For the last couple of years, India has basked in its status as a 'star performer' in the global economy, with strong growth even as China sputtered. But our article in October worried about signals that suggested that India's growth engine was slowing down. At the time, there was mostly anecdotal evidence from management about weak demand and consumer sentiment.

But the latest GDP data has proved this beyond doubt. India’s growth came in sharply lower than expectations, at a seven-quarter low of 5.4% in Q2FY25.

Suresh Narayanan, chairman and managing director of Nestlé India said in a media briefing, “The market is facing muted demand. It's extremely clear - the growth in the food and beverages sector which used to be double digits a couple of quarters ago, is now down to 1.5% to 2%”.

Most sectors saw economic activity slump in Q2, with mining and construction among the weakest. Manufacturing growth also slowed to a six-quarter low of 2.2%.

After the GDP report, analysts rushed to downgrade their growth forecasts for India. Goldman Sachs cut their projection to 6% in FY25, down from 6.4%.

After lowering her FY25 projection to 6% from 6.5%, Madhavi Arora, lead economist at Emkay Global Financial Services said, “The growth shock was due to lower manufacturing growth. We see urban consumption also staying pale owing to weaker incomes.”

The RBI had projected a 7.2% GDP growth for FY25, which now looks quite out of reach, and is likely to be lowered at its next monetary policy meeting on December 6. Will lower GDP growth have any effect on RBI’s interest rate decision? RBI so far has stubbornly refused to cut rates, citing high food inflation.

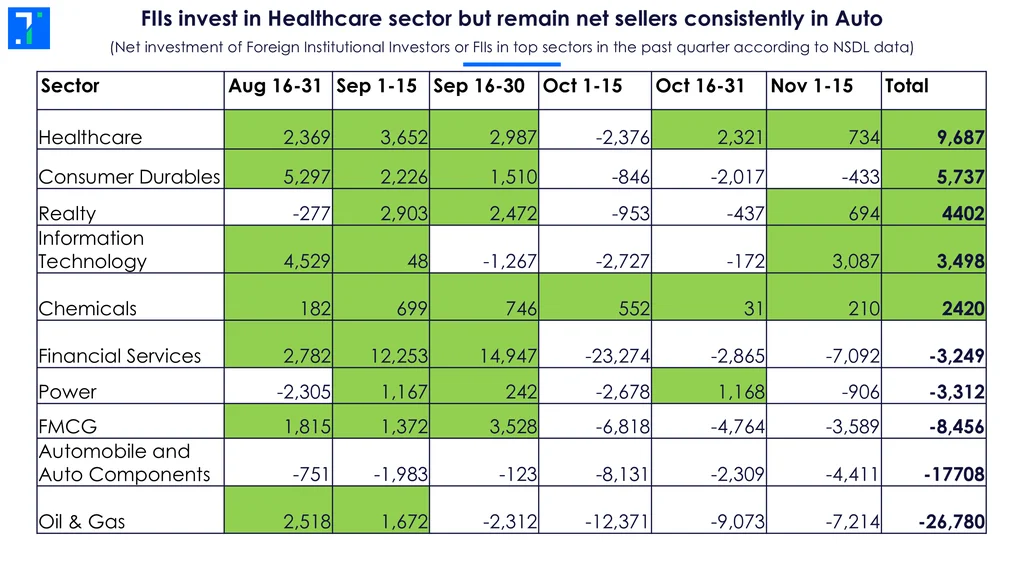

Stocks have been under pressure from foreign institutional investors (FIIs) selling. But there are sectors where FIIs have stayed bullish. Let’s dive in.

- Holding on: FII sector picks during the market correction

- Screener: Stocks outperforming their industries in Q2 revenue and profit growth with strong Forecaster estimates for Q3

FIIs press sell, but some sectors see inflows

FIIs have been relentlessly selling Indian equities since late September. India was no longer the star attraction this quarter due to China’s stimulus moves, higher-than-expected inflation, weak Q2 earnings, and US election jitters. October saw a historic high for FII outflows.

But sectoral data reveal some FII favourites - and some who aren't.

One consistent favorite, where FIIs kept buying even during the sell-off, is healthcare, a defensive sector. Regardless of market cycles, people get sick and need medicines and treatment, making healthcare an attractive choice for cautious investors.

Another standout was chemicals, the only sector with inflows across all these months. Despite grappling with high raw material and freight costs over the past two years, analysts see it recovering from multi-year margin lows.

Realty and IT also found favor with FIIs last quarter. But banking & finance, consumer durables and FMCG, initially net gainers, flipped mid-quarter as FIIs turned bearish. A slow rural recovery and soaring inflation have dampened FMCG prospects, especially after dismal Q2 GDP data showed private consumption growth slowing.

Power and oil & gas saw significant outflows, with the latter showing disappointing Q2 profits due to weaker refining margins and heavy inventory losses. The auto and auto components sector was a mirror image to chemicals, with FIIs selling across all months.

FII favourites outperform the Nifty 50 in the past quarter

The Nifty 50 touched multiple all-time highs earlier this year, only to take a sharp U-turn in October, sliding into correction territory with a 10% dip from its peak. During this volatile quarter, Foreign Institutional Investors (FIIs) saw their favorite sectors outperform the benchmark index.

FII favored sectors outperform the Nifty 50 in the past quarter

FIIs’ least preferred sectors tumbled sharply, with one exception: banking and finance, which managed to hold its ground amidst the sell-off.

Which companies drove these sector shifts?

Healthcare and Chemicals stocks keep gains

Leading the pack of top performing stocks are two consumer durables players: Premier Energies and Waaree Energies. Both debuted on the market this past quarter, and haven’t stopped climbing since.

In the Pharma sector, Piramal Pharma stole the spotlight. Strong traction in its CDMO segment pushed Q2 results beyond expectations. Low manufacturing prices and government incentives such as the Production-Linked Incentive (PLI) plan have turned India into an appealing CDMO destination for global companies that are diversifying away from China.

Top contributors in FII preferred sectors rise in the past quarter

Oberoi Realty and Persistent Systems have also risen in the past quarter due to strong Q2 results. Both companies beat their net income estimates according to Trendlyne’s Forecaster.

Tough times for Auto and Oil & Gas: What’s Driving the Decline?

The last quarter has been brutal for auto and oil & gas, with both sectors facing significant headwinds. Auto manufacturers like Maruti Suzuki, Tata Motors, Bajaj Auto, and TVS Motor saw stock prices tumble, reflecting falling year-on-year sales across passenger, commercial, and two-wheeler segments.

Adding to the gloom, Bajaj Auto's Executive Director Rakesh Sharma admitted that they had miscalculated, “The response in the motorcycle industry is a little bit muted…we thought that 6 to 8% growth will be there in the festive period, but it is not that much. It is 1 -2%”.

Oil & gas sector falls sharply in the past quarter

In the oil & gas sector, intense margin pressure has dragged down performance, with Reliance Industries—India’s largest company by market cap—underperforming the Nifty 50. The sector has struggled to offset weaker refining margins and larger-than-expected inventory losses.

Finally, the FMCG and electric utilities sectors also lagged the Nifty 50. In the FMCG sector, none of the top ten companies managed to outperform the benchmark, averaging a sharp 10.2% decline in stock prices.

Screener: Stocks outperforming their industries in Q2 revenue and profit growth with strong Forecaster estimates for Q3

Restaurants and electrical equipment stocks have the highest Forecaster estimates in Q3

With the end of the Q2FY25 result season, we take a look at stocks that have outperformed their industries in revenue and net profit growth in Q2, with high Forecaster estimates for Q3FY25. This screener shows stocks outperforming their industries in revenue and profit, with estimates for the next quarter suggesting an upbeat outlook.

The screener contains stocks from restaurants, IT consulting & software, banks, heavy electrical equipment, and pharmaceutical industries. Major stocks that appear in the screener are Godrej Properties, Dixon Technologies (India), Kaynes Technology India, Zomato, Suzlon Energy, Au Small Finance Bank, Devyani International, and Jubilant Foodworks.

Godrej Properties features in the screener as Trendlyne’s Forecaster estimates its revenue and EPS to grow by 162.8% YoY and 383% YoY respectively, in Q3FY25. This comes after its revenue and net profit grew by 122.5% YoY and 401.8% YoY in Q2FY25 on the back of higher bookings and new product launches. Analysts like Motilal Oswal Financial Services expect this realty company to deliver strong growth, improvement in cash flows, and higher margins, driven by a strong pipeline and healthy realisations.

Dixon Technologies also shows up in the screener as Forecaster expects its revenue and EPS to grow by 102.5% YoY and 111.4% YoY, respectively, in Q3FY25. Analysts at Sharekhan expect this high-flying consumer electronics stock’s revenue and profitability to improve, led by growth momentum in the mobile & EMS division, and a ramp up in the laptop segment.

You can find some popular screeners here.