By Deeksha Janiani

The philosopher Michel de Montaigne once said that, “There is no passion so contagious as that of fear.” The fear of a financial crisis that started at the headquarters of Credit Suisse quickly spread to Wall Street and the stock markets world over. Last week, it knocked at the door of oil markets which were otherwise going steady in the hopes of a brighter 2023.

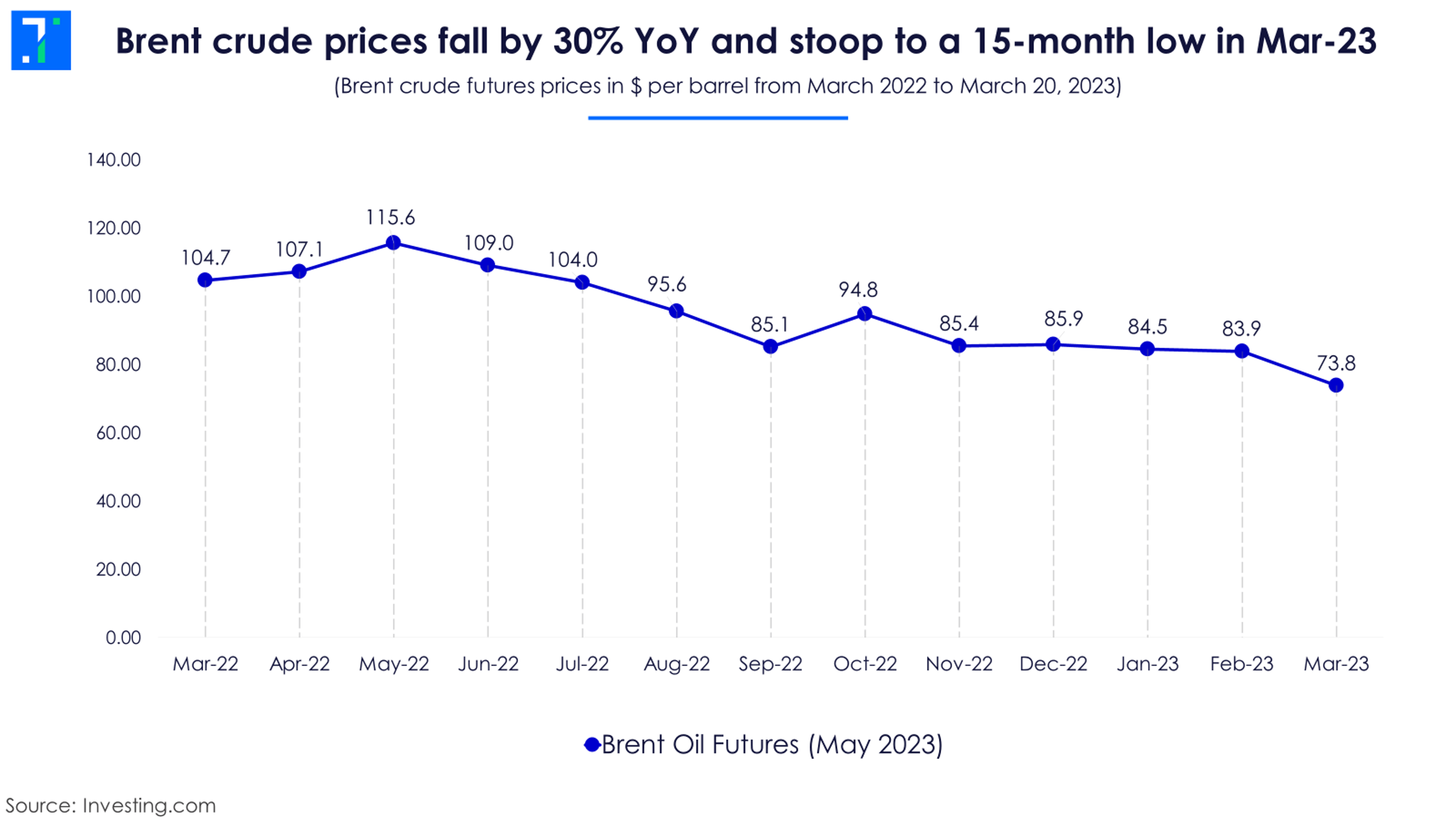

Brent crude prices corrected over 10% in the past 10 days as recessionary concerns in the developed world overshadowed the hopes of higher Chinese demand. There is no real evidence of a pickup in demand from China on the ground. In fact, the country’s average daily oil imports were slightly lower on a YoY basis in January and February.

Another factor exerting pressure on crude prices is a benign supply-side environment, contrary to what was envisaged.

Russia continues its crude oil exports in an uninterrupted fashion

Russia, the world’s third largest oil producer, has maintained its average crude oil exports in the range of 7.5-8 million barrels per day since February 2022. Its exports were down only 5% YoY in February 2023 despite the sanctions and price caps imposed by G7 nations.

Most of the Russian exports got routed to Asian nations, especially India and China, and some new African destinations. Russia accounted for 39% of Indian crude oil imports in February 2023, compared to under 1% before the war. Reliance, Indian Oil Corporation Ltd (IOCL) and Bharat Petroleum have snapped up over 60% of Russian oil.

The International Energy Agency (IEA) had originally predicted that Russia’s oil output would fall by 25% right after the war. But the doomsday prediction didn’t come true - Russia has kept pumping and selling oil. Later, the IEA revised the expected fall in 2023 to 10% and now again to 7%. Russia’s own estimate is that it intends to cut its production by just 5% from March.

Resilience in Russian oil supplies and subdued demand overall has caused a build-up in oil inventories. Oil stocks in the OECD nations rose to an 18-month high in February. Given these conditions, the IEA sees oil supply exceeding the demand atleast till mid of the year.

While there is more pain in store for the oil market bulls, Indian oil marketing companies are set for a recovery after returning profits in Q3.

OMCs out of the woods in Q3 as retail business turned profitable

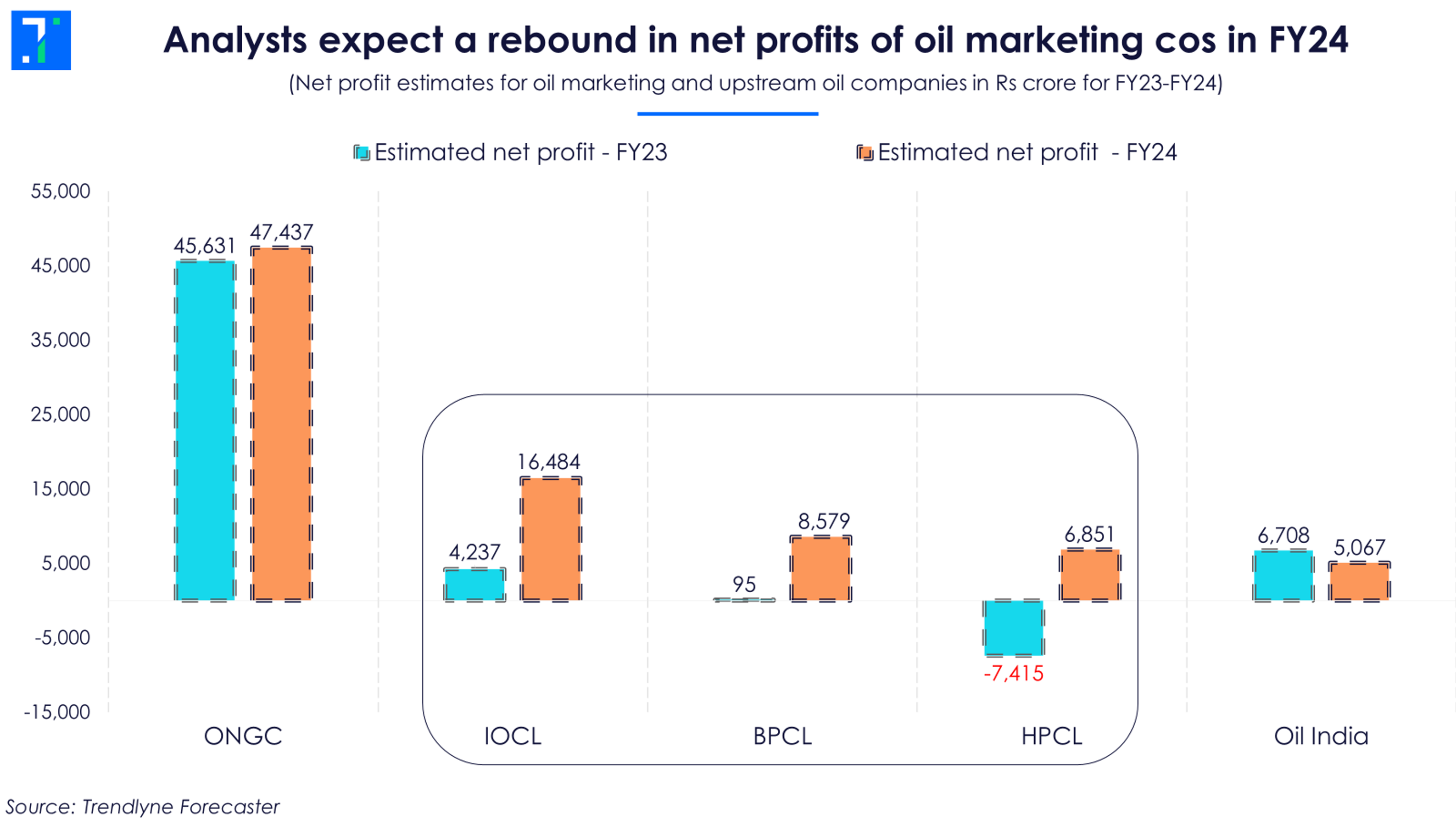

Oil marketing companies suffered losses of over Rs 21,000 crore in H1FY23 due to high input costs and a freeze in pump prices. There has been no hike in petrol and diesel rates since April 2022 as the Centre sought to rein in spiralling inflation, amid rising anger about high petrol and diesel prices. While OMCs were hurting, standalone profits of upstream players like ONGC and Oil India rose over 30% in H1 on strong realisations.

Things began to look up for OMCs in Q3FY23 as crude oil prices fell but retail fuel prices remained unchanged. Hindustan Petroleum, Bharat Petroleum and Indian Oil made positive marketing margins, backed by attractive spreads on petrol.

All three companies posted a net profit in Q3, aided by healthy refining margins, decent market sales and recovery in retail margins.

Overall, it is the robust gains from refining activity which cushioned the losses of OMCs in 9MFY23. Although their GRMs fell from the peaks of Q1, they were still higher on a YoY basis in Q3. In fact, refining margins of Indian OMCs have stayed above the benchmark Singapore GRM in the past five quarters.

The secret sauce: Private and state refiners pick up discounted Russian Urals

While private refiners took the lion’s share of cheaper Russian supplies earlier in 2022, state refiners have stepped up in a big way now. In February 2023, state-owned refineries bought 57% of the Russian crude oil imported to India with Indian Oil and BPCL being the frontrunners.

According to reports, refiners are getting a net discount of $8-$10 per barrel on their Urals purchases and the trade within the price cap of $60/barrel. Considering IOCL bought 10.5 million barrels of oil from Russia in February, its cost savings in just one month must have exceeded $100 million (~Rs 826 crore).

Can these benefits sustain going forward? Refining margins are ultimately dependent on broader fuel demand and future direction of crude oil prices.

Brokerages pare their crude oil forecasts for 2023

The IEA and oil-producing nations see 2023 as a tale of two halves. Muted demand and abundant supplies will likely depress oil prices in the first half and this is already in play.

However, there is the China factor. China may drive the global oil demand to record levels, creating a supply deficit and boosting oil prices in the second half of the year.

Under this assumption, OPEC is not anxious about the strong bearish sentiment in the oil markets. The OPEC alliance plans to stick to the production cut agreed upon in October and will not announce any new target until 2023 end. Their optimism has led them to raise growth forecasts for Chinese oil demand by 20% for this year

But global brokerages are not as bullish on crude oil as they were a few months ago. Russian supplies did not drop as expected and demand looks fragile. A leading oil market bull, Goldman Sachs, no longer sees Brent crude hitting $100/bbl in the next 12 months. It downgraded the forward estimates to $94/bbl, given the recent price correction.

Morgan Stanley, JP Morgan and Barclays had cut their Brent crude forecasts between February and March first week, given the supply surplus. However, there might be more downgrades in store due to the ongoing turmoil.

OMCs may see a big rebound in FY24, boosted by marketing margins

Riding on the weakness in crude oil prices and higher pump prices, the marketing margins of OMCs reached a 12-month high of Rs 3.4/litre in February, according to ICICI Securities. This is due to the improvement in retail margins on diesel, the most used fuel in India.

Marketing margins for OMCs will only edge higher in the coming months on strong fuel demand and pump prices being as is. This will be more beneficial for HPCL and BPCL, given their greater reliance on marketing profits. ICICI Securities sees the earnings of BPCL and HPCL rising by over 40% on every Rs 1.5/litre increase in marketing margins.

However, refining margins of OMCs are a different story, and the tide may be turning there. Singapore GRMs have relaxed to $6-6.5/barrel in March from $8.5 in January. Weak demand and the slump in oil prices may create downward pressure. This will hit Indian Oil the most given its higher share of refining profits.

Interestingly, the outlook for oil markets is positive for H2-2023, which means that OMCs may not clock subdued refining margins for more than a quarter or two. Analysts are bullish on the prospects of OMCs in FY24 and see the biggest jump in the net profits of HPCL.

Dark clouds loom large over oil markets right now and no one can predict exactly when the skies will clear. Indian oil marketing companies, however, are set to make a comeback in the backdrop of this crisis.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.