The second quarter of FY26 marked a recovery for Indian markets. After a shaky start to the year, things improved as global trade tensions eased and inflation dropped to an eight-year low. This boosted investor confidence. The Reserve Bank of India kept interest rates unchanged in August 2025, citing steady growth and rising rural demand.

Market sentiment has also improved in recent weeks, with progress in US-India trade talks, higher government spending on infrastructure, and stronger manufacturing activity. As companies' margins recovered, investors returned to buying—especially mid-cap stocks, which saw the biggest rebound.

This positive shift was mirrored in the actions of superstar investors like RARE Enterprises, Ashish Kacholia, Sunil Singhania, and Vijay Kedia who after an abundance of caution in the previous quarter, were actively buying again.

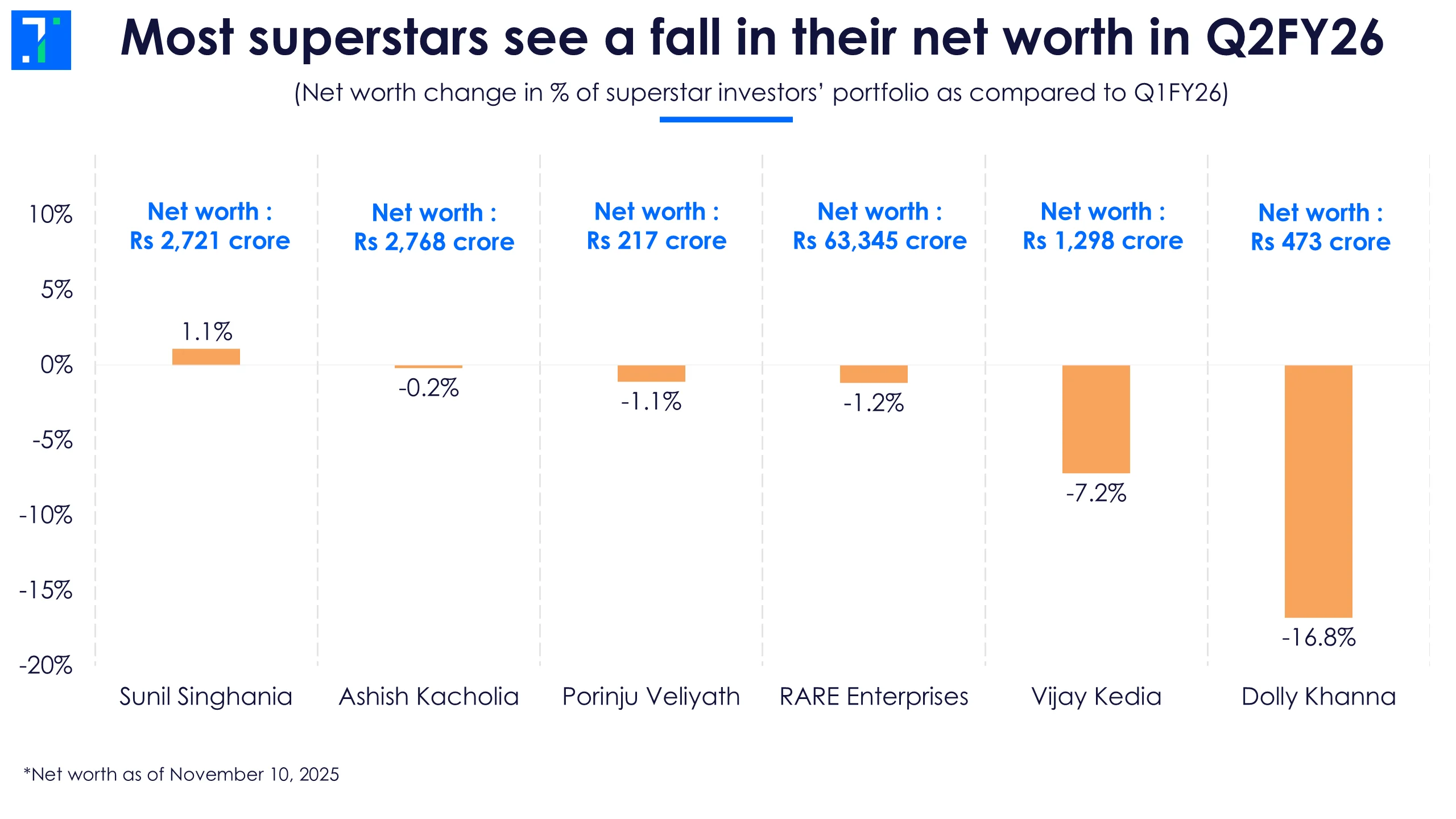

The chart below highlights how portfolio values of major superstars changed during the quarter. Interestingly, even though these investors added new companies, the total value of their portfolios dipped slightly, as they also sold some existing holdings.

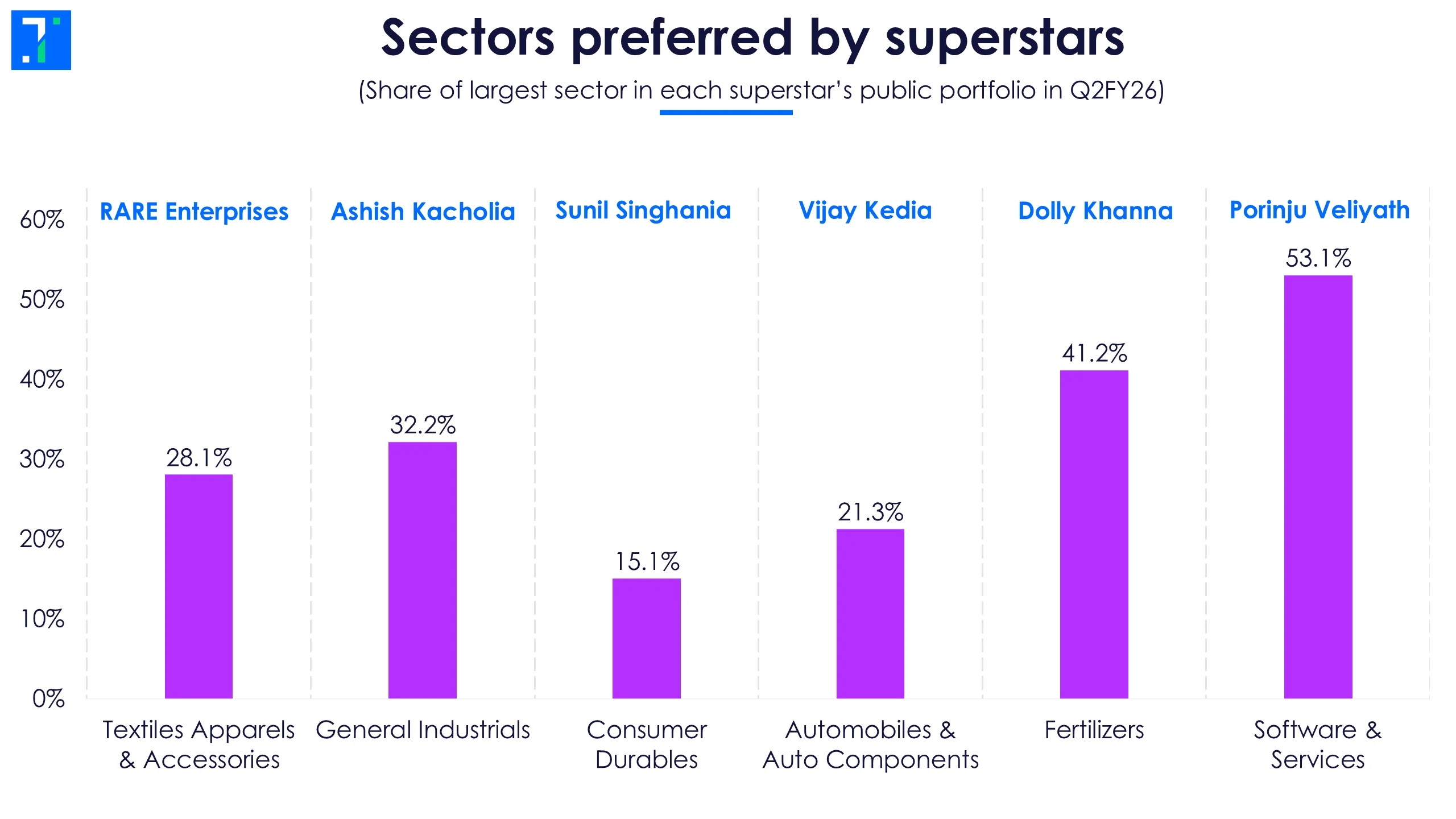

Each superstar investor's portfolio reflects their unique investing style and sector preferences.

Sector focus differs among these market leaders—RARE Enterprises has a strong preference for textiles, apparels & accessories, while Ashish Kacholia is focused on general industrial companies. Sunil Singhania favours consumer durables, and Vijay Kedia’s favorite is auto. Dolly Khanna tends to invest more in fertilizer companies, and Porinju Veliyath’s portfolio is led by the software & services sector.

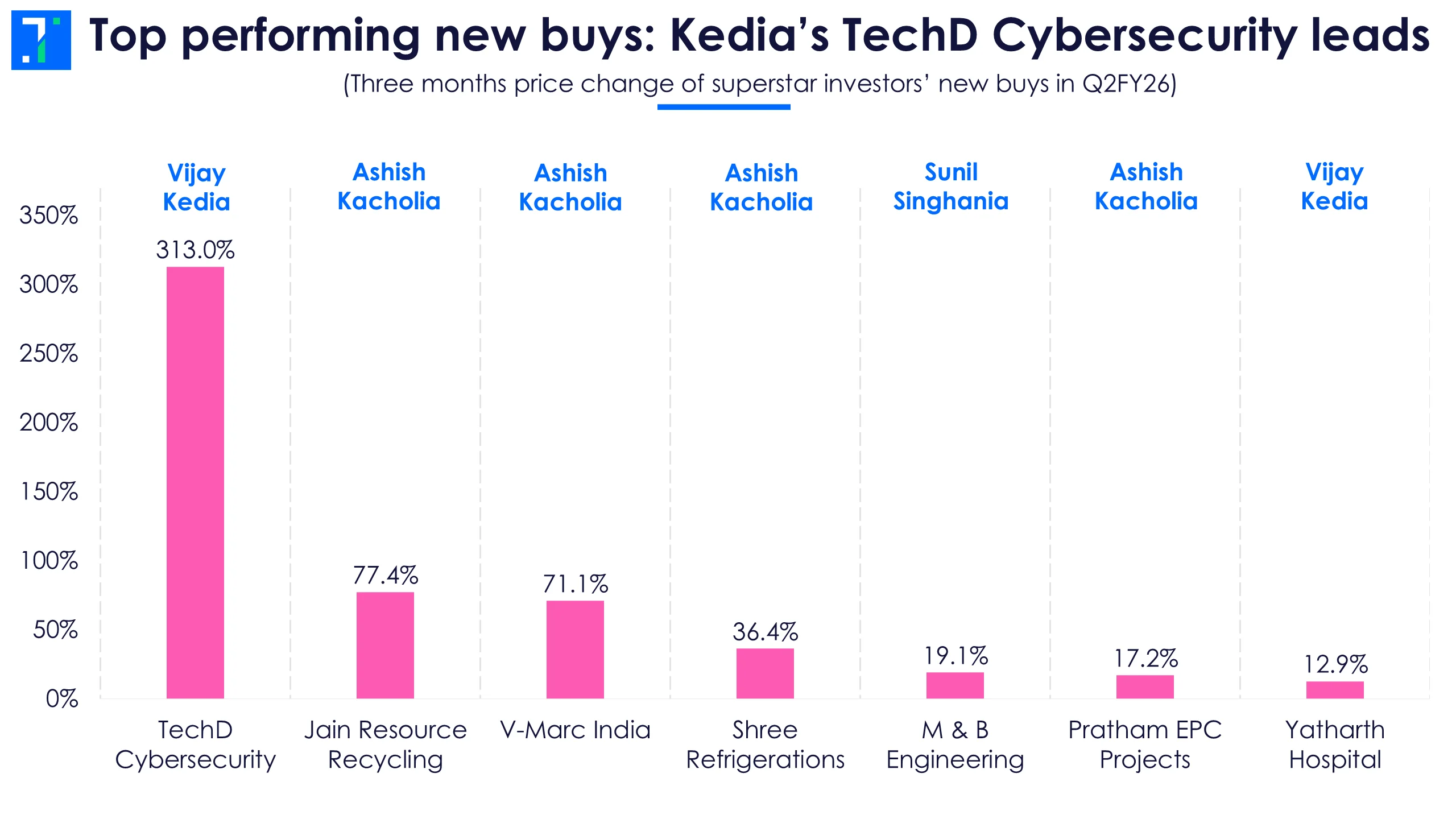

Vijay Kedia added two new stocks to his portfolio during the second quarter, one of which turned out to be a massive winner — TechD Cybersecurity. Ashish Kacholia also made several new investments, with Jain Resource Recycling emerging as his top performer. Here is a closer look at some of the key investments held by these market veterans.

Vijay Kedia’s investment in TechD Cybersecurity was a standout, rocketing up 313% after its stock market debut on September 22. Among Kacholia’s picks, Jain Resource Recycling saw a 77.4% gain, followed by strong performances from V-Marc India and Shree Refrigerations.

Sunil Singhania’s portfolio also featured a winner with M&B Engineering, which climbed 19.1% during the quarter.

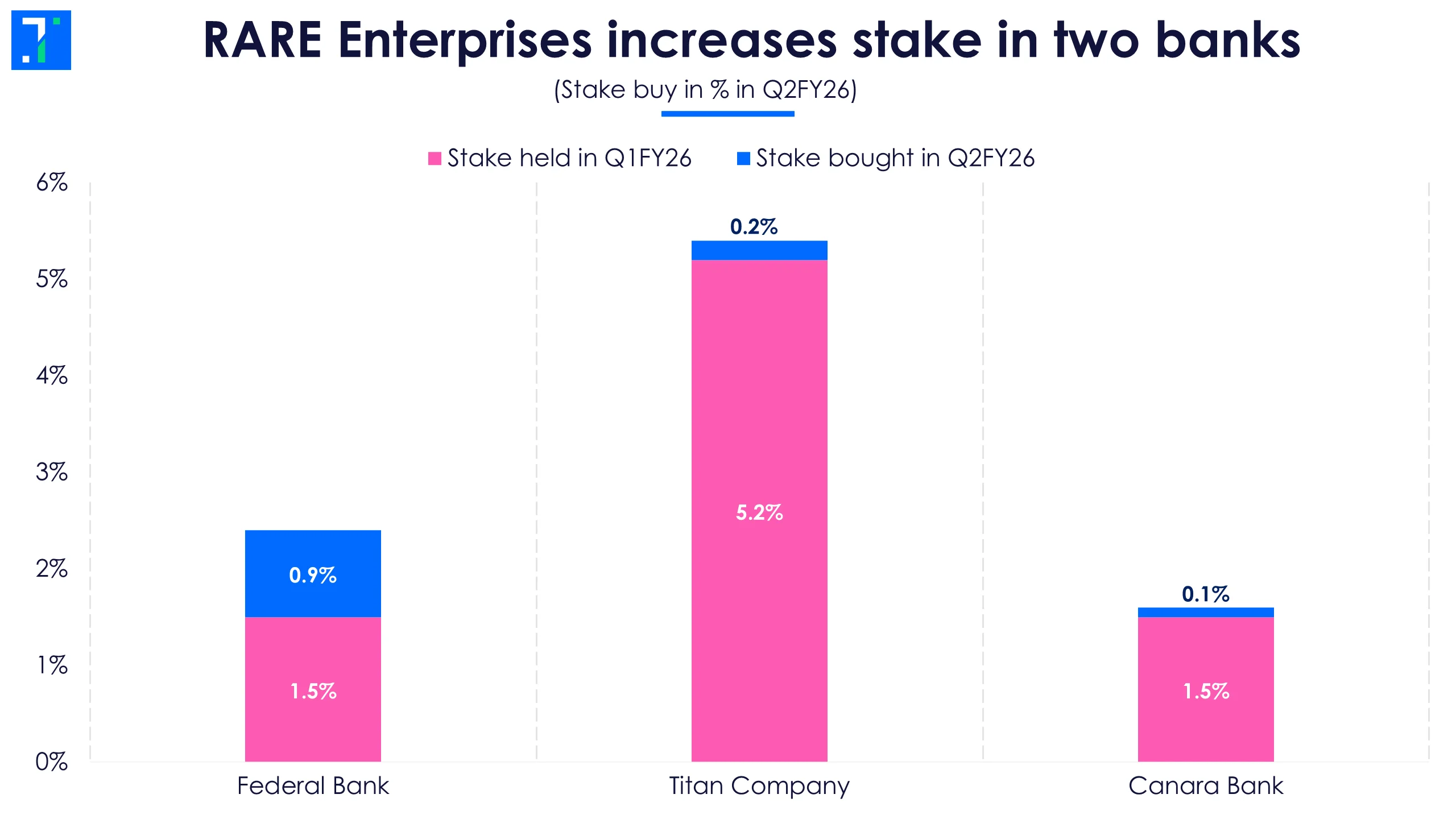

RARE Enterprises increases its bets on three firms

The portfolio of Rakesh Jhunjhunwala, now managed by Rekha Jhunjhunwala and RARE Enterprises, declined 1.2% to Rs 64,180 crore as of November 10. During the quarter, the fund increased its holdings in two banks — Federal Bank and Canara Bank. Its stake in Federal Bank rose by 0.9% to 2.4%, while its holding in Canara Bank went up by 0.1% to 1.6%.

Both these banking stocks have recently touched their 52-week highs. The banking sector has been trending upward in the past month, supported by proposed RBI rules that may allow banks to fund mergers and acquisitions (M&A) and attract more foreign investment.

RARE Enterprises also increased its investment in Titan Company, its largest holding in the portfolio. The fund raised its stake by 0.2% to 5.3%, with the shares now valued at Rs 17,843 crore. Over the past year, Titan’s stock has gained 19.4%, outperforming the gems and jewellery industry by 8.1 percentage points.

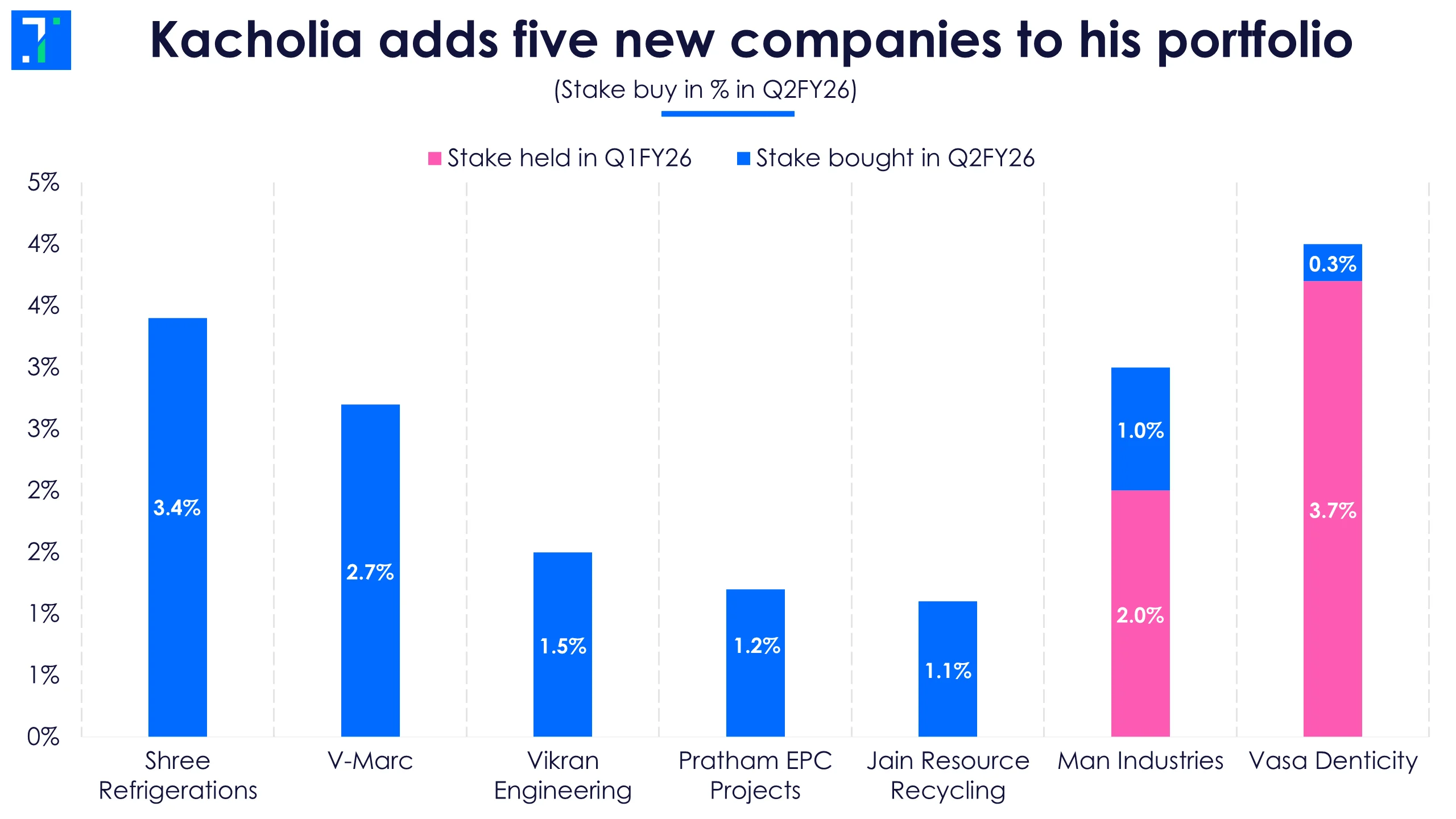

Ashish Kacholia welcomes five new companies, raises stake in two

Ashish Kacholia’s net worth remained flat at Rs 2,768 crore as of November 10. During the quarter, he added five new companies to his portfolio — three of them newly listed.

These were Shree Refrigerations, Vikran Engineering, and Jain Resource Recycling, where he holds 3.4%, 1.5%, and 1.1%, respectively. Both Shree Refrigerations and Jain Resource Recycling are trading above their issue prices, while Vikran Engineering is down about 1% from its issue price.

Kacholia also invested in V-Marc India, a wire & cable manufacturer (2.7% stake), and Pratham EPC Projects, an engineering firm (1.2% stake). Both companies appear in a screener of stocks outperforming their industry price change during the quarter. V-Marc’s stock gained 50.6% over the past year, whereas Pratham EPC’s stock has fallen by over 30%.

He also raised his stake in Man Industries by 1%, bringing his total ownership to 3%. The steel products maker has risen 21.9% in the past year and scores well on Trendlyne’s checklist with a score of 52.2%.

Kacholia increased his holding in Vasa Denticity by 0.3%, taking his total stake to 4%. Although the stock declined 7.7% over the past year, it still outperformed its industry average by 9.1%.

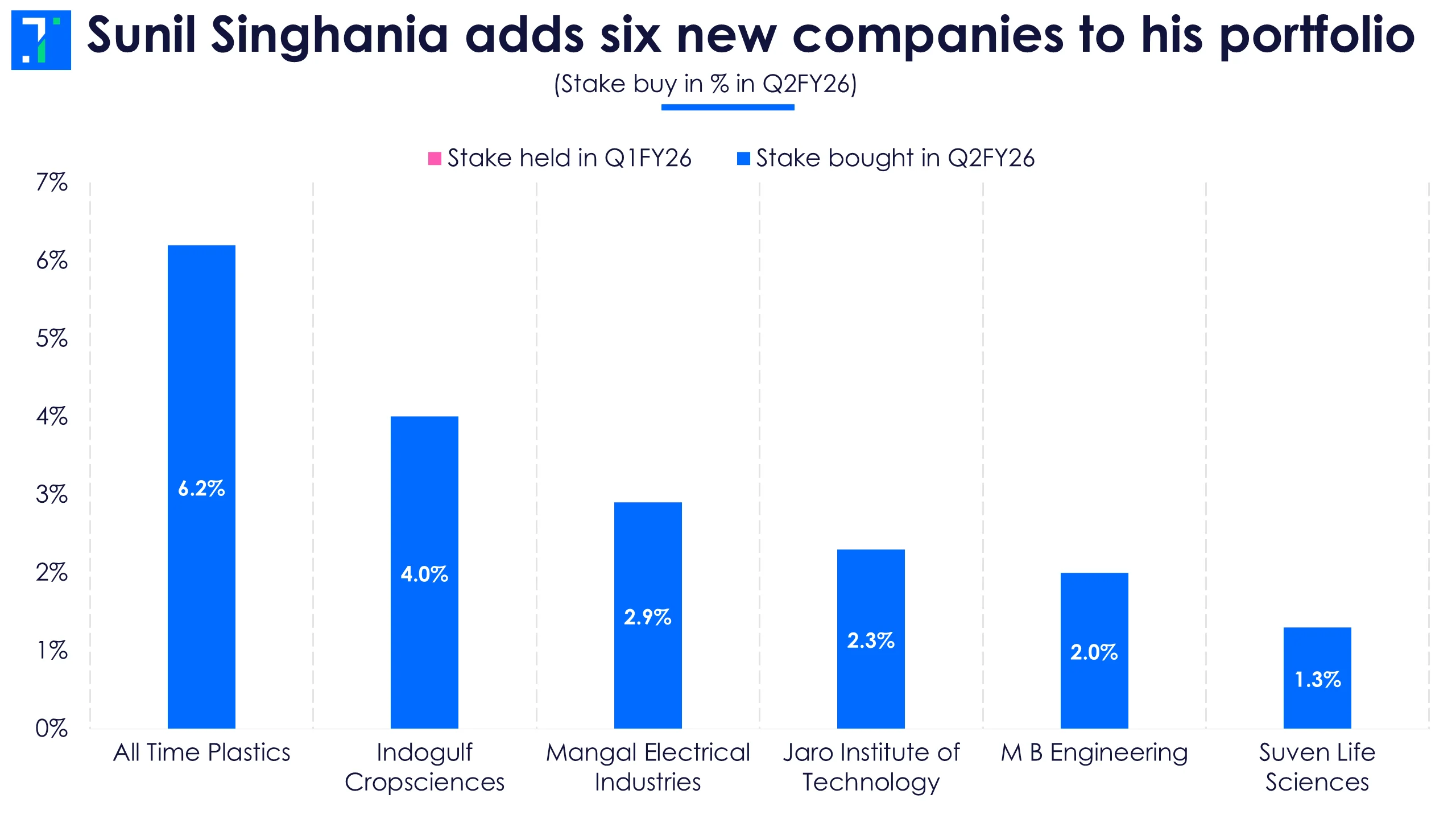

Sunil Singhania makes the most new buys this quarter

Sunil Singhania’s Abakkus Fund saw its net worth rise 1.1% to Rs 2,721 crore as of November 10. After a quiet previous quarter, the fund turned very active in Q2, adding six new companies.

Five of these were newly listed, with Suven Life Sciences being the only exception. His largest new holding was a 6.2% stake in All Time Plastics, whose IPO was oversubscribed 8.3X. The stock now trades 9% above its issue price. Mutual funds have also recently been increasing their holdings in the company.

Singhania also bought 4% stake in Indogulf Cropsciences, an agrochemical company whose IPO saw a strong 26X subscription but has since dropped 10.2% below its issue price. It appears in a screener of stocks that have outperformed their industry over the past quarter.

He also invested in Mangal Electrical Industries, Jaro Institute of Technology Management, and M&B Engineering. All three stocks had a flat start after listing, but M&B Engineering has since performed strongly — up 30% from its issue price. The other two stocks have declined in value.

During the quarter, Sunil Singhania also purchased a 1.3% stake in Suven Life Sciences. The healthcare services company’s stock has jumped 45.3% in the past year, outperforming its industry by 36.8 percentage points. However, the company is yet to turn profitable.

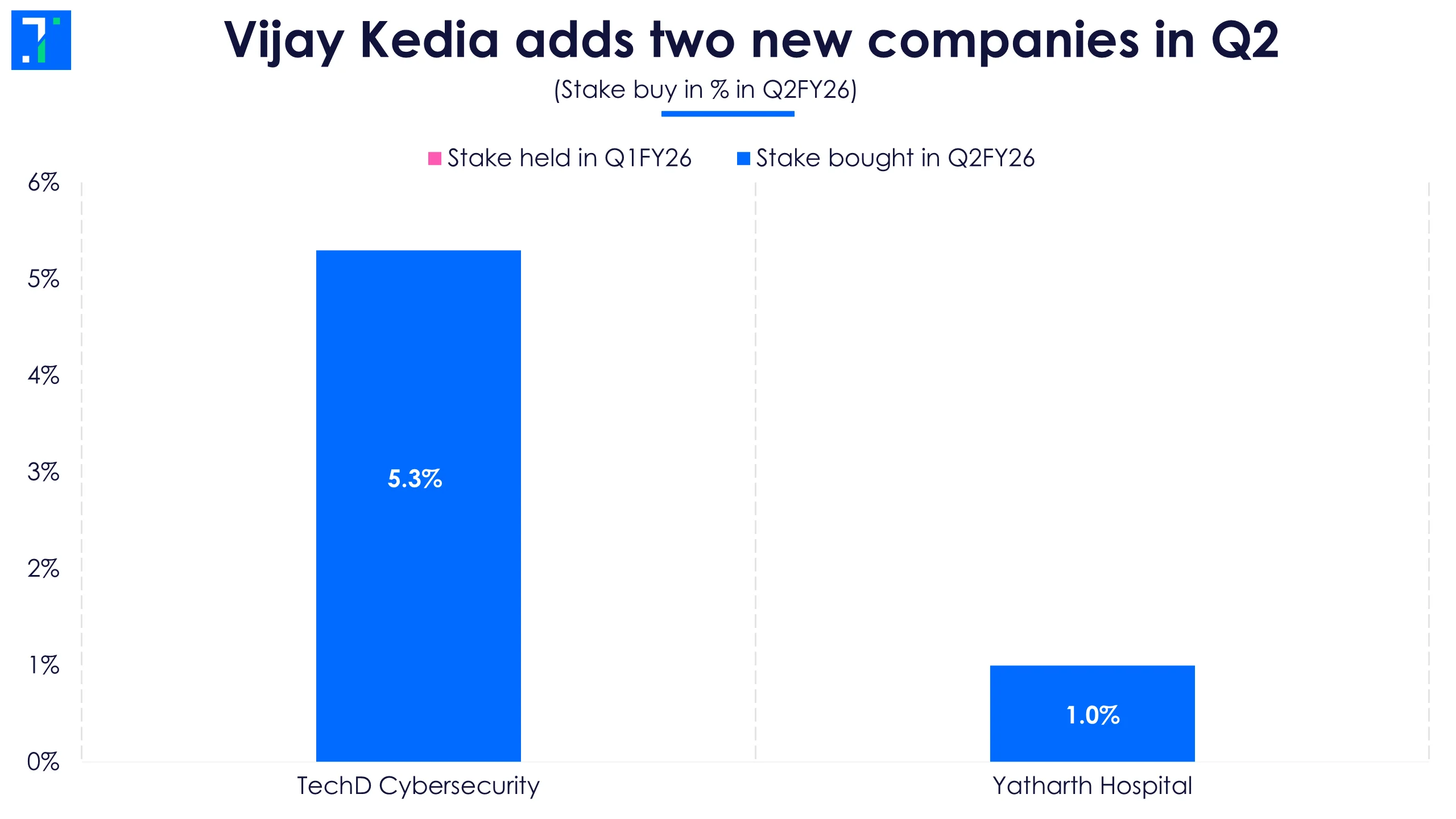

Vijay Kedia adds two new companies to his portfolio

Vijay Kedia added two new companies to his portfolio in Q2FY26. As of November 10, his net worth stands at Rs 1,298 crore, down 7.2%. The decline comes as he sold stakes in two companies and saw his biggest holding, Atul Auto, drop 3% over the past month.

During the September quarter, Kedia bought a 5.3% stake in TechD Cybersecurity during the September quarter. The IT consulting and software company made its debut at a 90% premium and has continued to surge since then. It also features in a screener of companies with low debt.

The ace investor also bought a 1% stake in Yatharth Hospital & Trauma Care Services during the quarter. The healthcare facilities company has outperformed its industry by 22.2 percentage points in the last three months. It appears in a screener of companies where FIIs or institutions are increasing their shareholding.

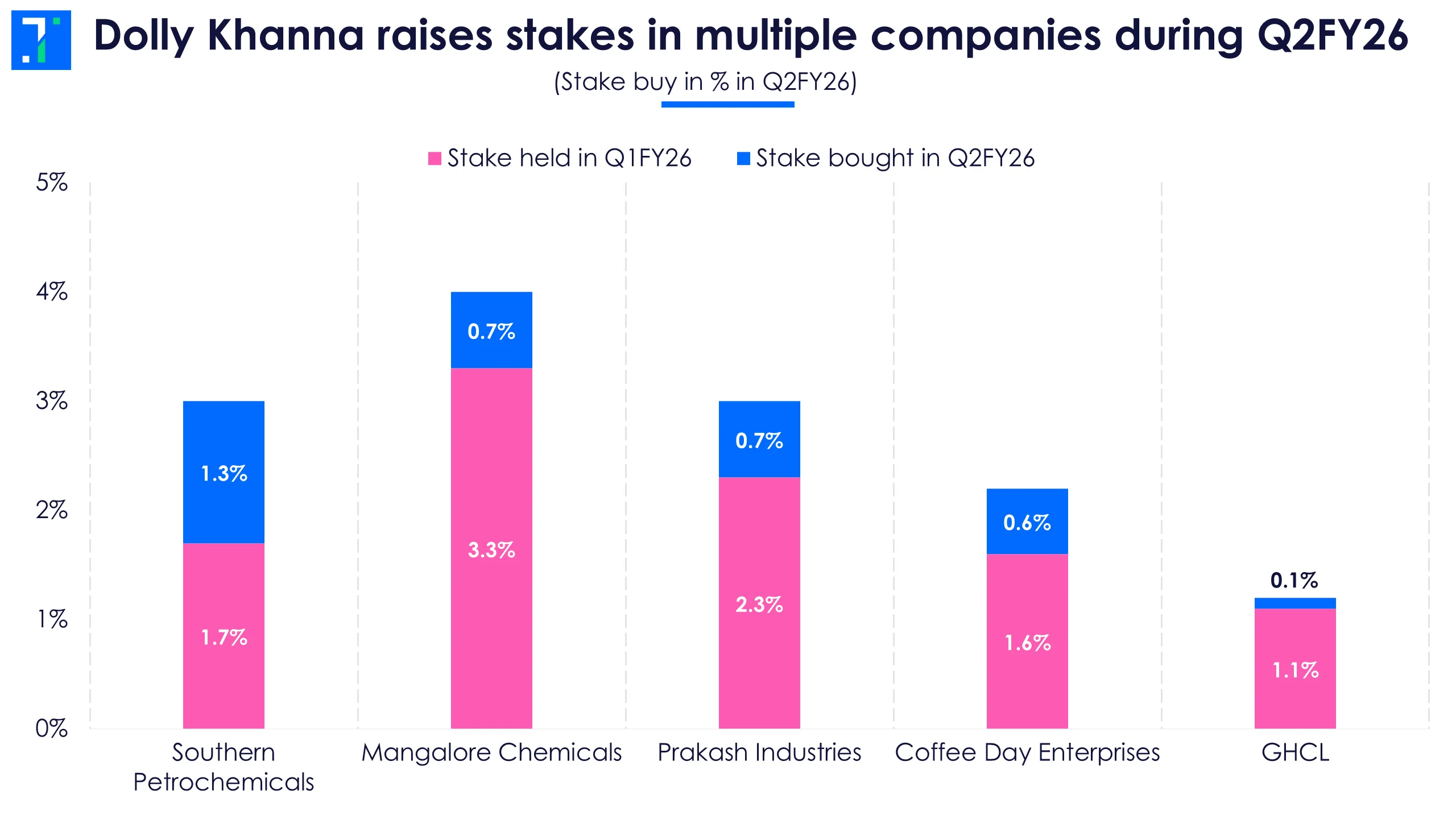

Dolly Khanna increases stakes in five companies

Dolly Khanna’s net worth dropped 16.8% to Rs 475 crore as of November 10, as she sold stakes in nine firms, with her holdings in six of them falling below 1%. She now publicly holds 11 companies and increased her stakes in five of them during the second quarter.

In Q2, Khanna bought a 1.3% stake in Southern Petrochemicals. She had first invested in the fertilizer company in Q1FY26 with a 1.7% stake. The stock has gained 2.1% in the past three months, outperforming its industry by 10.2 percentage points.

She also raised her holdings in Mangalore Chemicals & Fertilizers and Prakash Industries by 0.7% each, taking her stakes to 4% and 2.9%, respectively. This is the fifth consecutive quarter she has increased her stake in Mangalore Chemicals, whose stock has surged 107.7% over the past year.

Prakash Industries, which makes iron and steel products, appears in a screener of companies where mutual funds have increased their holdings over the past two months. Trendlyne classifies it as a “Strong Performer, Under Radar,” based on its Durability and Valuation scores.

Khanna also bought a 0.4% stake in Coffee Day Enterprises. The coffee chain operator’s shares have climbed 19% in the past year, outperforming its industry by 25.8 percentage points. Additionally, she slightly increased her stake in GHCL, a commodity chemicals firm, by 0.1%, taking her total holding to 1.2%.

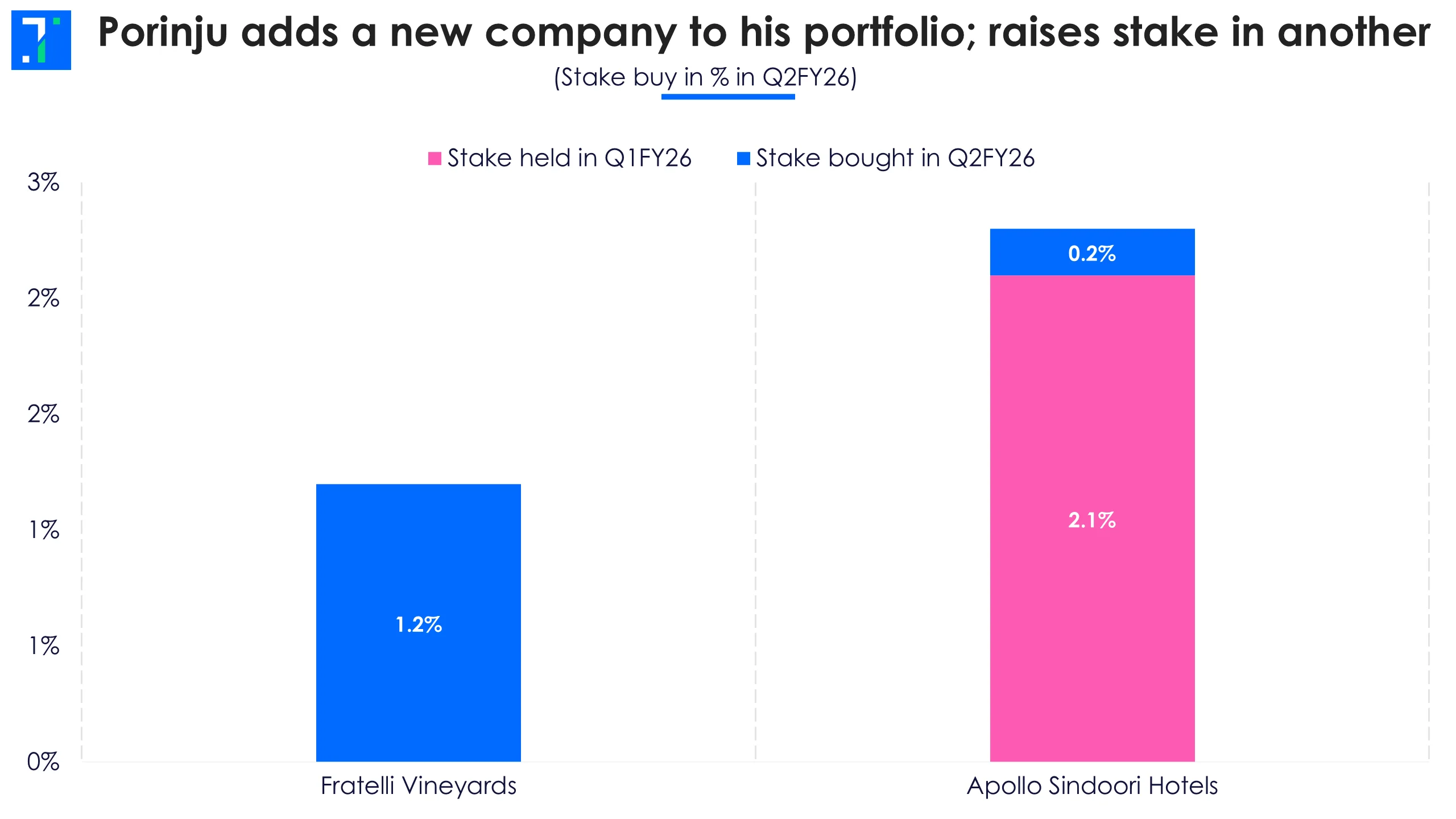

Porinju Veliyath adds a commodity trading firm to his portfolio

Porinju Veliyath’s net worth dropped 1.1% to Rs 217 crore. During the September quarter, he added Fratelli Vineyards to his portfolio by purchasing a 1.2% stake in the commodity trading and distribution company.

The company's share price has fallen by 57.6% over the past year. However, it appears in a screener of companies with consistently high return stocks over five years (up 579.5%).

In Q2FY26, Porinju also increased his holding in Apollo Sindoori Hotels, taking his stake to 2.3%. The company has a Durability score of 65 and a Valuation score of 51.5, indicating strong fundamentals and affordability. This marks the second consecutive quarter that the veteran investor has raised his stake in the hotel stock.