By Divyansh Pokharna

The market was under pressure for the fifth week in a row, with the Nifty 50 falling 1.1%. Weak quarterly results, US tariffs on India and other countries and persistent foreign investor selling all weighed on sentiment. Concerns about rising inflation in the US added to the cautious mood.

All eyes are now on the outcome of the RBI’s three-day policy meeting, which ends on August 6. With inflation cooling but global risks rising, most economists expect the RBI to keep the repo rate unchanged at 5.5%. However, investors will watch for any shift in the RBI’s stance amid US tariffs of 25%.

Barclays India noted, “That’s not to say the rate easing cycle in India is over, but it’s just about there. We expect the final 25 bps cut of this cycle to come in October.” Nomura has a different view, seeing a possible rate cut this week following the US move to impose a 25% tariff on Indian goods. It also expects additional 25 bps cuts in both October and December.

The IPO market is upbeat despite the broader weakness. Twelve companies, including four mainboard firms, will launch their public offers this week, aiming to raise around Rs 9,200 crore. That’s 26% more than the money raised by fourteen IPOs last week. Another twelve companies are also set to list on the exchanges this week, after eleven made their debut in the previous week.

Four mainboard and seven SME companies debut over the past week

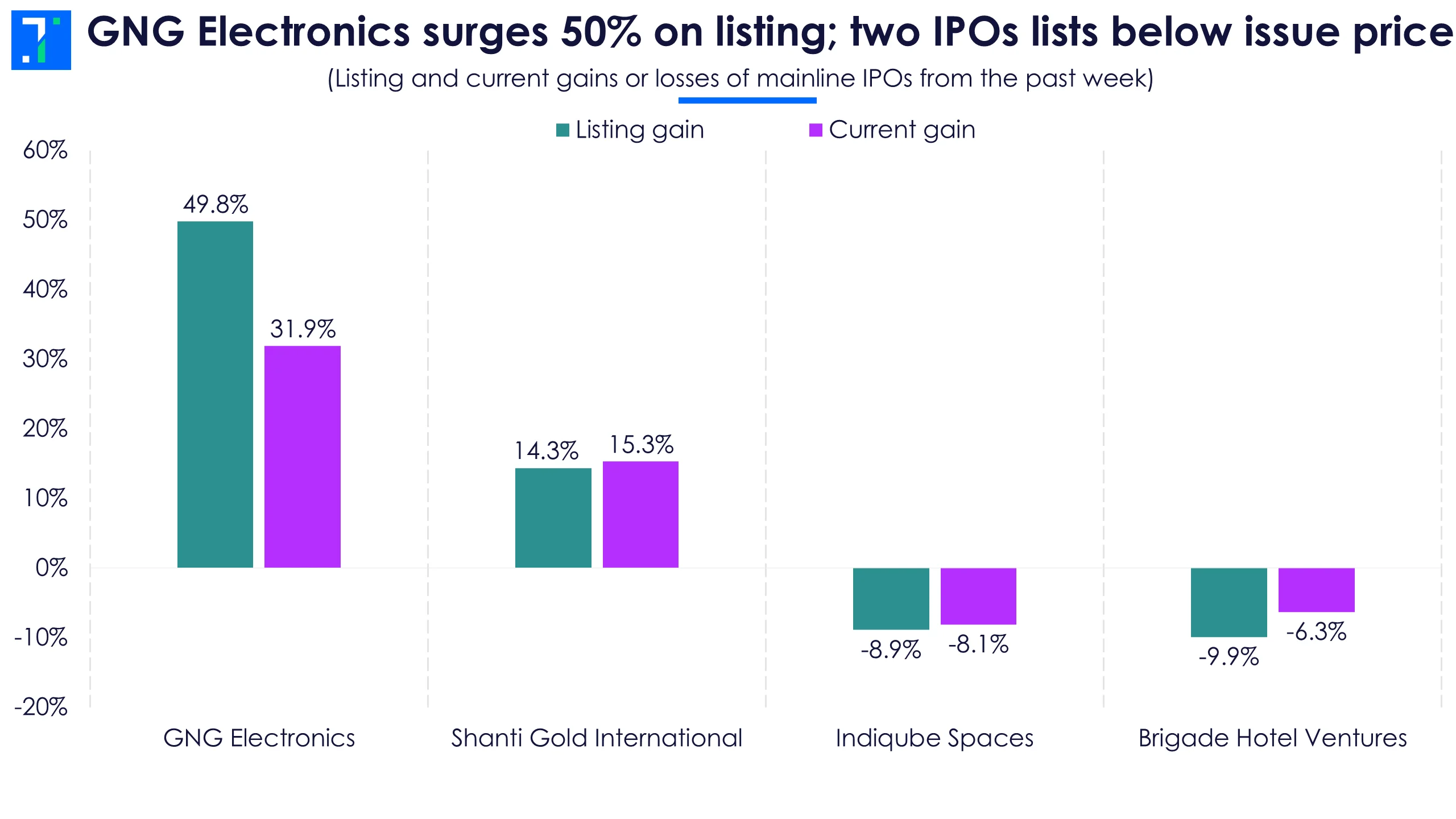

GNG Electronics led the mainline listings last week with a strong 49.8% gain over its issue price of Rs 237. The computer hardware company, which refurbishes laptops, desktops, and ICT devices in India and abroad, was heavily subscribed, with 242.4X by QIBs and 221.5X by HNIs. However, the stock has declined since listing and is now up 34.8% from its issue price.

Shanti Gold International, a maker of 22 karat casting gold jewellery, listed with a 14.3% premium after being subscribed 81.2X. The stock edged up slightly after listing and is currently trading 15.7% higher than its issue price.

GNG Electronics surges 50% on listing; two IPOs lists below issue price

Indiqube Spaces and Brigade Hotel Ventures both listed below their issue prices following relatively lower investor interest. Indiqube was subscribed 12.4X, while Brigade saw a 4.5X subscription. Both stocks have recovered slightly but still trade at a 7.1% and 5.8% discount, respectively.

Among the SME IPOs, Monarch Surveyors & Engineering Consultants, Shree Refrigerations, and Patel Chem Specialities saw strong listing gains of over 30%. While all three stocks slipped after listing, they continue to trade above their issue prices.

Sellowrap Industries and Umiya Mobile debuted with moderate gains of 8.4% and 4.5%, respectively. Sellowrap has moved higher post listing, whereas Umiya has declined but remains above its offer price.

On the other hand, TSC India and Repono listed at a discount and have continued to decline. Both are currently down over 9% from their issue prices.

A happy dozen: IPO rush continues with 12 issues set to open this week

Highway Infrastructure: This highways developer will open its IPO on August 5 and close it on August 7, with listing set for August 12. The company aims to raise Rs 130 crore, including Rs 97.5 crore from a fresh issue and the rest through an offer-for-sale (OFS). The price band is set between Rs 65 and Rs 70 per share. IPO proceeds will mainly go toward working capital and general business expenses.

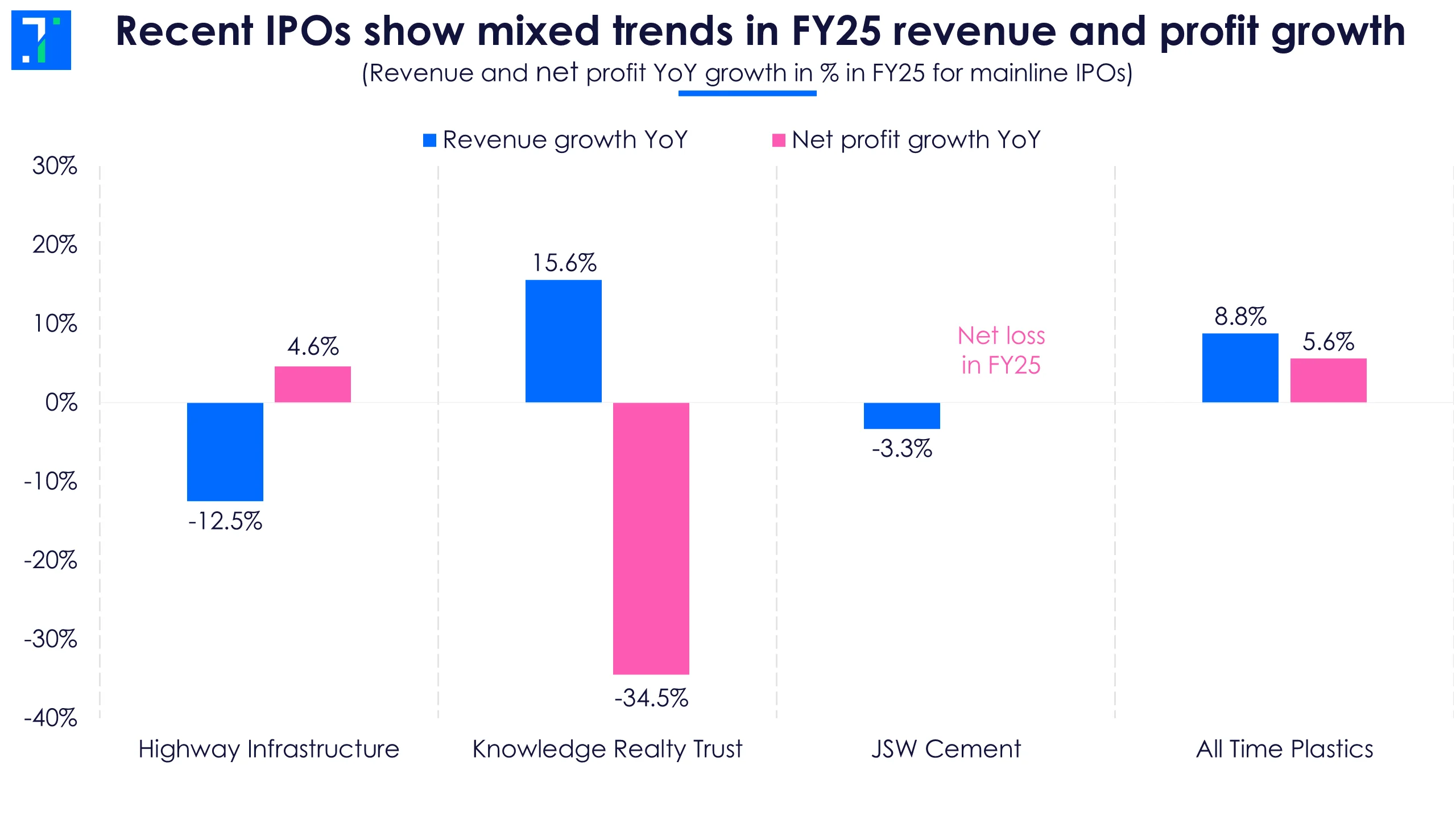

Recent IPOs show mixed trends in FY25 revenue and profit growth

Knowledge Realty Trust: This REIT owns 30 commercial properties across six cities, including Hyderabad, Mumbai, Bengaluru, Chennai, Gurugram, and GIFT City. Its portfolio includes offices and business parks with facilities like food courts and clubs. The IPO opens on August 5, closes on August 7, and lists on August 12. It aims to raise Rs 4,800 crore entirely through a fresh issue, with shares priced between Rs 95 and Rs 100. IPO proceeds will be used for repaying debt of its property-owning entities.

JSW Cement: This cement manufacturer, part of the JSW Group, is launching its Rs 3,600 crore IPO on August 7, closing on August 11, with listing set for August 14. The price band is fixed at Rs 139 to Rs 147. Of the total issue, Rs 2,000 crore is a fresh issue.

The funds will be used to build a new cement plant in Rajasthan and repay some loans. The company reported a loss of Rs 163 crore in FY25, compared to a net profit of Rs 62 crore in FY24, due to lower revenue and higher expenses.

All Time Plastics: This plastic products maker, backed by Sunil Singhania’s Abakkus Asset Manager, will open its IPO on August 7, close on August 11, and list on August 14. The offer includes a fresh issue worth Rs 280 crore and an OFS of 43.9 lakh shares. The company will use Rs 143 crore to repay loans and Rs 113 crore to buy machinery and install an automated warehouse system at its Manekpur unit. The remaining funds will go toward general business purposes.

In addition to the four mainline IPOs, eight SME IPOs are lined up this week. Of these, six opened for subscription on August 4 and will close on August 6, with listing scheduled for August 11.

- Bhadora Industries aims to raise Rs 55.6 crore through a fresh issue, with shares priced between Rs 97 and Rs 103 each.

- Parth Electricals & Engineering plans to raise Rs 49.7 crore, offering shares in a price band of Rs 160 to Rs 170.

- Jyoti Global Plast is looking to raise Rs 35.4 crore, which includes Rs 26.7 crore as a fresh issue and the rest as an OFS. The shares are priced between Rs 62 and Rs 66.

- Aaradhya Disposal Industries plans to raise Rs 45.1 crore through a fresh issue, with shares priced between Rs 110 and Rs 116.

- BLT Logistics aims to raise Rs 9.7 crore, offering shares in the Rs 71 to Rs 75 range.

- Essex Marine is looking to raise Rs 23 crore through a fresh issue, with shares priced at Rs 54.

Sawaliya Foods Products is opening for bidding on August 7, will close on August 11, and list on August 14. It aims to raise Rs 34.8 crore, including a fresh issue of Rs 29.5 crore, with shares priced between Rs 114 and Rs 120.

ANB Metal Cast will open its IPO on August 8, close on August 12, and list on August 18. The company plans to raise Rs 49.9 crore entirely through a fresh issue, with a price band of Rs 148–156.

Twelve new IPOs are lined up for listing this week

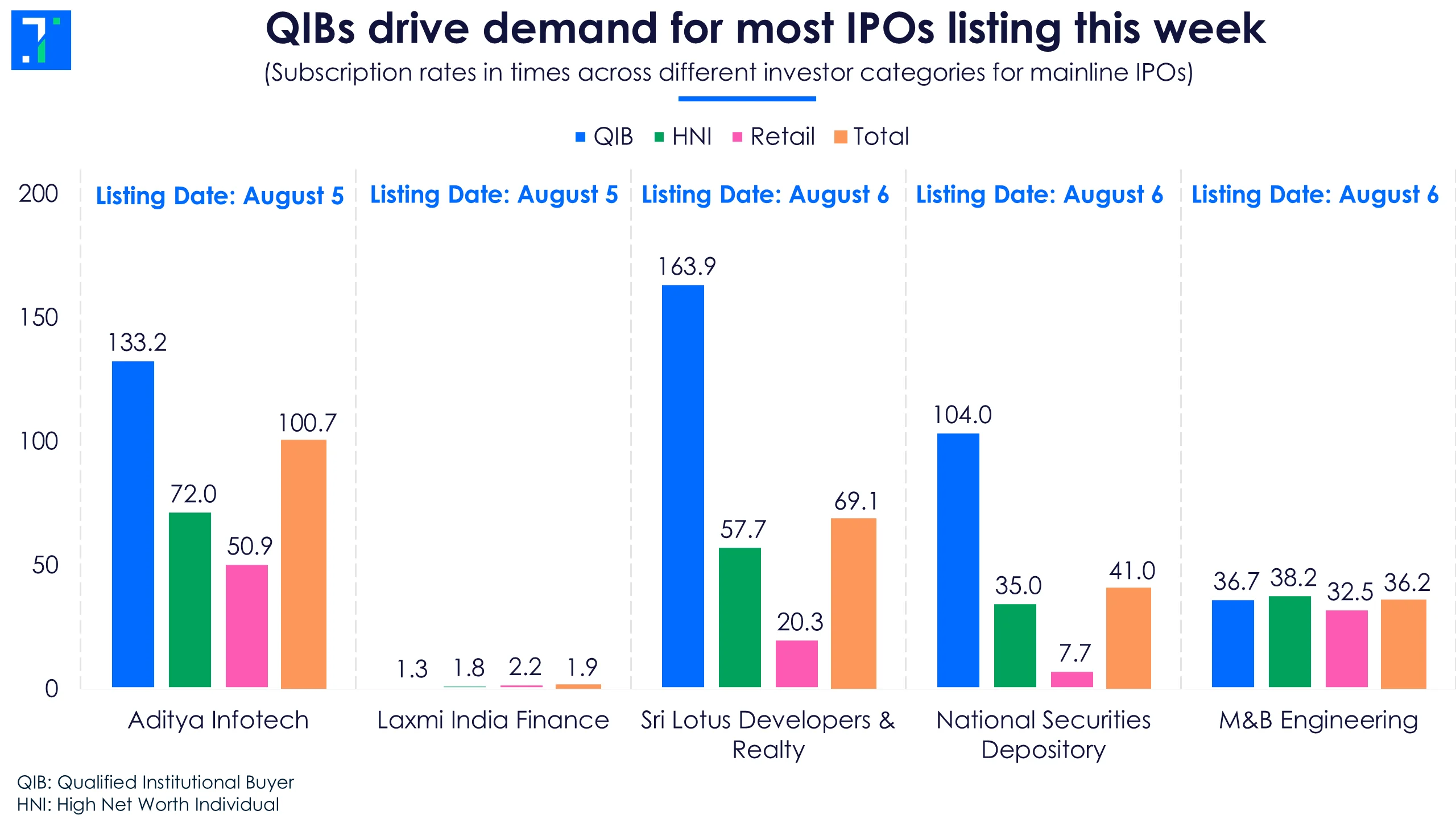

Aditya Infotech leads with a strong 100.7X subscription, mainly driven by QIB interest at 133.2X. The IT networking and surveillance equipment maker will list on August 5. Laxmi India Finance, an NBFC offering loans to MSMEs, vehicle buyers, and construction firms, was subscribed 1.9X. It also lists on August 5.

QIBs drive demand for most IPOs listing this week

Three IPOs are set to list on August 6. Sri Lotus Developers & Realty, focused on residential and commercial redevelopment projects, saw a 69.1X subscription. National Securities Depository (NSDL), a SEBI-registered securities depository, was subscribed 41X.

M&B Engineering, which manufactures steel structures and roofing systems, recorded a 36.2X subscription. All three will be listed on August 6.

Additionally, seven SME IPOs are scheduled to list this week.