By Ruchir SankhlaThe Nifty 50 ended flat on Monday after it dropped about 0.6% last week. Sentiment improved after the US Federal Reserve cut rates by 25 basis points, easing liquidity concerns. However, persistent foreign investor selling and a weaker rupee have weighed on the market.

In the week ahead, markets are likely to remain volatile as investors track global central bank cues, especially from Japan. The Bank of Japan may deliver its first rate hike in 11 months amid a weaker yen and rising inflation.

Kaynat Chainwala of Kotak Securities said, “Markets are likely to remain jittery, as a potential rate hike would push Japan’s benchmark rate above 0.5% for the first time in three decades, which could prompt a reversal of the yen carry trade and trigger capital shifts out of global equities.”

The primary market will be busy this week with five new issues, including three from the SME segment. Ten companies are also set to list on the exchanges, following sixteen debuts last week.

Sixteen new debuts over the past week, five from the mainboard

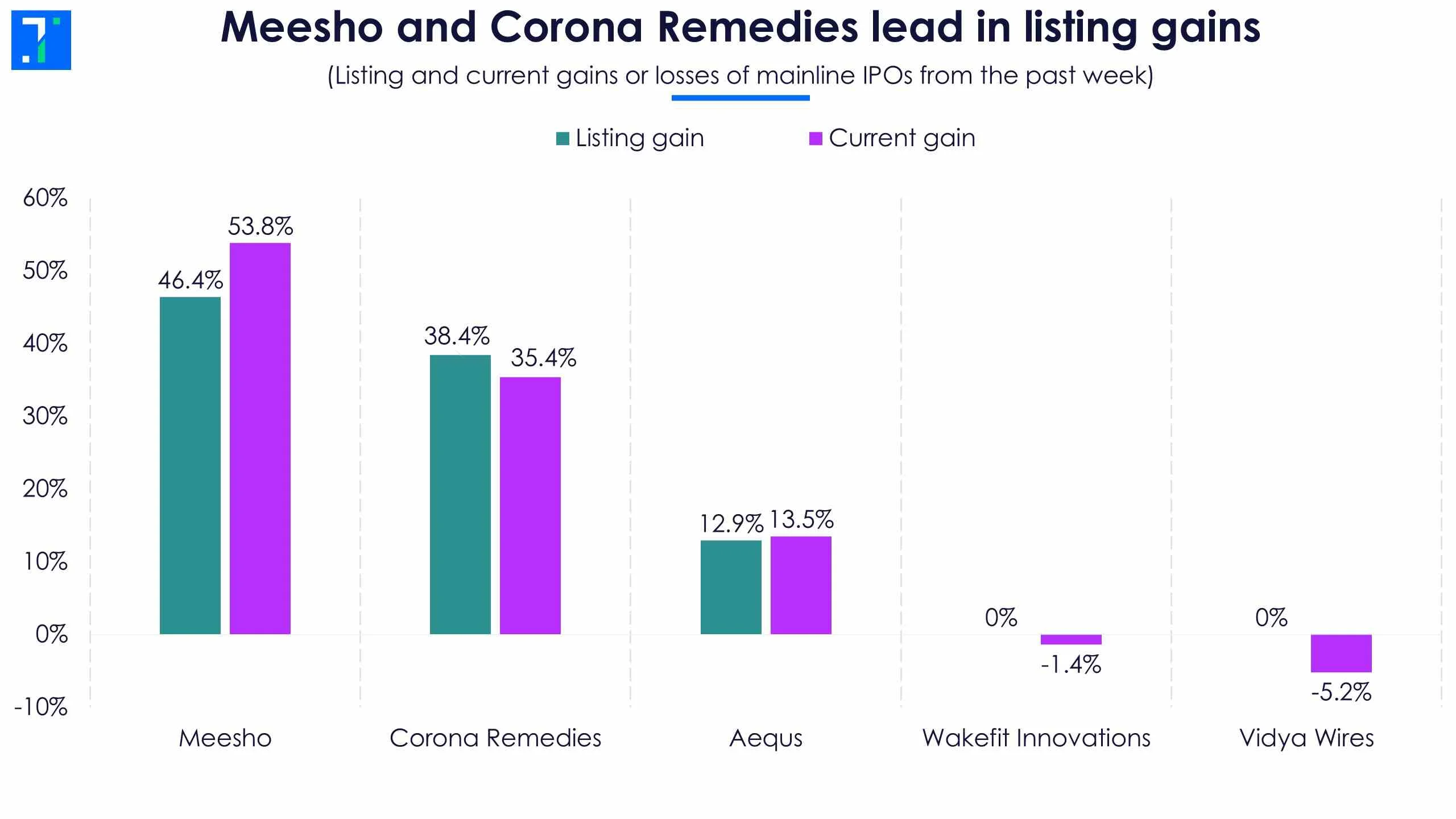

Wakefit Innovations, a D2C home and sleep solutions company, opened its IPO on December 8 at an issue price of Rs 195. It witnessed a flat listing at Rs 195 today (December 15) after its IPO was subscribed 2.5X the shares on offer.

Corona Remedies, a pharmaceutical company focused on chronic therapies, saw strong demand with an overall subscription of 137X. The Rs 655.4 crore IPO debuted at Rs 1,470 on December 15, a premium of about 38.4%.

Vidya Wires, a manufacturer of winding and conductivity products for the power and electrical sector, had a muted debut on December 10. Its shares made a flat debut at Rs 52 and are currently trading 5.2% lower.

Aequs, a manufacturer of aerospace and consumer products, posted a strong debut at Rs 140, a 12.9% premium to its issue price. It currently trades about 13.5% above its issue price.

Meesho, an e-commerce platform, delivered one of the year’s strongest listings, debuting at a 46.4% premium to its issue price of Rs 111. It now trades around 53.8% above its issue price.

Meesho and Corona Remedies lead in listing gains

The week’s SME listings delivered mixed outcomes, with sharp gains in a few names. Encompass Design, a home and lifestyle products maker, listed with nearly 90% gains, while Luxury Time, a retailer of luxury watches, also surged about 90% on debut, after its IPO received subscriptions for 404.2X the shares offered.

K V Toys, a manufacturer of toys, listed at a strong 33.9% premium after being subscribed 158.8X. Neochem Bio Solutions and Prodocs Solutions also debuted in the green, with gains of 10.2% and 4.3%, respectively. Helloji Holidays, despite a healthy 28.1X subscription, witnessed flat listing.

On the downside, Riddhi Display Equipments, a commercial display equipment maker, and Methodhub Software, an IT services firm, both debuted at nearly a 20% discount despite strong subscriptions of 8.1X and 27X, respectively. Shri Kanha Stainless, Flywings Simulator Training, and Western Overseas Study Abroad also saw muted demand, highlighting selective investor appetite across offerings.

Listings continue as IPO market thrives

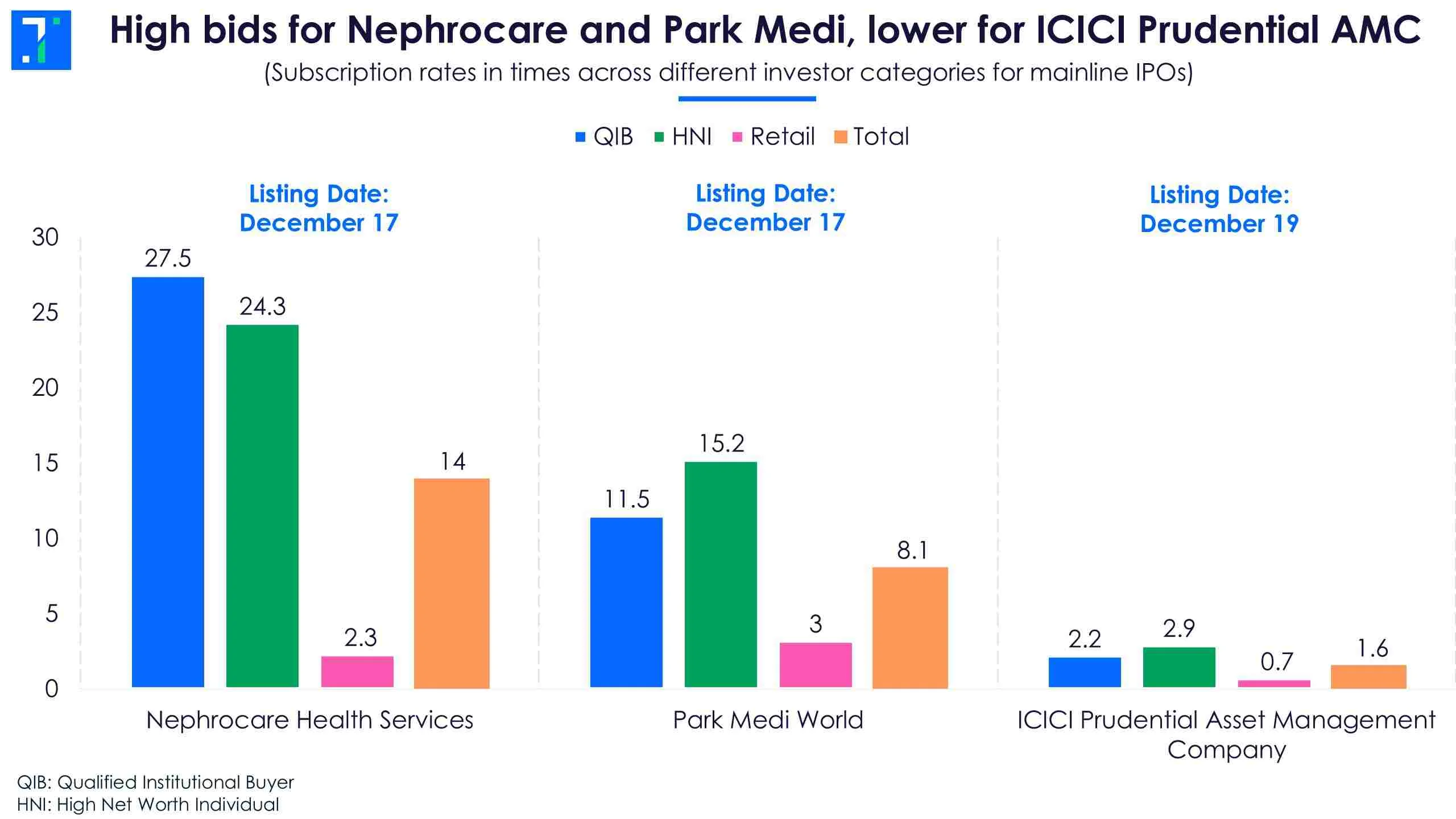

Nephrocare Health Services, India's largest dialysis services provider operating under the NephroPlus brand, closed its Rs 871 crore IPO for subscription on December 12. The issue was subscribed 14X overall, driven by strong interest from the qualified institutional buyers (QIB) segment at 27.5X. The company will list on December 17.

Hospital chain operator Park Medi World’s Rs 920 crore IPO received subscription for 8.1X the shares on offer. The company is also set to list on December 17.

ICICI Prudential Asset Management Company, a mutual fund house, launched its Rs 10,602.7 crore IPO on December 12. The issue, which is an offer for sale (OFS) by the promoter, is open until December 16. The company is set to list on December 19. As of the second day, it had been subscribed 1.6X.

High bids for Nephrocare and Park Medi, lower for ICICI Prudential AMC

Seven companies from the SME segment will enter the stock market this week.

Unisem Agritech, a hybrid seeds developer, and Shipwaves Online, a digital logistics platform, both closed their IPOs on December 12 with subscriptions of 2X and 1.6X, respectively, and are set to list on December 17.

HRS Aluglaze, an aluminium architectural systems company, received a strong 39.8X subscription for its IPO and will list on December 18. Pajson Agro, a cashew processing company, saw its IPO subscribed 5.9X and is also scheduled to list on the same day.

Stanbik Agro, Exim Routes and Ashwini Container Movers, a surface logistics provider, have IPOs open until December 16 and will list on December 19. All three are currently undersubscribed.

Nine new offerings to hit the market this week

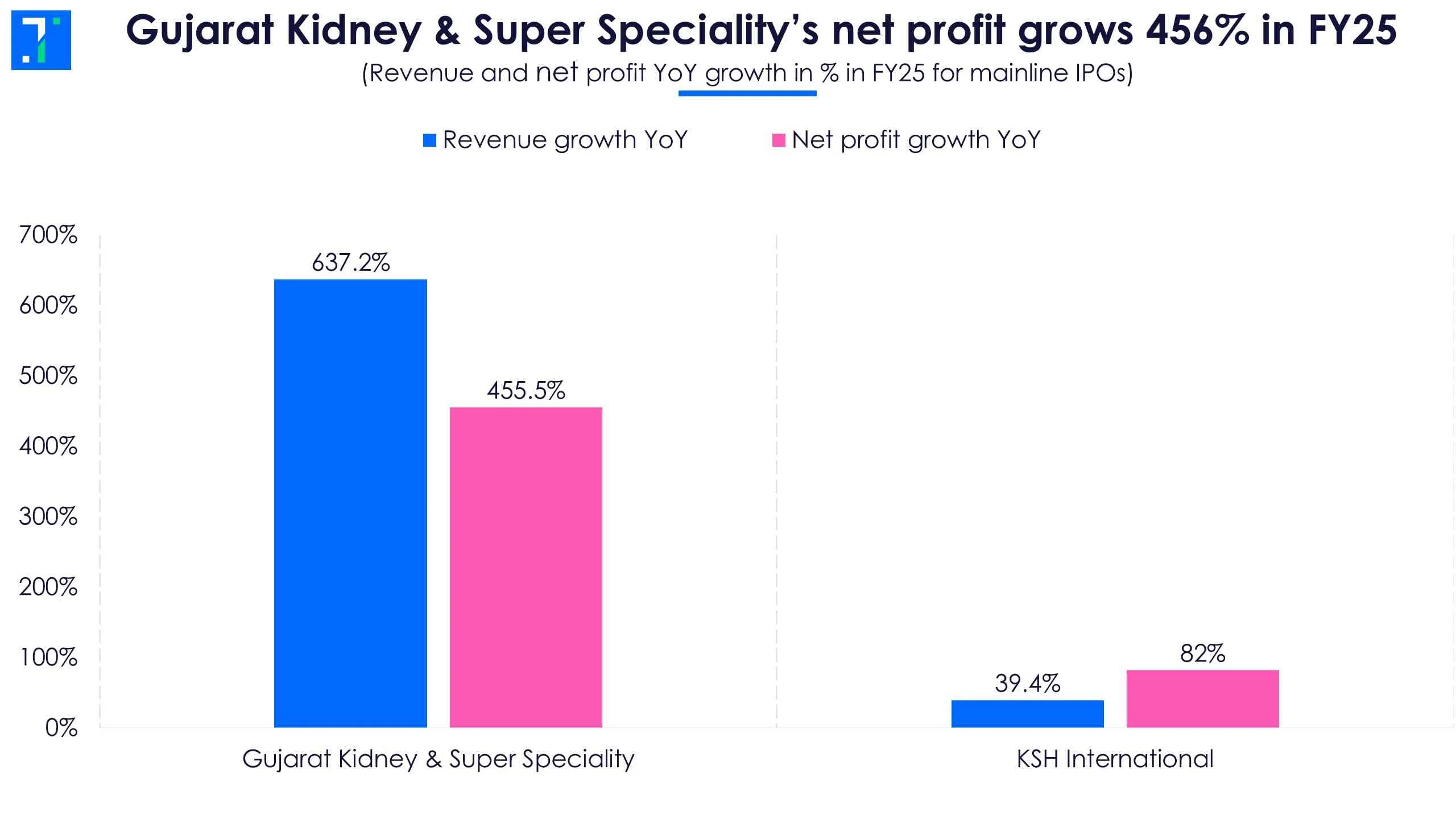

KSH International, an exporter of magnet winding wires in India, plans to raise Rs 710 crore at a price band of Rs 365-384 per share. The IPO opens on December 16, closes on December 18, and will list on December 23. It consists of a fresh issue of Rs 420 crore and an OFS of Rs 290 crore.

Gujarat Kidney & Super Speciality, a regional healthcare provider, is set to open its IPO on December 22. The issue is a fresh issue of up to 2.2 crore equity shares. The IPO is scheduled to close on December 24 and will list on December 30.

Gujarat Kidney & Super Speciality’s net profit grows 456% in FY25

Five SME offerings open their subscription windows this week.

Neptune Logitek, an integrated logistics solution provider, opened for subscription on December 15. The fixed-price IPO of Rs 46.6 crore will close on December 17 and list on December 22.

Global Ocean Logistics, a logistics company, is scheduled to open for subscription on December 17. The Rs 30.4 crore IPO, with a price band of Rs 74-78 per share, will close on December 19 and list on December 24.

MARC Technocrats is set to open for subscription on December 17. The Rs 42.6 crore issue has a price band of Rs 88-93 per share and will close on December 19. It is scheduled to list on December 24.

Phytochem Remedies, a cardboard box manufacturer, is scheduled to open for subscription on December 18. The fixed-price IPO of Rs 38.2 crore will close on December 22 and is expected to list on December 26.

Shyam Dhani Industries, a manufacturer of spices, is set to open for subscription on December 22. The issue size is approximately Rs 38.5 crore, with a price band of Rs 65-70 per share. It will close on December 24 and is expected to list on December 30.