By Deeksha Janiani

Less than five years after the grounding of Jet Airways, the Indian aviation industry is witnessing another airline heading for a crash landing. Go First has filed an application for voluntary insolvency with the National Company Law Tribunal (NCLT), citing engine failures as the cause. Defective engines supplied by Pratt & Whitney and their inability to repair these led Go First into deep troubles.

The Go First filing has triggered a domino effect in the industry, with SpiceJet’s aircraft lessor filing a bankruptcy case against it for non-payment of rentals. These developments have raised concerns about the fate of India’s smaller airlines, as they face a tough operating environment.

Go First currently has unpaid dues of nearly Rs 11,500 crore across the board, which led the airline to knock on the doors of NCLT. But the aircraft lessors have strongly opposed the airline’s urgent demand for a moratorium (postponement of repayment), stating that it was “not a case for first day, first show relief to be granted”. Their concern is that the insolvency filing by the Wadia Group is premature, since the company still has strong financials.

Nevertheless, NCLT admitted Go First’s application on May 10, and initiated a corporate insolvency process. This way the struggling airline has bought additional time to pay off its lessors and lenders.

A series of unfortunate events (and bad decisions) spelled doomsday for this airline.

Go First blames its failure on Pratt & Whitney engines

In dramatic fashion, Go First’s management has blamed an American manufacturer, Pratt & Whitney (P&W), for the engine crisis, accusing them of a “lazy response” and a “deliberate attempt to kill us”. The serial failure of P&W aircraft engines caused 50% of Go First’s fleet to be out of operation by December 2022.

Go First’s revenues stalled, but expenses didn’t. Despite the grounded aircraft, the airline was still burdened with fixed costs such as lease rentals and finance expenses. Overall, it estimates the loss of revenues and additional expenses from stalled operations to be Rs 10,800 crore.

Go First is not the only airline that has faced issues with P&W engines. IndiGo was the first to report engine failures in early 2017, followed by Go First in 2018. But IndiGo was quick to act and switched to CFM International’s aircraft engines post 2019. It also successfully negotiated with P&W and received substantial compensation for the faulty engines.

Go First’s management decisions are partly to be blamed here. When the going was good, it chose to turn a blind eye to the issue and signed a new deal with P&W again in 2019. With the onset of the pandemic, the company incurred heavy losses which accumulated to Rs 4,416 crore by FY22. At this juncture, it lacked the resources to either negotiate with P&W or replace the engines in its fleet.

Reports suggest that Go First deferred repair work and had a history of not paying its dues on time. Accordingly, P&W had stopped providing maintenance services to Go First from May 2022.

Now that Go First is unlikely to take off again, other players in the market have a wonderful opportunity to expand their share. A similar situation arose when Jet Airways declared bankruptcy in 2019.

Rewind: IndiGo gained the most as Jet Airways went under

Just a year before its bankruptcy, Jet Airways held the position of the second largest airline in India by market share. However, it was the market leader back in 2006. But it slowly lost its position to the emergence of low-cost carriers like IndiGo and SpiceJet.

Within just 12 years of operation, IndiGo successfully captured 40% of the market share in India’s airline industry. It went on to win nearly half of the market share vacated by Jet Airways in 2019. Meanwhile, other top airlines at the time - SpiceJet, Go First, Air India and Vistara - managed to gain 2-2.5% market share each after Jet’s exit.

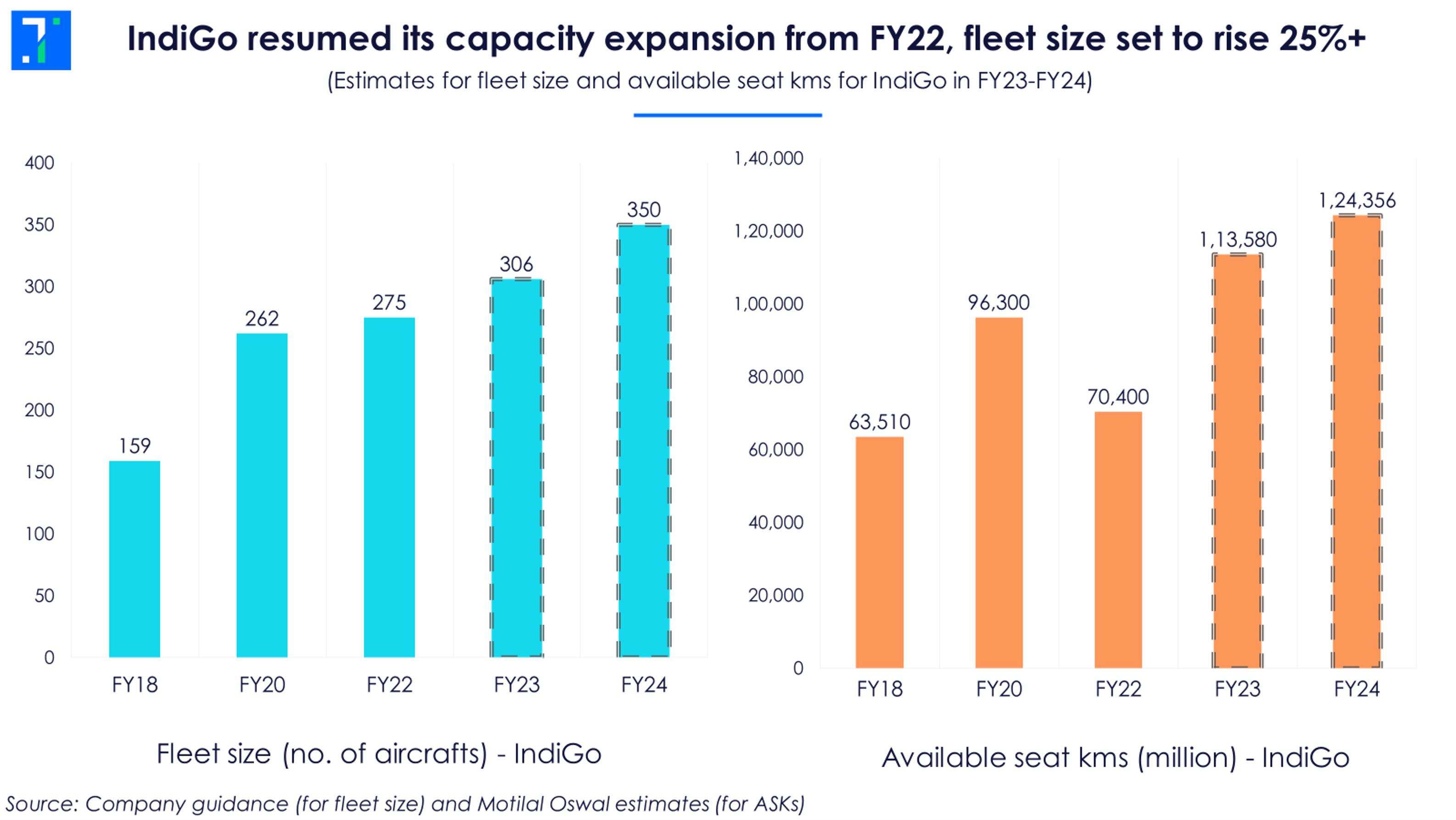

The market share gains translated into higher growth for IndiGo. It added over 100 aircraft to its fleet of 160 between FY18-FY20. Eventually, its EBITDA jumped over 60% YoY in 9MFY20, backed by the expansion in operations.

As for Jet Airways, its fate still hangs in the balance. The Jalan-Kalrock consortium, which took over the resolution process of the fallen carrier, has been unable to settle Jet Airways' outstanding debt and kick-start its operations. Its CEO designate resigned in April this year and its air operator certificate will lapse on May 19.

IndiGo emerged stronger post the Covid crisis

The airline industry has battled multiple challenges since March 2020. The slow pick-up in passenger traffic post-Covid, a steep jump in fuel prices, and a stronger dollar strained the industry. Even as ‘revenge’ travel became popular post March 2022, airline companies were hardly making any profits.

IndiGo finally raked in decent net profits in Q3FY23 as demand swelled, yields improved and fuel prices cooled-off.

The airline also managed to win market share in these trying times. Vistara also gained ground between Q1-2021 and Q1-2023. In contrast, Spice Jet lost over 5% of its market share due to a severe cash crunch and technical glitches in its aircraft. Similarly, Air India lost out due to its liquidity woes, until it was rescued by the Tata group.

Why is generating cash so difficult in this industry?

The airline business is notorious for its high capital requirements and volatile fuel costs, which can account for 40-45% of expenses. This causes companies to borrow heavily to acquire assets and manage working capital.

In India, airlines also face higher state taxes on jet fuel, with VAT on ATF as high as 25%-26% in Delhi and Rajasthan. Some states have started reducing fuel taxes after 2021.

So, now with such a heavy cost structure, earning healthy revenues is vital. In order to overcome these challenges, airlines need to focus on higher utilization of their planes and charging attractive fares. But airlines in India have fought price wars ever since the mid-2000s, as customers are value conscious and reluctant to pay more for ‘frills’.

This has been a contributing factor to the downfall of premium players like Jet Airways.

No place for the weak? Airline industry heading towards a duopoly

With Go First facing insolvency and Spice Jet cash-starved, the Indian airline industry is headed for another round of consolidation. The American airline industry faced a similar situation post the sub-prime crisis. The top four US airlines - American, United, Delta and Southwest became stronger and held 85% market share in 2015, up from 65% in 2010.

Now, Go First’s suspension will vacate around 8% of the market share in India, which IndiGo is likely to grab a major part of, followed by the Tata Group. Both these groups are on an expansion spree and are already in talks to take over Go First’s aircraft.

The industry is likely to become a duopoly, with Indigo eventually commanding 60% of the market share and the three Tata group airlines holding 28%-30%. If SpiceJet averts the ongoing crisis, it may also gain some share. But it will remain much smaller fry in the industry.

The airline industry is headed for the blue skies right now. Crisil estimates that passenger traffic will rise by over 15% in FY24 due to robust demand. Jet fuel prices have declined by more than 30% from their July highs. Analysts expect the listed airline players to clock profits in FY24.

Over the long-term, Airbus sees India’s air passenger traffic growing faster than other economies, driven by a rise in middle-class population and per-capita incomes. IndiGo and the Tata Group have come out victorious from the intense twists and turns of the past 20 years and are likely to remain dominant players in the industry for the long haul.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.