By Deeksha Janiani

Consider this tale of two Indias: Mr. Singhania is standing in a long queue, hoping to grab one of the few units left in ‘The Arbour’, a luxury project by DLF. He is enamored by the infinity pool, luxury clubhouse and posh location.

He promises himself that he will use the state-of-the-art gym. He might even play a few games on those badminton courts. Lured by the DLF tag, he is willing to pay 30% more than the average going rate in Sector 63 of Gurugram.

Now let’s turn to Suruchi, a young mother from an average Indian middle-class family, who lives in a small rental. She thinks twice before making herself an extra cup of coffee, as double-digit inflation in milk prices has hit her family pretty hard.

While Singhania is chasing his dream of luxurious living, Suruchi's story highlights the struggles of the ordinary Indian affected by inflation, unemployment and the soaring prices of essential commodities. Nowhere may this gulf be more visible than in the real estate market.

Early in 2022, former RBI governor Raghuram Rajan had warned of a K-shaped recovery in India. His prediction came true in the second half of the year. Sectors like auto, consumer durables and fashion retail shifted their focus towards premium goods, as the wealthy returned to shops and malls, making up for lost time.

The real estate sector has witnessed a similar story.

Although Nifty Realty underperformed in 2022, housing sales numbers broke records, driven by the premium and luxury segments. The sales momentum continued into Q1-2023. With RBI pausing rate hikes, investors have finally begun to take interest in this space again. As a result, Nifty Realty was the top index outperformer in the past month.

Housing sales touched an 8-yr high in 2022, demand stays strong in 2023

Residential sales in 2022 across the top seven cities jumped by over 50% YoY and beat the original estimates of real estate consultancy Anarock.

Housing prices also rose by 5-7% YoY, which coupled with higher home loan rates has made middle-income housing much more expensive.

Continuing its stellar run, housing sales crossed the mark of one lakh units in the first quarter of 2023 with a YoY increase of 14% and a sequential rise of over 20%. Mumbai, Pune and Bangalore emerged as the top growth drivers, while Delhi NCR and Kolkata were laggards.

Pune has recently gained traction due to the fast development of the IT sector in the city, with techies fueling the demand for residential homes. Then, there is the added demand from prospective homebuyers in Mumbai who find a more affordable option in this satellite city.

Given the strong sales, the inventory overhang across seven cities fell to 20 months in Q1-2023 from 51 months in Q1-2021. Inventory overhang refers to the number of months required to sell the current stock. An overhang of 18-24 months is considered healthy for this sector.

“‘Pathan’ of real estate”: DLF’s Arbour makes a clean sweep in its pre-launch

Commenting on the success of ‘The Arbour’, Aakash Ohri, Group Executive Director at DLF, said in an interview, “This is like the ‘Pathan’ of real estate. This has been the biggest blockbuster in this industry.”

This luxury project was sold out within three days of its pre-launch, fetching the company over Rs 8,000 crore in sales bookings. The project consists of 4BHK flats with an area of 3,956 sqft, priced at over Rs 7 crore. DLF charged its customers the steep price of Rs 18,200 per sqft, which is significantly higher than the average property rate of Rs 13,950 per sqft on Golf Course Road.

Interestingly, the company took 10% of the price as the booking amount and not just the usual application fee of Rs 5-10 lakh to weed out unsure buyers. The buyers were mainly promoters and top officials in corporates, NRIs, start-up founders, doctors and lawyers.

DLF’s management also confirmed that these record sales were not due to the capping of capital gains tax exemption under Sec 54 of the IT Act, which affects the ultra-luxury housing segment.

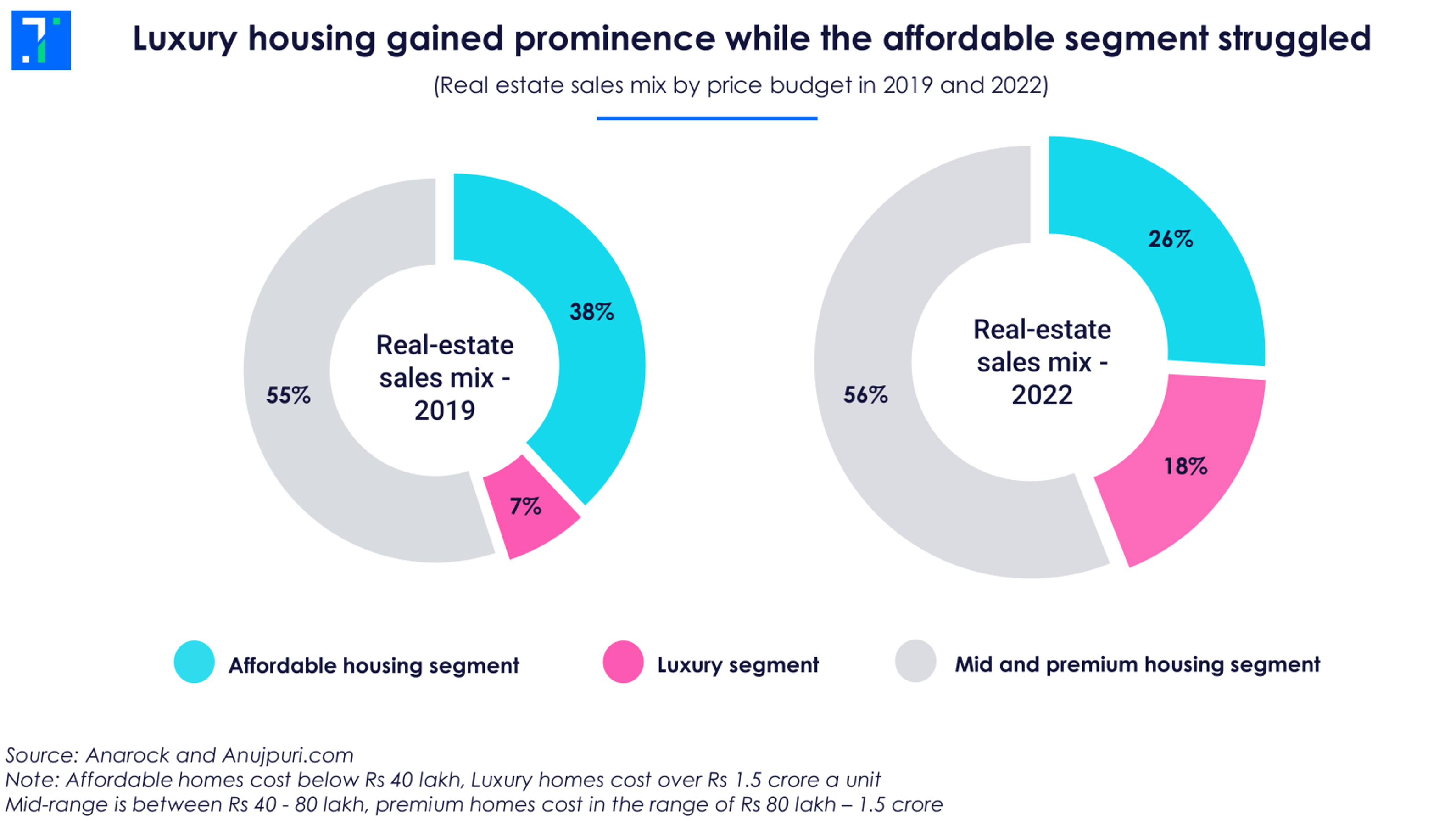

Rising sales in the luxury housing segment isn’t a one-off trend, but rather a secular story in the making. The share of this segment has more than doubled in three years, led by Delhi NCR, Mumbai, Hyderabad and Bangalore. This segment is less sensitive to interest rate cycles and its growth is driven by a combination of factors, including millennials’ dream of a better lifestyle, the rise in per-capita income, and the growing number of HNIs.

Godrej Properties and Sobha shine in terms of pre-sales growth

While Macrotech Developers managed to maintain a pre-sales run-rate of Rs 3,000 crore for three consecutive quarters, Godrej Properties saw a 25% YoY jump in its Q4 sales bookings. This was primarily led by a double-digit growth in volumes. Pre-sales growth for Prestige Estates was mainly driven by a more than 20% rise in average realizations.

Sobha, a relatively smaller player, reported robust growth of over 25% in Q4 sales bookings, led by both price and volume gains. The company’s pre-sales growth in million sqft terms was driven by Kerala and Hyderabad. Notably, Sobha launched its very first project (luxury segment) in Hyderabad in the quarter gone by.

Real estate players have healthy project launch plans coming up

Enthused by the positive demand trends, real estate companies have a good project launch pipeline over the next two years. The focus of Godrej Properties and Macrotech Developers is their home turf – Mumbai and Pune.

For DLF, most of its upcoming launches are planned for its primary market –Delhi NCR. However, it also aims to launch fresh projects in regions like Chennai, Goa and Chandigarh.

Among the big players, Prestige Estates has aggressive launch plans on the anvil, with NCR, Mumbai and Pune as the primary growth drivers for its upcoming residential projects. The company sees its debt portion rising by over 2.5X to Rs 12,000 crore in the next five years to fund these growth plans.

Backed by their healthy launch plans, companies like Prestige and Macrotech aim to register over 15% CAGR in their pre-sales over the next three years.

Luxury housing is fuelling growth, but there are some red flags

The real estate sector is performing well, except for the affordable housing segment. Luxury housing in particular, is thriving, and real estate companies have noticed. To capitalize on this trend, Godrej Properties has purchased a 4-acre land in Pune to develop its very first luxury housing project in the city.

Consensus estimates of analysts expect players across the board to post double-digit revenue growth in FY24, according to Trendlyne’s Forecaster.

However, there are certain risk factors to watch out for. A major concern is the slowdown in the IT sector, which could impact the spending power of techies who are a major consumer group fuelling demand in Pune, Bangalore and Hyderabad. If the weakness in affordable housing persists, it can seep into the mid-range and lower end of the premium segment.

Then there is the added risk of future interest rate hikes. RBI has paused the cycle for now, but any future decision to raise rates could impact real estate, particularly homeowners who are already struggling with the rising tenures of their loans.

The number of years remaining on loans have doubled in some cases in response to rising rates. For example, say you took a home loan of Rs 50 lakh for 18 years with interest rates at 6.5%. New rates are now 9.2%. If you opt to pay the same EMI at Rs 40,000, your loan tenure nearly doubles to 35 years. You will end up repaying the loan till the age of 70, if you are 35 now.

Overall, the real estate sector has shown resilience in 2022 despite macroeconomic challenges. However, it remains to be seen if it can maintain its winning streak in 2023.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.