By Divyansh Pokharna

Bears stayed in control of markets for the fourth straight week, with the Nifty 50 slipping 0.5%. The broader market saw heavier pressure due to weak June quarter earnings, global uncertainty, and persistent selling by foreign investors.

India signed a major Free Trade Agreement with the UK on July 24, which will eliminate tariffs on most Indian exports and gradually reduce duties on British imports like vehicles and whisky. Ajay Srivastava, Founder of the Global Trade Research Initiative, called it "a policy shift, especially as India has long used high tariffs to protect domestic manufacturers.”

Global trade will remain in focus this week, with August 1 set as the deadline for countries to finalise trade deals with the US. President Trump has warned of steep tariff hikes if agreements aren’t reached. Hopes of a mini trade deal with India are fading, with tariffs likely to rise to 26%. A US delegation is reportedly expected to visit India later in August to continue talks.

The IPO market this week is set to be the busiest in a long time. A total of 14 public issues are lined up, including five mainboard IPOs. Ten companies are also set to make their market debut, while three were listed last week. Together, these IPOs aim to raise over Rs 7,300 crore, with Rs 7,008 crore coming from the mainboard offerings.

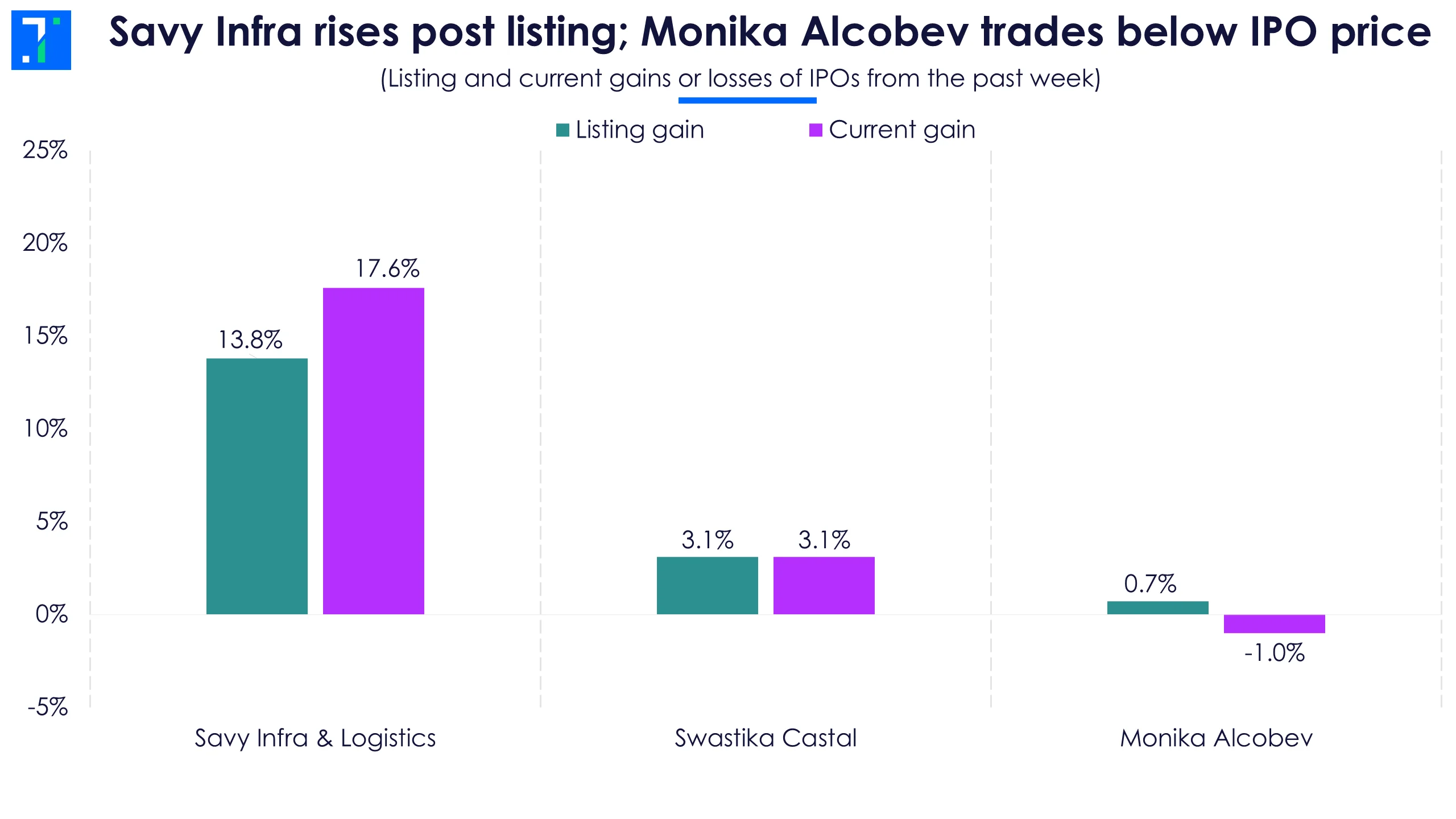

Five new debuts over the past week, two from the mainboard

Savy Infra & Logistics, a construction & engineering firm, listed on July 28 at a 13.8% premium over its issue price of Rs 120. The IPO saw strong demand, with HNIs subscribing 261.6X and retail investors 121.7X. The stock is now trading 17.6% higher.

Savy Infra rises post listing; Monika Alcobev trades below IPO price

Swastika Castal, a forging company, also listed on July 28 with a 3.1% gain after a 4.9X IPO subscription. The stock is currently trading flat at the same level.

Monika Alcobev, a premium liquor importer and distributor, opened with a 0.7% gain and is currently trading 1% below its issue price after receiving a 3.8X subscription.

IPO pipeline swells: 14 issues set to open this week

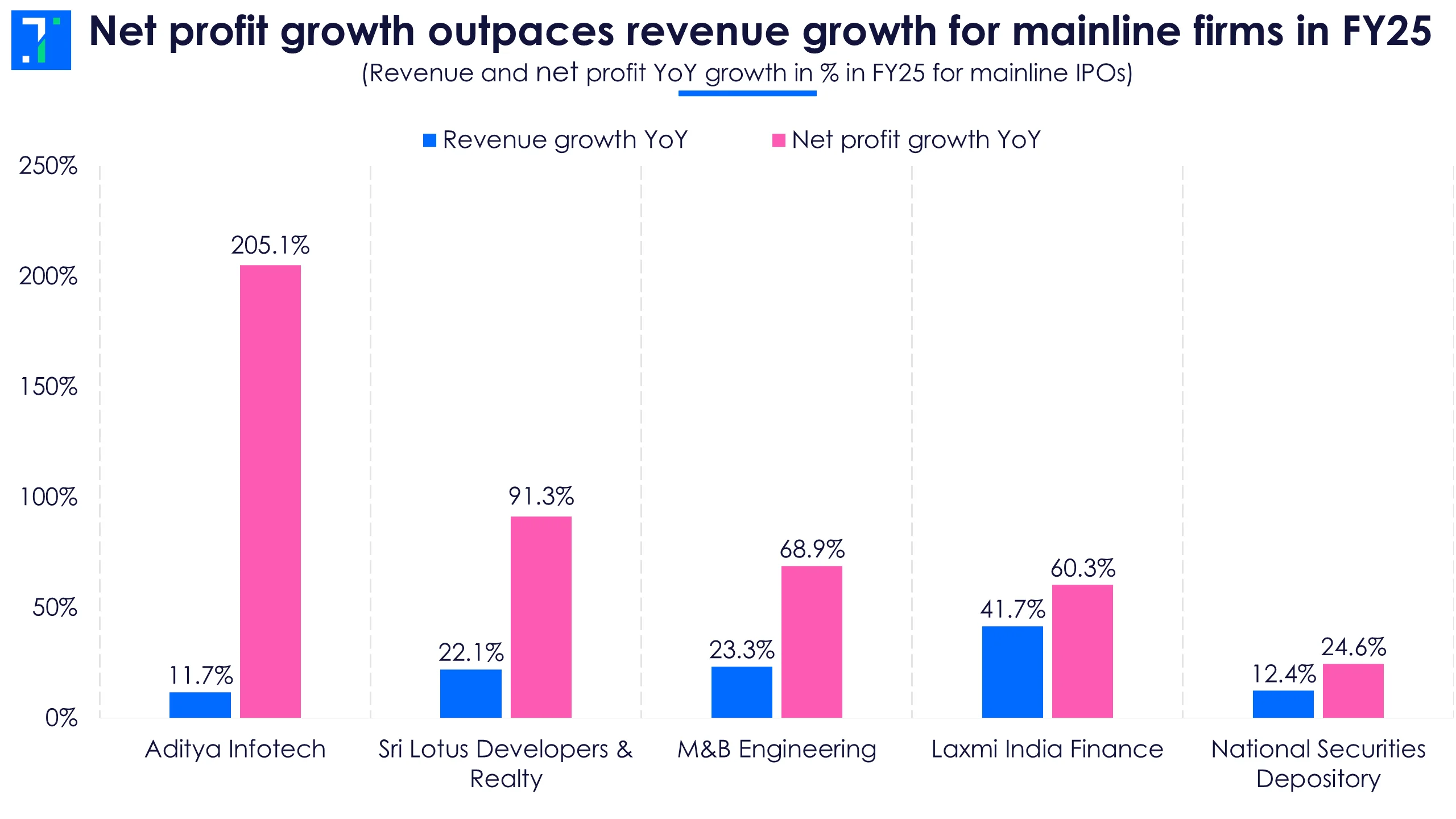

Two IPOs, Laxmi India Finance and Aditya Infotech, are scheduled to open for bidding on July 29. They will close on July 31 and are set to list on August 5.

Laxmi India Finance is launching its Rs 254.3 crore IPO, with Rs 165.2 crore as a fresh issue and the rest as an offer for sale (OFS). This NBFC provides loans to MSMEs, vehicle loans, construction loans, and other lending products, supporting small businesses and entrepreneurs. The company plans to use the proceeds to strengthen its capital base for future lending needs. The price band for the IPO is set at Rs 150 to Rs 158.

Aditya Infotech, an IT networking equipment maker, manufactures and supplies video security and surveillance products, solutions, and services under the brand name 'CP Plus'. It is launching a Rs 1,300 crore IPO, which includes a fresh issue of Rs 500 crore and the rest as an OFS. The proceeds will be used to repay or prepay certain borrowings. The price band is set at Rs 640 to Rs 675.

Net profit growth outpaces revenue growth for mainline firms in FY25

National Securities Depository (NSDL), Sri Lotus Developers & Realty, and M&B Engineering are scheduled to open their IPOs for subscription on July 30. The issues will close on August 1 and list on the bourses on August 6. NSDL is the largest among them.

NSDL, a SEBI-registered market infrastructure institution, acts as a securities depository in India. It maintains electronic records of allotment and ownership transfer of securities and offers services like dematerialisation and trade settlement. The company is raising Rs 4,011 crore through a complete OFS, with promoters including NSE, HDFC Bank, and SBI offloading stakes. The price band is set at Rs 760 to Rs 800.

Sri Lotus Developers & Realty is launching a Rs 792 crore IPO through a completely fresh issue at a price band of Rs 140 to Rs 150. The Mumbai-based real estate company focuses on residential and commercial redevelopment projects. It plans to use the proceeds to invest in its subsidiaries and partly fund the construction cost of ongoing projects.

M&B Engineering, a steel products manufacturer, is engaged in the business of Pre-Engineered Buildings and Self-Supported Roofing solutions. It manufactures and installs self-supported steel roofing systems. The company is launching a Rs 650 crore IPO, which includes a fresh issue of Rs 275 crore and the rest as an offer for sale. The price band is set at Rs 366 to Rs 385.

Nine SME IPOs to open for bidding this week:

- Repono and Umiya Mobile opened for subscription on July 28 and will close on July 30. Both are set to list on the BSE SME on August 4. Repono is raising Rs 26.7 crore, while Umiya is raising Rs 24.9 crore.

- Kaytex Fabrics, a textile company, is aiming to raise Rs 54.1 crore, largely through an offer for sale. Its IPO opens on July 29, closes on July 31 and will list on NSE SME on August 4.

- B.D. Industries, Mehul Colours, and Takyon Networks are set to open on July 30, close on August 1 and list on August 3. B.D. Industries is raising Rs 45.4 crore, while Mehul Colours and Takyon Networks are each targeting around Rs 20 crore.

- Cash Ur Drive Marketing and Renol Polychem will open for bidding on July 31 and close on August 4, with listing on NSE SME on August 7. Cash Ur Drive is looking to raise Rs 60.8 crore and Renol aims to collect Rs 25.8 crore.

- Flysbs Aviation, which provides private jet services, is scheduled to open its IPO on August 1, close on August 5 and list on August 8.

Ten new listings lined up this week on the bourses

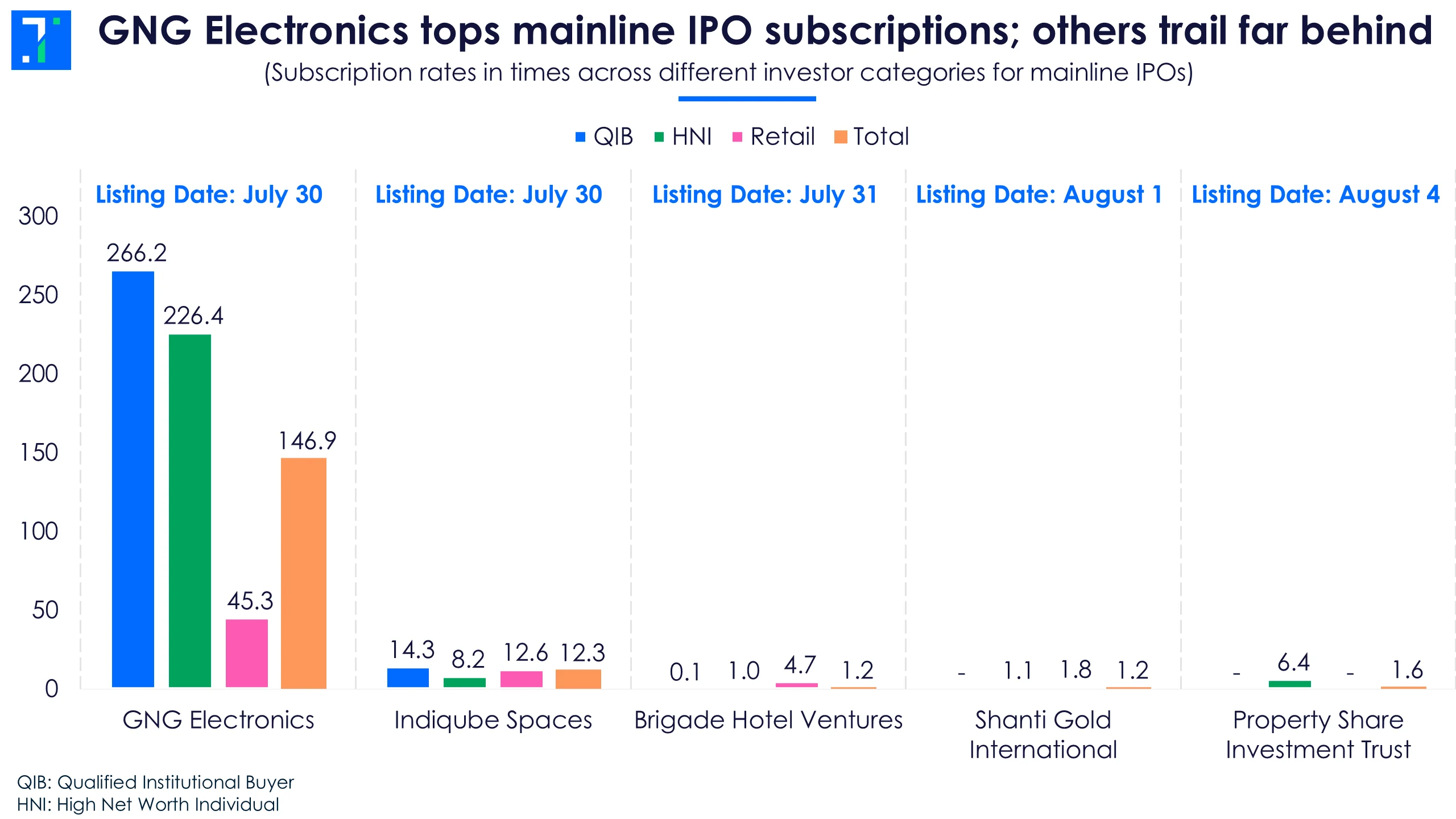

GNG Electronics leads in subscription bids with 137.8X oversubscription, driven by 242.4X subscription from QIBs and 221.5X from HNIs. The computer hardware firm, which refurbishes laptops, desktops and ICT devices in India and abroad, is set to list on July 30.

Indiqube Spaces saw a 9.3X subscription. The company provides plug-and-play office spaces and workspace services to businesses. It will also list on July 30. In FY25, it posted a net loss of Rs 139.6 crore, down from Rs 341 crore in FY24.

GNG Electronics tops mainline IPO subscriptions; others trail far behind

Brigade Hotel Ventures saw a moderate 1.1X subscription by day 2. The company, which develops and operates hotels in key South Indian cities, will close its IPO on July 28 and list on July 31.

Shanti Gold International, which makes 22 karat casting gold jewellery, recorded 1.1X subscription on day one. The IPO closes on July 29 and lists on August 1.

Property Share Investment Trust saw 5.9X HNI participation, with no bids from QIBs. The IPO was not reserved for retail investors. The issue is priced between Rs 10 lakh and Rs 10.06 lakh per share, with listing scheduled for August 4.

The high issue price reflects that each unit offers a share in a large, rent-earning commercial property. The investors expect a 9% annual yield from rental income, distributed like dividends.

Additionally, five SME IPOs are scheduled to list this week.

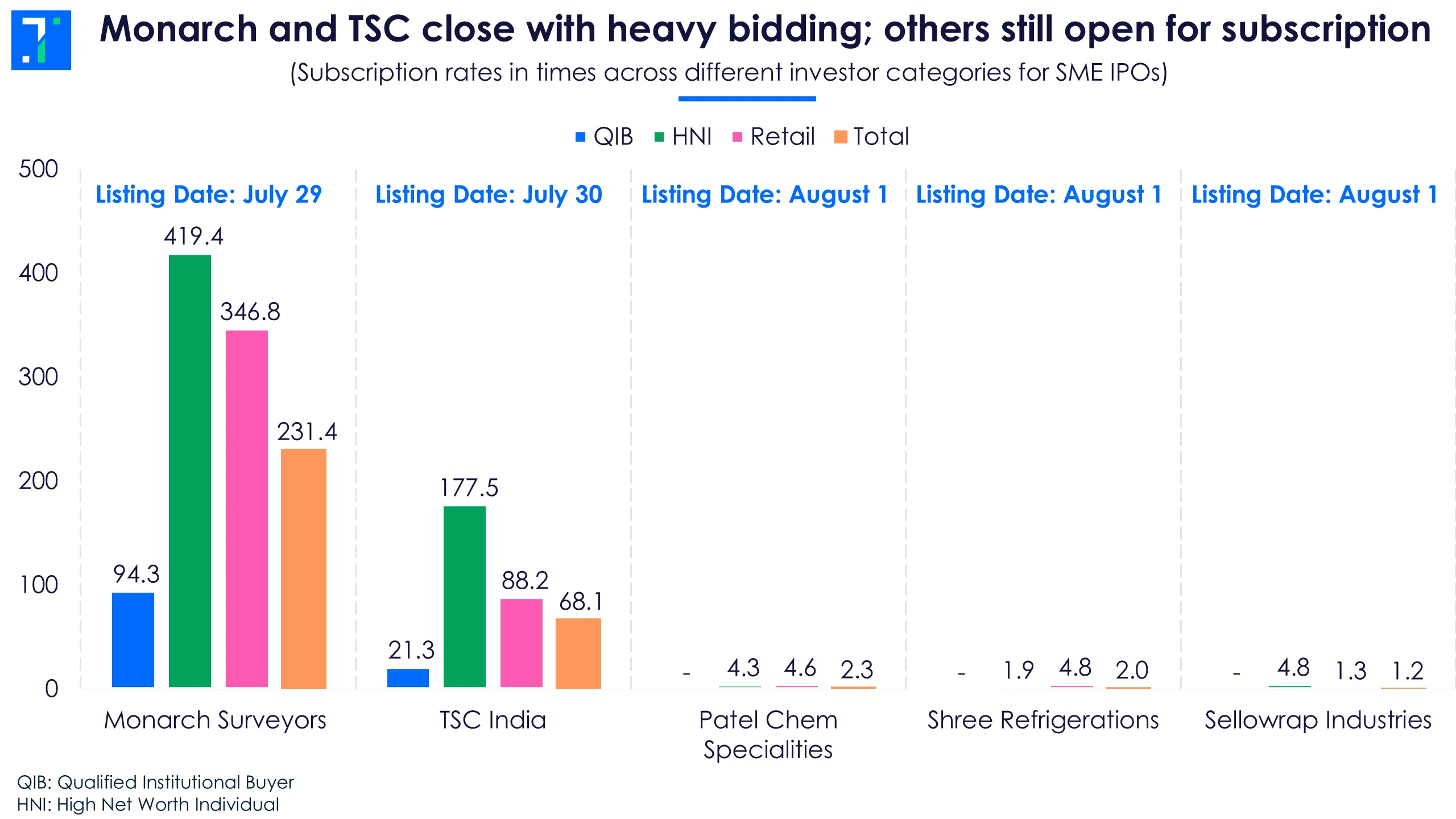

Monarch and TSC close with heavy bidding; others still open for subscription

Monarch Surveyors & Engineering Consultants will debut on July 29 on the BSE SME platform after being subscribed 231.4X, with HNIs bidding over 400X.

TSC India, subscribed 68X, is scheduled to list on July 30 on NSE SME.

Three more SME IPOs—Patel Chem Specialities, Sellowrap Industries, and Shree Refrigerations—will close bidding on July 29 and list on August 1. All three saw moderate demand across categories.