By Deeksha Janiani

India Inc saw its pace of growth slacken in Q3 due to the slowdown in consumption and sharp correction in commodity prices. While the topline of companies grew in double-digits, profit growth fell on margin compression and rising interest costs. However, some smallcap companies emerged stronger despite the broader macroeconomic challenges.

There were eight such star performers which surpassed their respective industries in terms of YoY revenue and net profit growth in Q3, and seem poised for upbeat growth. These companies are trading below their industry valuations and outperformed industry returns in the past quarter.

A hot summer for Gujarat Fluorochemicals, which is rising on the fluoropolymer opportunity

Gujarat Fluorochemicals (GFL) outperformed the specialty chemical industry’s topline and bottomline growth by a big margin in Q3. It also beat consensus estimates of analysts by clocking over 60% YoY net profit growth. The company is trading at over 40% discount to the industry’s PE valuation currently.

It’s expected to be a scorching summer this year, and GFL sees robust demand for refrigerants in the upcoming quarters with its new manufacturing plants ramping up and summers starting from March. Going forward, the company may also raise its original capex target of Rs 1,250 crore for FY24.

The next big driver for the company will be fluoropolymer chemistry which finds its application in green hydrogen technology, EV batteries and semiconductors. Analysts see GFL’s revenue rising at over 25% CAGR between FY22-FY24, driven by capacity additions.

The surprise star: AIA Engineering delivers on strength of core industries

This capital goods player surpassed industry growth by over 2X, and beat net profit estimates of analysts by 65% in Q3. Its net profit saw an impressive jump due to robust rise in sales volumes and EBITDA margins.

Going forward, AIA Engineering sees strength in its user industries (cement and mining) and expects no major challenges for its customers in the near term. Accordingly, it has lined up a capex of Rs 300 crore for FY24, of which Rs 200 crore will go into the brownfield expansion of grinding media.

The company expects to clock double-digit volume growth in FY24. However, its realizations may fall once it passes the benefit of lower input costs to its customers. Hence, AIA may see its growth moderating in FY24.

Premiumization and store additions will underpin the growth story of Metro Brands

Metro Brands surpassed the footwear industry’s revenue growth by nearly 20 percentage points in Q3, aided by the highest-ever store additions in a quarter. The company added 96 stores in 9MFY23 and is set to open 100+ stores across its brands in the near term.

Metro completed the acquisition of sports and athleisure-based Cravatex Brands in Q3. It is now focused on clearing the excess channel inventory for FILA and Proline. The company will launch a new collection from these brands this summer.

Metro is seeing strong demand for its premium products, fueled by the wedding season, growth of the middle-class segment and shift from unorganized to organized retail. Analysts expect its revenue and profits to grow at a CAGR of over 35% in FY22-FY24.

Girl power helping CreditAccess Grameen ride a strong credit cycle

CreditAccess is a microfinance institution providing loans to rural women. The company reported its highest-ever profits in Q3 and surpassed the NBFC industry’s profit growth by over 45 percentage points. It also beat analysts’ net profit expectations by a little over 10%.

Commenting on the growth opportunities, Udaya Kumar, MD at CreditAccess, said, “For the non-microfinance book, we are doing a lot of pilots, which are giving a very good sign of future prospects.” CreditAccess is working on new products like individual loans, gold loans, two-wheeler loans and affordable housing loans.

The management sees the AUM growing by 24-25% in FY23 and at a 20-25% rate in the next 3-4 years, driven by new customer acquisition and increase in loan ticket size.

Outlook shiny for Kalyan Jewellers, to benefit from expansion outside core markets

Kalyan Jewellers outperformed the net profit growth of the gems and jewelry industry by 17 percentage points in Q3. It also beat the industry’s returns by over 12% in the past quarter. Its Middle East business grew way ahead of the domestic business in Q3.

Gold purchases have seen a comeback - Kalyan saw demand revive in January after customers postponed purchases in December on volatility in gold prices. The company plans to launch 52 new stores in 2023, the majority of which will be based on the ‘franchisee-owned, company-operated’ model. This will enable Kalyan to save on capital while expanding rapidly.

Kalyan will expand stores across metros, tier 1, 2 and 3 cities in regions other than south India. Analysts see its revenue rising at a CAGR of over 20% between FY22-FY24.

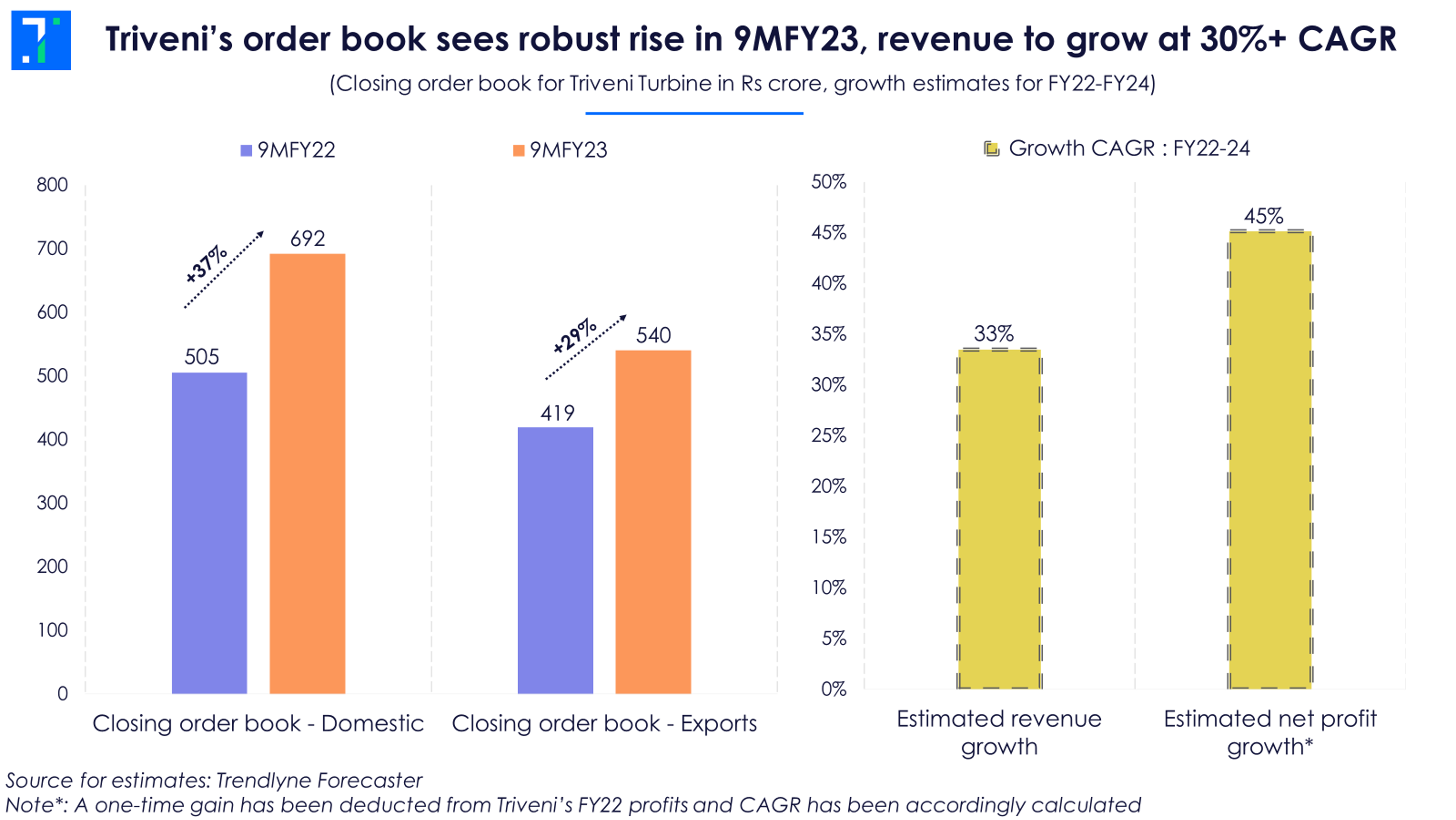

Triveni Turbine stands to gain from focus on energy transition

Triveni Turbine outperformed the heavy electrical equipment industry’s profit growth by more than 50 percentage points in Q3. The company generated nearly 15% returns for its investors in the past quarter.

Triveni reported a closing order book of Rs 1,232 crore, up 33% YoY from the end of last year. Order inflows in 9MFY23 were driven by the aftermarket segment and the domestic market. The company saw over 50% rise in its international enquiries for Q3, mainly from the renewable energy segment.

Notably, Triveni saw a decline in domestic enquiries for Q3. However, the management expects the segment to pick up in the upcoming quarters, led by the capex upcycle. Analysts see its revenue rising at a CAGR of over 30% between FY22-FY24 led by its strong order book.

Cera Sanitaryware is confident of sustaining growth despite the rate hike cycle

Cera Sanitaryware outperformed the home furnishings industry by over 30% on net profit growth. It also sprung a positive earnings surprise in Q3FY23. Cera has returned 20% gains to investors in the past three months, the highest among the companies discussed here.

Commenting on the risk of higher interest rates, Ayush Bagla, Executive Director at Cera, said, “We are more of a B2C company, focused on home-improvement than just developer demand. We are at the highest end of the interest rate cycle and this is our best Q3 ever.” New product launches are another contributing factor to Cera’s strong growth.

The company aims to raise its capex by 4X and spend it on a brownfield faucetware project and a greenfield sanitaryware project. It looks to double its revenues between FY22-FY26 (implied growth rate: 18-20%) and improve margins by 0.5%-0.75% every year.

Craftsman Automation to get mileage from the positive auto cycle

Craftsman Automation outperformed the industry’s net profit growth by over 20 percentage points in Q3. It is trading at nearly 30% discount to its industry’s PE value. Craftsman Auto’s high growth is backed by strong domestic demand for commercial and passenger vehicles.

Craftsman manufactures critical transmission components, especially for medium and heavy commercial vehicles. ICRA forecasts volumes for this segment to grow at 25-30% YoY in FY23 (base was low in FY22) and by 10% YoY in FY24.

The company also completed the acquisition of DR Axion India to increase the share of revenue from PVs. Craftsman sees all its segments, which are powertrain, aluminum die-casting and industrial engineering, growing by 15%-20% in FY24. Analysts expect its net profit to grow at a CAGR of over 45% in FY22-FY24, according to Trendlyne’s Forecaster.