TopIT consulting & software companies have been losing the gains they made in the market over the past two years due to inflationary pressures. Amid high inflation in the US and the geopolitical crisis in Europe, speculations were rife about an imminent slowdown in IT spending by clients.

The gloomy business environment in Q2FY23 did not inspire much optimism for top-tier IT companies. However, IT firms sprung a surprise, and delivered healthy demand growth despite these headwinds.

Salil Parekh, CEO and Managing Director of Infosys did strike a note of caution however, saying, “While H1 growth was strong we expect H2 growth to be impacted due to seasonality from furloughs and lower working days.”

Companies like Tata Consultancy Services (TCS) and HCL Technologies have managed to beat the street’s expectations in Q2, as earnings beat Trendlyne’s Forecaster revenue estimates.

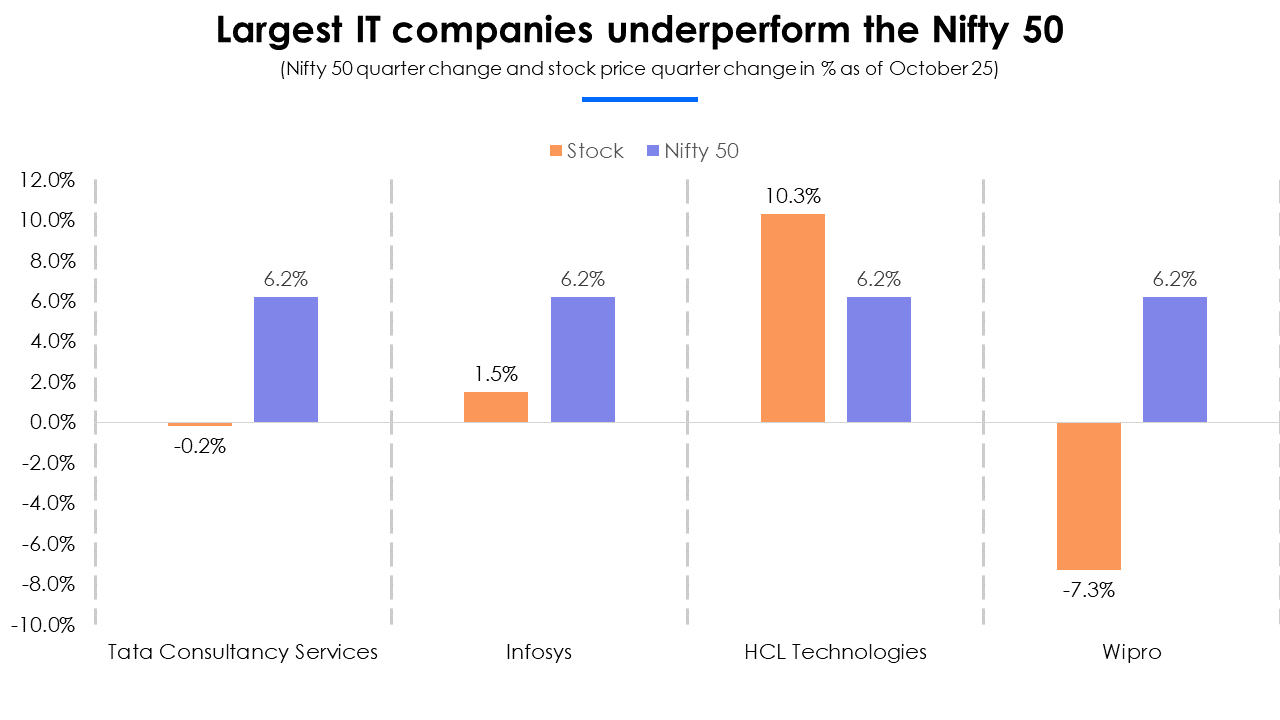

The IT companies in focus barring HCL Technologies, continued to underperform the Nifty 50 index over the past quarter.

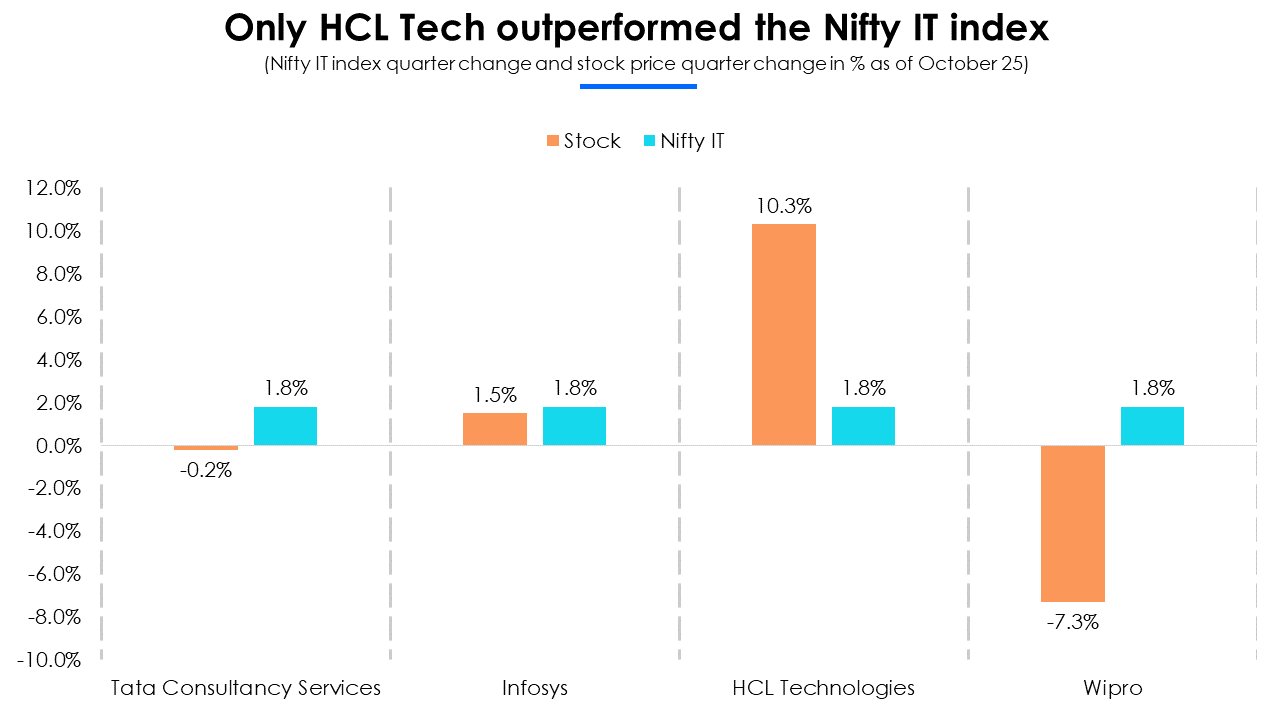

These stocks have also underperformed the Nifty IT index, with only HCL Tech beating the sectoral index . The index overall has also underperformed the Nifty 50 over the last year.

Revenue rises as demand remains intact across top IT firms

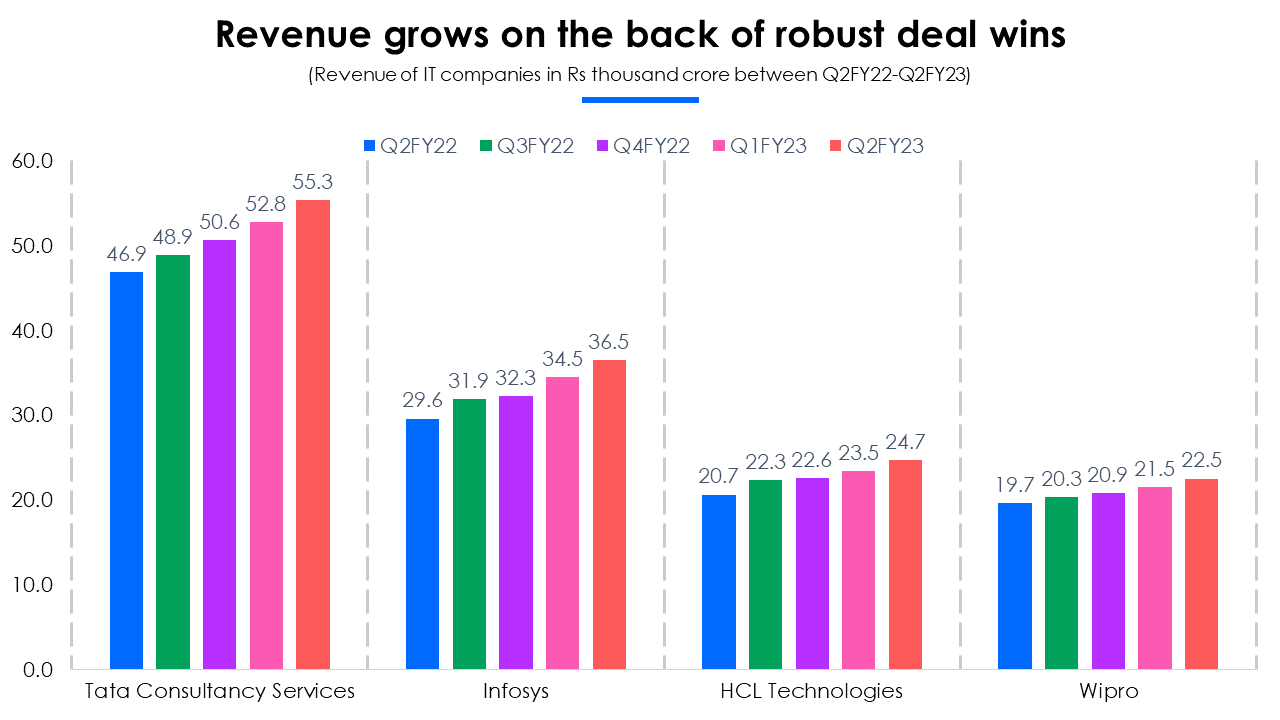

Despite market pessimism, all the IT companies in focus saw revenue growth in Q2FY23 on the back of demand across segments and robust deal wins. While recessionary fears are gaining ground in the US and Europe, top-tier IT firms witnessed healthy momentum in these markets.

Infosys’ revenue rose by the largest margin among the big four, growing 6% QoQ, driven by the digital services segment. The company’s manufacturing, life sciences, and Hi-Tech business verticals performed the best in terms of revenue growth in Q2. In the coming quarters, the management expects a slowdown in discretionary spending in the hi-tech and telecom industry segments.

Tata Consultancy Services’ revenue grew 4.8% on the back of robust demand for cloud transformation services. Revenue growth was led by the technology and life sciences segments, which rose QoQ by 5.7% and 5.9% respectively. The company’s largest segment, banking, financial services, and insurance (BFSI), grew by a small margin.

In fact, all the tier-1 IT companies saw their financial services or BFSI segment rise moderately. TCS’ management expects some weakness in the insurance sector within the BFSI segment.

HCL Technologies’ overall growth was driven by its IT services segment, which comprises IT & business services, engineering and research & development segments.

The revenue from IT services contributed more than 90% to HCL Tech’s total revenue this quarter. However, this growth was offset by a sharp fall of 7% QoQ in revenue from the product & platform business. The management sees the IT services segment rising 16-17% YoY in constant currency (CC) terms for FY23.

Wipro saw healthy revenue growth across all geographies and sectors, led by its manufacturing, consumer, and energy segments. Despite a weak macro outlook, the firm’s management expects the BFSI segment to perform well in the coming quarters. However, the management anticipates slowing demand in its consulting business and weakness in manufacturing, technology, and retail segments.

Although these companies saw a healthy demand environment this quarter, that does not mean they were unscathed by macro headwinds. The big four companies did witness a delay in decision-making from their clients on new deals. Many of their clients are also prioritising short-term projects over long-term ones.

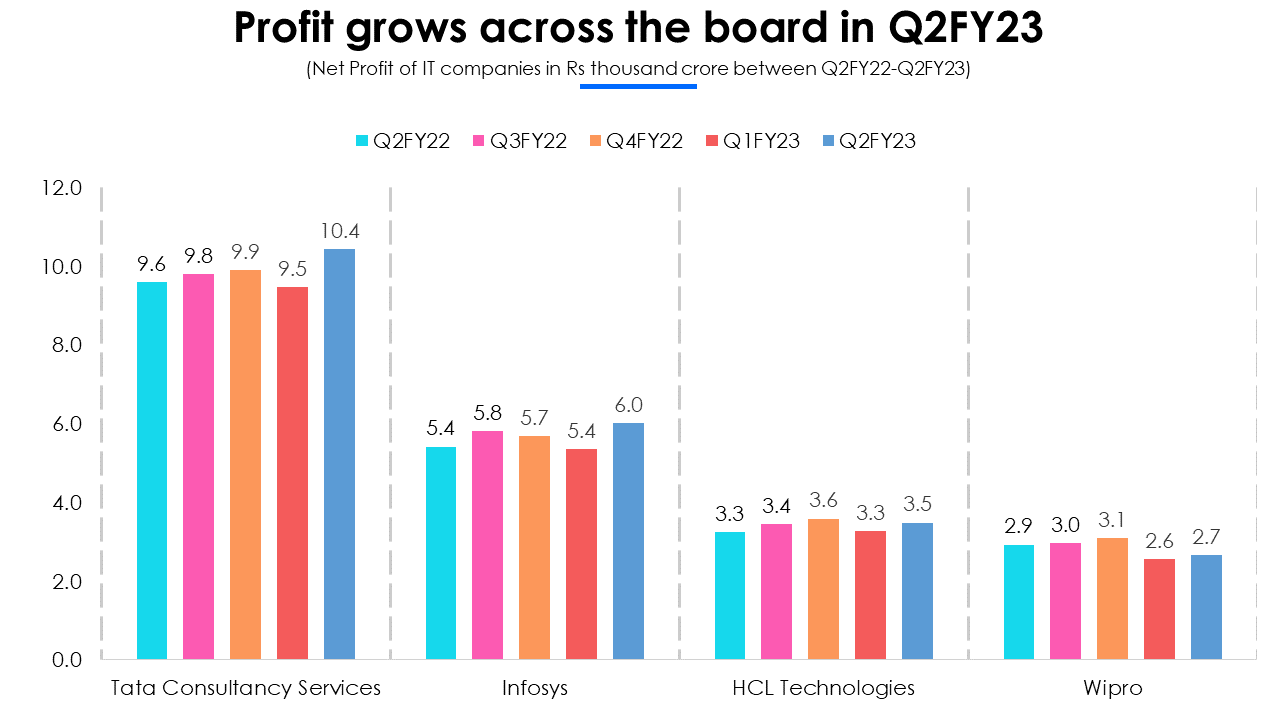

The big four see profit growth in Q2, after a decline in Q1FY23

All the companies’ profits grew on the back of cost optimisations, higher realisations, and operational efficiencies. Their profit growth turned positive on a QoQ basis in Q2, as compared to a decline in net profit in Q1FY23. Infosys’ net profit grew after falling for two quarters sequentially.

Infosys leads the pack in profit growth followed by TCS, growing 12.3% QoQ and 10.1% QoQ, respectively. HCL Tech’s profit growth was aided by higher other net income and lower-than-expected taxes, according to Sharekhan.

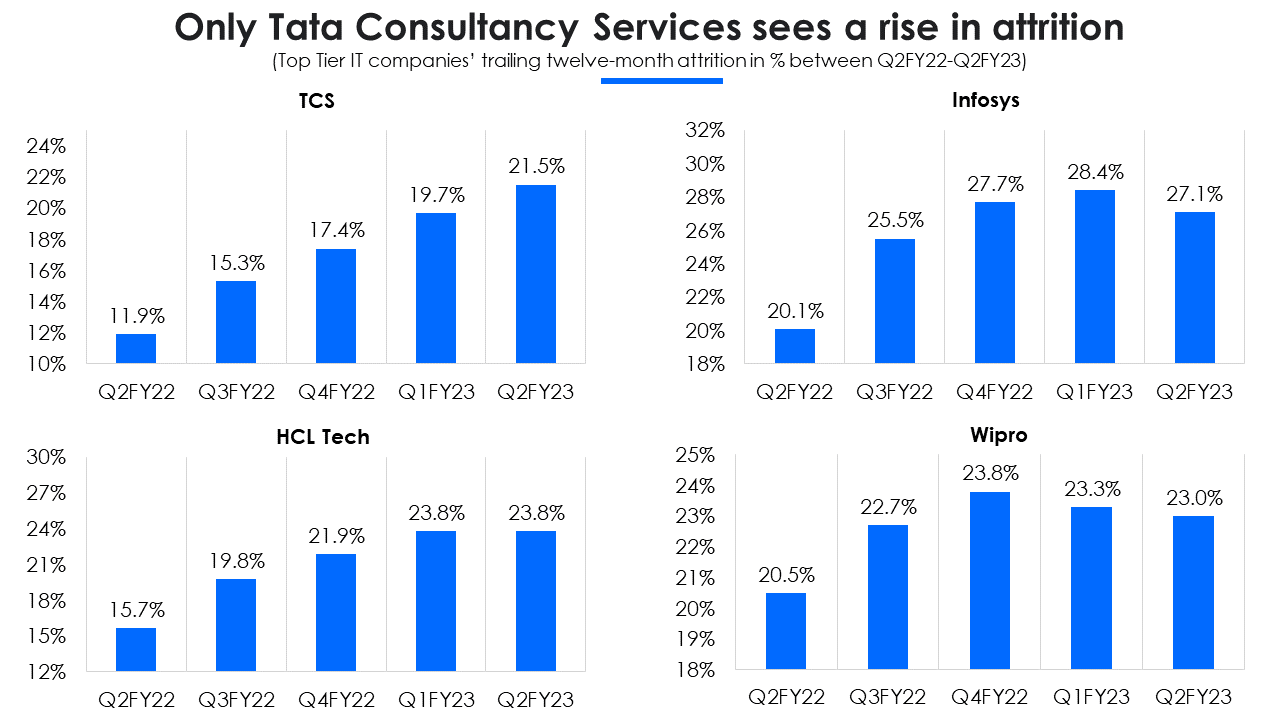

Attrition finally shows signs of moderating

It finally looks like major IT firms are able to moderate or contain their attrition rates. Infosys and Wipro’s attrition rates fell for the first time in many quarters, with Infosys’ attrition rate declining 130 bps QoQ to 27.1% and Wipro’s falling by 30 bps QoQ. The management of Infosys believes its initiatives put in place to reduce attrition are working and expects attrition to continue to fall.

HCL Tech’s attrition remained flat, after rising for many quarters. TCS was the odd one out, as its attrition rate grew 180 bps QoQ to 21.5%. However, the company believes that attrition has peaked and will begin to decline from H2FY23 onwards. “With supply catching up across the industry, the pressure to poach experienced talent is easing. So, we should start seeing the churn settle in the coming months,” TCS’ management said.

Other companies also echo TCS’ expectation of attrition moderating from here on out as the supply-side situation improves. They believe attrition rates have peaked and will start to normalise from Q3FY23 onwards.

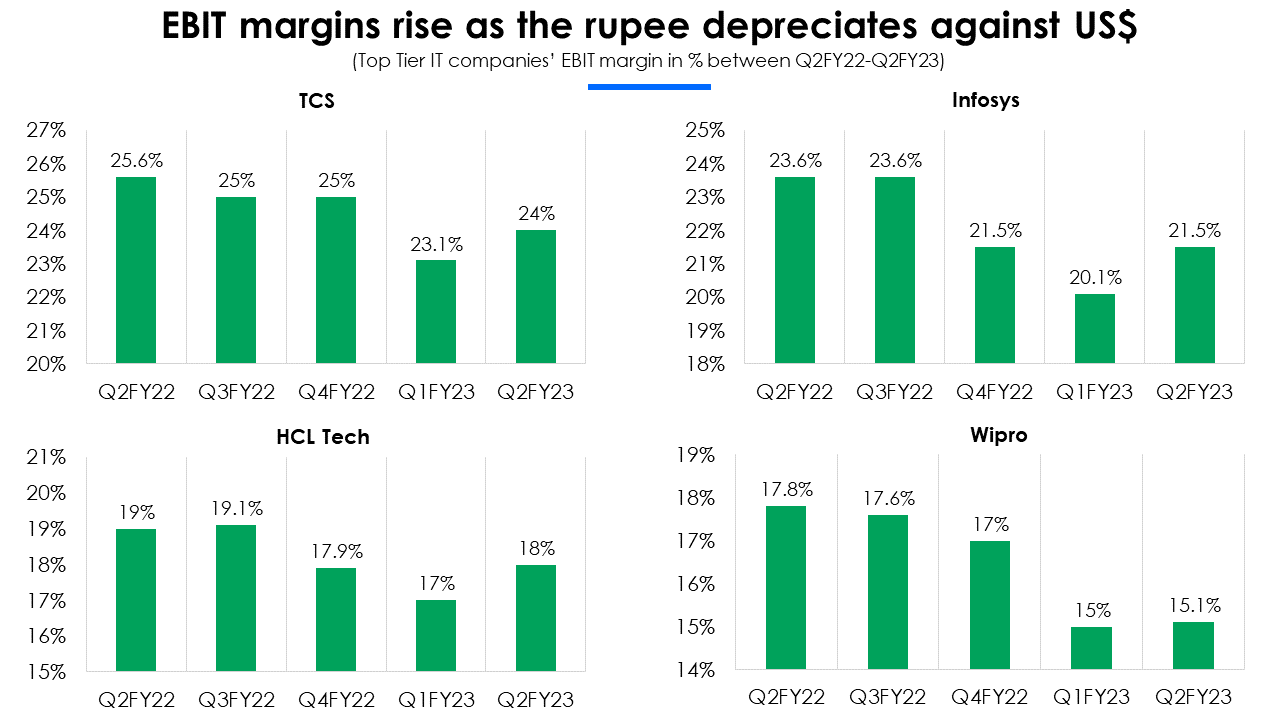

EBIT margins improve across the board

The big four IT firm’s EBIT margins rose across the board in Q2FY23. The companies attribute this to cost optimisations, lower subcontractor costs, higher realisation, optimisation in large deals, pyramiding, and the depreciating rupee against the US dollar.

Infosys’ EBIT margin saw the biggest improvement, growing by 140 bps QoQ to 21.5%, followed by HCL Tech’s margin rising by 100 bps QoQ to 18%. It is important to note that HCL Tech was able to improve its EBIT margins despite starting its salary hikes for its employees in Q2FY23.

TCS saw its EBIT margin improve by 90 bps QoQ due to better operational productivity and the depreciating Indian rupee. The management continues to be optimistic about achieving a 25% EBIT margin by Q4FY23 as it sees supply-side headwinds easing.

It looks like the initiatives put in place by the IT giants to counter margin pressure have worked this quarter. However, major headwinds such as travel and visa costs, lower-working days and cross-currency movements may offset gains.

Taking the global economic outlook into consideration, Infosys and HCL Technologies lowered the upper band of their margin guidance for FY23. Infosys lowered margin guidance to 21-22% from 21-23% and HCL Tech reduced it to 18-19% from 18-20%.

Deal wins boost revenue growth

As mentioned above, robust deal wins this quarter have pushed revenue growth gains for IT companies. Infosys’ large deal total contract value (TCV) surged 59% QoQ to $2.7 billion, out of which 54% was net new in Q2. The company bagged the majority of its large deals in financial services, retail, communication, energy, and hi-tech segments.

HCL Tech’s new deal TCV grew 16% QoQ, and it bagged a mega deal worth $125 million for five years starting from FY24. The management expects the deal pipeline to remain healthy in the coming quarters and aims to touch a deal win target of $2-2.5 billion every quarter.

Both TCS and Wipro saw their TCV in Q2 fall on a QoQ basis, but it grew on a YoY basis. The management of both the companies were pleased with the deal wins this quarter and noted that these wins were in line with their long-term targets.

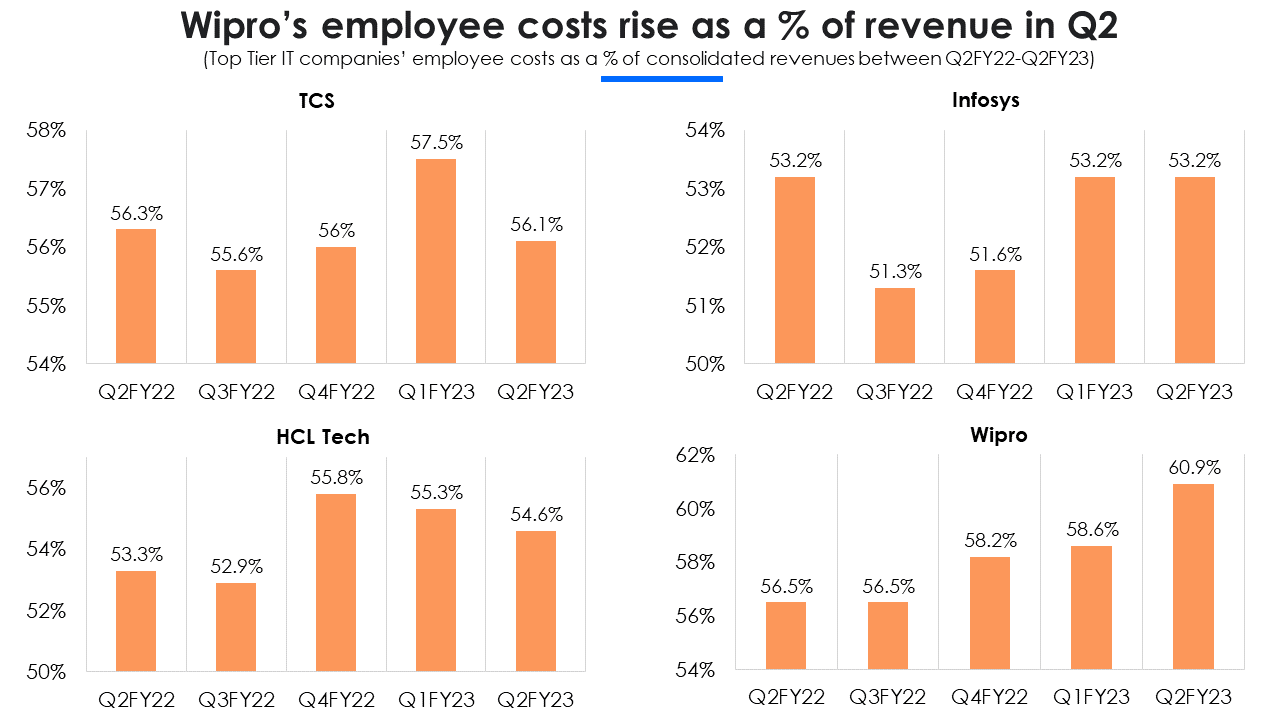

TCS and HCL Tech’s employee costs fall, and subcontracting costs fall across the board

TCS and HCL Tech saw their employee costs as a percentage of revenue decline on a QoQ basis in Q2FY23. HCL Tech managed to do it while also beginning to hike salaries from Q2. Whereas, Infosys’ employee costs remained flat on a QoQ basis.

Only Wipro has seen a continued rise in its employee costs as a proportion to its revenue. This is surprising considering its net employee hiring dropped sharply to 605 in Q2, from headcount additions of over 10,000 in the previous five quarters. Wipro’s management attributes the rise in employee costs to retaining talent and controlling attrition levels.

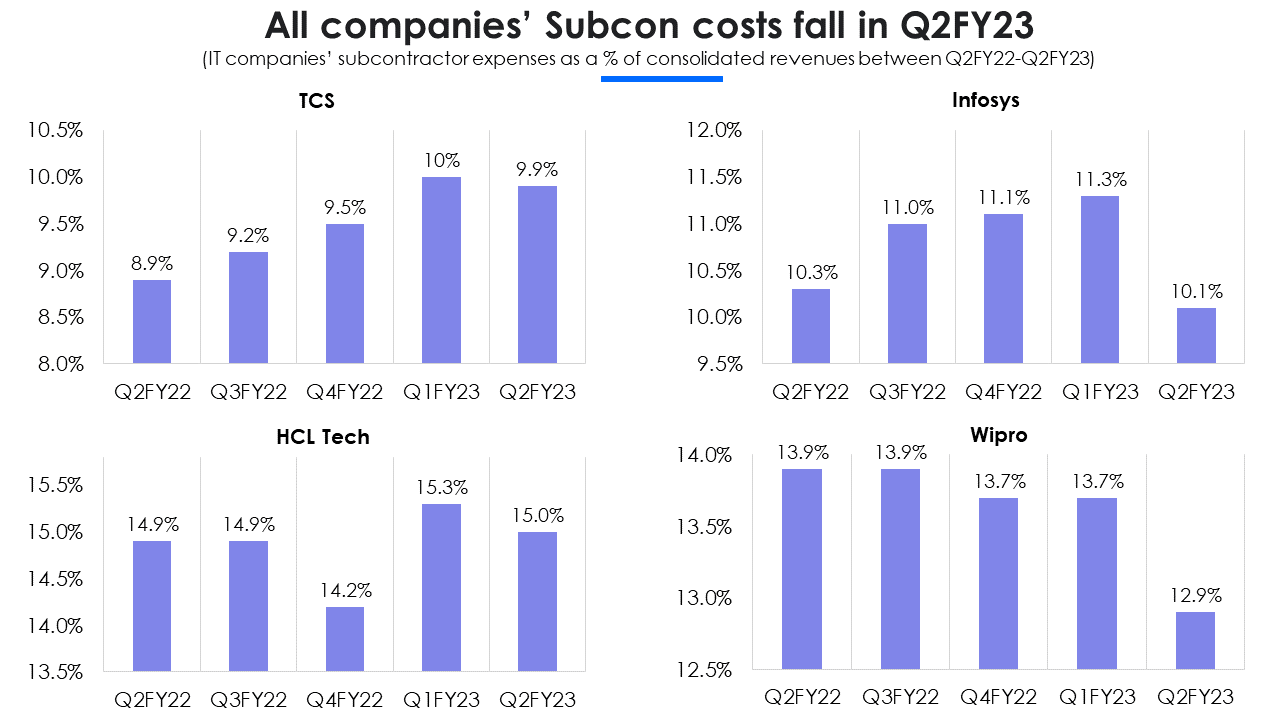

With a better supply of talent compared to the previous few quarters and attrition rates moderating, subcontractor costs have fallen across the board. Infosys saw the biggest drop in sub-contractor expenses as a proportion to its revenue, dropping 120 bps QoQ. Although sub-con expenses are falling, they still remain higher than normal levels for all IT firms.

However, most companies’ management are optimistic about subcontractor costs declining from here on out. They expect supply-side constraints to ease and attrition rates to fall, which will lead to the normalisation of subcontractor costs down the line.

Demand outlook remains strong, margin pressures to persist

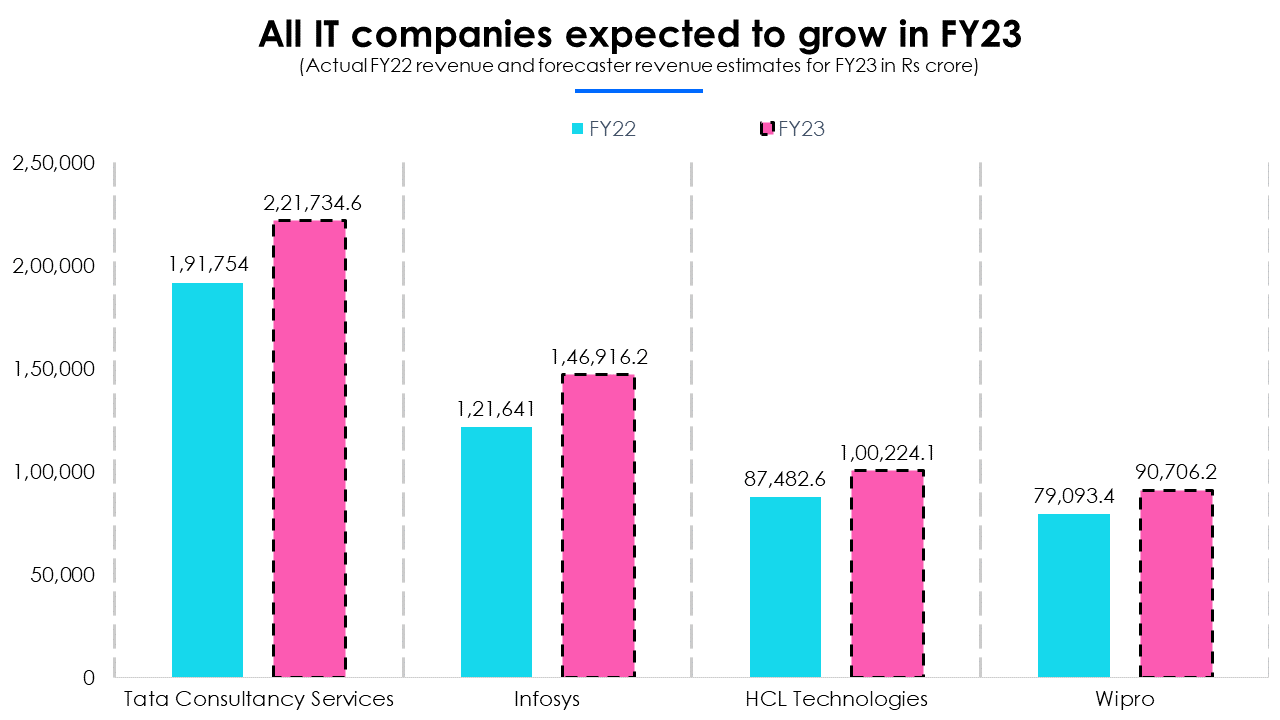

The street anticipates double-digit revenue growth for all the big four IT giants in FY23, according to Trendlyne’s Forecaster. Among them, Infosys is expected to lead in terms of revenue growth, rising by 17.2%. This number is higher than its revenue guidance of 15-16% for FY23.

Management across the board expect demand to continue to rise even with unfavourable economic conditions persisting. All companies see the US market leading the growth momentum in the coming quarters, while Europe is expected to grow slower due to geopolitical uncertainties.

Although top-tier IT companies saw a rise in demand, and some relief as attrition levels fell, the overall commentary is that margins will continue to be impacted by macroeconomic headwinds. With recessions predicted in the US and Europe, a complete recovery in the overall business environment remains elusive for these companies.

The big four IT companies face many uncertainties in the coming quarters. If the economic situation worsens, IT spending and demand run the risk of decreasing sharply. In these turbulent times, one can only wait and see if the worst for the IT sector has passed.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.