By Ketan SonalkarTraders often talk about the September Effect - that since 1928, indices have historically seen a decline during this month. And 2022 was no exception, as the benchmark Nifty index fell by 3.7% and retreated from the highs made in August. The month saw rising uncertainty around the Russia Ukraine war, and the US Fed and other Central Banks hiking rates to control inflation and the rise in oil prices.

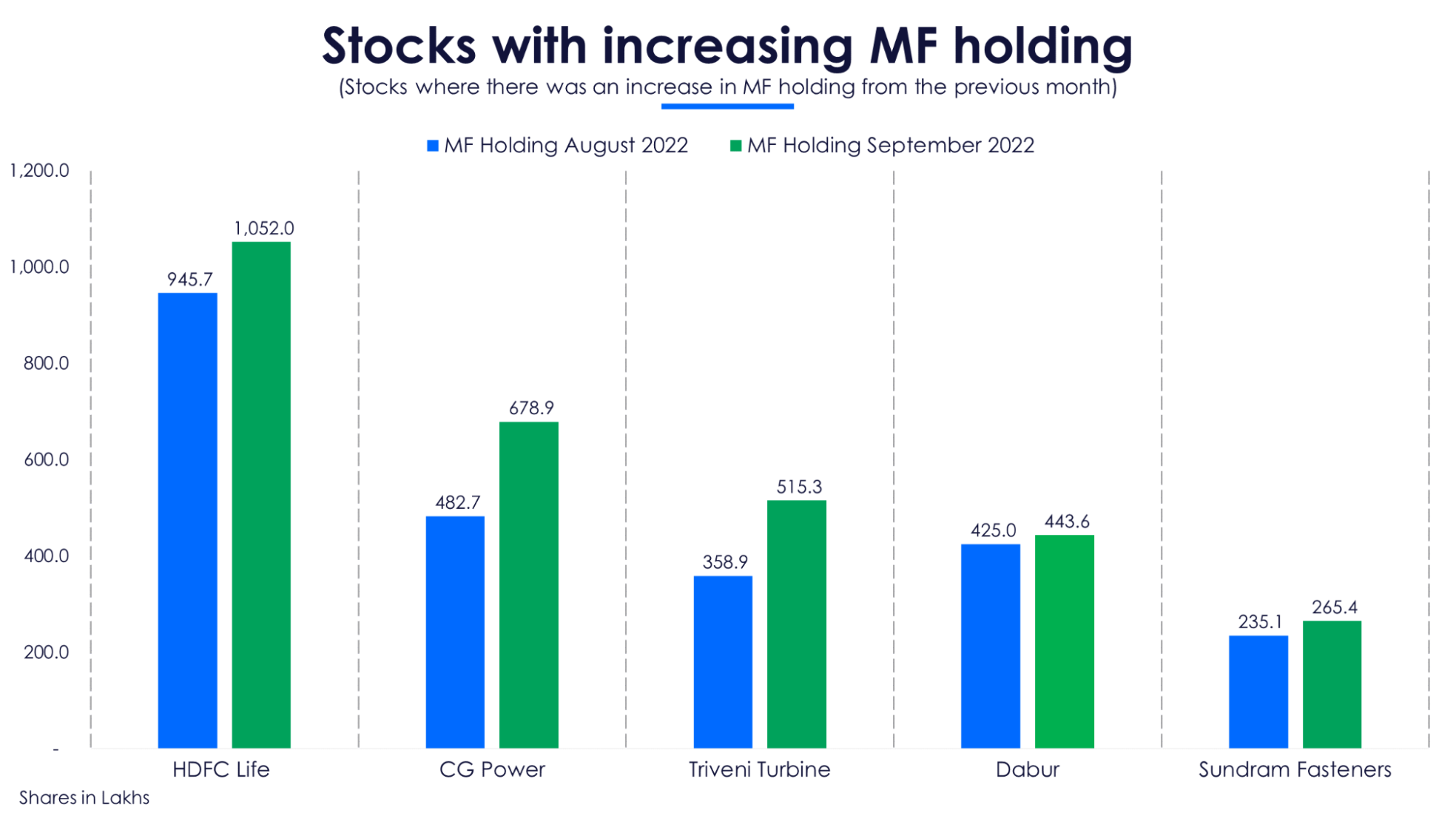

Despite this, mutual funds found buying opportunities in stocks that hold future potential. This month also saw a lot of recently launched schemes add stocks to their portfolios. This month's buys include a life insurance company, FMCG players as well as capital goods manufacturers.

This list is based on a screener where the mutual fund holding grew by a certain minimum percentage and at least four schemes bought more than a lakh of shares each.

HDFC Life - Tie up with group company to widen customer base

HDFC Life is one of India’s leading private life insurance companies and part of the HDFC Group. It has been gaining market share and also has better operating metrics than other private insurers.

In September 2022, it partnered with another group company, general insurance player HDFC ERGO, to provide a combination of life insurance along with health insurance. This is expected to further widen its customer base. Another positive development for HDFC Life includes the approval of the merger of Exide Life with HDFC Life from the NCLT.

Fund managers who bought shares of HDFC Life

Shares of HDFC Life were added to respective schemes by Mahesh Patil for Aditya Birla Sun Life Frontline Equity Fund Growth, Hiten Shah for Kotak Equity Arbitrage Fund Growth, Aniruddha Naha and A. Anandha Pabmanabhan for PGIM India Flexi Cap Fund Regular Growth as well as Vinay Sharma and Kinjal Desai for Nippon India Banking & Financial Services Fund Growth.

CG Power - Railway orders put the company on the fast track

CG Power (CG Power and Industrial Solutions) is a manufacturer and distributor of electrical equipment such as transformers, reactors, and other control equipment. It also manufactures industrial motors and pumps, and communication systems.

Indian Railways, which is undergoing dynamic growth in both freight and passenger transportation, has fueled CG Power with various opportunities for future growth. Indian Railways continue to give orders to CG Power for electrification, signaling system upgrades, and high horsepower locomotives. The company has also approved a capex of Rs 32 crore for the railway business. The motors business, which constitutes around 78% of the CG Power product portfolio, has also been issued a capex of Rs 80 crore.

Fund managers who bought shares of CG Power

Buying interest in CG Power saw addition to portfolios by Atul Bhole and Dhaval Gada toDSP Flexi Cap Fund Payout of Income Dist cum Cap Wdrl, Vinit Sambre and Resham Jain to DSP Midcap Fund Growth, Shridatta Bhandwaldar to Canara Robeco Flexi Cap Fund Growth and Atul Bhole and Vikram Chopra to DSP Equity & Bond Fund Growthschemes respectively.

Triveni Turbine - Robust demand and capacity expansion drive interest in the stock

Triveni Turbine is the domestic market leader in steam turbines up to 30 MW. The company designs and manufactures steam turbines up to 100 MW, and delivers end to-end solutions to customers.

In Q1FY23 it registered a robust revenue growth of 40.7% to Rs 259 crore supported by 59% YoY increase in export business, while domestic business increased by 32% YoY. The management expects execution to pick up pace and to generate 35% top-line growth in FY23. This is backed by its expansion plans with the addition of a new bay in the Sompura plant. This is expected to augment the space for assembly and testing of steam turbines at the factory. The management expects this to be complete in Q2FY23 and post the expansion, the capacity will rise from 150-180 machines to 200- 250 machines per annum.

Fund managers who bought shares of Triveni Turbine

Fund managers who bought Triveni Turbines include Sohini Andani and Mohit Jain for SBI Magnum Midcap Fund Regular Growth, Mahesh Patil and Dhaval Shah for Aditya Birla Sun Life Multi-Cap Fund Regular Growth, Vishal Gajwani for Aditya Birla Sun Life Small Cap Fund Growth and Sudhir Kedia and Ravi Gopalakrishnan for Sundaram Flexi Cap Fund Regular Growthschemes respectively.

Dabur - Expanding product range and good monsoon to provide a boost

Dabur is one of India’s largest FMCG companies with a presence in segments like health supplements, oral care, hair care, home care and juices. Dabur also derives around 50% of its sales from rural regions with a presence in 90,000 villages.

Dabur introduced new products across categories in the past few months. These include the premium tea segment with the Vedik Tea brand. It has also entered a new segment of peanut butter. Dabur is also pushing its marketing strategy by hiring Amitabh Bachchan as their brand ambassador. Another factor favourable to Dabur is a good monsoon season which is expected to boost the rural economy, a major contributor to its sales.

Fund managers who bought shares of Dabur

Fund managers who added shares to respective schemes include Mahesh Patil for Aditya Birla Sun Life Frontline Equity Fund Growth, Yogesh Patil forLIC MF Large & Mid Cap Regular Growth andLIC MF Large Cap Fund Growth, and Hiten Shah forKotak Equity Arbitrage Fund Growth.

Sundram Fasteners - Rebound in the auto sector drives growth

Sundram Fasteners manufactures a range of high tensile fasteners for precision-driven sectors like Automotive, Wind Energy, Aviation, Farm Equipment and Infrastructure. They specialize in cold extruded and precision forged parts used in two-wheelers, front wheel drive vehicles and internal combustion engines.

The company has planned a capex with fresh investments worth Rs 400 crore over the next two years as it sees bright prospects for the Indian automobile sector. The powertrain components division had won contracts worth Rs 150 crore for EV products in July 2022.

Fund managers who bought shares of Sundram Fasteners

Addition of shares of Sundram Fasteners was done by Harish Bihani and Sharmila D’mello to ICICI Prudential Long Term Equity Fund (Tax Saving) Growth andICICI Prudential Smallcap Fund Growth, Samir Rachh and Kinjal Desai to Nippon India Small Cap Fund - Growth and Vishal Gajwani to Aditya Birla Sun Life Small Cap Fund Growth.

Tata Chemicals - Strong leadership to be further strengthened with capacity expansion

Tata Chemicals is one of the top five players in the global soda ash market. The company manufactures soda ash, sodium bicarbonate, cement, salt, marine chemicals and crushed refined soda along with other specialty chemicals. Basic chemicals form 75% of overall revenue while the rest comes from specialty products.

The company posted its highest ever quarterly revenues and net profits in Q1FY23. In the Q1FY23 results management commentary, they said that demand for soda ash is strong in spite of high prices. Demand is also robust from the detergent and glass industry. They expect better growth from solar panels to aid demand for the glass industry and thereby soda ash.

The company has expansion plans with a capex of Rs 1,100 crore in progress where the capacity of soda ash will increase by 2.3 lakh MT, bicarb by 0.7 lakh MT and salt by 3.3 lakh MT.

Fund managers who bought shares of Tata Chemicals

Buyers of Tata Chemicals for respective schemes include Pankaj Tibrewal for Kotak Small Cap Growth, Kayzad Eghlim and Priyanka Khandelwal for ICICI Prudential Equity Arbitrage Fund Regular Growth, Sailesh Jain for Tata Arbitrage Fund Regular Growth and Neeraj Kumar and Arun R. for SBI Arbitrage Opportunities Fund Regular Growth.

Interglobe Aviation - Demand for air travel crosses pre Covid levels

Interglobe Aviation, more commonly known as Indigo is one of India’s low cost carriers (LCC) with a market share of 54% in the Indian aviation sector.

The airline industry which was affected badly during the pandemic is now bouncing back in FY23. Indigo operated at a load factor of 80% in Q1FY23. The rising load factor was driven by a strong rebound in leisure & corporate travel. Further, international travel has normalised and has reached its precovid levels.

Indigo in September also announced that it has entered freight services. Its first freight plane was one that was converted from a passenger plane. The freight carriers will be able to service markets between China in the east and the Gulf in the west, as well as the CIS countries to the north, according to the management. IndiGo also said it will be utilising the same pool of pilots and engineers that fly and service its current fleet for the cargo planes.

Fund managers who bought shares of Interglobe Aviation

Shares of Indigo were bought by Manish Gunwani and Kinjal Desai for Nippon India Growth Fund - Growth, Atul Penkar and Dhaval Gala for Aditya Birla Sun Life Tax Relief 96 Pyt of Inc Dis cum Cap Wdrl, Sailesh Jain for Tata Arbitrage Fund Regular Growth and Mahesh Patil for Aditya Birla Sun Life Frontline Equity Fund Growthschemes respectively

Syngene - New international deal to have significant long term impact

Syngene International serves pharmaceutical, biotechnology, nutrition, animal health, consumer goods and speciality chemical companies globally, with a range of integrated research services for the clinical development and manufacturing process.

Recently Syngene signed a 10-year biologics manufacturing agreement with leading animal health company, Zoetis. It will manufacture the drug substance for Librela (bedinvetmab), a monoclonal antibody used for treating osteoarthritis in dogs. According to the management, this agreement paves the way for development and manufacturing of other molecules in the coming years and is expected to be worth $500 mn to Syngene over 10 years, subject to regulatory approvals and market demand.

Fund managers who bought shares of Syngene

Addition of shares of Syngene was done to respective schemes by Harish Bihani and Sharmila D’mello for ICICI Prudential Long Term Equity Fund (Tax Saving) Growth and ICICI Prudential Smallcap Fund Growth, Gaurav Misra for Mirae Asset Focused Fund Regular Growth, and Pranav Gokhale and Amit GanatraInvesco India Growth Opportunities Fund Growth.

Hatsun Agro Products - Expansion to a pan India brand drives revenue growth

Hatsun Agro Products manufactures and markets dairy products like milk, curd, ice creams, dairy whitener, skimmed milk powder, ghee, paneer and other milk based products. The Q1FY23 results recorded highest ever quarterly revenues at Rs 2,020 crore. This was the result of expanding beyond its stronghold in South India.

While the company for most of its existence was limited to the southern states, its retail expansion in the last two years helped it reach customers in new markets like Maharashtra, Odisha, West Bengal and Madhya Pradesh. Hatsun Agro Products invested about Rs 450 crore in the last financial year across new manufacturing facilities for capacity expansion in ice cream, milk, curd, milk products and cattle feed.

Fund managers who bought shares of Hatsun Agro Products

Shares of Hatsun were added by S. Bharath and Ratish Varier to Sundaram Mid Cap Growth, Sohini Andani and Mohit Jain to SBI Magnum Midcap Fund Regular Growth, R. Srinivasan and Mohit Jain to SBI Focused Equity Fund Growth and Saurabh Pant and Mohit Jain to SBI Large & Midcap Fund Regular Payout Inc Dist cum Cap Wdrlschemes respectively.

Britannia - Management rejig and and international foray key positive triggers

Britannia, a leading food-products company, sells various brands of biscuits, cakes, dairy products, breads etc. in India as well as globally.

The company recently teamed up with Nairobi-based Kenafric Industries to purchase Catalyst Capital-backed Britannia Foods Ltd. in Kenya in a $20 million transaction that also involved acquiring property and a plant, Mikul Shah, a director at Kenafric, said in an interview. Britannia Industries, unrelated to Britannia Foods, took a controlling stake in the partnership.

The company also saw a change in the top management team with Ranjit Kohli taking over from Varun Berry as the CEO, while Varun Berry was elevated to executive vice-chairman and managing director.

Fund managers who bought shares of Britannia

Buyers in Britannia included Sohini Andani and Mohit Jain for SBI Bluechip Fund Regular Growth, Sankaran Naren and Sharmilla D’mello for ICICI Prudential Focused Equity Fund Growth, Shridatta Bhandwaldar for Canara Robeco Flexi Cap Fund Growth and Neelesh Surana and Ankit Jain forMirae Asset Emerging Bluechip Fund Growthschemes respectively.