By Ruchir Sankhla

Indian markets snapped a three-week losing streak last week but turned weak again on Monday. Strong domestic inflows and hopes that the US Federal Reserve may ease interest rates in the coming months supported the brief recovery.

On the downside, slow progress in India–US trade talks (“stuck at Trump’s door”, CNBC reports) and selling by foreign investors have kept the market muted.

Trading activity is expected to stay light this week due to the global holiday season. Major markets, including the US and Europe, will be closed on January 1 for New Year’s Day.

Vinod Nair, Head of Research at Geojit Investments, said, “Market sentiment is likely to stay cautious as investors brace for the upcoming earnings season and keep an eye on global developments and currency movements."

IPO activity remains muted this week, with only one SME issue open for subscription. Eleven companies are set to list, marking a shift from just three new listings last week.

Three new companies debuted on the bourses in the past week

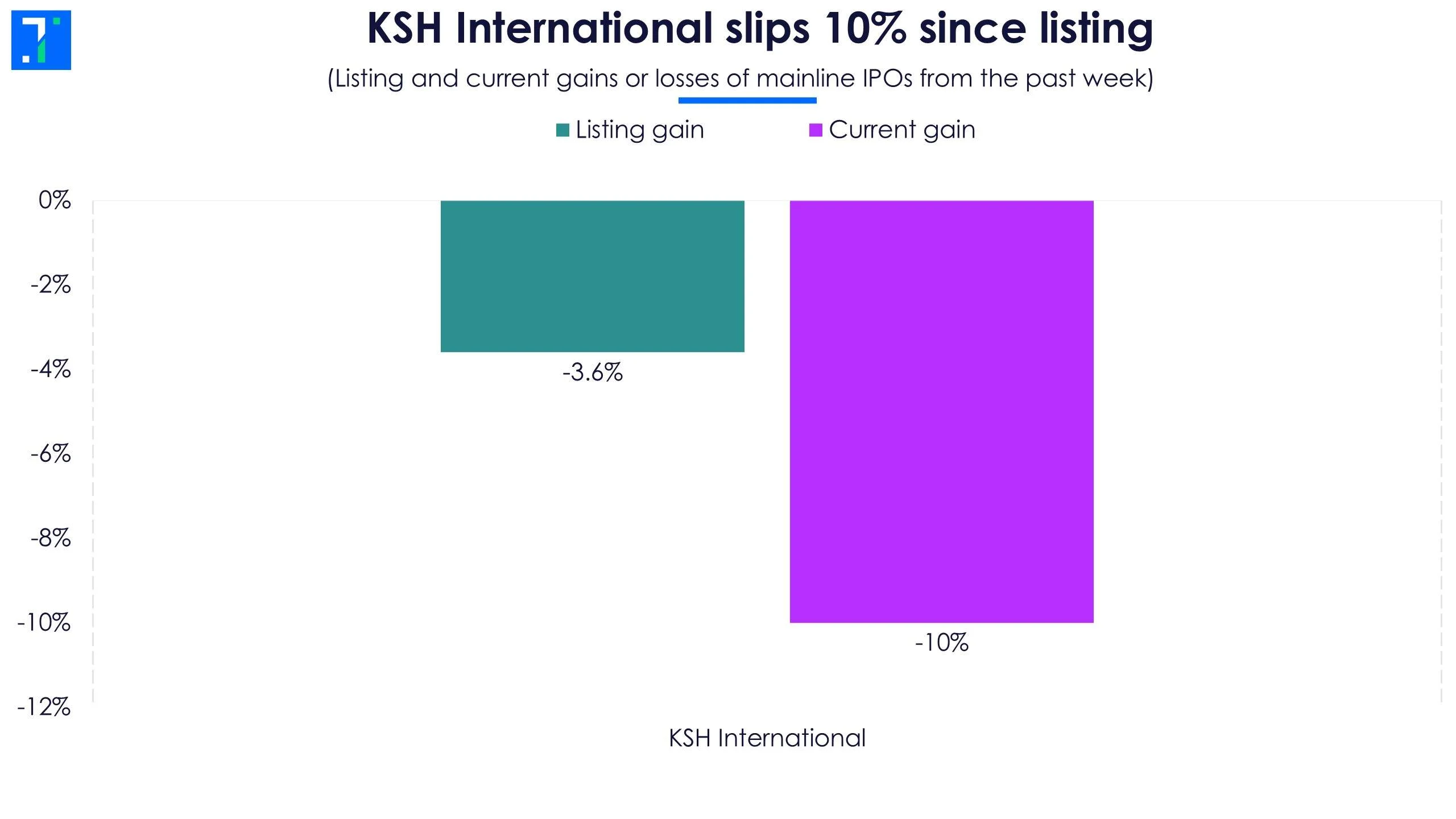

KSH International, an exporter of magnet winding wires, made a weak stock market debut on December 23. The company’s IPO, initially sized at Rs 710 crore and later revised to Rs 644.4 crore, saw weak overall subscription of 0.8X. It got listed at Rs 370, a 3.6% discount. The shares are currently trading 10% below the issue price of Rs 384.

KSH International slips 10% since listing

MARC Technocrats, an infrastructure consultancy firm, experienced a disappointing listing on December 24. Despite receiving a healthy subscription of 9.4X, the company’s Rs 42.6 crore issue debuted at Rs 74.4 per share, a 20% discount over its issue price of Rs 93.

Global Ocean Logistics, a multimodal logistics company, saw a flat listing on December 24. The Rs 30.4 crore fresh issue, subscribed 12.8 times, debuted at Rs 79.2, a 1.5% premium over the issue price of Rs 78.

Phytochem Remedies (India) withdrew its Rs 38.2 crore IPO on December 22 after it failed to achieve SEBI’s mandatory 90% minimum subscription. The issue was subscribed only 59% by the close of bidding, with the company citing unfavourable market conditions and valuation concerns.

An eventful week ahead with eleven IPOs scheduled to list

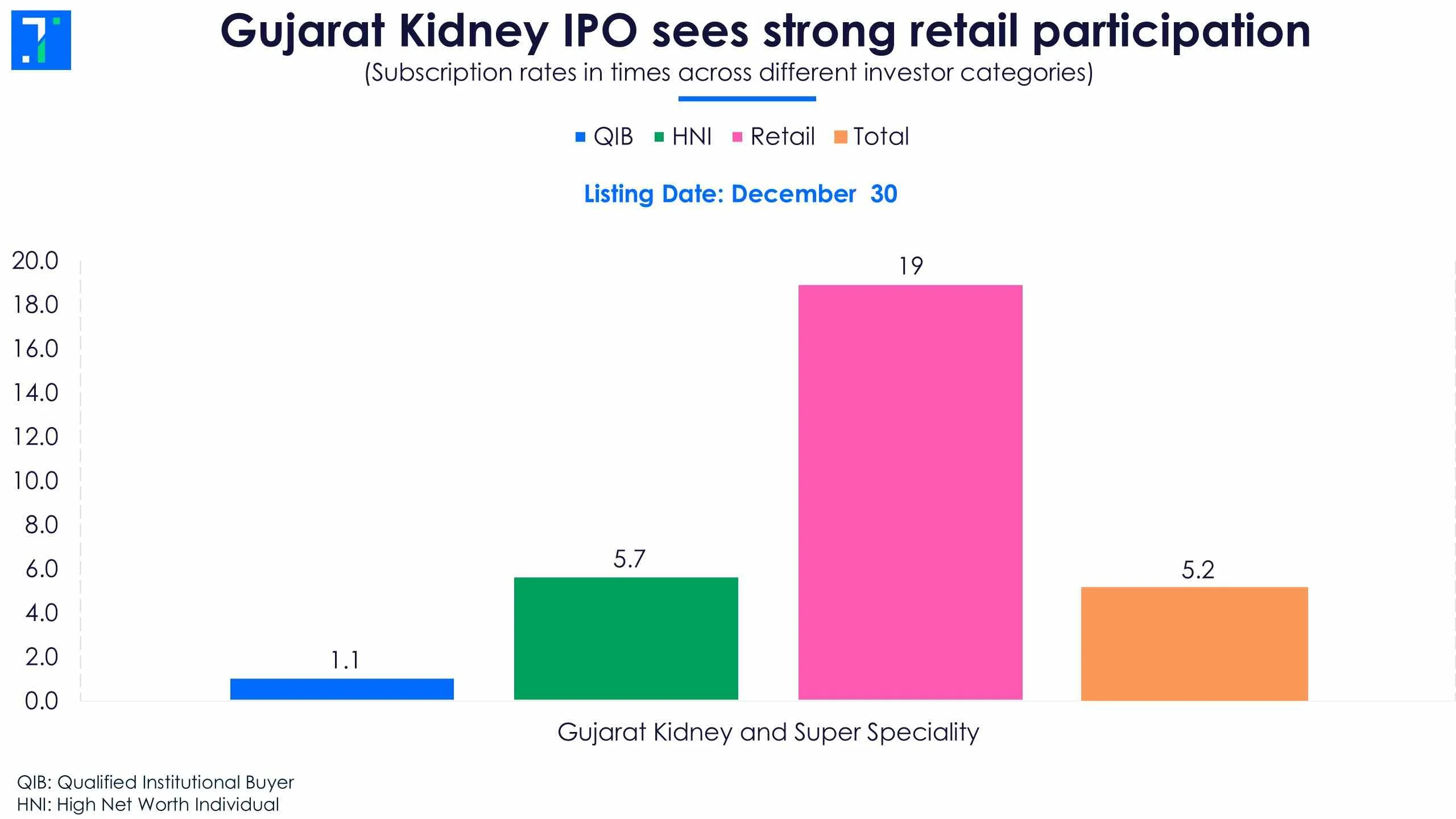

Gujarat Kidney and Super Speciality, a regional multi-speciality healthcare provider, closed its Rs 250.8 crore IPO for subscription on December 24. The issue was subscribed 5.2X overall, driven by strong demand from the retail investor segment at 19X. The company will list on December 30.

Gujarat Kidney IPO sees strong retail participation

A busy week ahead for the SME segment with ten IPOs slated to hit the market.

- Sundrex Oil Company closed its Rs 32.3 crore IPO on December 24, with overall subscription of 1.5X led by retail investors. The lubricant maker will list on December 30.

- EPW India wrapped up its Rs 31.8 crore IPO on December 24, with a 1.3X subscription, driven by high-net-worth individuals (HNIs). The company will debut on December 30.

- Dachepalli Publishers saw its Rs 40.4 crore IPO subscribed 1.9X by December 24, supported by strong HNI demand. The education-focused publisher will list on December 30.

- Shyam Dhani Industries received a strong response, with its Rs 38.5 crore IPO subscribed 918.1X overall by December 24. The spice manufacturer will list on December 30.

- Dhara Rail Projects closed its Rs 50.2 crore IPO on December 26, achieving 104X subscription on the back of institutional interest. The company is expected to list on December 31.

- BaiKakaji Polymers closed its Rs 105.2 crore IPO on December 26 with 5.4X subscription, led by HNIs. The plastic granules manufacturer will list on December 31.

- Apollo Techno Industries closed its Rs 48 crore IPO with a 47.1X subscription on December 26, driven by strong HNI participation. The company will list on December 31.

- Nanta Tech closed its Rs 31.8 crore IPO on December 26, with an overall subscription of 6X. The audio-visual integration company is slated to list on December 31.

- Admach Systems, an engineering machine manufacturer, closed its Rs 42.6 crore IPO on December 26, receiving 4X subscription, driven by individual and HNI investors. The stock will list on December 31.

- E to E Transportation Infrastructure opened its Rs 84.2 crore IPO on December 26, with early bidding indicating strong market interest. The issue closes on December 30 and lists on January 2, 2026.

This week sees a single IPO coming up for subscription

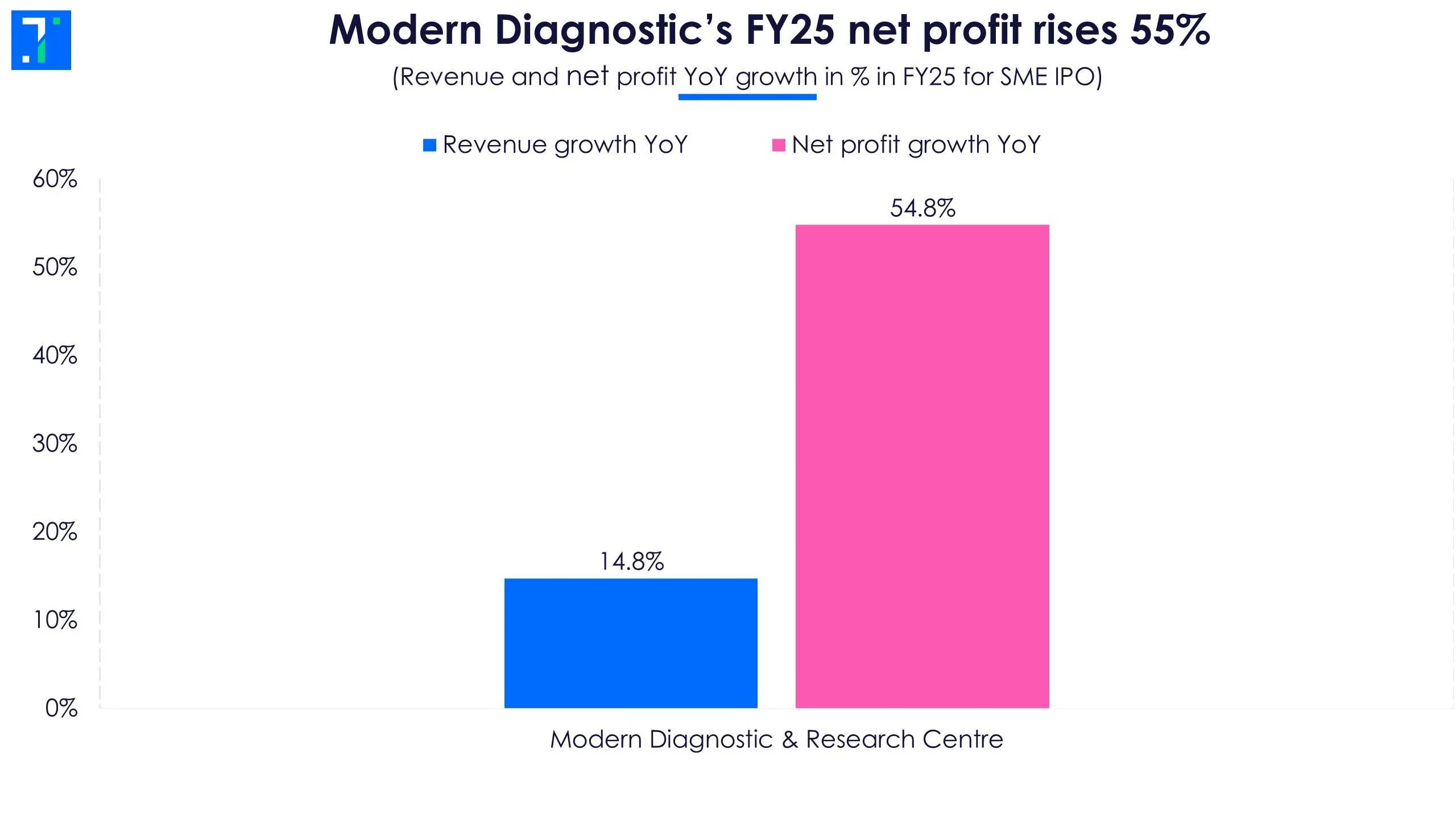

Modern Diagnostic & Research Centre, a diagnostic healthcare provider with a strong presence in North India, plans to raise Rs 36.9 crore at a price band of Rs 85–90 per share. The IPO is scheduled to open on December 31, close on January 2, and list on January 7. The issue consists entirely of a fresh issue of 41 lakh equity shares, with no offer-for-sale component from existing promoters.

Modern Diagnostic’s FY25 net profit rises 55%

The company has reported a sharp improvement in its financial performance over the past years. It turned profitable in FY24, thanks to improved cost control and higher test volumes across its network. The IPO proceeds will be used to purchase new medical equipment, fund working capital needs, and reduce debt.