Ashish Kacholia is known in the industry for his skill in picking small and midcap winners. He started his career in Prime Securities, and later moved to Edelweiss. He co-founded Hungama Digital with Rakesh Jhunjhunwala and now serves as a board member. He started his own company Lucky Securities in 2003. Kacholia holds a Bachelor's degree in Production Engineering and a Master's in Management Studies.

Kacholia primarily invests in small-cap and a few mid-cap companies, and has an uncanny eye for finding potential multibagger stocks. His net worth in Q2FY23 was Rs 1,772 crore, and he publicly holds stakes in 40 stocks, of which 37 are small-cap companies.

Best-performing companies in Kacholia’s portfolio are Beta Drugs, Safari Industries (India) and Carysil. The price of Beta Drugs has increased 573.4% since he added it to his portfolio in Q4FY19. He currently owns a 5.7% stake in the pharma company.

Kacholia bought stakes in Safari Industries (India) and Carysil in Q4FY20 and Q3FY16 respectively. Their stock prices have also risen by 328.4% and 276.3% respectively since the purchase. The investor booked profits on Mastek (bought in Q2FY19), Vishnu Chemicals (bought in Q3FY16) and Mold-Tek Packaging (bought in Q1FY18) before cutting his stake to below 1% in Q2FY23, as they started to hurt the portfolio holding value. The prices of these companies rose by 271.6%, 353.4% and 191.9% respectively till Q2FY23, since the time of purchase.

The worst-performing stocks in Kacholia’s portfolio are IOL Chemicals and Pharmaceuticals and United Drilling Tools. Their prices have fallen by 52.7% and 41.5% respectively since added to the portfolio in Q3FY21 and Q3FY22. He also cut his stake in Kwality Pharmaceuticals to below 1% in Q2FY23 as its price fell 50.8% by the end of the quarter of purchase.

Chemicals, consumer durables, textiles among Kacholia’s favourite sectors

Kacholia’s diversified portfolio has 16.4% investment in the chemicals and petrochemicals sector, aggregating to Rs 300.7 crore. He has invested 14.9% of his portfolio in consumer durables, 13.9% in textiles, apparel and accessories, and 9.4% in general industrials. While commercial services and supplies and pharmaceuticals and biotechnology amounts to 8.3% each, software and services has 7.8%, and diversified consumer services 5% of his portfolio. The least invested sectors are food, beverages and tobacco, banking and finance, FMCG, realty, and hardware technology and equipment with less than 2% each.

The marquee investor went on a buying spree and added nine new stocks to his portfolio in Q2FY23. He also increased his holdings in 12 companies during the same period. He reduced his holdings in ten companies, of which five were cut to below 1%. In new additions, he bought 5% of Dudigital Global, 3.3% of D-Link (India) and 2.6% of Agarwal Industrial Corp. He also increased his stakes in Hindware Home Innovation and Ador Welding by 1.3% and 1% respectively. Kacholia cut a 0.3% stake in Genesys International Corp and 0.2% in Safari Industries (India) and reduced holdings in Mastek, Mold-Tek Packaging, Vishnu Chemicals, VRL Logistics and Kwality Pharmaceuticals to below 1%.

During the recent quarter, Kacholia bought a 2.1% stake in Raghav Productivity Enhancers on November 4, a 1% stake in Likhitha Infrastructure on November 30 and a 0.8% stake in Aditya Vision on December 9. On December 21, he sold a 0.6% stake in D-Link (India) in a bulk deal.

Kacholia prefers companies with good fundamentals

Of the 40 companies that Kacholia holds, only one reported a net loss in Q2FY23. Sastasundar Ventures reported a consolidated net loss of Rs 4.9 crore despite a 60.3% rise in consolidated revenue, while the rest had net profit.

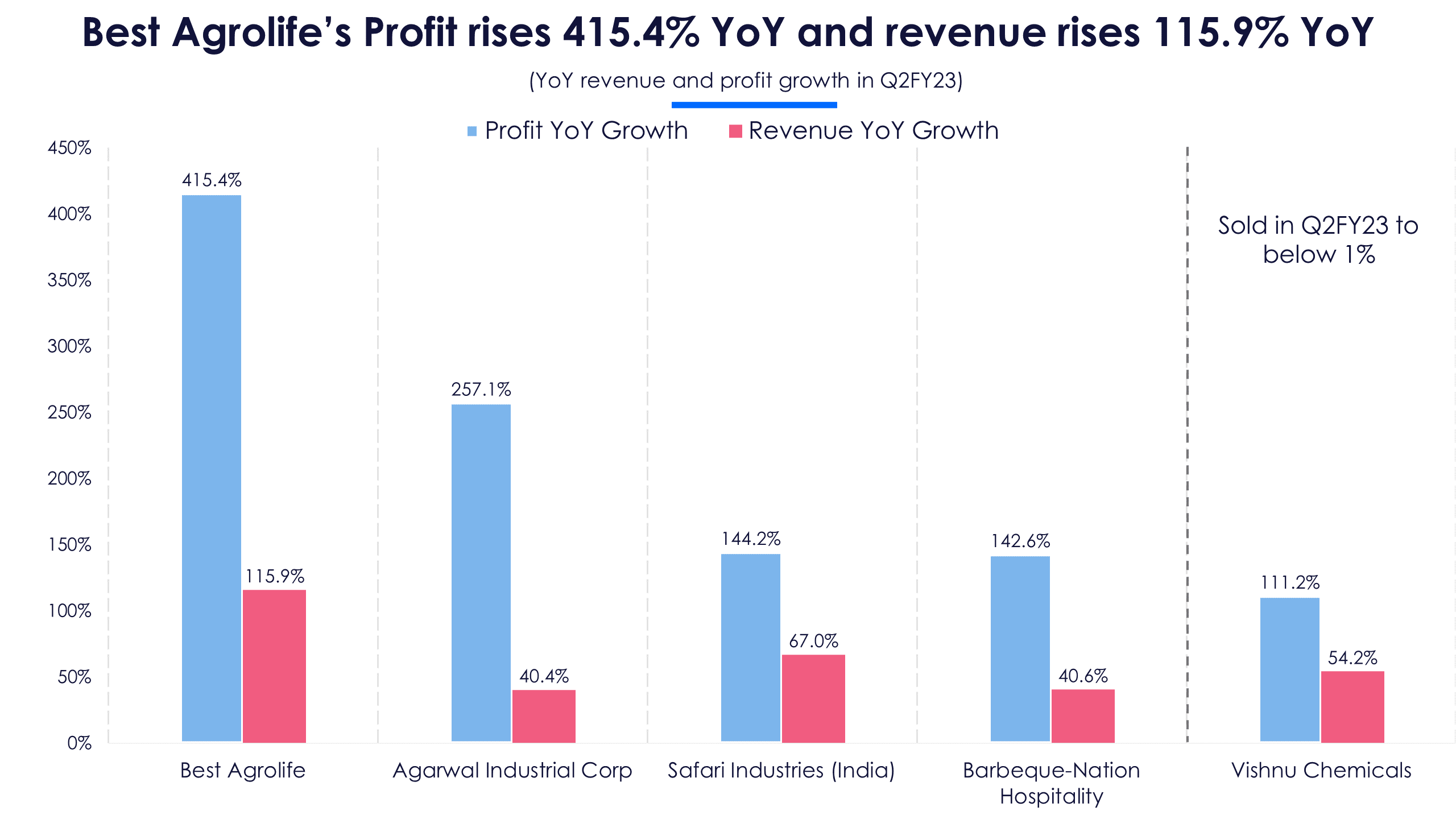

During Q2FY23, Best Agrolife reported a net profit of Rs 129.8 crore, indicating an increase of 415.4% YoY, while its revenue rose by 115.9% YoY. Agarwal Industrial Corp, Safari Industries (India) and Barbeque-Nation Hospitality reported a YoY rise in net profit by 257.1%, 144.2% and 142.6% respectively, while their revenue increased by 40.4%, 67% and 40.6%. Kacholia cut his stake in Vishnu Chemicals to below 1%, while its profit grew by 111.2% in Q2FY23. Eleven companies in the portfolio reported a YoY fall in net profit, while three reported a YoY fall in revenue. United Drilling Tools, IOL Chemicals and Pharmaceuticals, Carysil and Vaibhav Global are among the companies that reported a fall in net profit.

From the portfolio, 22 companies outperformed their respective industries over a year and quarter, and 17 companies outperformed over a month. PCBL, Arvind Fashions and La Opala RG are among the companies that outperformed their industries.

Sastasundar Ventures announced the highest basic annual EPS of Rs 222.7, followed by Bharat Bijlee (Rs 98.3), Garware Hi-Tech Films (Rs 72), Agarwal Industrial Corp (Rs 51.1) and Best Agrolife (Rs 46).

While 21% of the stocks in Kacholia’s holdings, like Barbeque-Nation Hospitality, Best Agrolife, Shaily Engineering Plastics and Safari Industries (India) are currently trading in the PE Buy Zone, 27% are trading in the PE Sell Zone. Companies in the Sell Zone include HLE Glasscoat, Vaibhav Global and Fineotex Chemical. Meanwhile, the PE of seven stocks is above their respective sectors, like HLE Glasscoat, Arvind Fashions, Genesys International Corp, Megastar Foods and Shankara Building Products.

How volatile is Kacholia’s portfolio?

Over a year, the beta for 20 stocks in Kacholia’s portfolio is below 1 and 16 are greater than 1. However, 29 stocks have a beta lesser than 1 for a quarter. The average beta of the portfolio for a year is 0.94, whereas it is 0.8 for a quarter.

The Beta of Ashish Kacholia’s portfolio is lesser than that of the Nifty 50. Even though the volatility is marginally in line with the benchmark index for a year, it is lower over the quarter. We can conclude that Kacholia, despite his preference for smaller companies, may make safer bets while buying stocks. On the valuation side, he currently holds stocks in both the PE Buy and Sell Zones.

Overall, the marquee investor looks for companies with strong fundamentals and have the potential to turn into multibagger stocks. He then tends to hold them for a longer period to book higher profits, and rarely panics during downturns.