No one wants the news to be too interesting. But that's what has happened in 2025. After Trump's tariffs came the India-Pakistan conflict, and now it's the Iran-Israel war. It’s been a year where one should ask: "Who needs Netflix?" Just refresh the news page.

Everyone praises the patient, long-term investor. And sure, patience may be a virtue, but these days it’s being tested everyday.

How are the world’s major indices holding up in the storm? Trendlyne’s global indices dashboard has the answers, and we take a closer look.

In this week’s Analyticks,

- Markets versus global shocks: A performance check of global indices

- Screener: Stocks beating the Nifty 50 and their sectors over the past quarter and year

Global indices: 2025's winners and losers

Only three major indices have posted gains so far in 2025: Hong Kong’s Hang Seng Index, followed by Germany’s DAX and the UK’s FTSE 100.

The Taiwan Weighted Index, 2024’s top performer, has tumbled to the bottom, hit by a cooling AI-tech boom and worries over US tariffs targeting semiconductors.

Only Hang Seng and DAX post double-digit gains in the past six months

Nifty 500 and Nasdaq 100 bounced back with double-digit gains over the past quarter. But despite the recent recovery, both indices have been flat overall in 2025 due to a weak start to the year.

India’s Nifty 500 is the top performer over five years, with the Nasdaq 100 in the second spot. The Hang Seng, FTSE 100, and Shanghai Composite lag over the same time period.

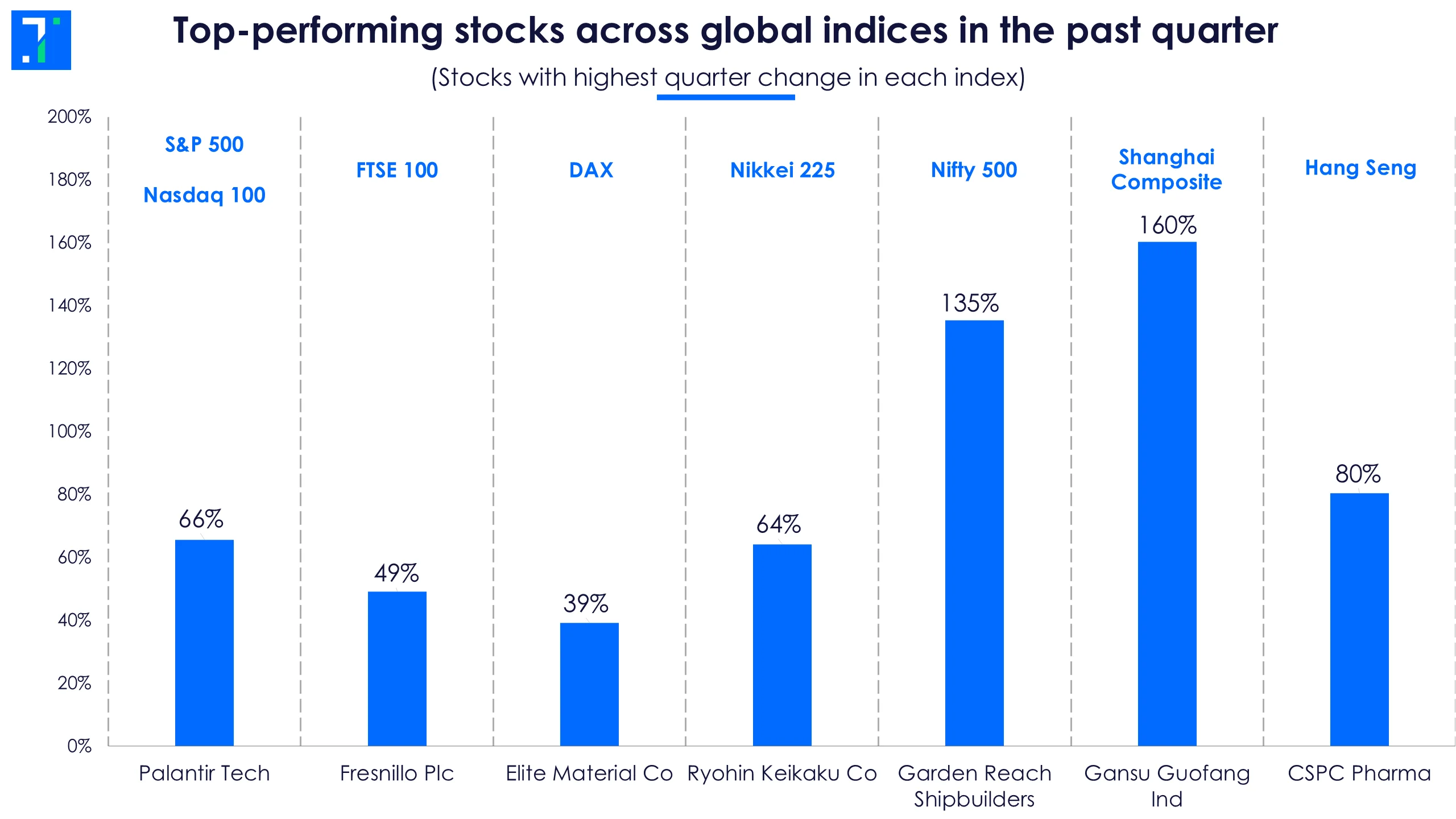

Despite continued global upheaval, indices recovered in the past quarter. The top stock gainers in the respective indices indicate that tech was the top performer for the US, while energy, pharma, and industrials won elsewhere.

Top-performing stocks across global indices in the past quarter

Palantir Tech, a major US tech player in defence, national security and healthcare, was the top S&P 500 performer in 2024 and has extended its momentum in 2025.

Garden Reach Shipbuilders is the Nifty 500’s best performer in the past quarter. This aerospace and defence company is rising after strong Q4 results.

Rising oil prices keep central bankers on their toes

Most central banks started easing rates last year, after rate hikes to tackle record inflation in 2022. The Reserve Bank of India (RBI) initially held back but joined the rate-cutting cycle in 2025.

RBI and ECB cut rates in 2025; US Fed hits pause

Under the new RBI Governor Sanjay Malhotra, who took office in December, the central bank has moved quickly to boost growth, and has cut rates by a whole percentage point.

The US Fed, in contrast, has been more cautious in 2025, holding rates steady amid the uncertainty around Trump tariffs. Analysts project two rate cuts of 25 basis points this year, with the first likely in September. But this is far from guaranteed.

Now, the Israel–Iran conflict has oil prices surging. Brent crude jumped 10–13% since the first attack by Israel, briefly hitting $78 per barrel. Any instability in the Strait of Hormuz—which Iran controls, and which handles around 20% of global crude oil shipments—could send energy prices past $100, complicating central banks' efforts to reduce inflation.

According to the Fed’s model, a $10 increase in oil prices is expected to increase US inflation by 0.4% and lower GDP by 0.4%.

What’s driving equity markets in India and the US?

The Nifty 50 has recovered in the past quarter, hovering around the 25,000 mark again, thanks to better-than-expected Q4 results. Sectors like general industrials, realty, transportation, and commercial services and supplies stole the spotlight.

General Industrials emerges as the star sector in the past quarter

The top four contributors in the general industrials sector are from the defence industry: Hindustan Aeronautics, Bharat Electronics, Solar Industries, and Bharat Dynamics. As the Indian government focused on national security, it boosted spending on domestic defence equipment and product manufacturing.

Real estate stocks rallied in the last quarter, led by DLF, as Indians aspired to luxury apartments that come with fancy flooring, big balconies, and giant gyms that will be rarely used. Analysts point to easing interest rates as a key driver for rising home purchases.

Transportation stocks jumped on falling crude oil prices, though the recent spike in oil may pose risks ahead. Meanwhile, commercial services and supplies continued their upward trend, emerging as one of the top-performing sectors over the past year.

Commercial services and consumer durables are the star segments in the US

In the past quarter, strong consumer demand, falling interest rates, and solid earnings from retail giants have boosted commercial services and consumer durables in the US.

Visa and Mastercard led gains in commercial services, helped by rising digital transactions and strong financials. In consumer durables, lower borrowing costs and a retail recovery drove demand.

Commercial services & supplies: Top-performing sector in the past quarter

In hardware tech, Nvidia and Broadcom jumped on AI and hardware momentum, while Tesla lifted the auto sector with strong deliveries and renewed investor confidence, after Elon Musk departed from the US government and cut down on his late-night posting on X.

Screener: Stocks outperforming the Nifty 50 and their sectors over the past quarter and year

Banking, general industrials rise the most in the past quarter and year

With global markets in turmoil after the rising tensions between Iran and Israel, we look at stocks that have outperformed the benchmark Nifty 50 index and their sectors. This screener shows stocks that have outperformed the Nifty 50 and their respective sectors over the past year and quarter.

The screener is dominated by stocks from the banking & finance, general industrials, software & services, realty, and pharmaceuticals & biotechnology sectors. Major stocks in the screener are Garden Reach Shipbuilders & Engineers, BSE, Intellect Design Arena, Valor Estate, Reliance Power, Authum Investment, Multi Commodity Exchange, and GE Vernova T&D India.

Garden Reach Shipbuilders & Engineers’ stock price has surged 143.3% and 94.6% over the past quarter and year. This aerospace & defence company’s Q4FY25 net profit and revenue jumped 118.9% and 60.9% YoY, respectively. Inventory destocking, lower purchase of products for resale, sub-contracting, and finance costs helped increase net profit, while improvement in order execution drove revenue growth. The company also won multiple contracts from India and overseas, including an order reportedly worth Rs 25,000 crore to supply eight Next Generation Corvettes (NGC) for the Indian Navy.

Intellect Design Arena also features in the screener after its stock price rose 93.4% and 16.1% over the past quarter and year, respectively. This IT software products company’s revenue and net profit jumped 18.7% and 85.4% YoY during Q4FY25. Improvements in collections and the license, platform and asset management company (AMC) segments helped revenue growth. The company secured nine new customer wins for its digital transformation journey and achieved 16 product implementations for global financial institutions.

You can find some popular screeners here.