On March 7, the Nifty 50 breached the psychological level of 16,000 and fell to 15,771.65 after four days of trading in red. Concerns on higher inflation, a weakening rupee and record crude oil prices had spooked investors. Though the index is up 3% in the last two days, the Russia-Ukraine war is far from over.

This week, we dive into a sector with direct correlation with the current oil shock, and how a healthcare company is taking on competition in the post-pandemic world.

In this week’s Analyticks:

- Record crude oil prices add to woes of Indian Oil, BPCL and HPCL, as analysts forecast weak FY23

- Going to war - on the internet: Apollo Hospitals looks to raise capital for its healthcare platform, to compete with PharmEasy

- Screener: Which stocks are outperforming their industries, with strong fundamentals and lower PE?

Let’s get into it.

As crude oil jumps, oil marketing companies hope for price hikes at the pump

With crude oil prices scaling the $130/bbl peak before falling back, speculations are rife about upcoming price hikes in petrol and diesel prices in India. Many believe that the four month long pause in fuel price increases were because of state assembly elections.

Petrol and diesel prices haven’t moved up since November 2021 despite the sustained rise in crude oil prices from December. The current petrol price in New Delhi is Rs 95.4/litre and diesel price is Rs 86.67/litre. According to rating agency ICRA, the Indian crude oil basket, which indicates the purchase price of our crude imports, averaged at $114.6/bbl in March 2022 (March 1-7), relative to $93.3 a barrel in February 2022.

Ideally an increaseof $1/bbl in crude oil requires a 50 paise corresponding increase in retail fuel prices. This means that petrol prices should have increased by Rs 17/litre to Rs 112.41/litre.

A recent report stated that OMCs are suffering a marketing loss of Rs 20 per litre with current crude prices, amounting to a Rs 900 crore loss per day. On the face of it, OMCs are free to revise retail fuel prices fortnightly based on the movement in crude oil prices in international markets since 2014.

But more often than not, fuel prices move or don’t move with the political events occurring across India. Interestingly, fuel prices weren’t increased even after the recent state assembly polls got over on Monday. According to a senior government official, the Center is working on options involving reduction in excise duty that might reduce the burden on consumers.

Will OMCs take a considerable hike in prices to protect their marketing margins - the mark-up they charge on fuel costs - in the current environment of spiraling oil prices? Or will the invisible hand of politics push them to keep prices benign?

Weak marketing margins cast a shadow on healthy refining profits in Q3FY22

The benchmark Singapore gross refining margin (GRM) saw a consistent rise to $6/bbl in January, 2022 and then to $7.5/bbl in February, 2022. Higher auto and aviation fuel demand led to a favorable improvement in gasoline, aviation turbine fuel and naphtha cracks in Q3FY22. Crack is the difference the oil refiners earn by converting crude oil into refined petroleum products. Understandably, the gross refining margins of Indian oil marketers also jumped 3X YoY and 2X QoQ to an average of $9.4/bbl in Q3FY22.

Notably, Indian Oil Corp stands to benefit the most amongst other OMCs if the GRMs continue to rise or remain at such high levels. This is because the company is not only the top refiner in India but also controls one-third of India's five-million-barrels-per-day refining capacity. Also, more than 90% of its market sales volumes are met through its own refining output. As of 9 months ended December, 2021; the company derived around 38% of its EBITDA through refining operations.

Interestingly, the OMCs’ sales volumes recovered in double-digits on a sequential basis in Q3 led by healthy demand witnessed for motor spirits. However, high-speed diesel demand continued to lag. If we come to the market sales reported by the OMCs for Q3FY22, they were largely range-bound on an YoY basis.

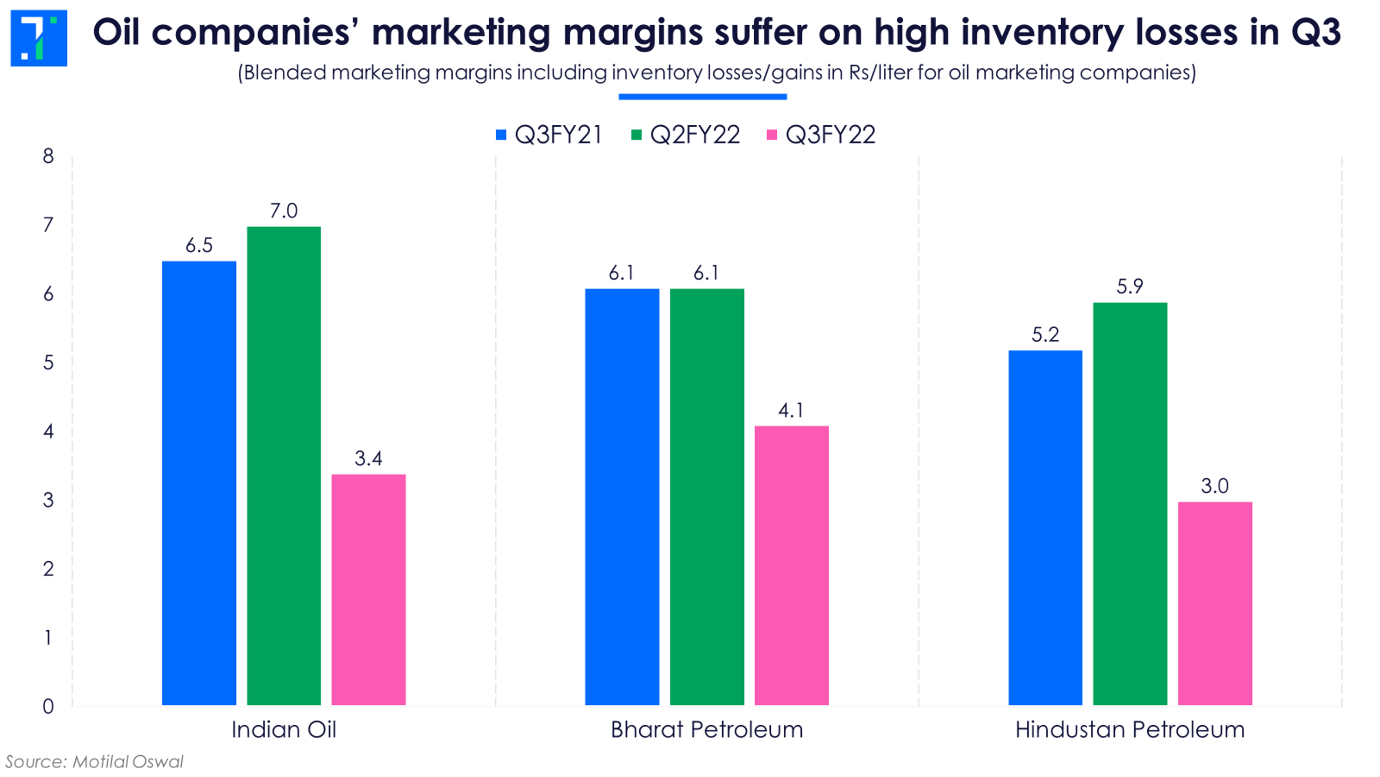

The Centre reduced excise duty on petrol and diesel from November 4, 2022. Hence the OMCs could not pass on the burden of higher excise duties they paid on their fuel inventory outlets to the final consumers. Understandably, Bharat Petroleum (BPCL) and Hindustan Petroleum (HPCL) suffered marketing inventory losses between Rs 1,400 and Rs 1,800 crore in Q3.

Ultimately, weak profits from the marketing segment affected the overall operational performance of OMCs in Q3FY22.

All eyes are now on impending fuel price hikes as crude is boiling

When crude oil prices are on a downward slope, OMCs do not pass on the complete benefit of lower input costs to consumers. This is where they make higher marketing margins. If we talk about the refining segment, profits are generally lower as GRM adjusts to lower crude prices. In such a situation, analysts generally recommend a company like HPCL since it does not rely on its refining output to meet its market sales target.

Currently our situation is the opposite to the example given above i.e. crude oil prices are rising and are at high levels. Hence, OMCs are also witnessing higher input costs which they may not be able to completely pass on. People are already feeling the pinch of high inflation and high fuel prices.

However, higher gross refining margins on improved cracks will soften the impact of lower marketing profits. So, for Q4FY22, performance of OMC might be on the weaker side yet again as the fuel prices at their retail outlets haven't moved in tandem with international crude oil prices in the past four months.

The spike in crude prices is so sharp, it is inevitable that pump prices will rise again. If they do, any material impact on marketing margins of OMCs might be visible only from Q1FY23.

Analysts expect OMCs’ revenues to see a dismal YoY rise of 4% in FY23 on an average. They expect the earnings to fall by nearly 30% YoY on an average in the next fiscal.

Apollo Hospitals leverages its strong network to ramp up its omnichannel digital healthcare services

Apollo Hospitals posted strong Q3FY22 results, despite Q3 being a typically weak quarter for the hospital sector. The company’s revenues and profits continue to grow with the help of multiple growth levers. Apollo Hospital’s major growth project is Apollo HealthCo, which Apollo Hospitals formed in June 2021 to house its front-end and back-end pharmacy businesses, and the high growth digital business branded Apollo 24|7.

Apollo Hospital’s revenue rose 32% YoY to Rs 3,656 crore and net profit rose 75% to Rs 228.4 crore. Revenue growth was driven mainly by the return of elective surgeries and higher average revenue per operating bed (ARPOB). ARPOB increased by 14.8% YoY to Rs 46,062 mainly driven by the better payor (over 75% from self-pay and insurance category) and case mix. Hospitals prefer higher contributions from self-pay and commercial insurance categories as they have higher margins than the government contracts.

Apollo HealthCo is an omnichannel digital healthcare platform, directly competing with API Holdings (PharmEasy), which recently got the regulator’s approval for its Rs 6,250 crore initial public offering (IPO). Both online platforms are new age “healthtech'' companies offering a wide range of healthcare services. Apollo Hospitals, the parent company of Apollo HealthCo, is looking for investors to raise capital for the past two quarters. However, a deal is elusive. With API Holding’s IPO on the cards, Apollo HealthCo might then be benchmarked to its valuation.

Apollo HealthCo posted a higher revenue of Rs 5,000 crore (9M FY22) compared to API Holdings’ Rs 2,335 crore reported in FY21 . But API Holding plans to leverage its higher number of registered users (250 lakhs vs 66 lakh of Apollo HealthCo) to drive revenues.

Apollo Hospitals hopes to improve its operating profit margin through the backward integration of Apollo HealthCo, especially from the e-pharmacy segment. Currently, 41% of Apollo Hospital’s total revenue is derived from the pharmacy segment. Revenue from the combined pharmacy platform business rose 15% YoY in Q3FY22 to Rs 1,661 crore. The customer acquisition cost for the e-pharmacy industry is around Rs 500. However, Apollo HealthCo boasts a customer acquisition cost of Rs 150 helped by the strong network provided by its parent company. While older hospitals continue to boost the operating margins (22%), new hospitals reported lower operating margins of 12.4% in Q3FY22. With Apollo Hospitals’ plan to launch around six new hospitals in the next three years, the operating margin can come under pressure.

The operating profit margin of Apollo Hospitals is on an uptrend from Q4FY20, helped by higher bed occupancies and higher margins from older hospitals. The operating profit margin improved by 190 basis points YoY while bed occupancy increased by 200 basis points to 65% in Q3FY22.

Brokerages like HDFC Securities and ICICI Securities have a positive outlook on the company as they expect it to announce strategic funding partnerships for Apollo HealthCo and in turn, drive revenue growth. The company’s management plans to raise the capital by the end of FY22. The delaying of this deal, coupled with the aggressive expansion of API holdings, can become a roadblock for Apollo Hospitals to gain market share through its omnichannel healthcare platform.

Screener: Stocks which are outperforming their industry, with strong durability and momentum scores

Markets tumbled this month as Russia waged a war on Ukraine. The Nifty 50 and Nifty Midcap 100 indices fell 6% and 7.5%, respectively. However, the Nifty Metal gained (2%) over the past week-and-a-half.

This screener (subscriber access) shows 13 Nifty500 stocks with PE TTM lower than their industry, which are outperforming their industry in one year returns. These stocks are consistent performers with decent topline and bottom-line growth in Q3FY22.

Among the 13 companies, Narayana Hrudalaya is the only healthcare company. Pharma company Laurus Labs has also made the list.

Metal stocks like Tata Steel, among others, are gaining on analysts' expectations of upcoming export opportunities for the entire metal industry in US and European markets.On a surprising note, fertilizer stocks like Gujarat State Fertilizer & Chemicals also came up in this screener, despite crude oil prices rising.

You can find popular screenershere.