for the quarter. Uday Kotak, CEO and Managing Director of Kotak Mahindra Bank, emphasized the need for higher capital buffers for banks to "build a fortress of resilience in these uncertain times." During the conference call, he noted that the Indian banking system is in good shape and in a "Goldilocks" phase, with favorable domestic macro factors, even as external factors such as the global slowdown and foreign regional bank failures are impacting India's growth trajectory.

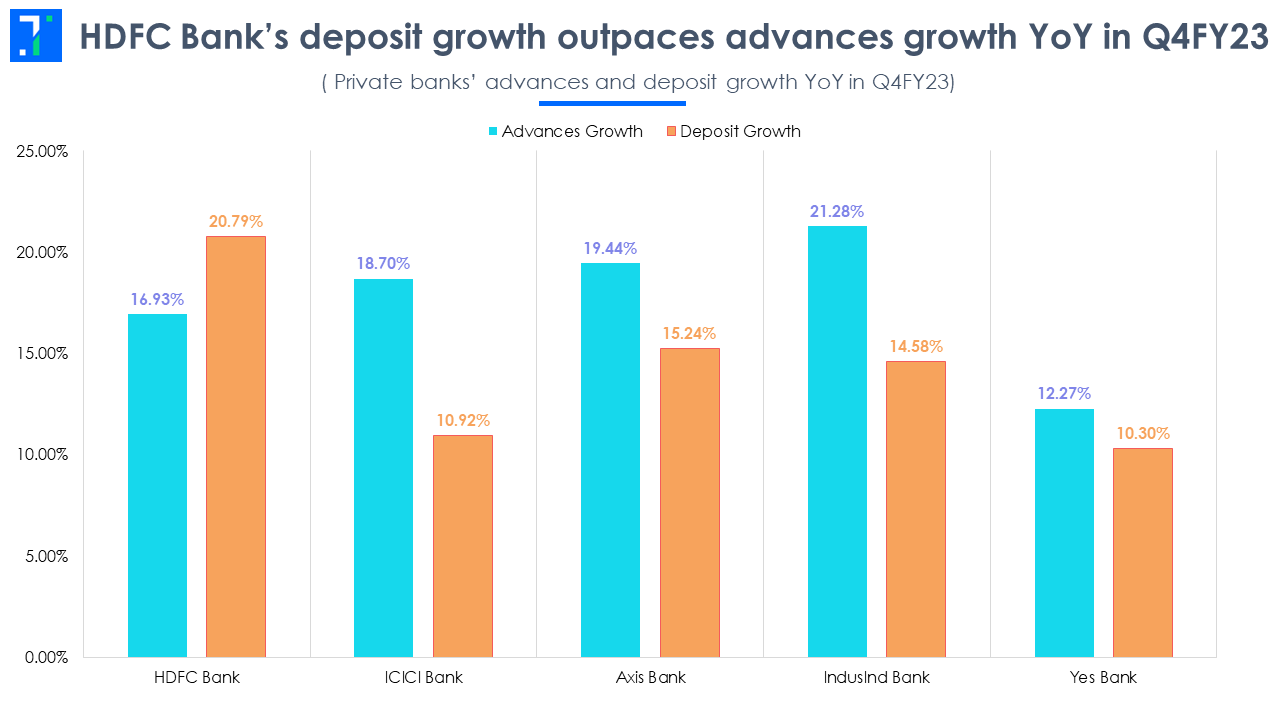

Credit growth slows for large private banks

The high-teen credit growth, visible until Q3FY23, is fizzling out. Recent data released by the RBI indicates a sharp drop in industrial lending from 13.6% in October 2022 to 6.9% in February 2023. The drop has been led by lower credit offtake by medium-sized industries. However, credit requirements from retail sectors in segments like personal loans, vehicle finance, and credit cards remain elevated. Non-Banking Financial Companies (NBFCs) have also been major consumers of credit in Q4FY23.

Although large private banks have shown promising growth of advances in FY23, it remains to be seen if they can sustain this in FY24.

Note: Axis Bank numbers in the charts below are inclusive of its recent acquisition of Citibank.

Note: Axis Bank numbers in the charts below are inclusive of its recent acquisition of Citibank.

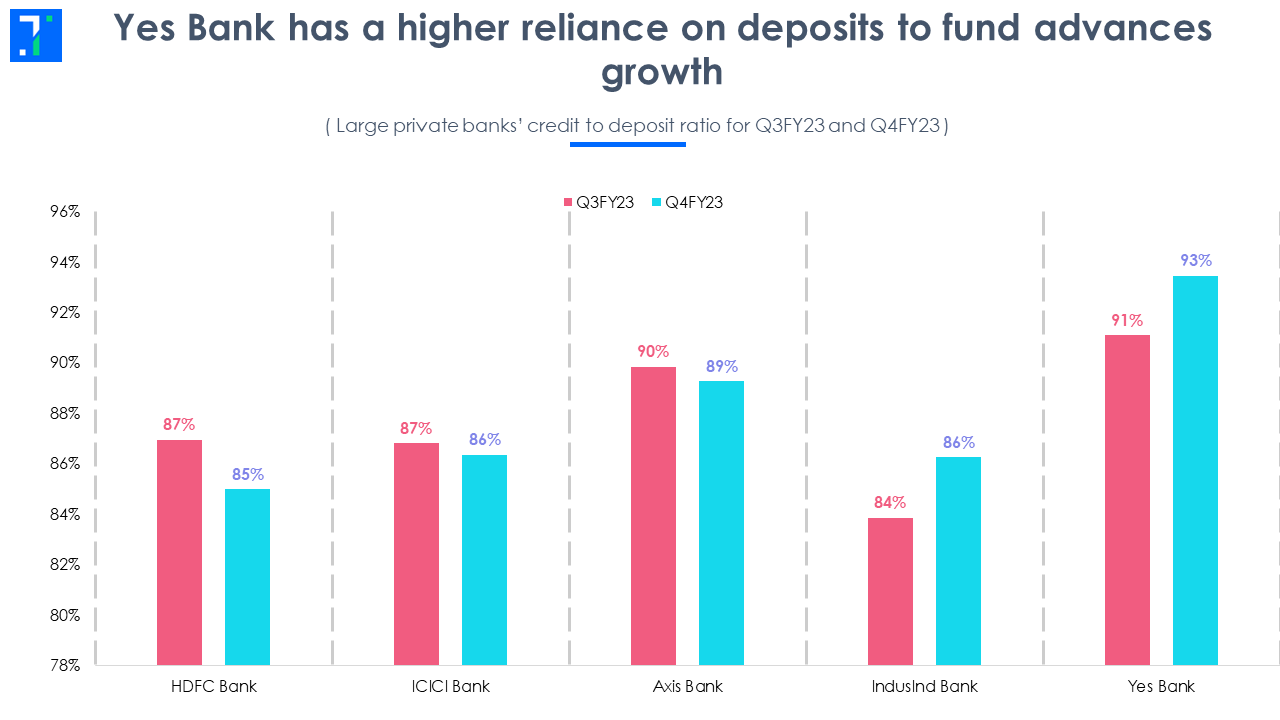

The credit growth witnessed in FY23 by these large private banks was backed by a higher deposit base. This is visible in the increase in the credit-to-deposit ratio of banks such as IndusInd Bank and ICICI Bank, which rose nearly 500 bps in FY23.

In the fourth quarter however, there was a deviation from the trend as three out of five large private banks curbed their credit growth. This was due to higher interest rates, which led to an increase in deposits and lower demand for loans. As a result, HDFC Bank, Axis Bank and ICICI Bank saw a decline in their CD ratio. IndusInd Bank and Yes Bank were exceptions and continued to chase credit growth.

In the fourth quarter however, there was a deviation from the trend as three out of five large private banks curbed their credit growth. This was due to higher interest rates, which led to an increase in deposits and lower demand for loans. As a result, HDFC Bank, Axis Bank and ICICI Bank saw a decline in their CD ratio. IndusInd Bank and Yes Bank were exceptions and continued to chase credit growth.

Most private banks have now exceeded the 85% CD ratio, which can potentially lead to an asset-liability mismatch (ALM) if not managed properly. For instance, Yes Bank’s CD ratio at 93% is high, which leaves little room for growth unless the bank raises more deposits. It's worth noting that part of Yes Bank's advances are funded by bond issuances.

The current interest rate also demands moderate credit growth with a rapid rise in deposits for FY24.

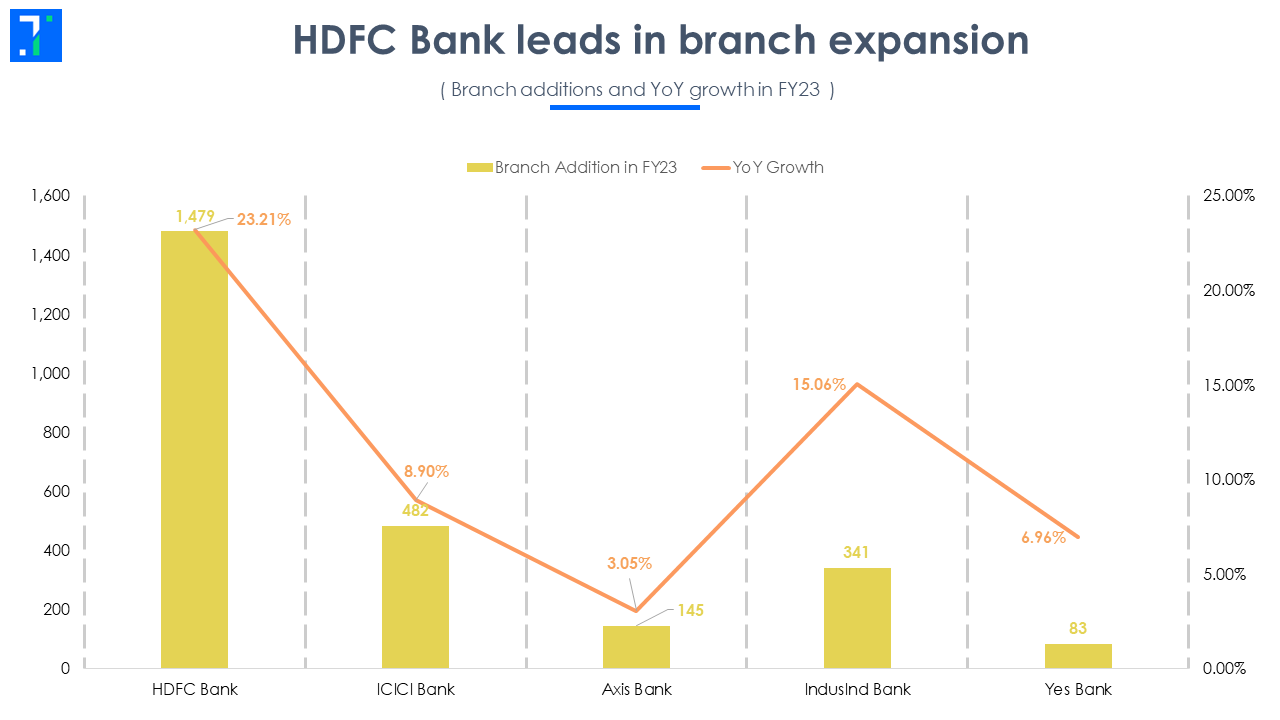

HDFC Bank expands its branch network rapidly in FY23

HDFC Bank is taking steps to scale up its credit/deposit growth by expanding its presence in rural and semi-urban areas, where it has a lower footprint. The bank added 1,479 branches in FY23, an increase of 23% from FY22. This move is expected to boost its customer base.

IndusInd Bank is leading the pack with a 15% increase in its branches. The benefits of new branches will start showing up on the income statement and balance sheet with a lag effect.

IndusInd Bank is leading the pack with a 15% increase in its branches. The benefits of new branches will start showing up on the income statement and balance sheet with a lag effect.

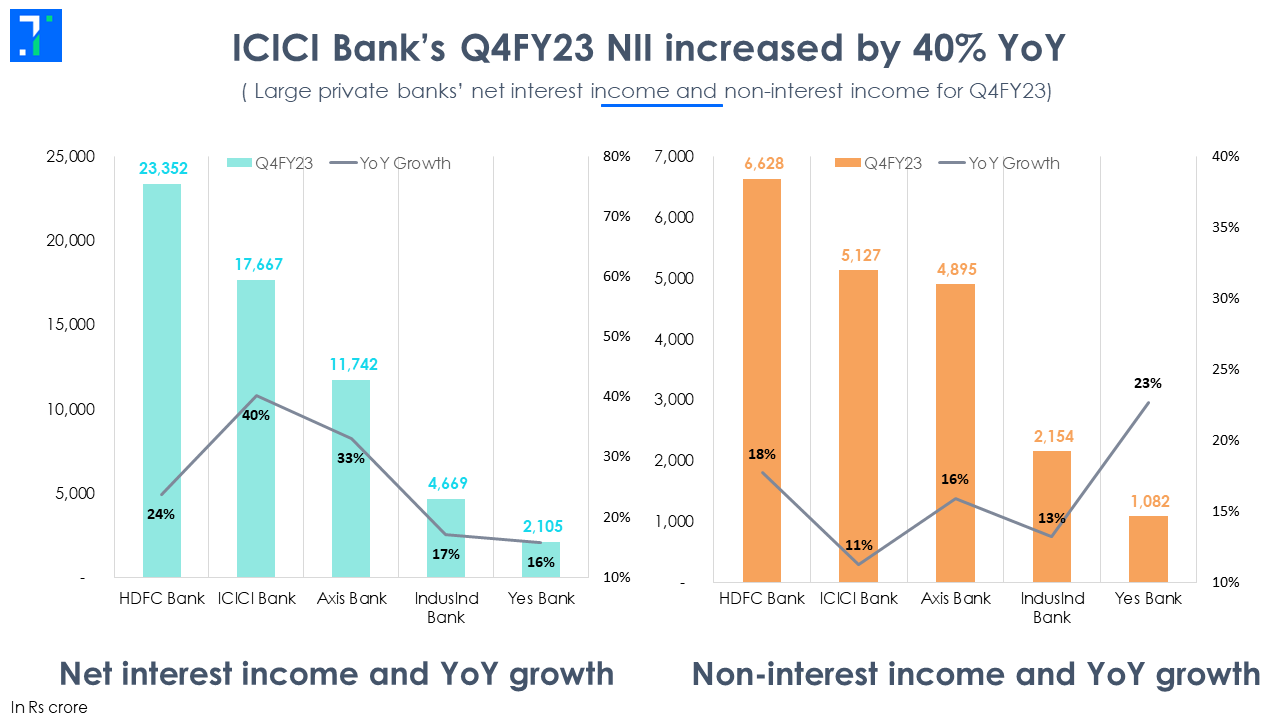

Large private banks see high growth in interest and fee income

All major banks have seen a significant increase in fee income, mainly driven by new loan disbursals. For IndusInd and Yes Bank, fee income accounts for nearly one-third of their gross income. For other banks, it ranges from 22% to 28%.

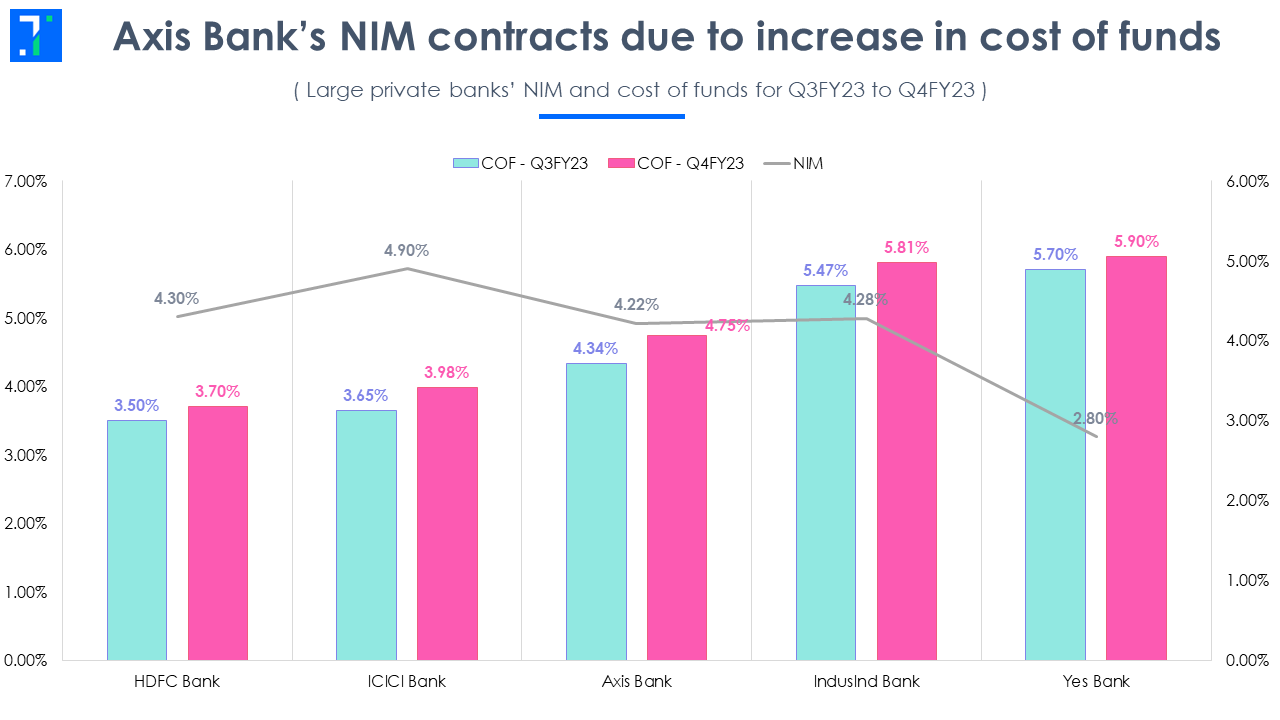

Another key indicator of performance for banks is the net interest income (NII), which has also seen a rapid pace of growth. For instance, ICICI Bank’s NII has grown 40% YoY, driven by margin expansion and high credit growth. Its net interest margin (NIM) at 4.90% is one of the highest among large banks.

Another key indicator of performance for banks is the net interest income (NII), which has also seen a rapid pace of growth. For instance, ICICI Bank’s NII has grown 40% YoY, driven by margin expansion and high credit growth. Its net interest margin (NIM) at 4.90% is one of the highest among large banks.

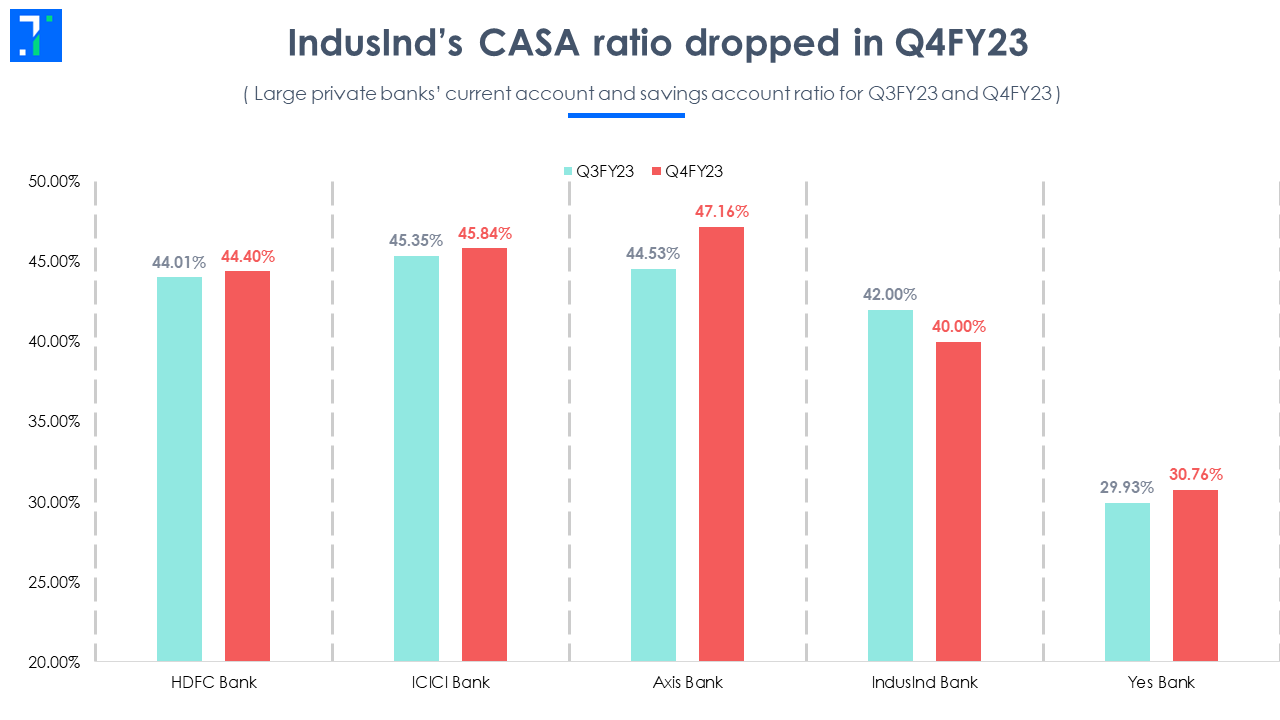

Most banks have seen margin expansion backed by substantial increases in lending rates. The CASA ratio, which had been dropping until Q3FY23, flatlined with a marginal increase in Q4FY23 (a fall in CASA ratio increases the cost of capital. While the cost of capital showed an increasing trend until Q3FY23, the marginal increase in CASA in Q4FY23 indicates moderation in cost of capital for large private banks. Among the large private banks, IndusInd Bank is the only one that saw its CASA ratio drop, while Yes Bank shored up its current and savings account by increasing its CASA ratio by 83 bps QoQ.

Most banks have seen margin expansion backed by substantial increases in lending rates. The CASA ratio, which had been dropping until Q3FY23, flatlined with a marginal increase in Q4FY23 (a fall in CASA ratio increases the cost of capital. While the cost of capital showed an increasing trend until Q3FY23, the marginal increase in CASA in Q4FY23 indicates moderation in cost of capital for large private banks. Among the large private banks, IndusInd Bank is the only one that saw its CASA ratio drop, while Yes Bank shored up its current and savings account by increasing its CASA ratio by 83 bps QoQ.

The increase in yield on advances, and the rise in the cost of deposits have been disproportionate. For instance, ICICI Bank’s cost of deposits improved by 50 bps in FY23, while the yield on advances increased by 144 bps.

The increase in yield on advances, and the rise in the cost of deposits have been disproportionate. For instance, ICICI Bank’s cost of deposits improved by 50 bps in FY23, while the yield on advances increased by 144 bps.

As a result, lending rates have shot up significantly, which may not be sustainable when interest rates begin to rise. This could lead to an increase in NPAs. The yield on advances for IndusInd Bank at the end of Q4FY23 was as high as 12.02%.

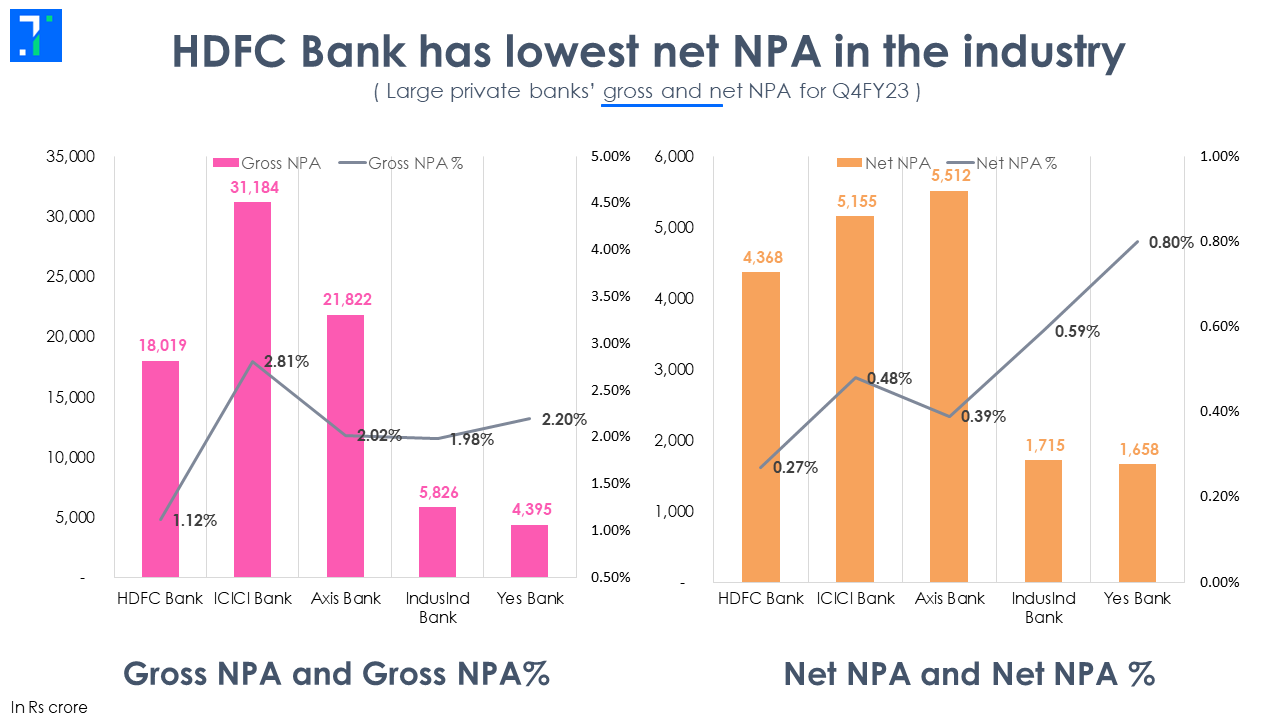

Low net NPAs in private banks may not last as credit growth slows and interest rates fall

Net NPAs have reached their lowest levels, comparable to the high credit growth era of banks from 2006 to 2011. However, gross NPAs are still moderating. High-interest rates and credit growth do not go hand in hand. The fixed-interest loans, which are mainly retail loans, will likely start to see high defaults once the interest rates start falling. For instance, HDFC Bank and Axis Bank have only 41% of its loans linked to external benchmark-linked lending rates.

Usually, a high credit growth cycle is followed by a rise in NPAs,. Eespecially when the credit growth is achieved in a high-interest rate environment. As credit growth slows down to below 10% from the current 16%-17%, coupled with interest rates falling by around 200 bps, gross NPA levels are expected to increase by 150 -180 bps.

Usually, a high credit growth cycle is followed by a rise in NPAs,. Eespecially when the credit growth is achieved in a high-interest rate environment. As credit growth slows down to below 10% from the current 16%-17%, coupled with interest rates falling by around 200 bps, gross NPA levels are expected to increase by 150 -180 bps.

The question is, are the banks well equipped to absorb this kind of rise in NPA? The answer is yes.

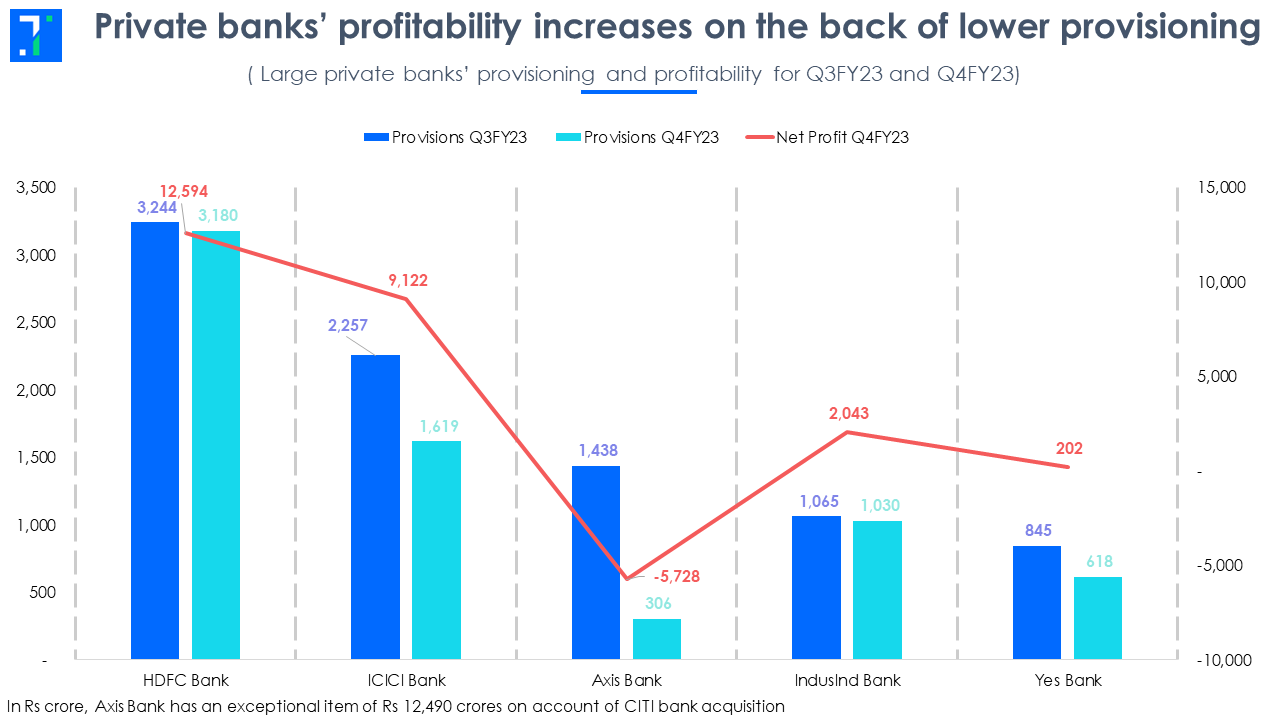

Strong provision coverage and lower provisions boost profitability

Banks have been taking measures to recognise NPAs and make provisions for the last 6-7 years. Consequently, the provision coverage ratio of most banks has increased to above 70%. Moreover, banks have also strengthened their capital buffers. Nearly all private banks maintain their capital adequacy ratio above 17%, while the RBI mandate requires it to be at 9%. This gives sufficient room for further provisioning.

The high PCR and lower net NPA levels have decelerated the provisioning requirements for banks. Currently, banks are reporting only a small portion of their operating profit as provisions. In pre-Covid era, provisions accounted for more than 50% of operating profits. The lower provisioning is driving profitability and increasing the overall liquidity buffers of banks.

The high PCR and lower net NPA levels have decelerated the provisioning requirements for banks. Currently, banks are reporting only a small portion of their operating profit as provisions. In pre-Covid era, provisions accounted for more than 50% of operating profits. The lower provisioning is driving profitability and increasing the overall liquidity buffers of banks.

However, the low provisioning environment is not expected to last for long. With the possibility of an increase in NPA once interest rates drop and the RBI's expected credit loss (ECL) mechanism, banks will need to remain vigilant in their provisioning requirements. However, with their strong capital buffers and high provision coverage ratios, banks are in a better position to absorb these shocks.