It's that time of the year, when promises that CEOs made in the previous quarter are checked against actual financial results.

And so far, it’s been a mixed bag for Q1FY24.

Sectors like banking and finance, auto ancillaries, capital goods and construction have continued to outperform, with impressive growth and a promising outlook. Uday Kotak, Managing Director at Kotak Mahindra Bank, said that the financial sector "is in its Goldilocks period. Clock striking midnight feels far away for Cinderella.”

In contrast, the IT sector and a few FMCG players have seen a growth slowdown so far. And textiles and chemicals players were hit by a YoY decline in their Q1 revenue and profits.

When we look beyond sectoral trends, an intriguing volume story has also emerged this quarter.

With inflation falling and demand bouncing back, several big companies reported a strong jump in their Q1 sales volumes. This is especially true for building material companies like UltraTech Cement, Supreme Industries and APL Apollo.

Similar signs of a volume rebound are visible in the pharma and FMCG spaces. But there are also bigwigs like HUL, who were left out and are still waiting for the volume recovery to come their way.

One group of companies in particular, managed to impress the street with their growth. This week, we bring you an exclusive report on these five players, which surpassed analyst expectations and sector performance to deliver outstanding Q1 results.

In this week’s Analyticks:

- Q1FY24 outperformers: Companies that surprised investors with a strong Q1 showing

- Screener: Stocks where promoters increased pledged shares QoQ

Let’s get into it.

Results special: Five companies that beat estimates in Q1

In this week’s edition, we look at five players that easily beat revenue and profit growth expectations in Q1FY24. Many of these companies are also reasonably valued relative to their future prospects.

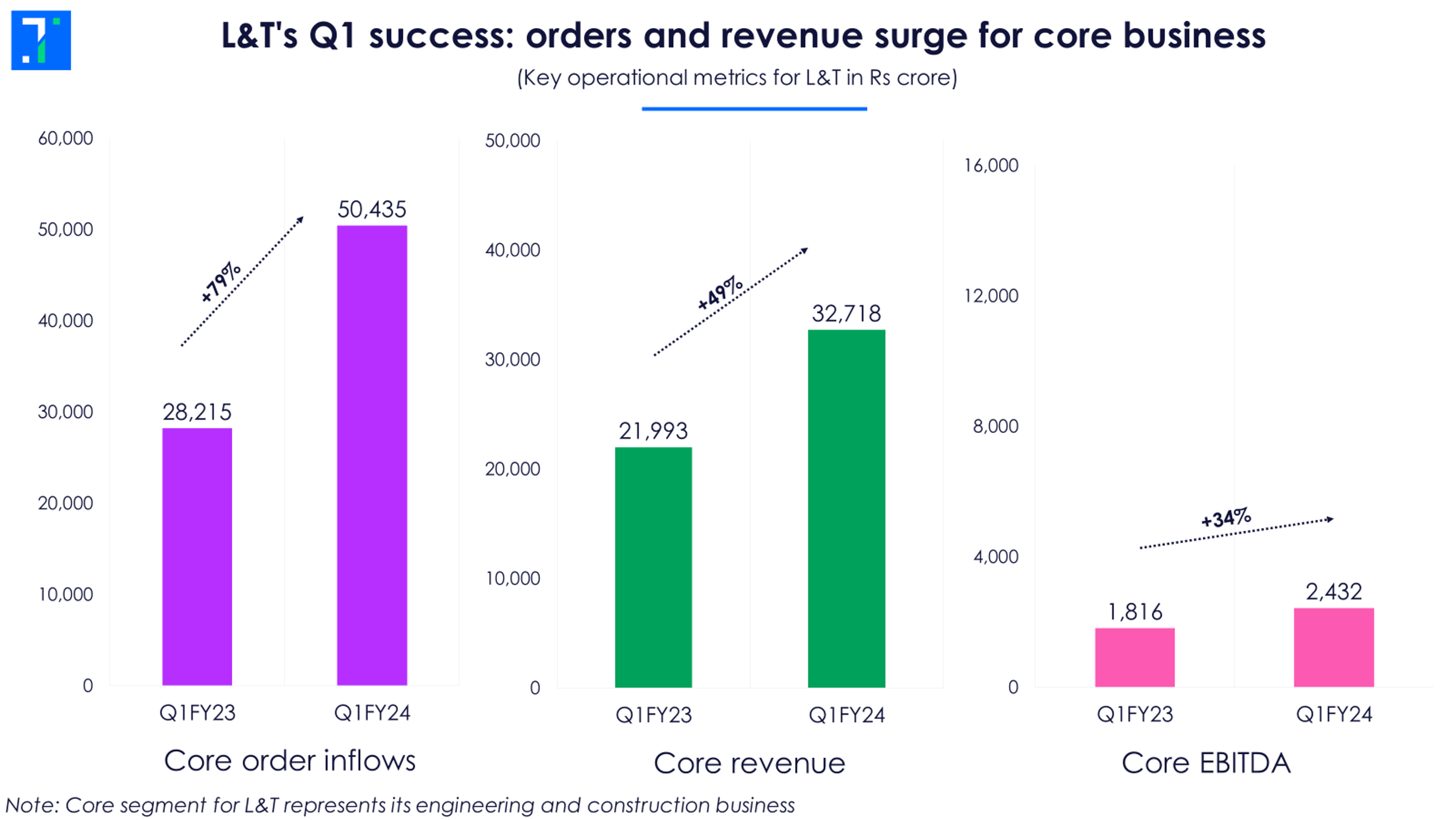

L&T beats expectations with strong infra and energy execution

This engineering & construction major beat analysts' net profit expectations by 19% in Q1. Revenue for its core engineering business jumped nearly 50%, thanks to a pick up in project execution in infrastructure and energy.

Order wins were equally encouraging for L&T in Q1. The company received bookings across segments like railways, renewables, rural water supply, transmission & distribution, and commercial & residential buildings.

For the rest of FY24, L&T sees order prospects worth Rs 10.07 lakh crore, an increase of over 30% from the previous year. Prospects - meaning projects that L&T can bid for - have risen due to higher activity in the Middle East, especially Saudi Arabia, where the government is flush with budget surpluses.

R Shankar Raman, CFO at L&T, commented on the Middle East growth, “Recently, there has been a shift in investment preference in the Middle East. They want to develop rail networks, invest in solar energy and green hydrogen. Fortunately, that plays to our strengths.”

Tata Motors: Jaguar Land Rover presses the accelerator

This auto major beat analyst expectations on net profit by 16% in Q1FY24. This was driven by a 40% surge in revenue and a seven percentage point rise in EBITDA margin. The highlight of the quarter was the JLR business.

Tata Motors’ JLR division sells high-margin luxury SUVs. It saw a strong jump in the wholesales of Range Rover, Range Rover Sport and Defender during the quarter. Sales were particularly strong in regions like North America, the Middle East and China.

The company expects the demand for the JLR division to rise in H2FY24, as it ramps up production. It also sees a recovery in demand for its commercial vehicles after the monsoons. The management acknowledged the especially strong growth in heavy commercial vehicles, which is expected to continue.

Tata Motors faced high net losses between FY19 and FY22, but it was back in the black in FY23. Analysts predict that the company’s profits will jump over 8X in the next two years, helped by a low base. Consequently, it has attractive valuations.

JSW Steel 'steals' the show with robust sales volume and lower costs

This metals company exceeded analyst profit estimates by a whopping 162% in Q1. Lower input and power costs drove a margin rise of over five percentage points.

A jump in steel sales volume boosted JSW Steel’s revenue growth. The infrastructure and construction space drove demand, as did its retail customer segment.

Going forward, the company has guided for steel sales of 25 million tonnes in FY24, which translates to 12% YoY growth. JSW Steel also plans to expand its production capacity by over 30% in the next two years. Analysts expect the company to benefit from rising government capex, and predict a rebound in net profits by FY25.

Cipla's American business helps it shine

This pharma major surpassed analyst net profit estimates by 11% in Q1. The top-line growth was driven by a strong performance of the US business, and a decent show in the India business.

Cipla saw robust volume growth for its basic generics business in the US. Commenting on this, Umang Vohra, CEO at Cipla, said, “The supply-demand equation in the US market is readjusting and competition is falling, due to companies going up for sale or facing bankruptcy. This is resulting in growth for Cipla's base families. Pricing pressures are also easing.”

Cipla’s branded prescription business in India also did well in Q1, beating the growth of the broader pharmaceutical market. The company’s growth has been especially strong in the respiratory and cardiac segments.

Going ahead, Cipla has a good launch pipeline for the US market. The company is reasonably valued and analysts foresee a profit growth of over 20% in the next two years.

Favourable demand for wires and cables is boosting Polycab India

This consumer durables player beat consensus net profit (net income) estimates by 46% in Q1FY24. The revenue growth in its flagship wires and cables division drove the bottom line, with a 50-60% YoY volume jump.

Infrastructure, electricity transmission & distribution, and the real estate segments drove domestic demand for wires and cables. Exports also saw strong momentum, thanks to healthy demand from the oil and gas, and renewables sectors.

Commenting on the growth trajectory, Gandharv Tongia, CFO at Polycab, said, “We should be able to get to a top line of Rs 20,000 crore by FY26, but it is also possible that we achieve it sooner.” The management's confidence here suggests growth beyond the target CAGR of over 12%.

Analysts expect that the company will achieve a revenue and net profit growth of over 18% in the next two years. But the stock is currently trading at expensive valuations relative to its prospects.

Screener: Stocks where promoters have increased pledged shares QoQ in Q1

As the latest shareholding data for companies comes out, we take a look at the stocks that saw a significant rise in promoter-pledged shares (which indicates higher loans taken out against stock). This screener shows stocks with increasing promoter pledges over the past quarter. This is typically a negative signal for a company.

The screener has 18 stocks from Nifty 500 and one stock from Nifty 50, representing sectors like banking, pharmaceuticals & biotechnology and utilities. Major stocks that appear in the screener are Hindustan Zinc, Eris Lifesciences, Max Financial Services, Ajanta Pharma, PVR Inox and Aurobindo Pharma.

Hindustan Zinc stands out with the highest rise of 11.8 percentage points QoQ in promoter-pledged shares. Its promoter, Vedanta, increased its pledged shares to 99.4% of its total holding. It pledged 4.4% of its holding on May 25 to Glencore International against a loan of $250 million and 3.3% of its holding to Axis Trustee Services for an undisclosed amount.

Max Financial’s promoters increased their pledge by 8.3 percentage points over the past quarter. This takes the promoter pledge to 93.3% of their total holding. The life insurance player struggled with declining net profits and profit margin in Q4FY23.

Eris Lifesciences’ promoters pledged 11.4% of their holding in Q1FY24. This is the first time the promoters have pledged shares. Share price performance dwindled as it posted declining net profit and revenue for the second consecutive quarter in Q4FY23.

You can find some popular screeners here.