The Nifty 50 was running in sand this past week. It touched a one-year high of 26,246.7 but then slid back, and struggled to stay above the psychological 26,000 mark. After the high, the index slipped for three straight sessions, a clear reminder that volatility still has the upper hand.

Meanwhile, the Indian rupee hit a fresh all-time low against the dollar last Friday. Fading hopes of a US Fed rate cut and slow progress on the India–US trade deal have kept up the pressure on the rupee.

Naveen Mathur, Director of Commodities and Currencies at Anand Rathi, noted: “Combined global and domestic cues created negative sentiment, leading to the sharp fall we saw on Friday. The RBI will definitely intervene. I don’t see the rupee breaching 90 against the dollar.”

Overall, the last few months of 2025 have felt like a pause, as we wait for action that doesn’t happen. The lack of momentum has kept the Nifty 50 shy of new highs.

So where do valuations stand? And how have the major indices actually performed through this complicated year? Are markets finally becoming more reasonable, or quietly turning more expensive?

Let’s dive in.

Midcap momentum: Index stands out, beats Nifty 50 and Smallcap

After a turbulent year following the Nifty 50’s all-time high last September, confidence is slowly returning. On November 10, Goldman Sachs turned bullish on India again, upgrading the country to “overweight” just 13 months after its downgrade. The firm is now forecasting the Nifty 50 to reach 29,000 by December 2026.

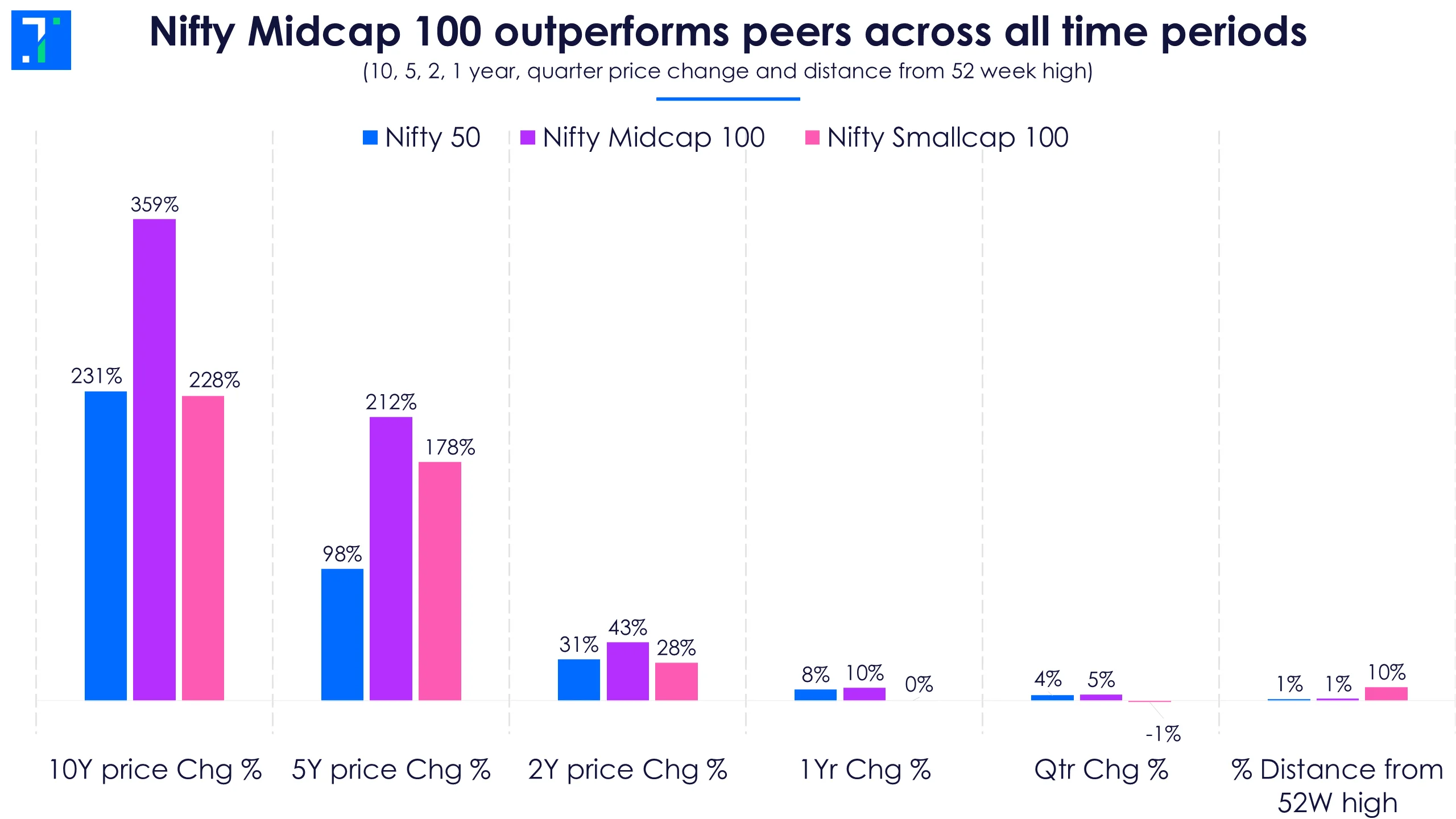

Across long time frames, all three major indices — Nifty 50, Nifty Midcap 100 and Nifty Smallcap 100 — have posted gains. But one index has clearly set the pace: the Nifty Midcap 100, which has consistently outperformed both large and small-cap peers.

The Midcap 100’s 5-year return is now more than double that of the Nifty 50.

Earlier this year, midcap valuations looked stretched, but that picture has changed. Today, the Midcap 100 offers the holy grail combination: strong performance and more reasonable valuations.

Are we in a 'buy zone'?: Earnings catch up among midcaps

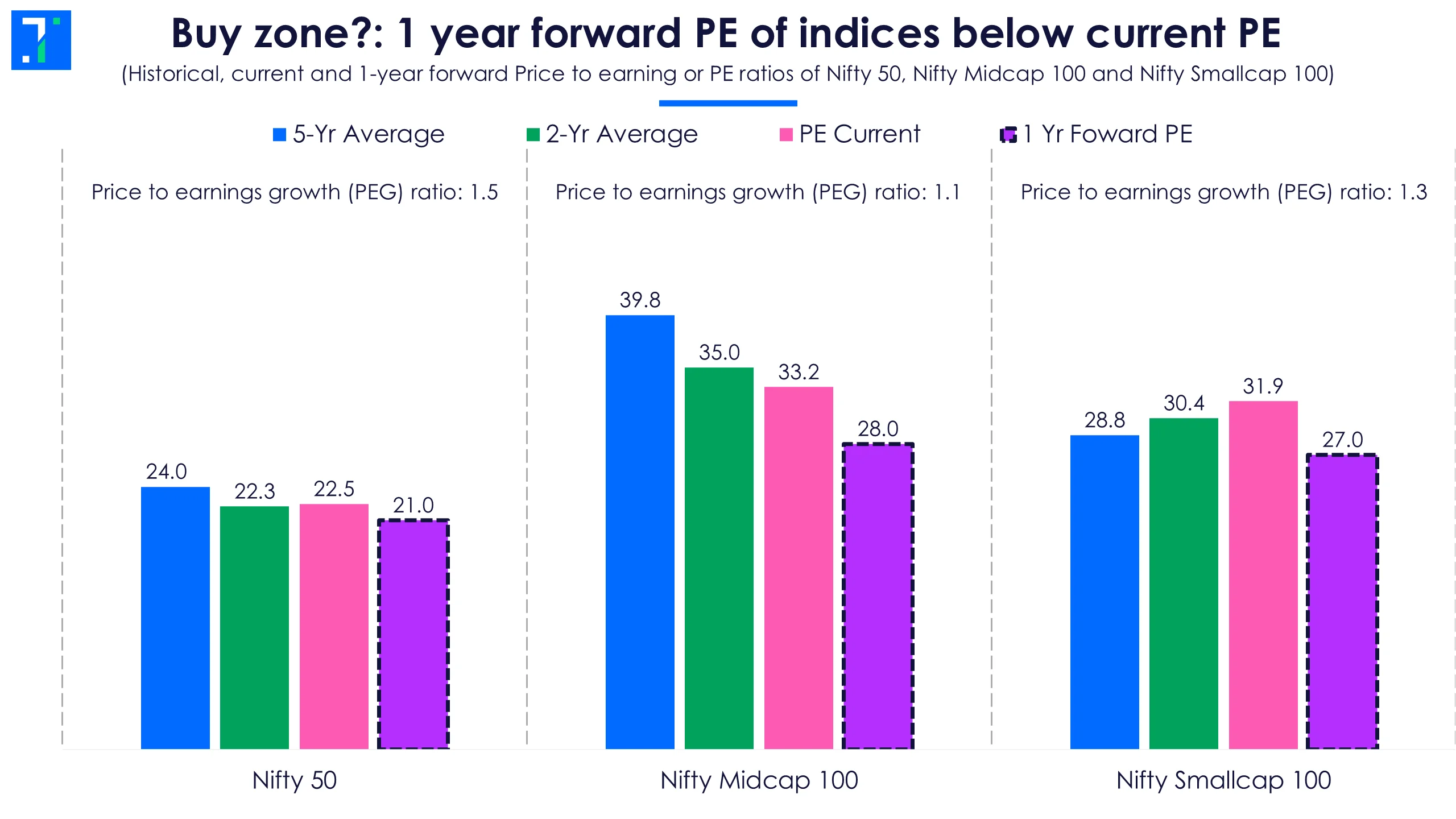

Midcaps have long commanded a valuation premium, thanks to their growth potential. At a PE of 33.6, the Nifty Midcap 100 is the most expensive of the three major indices, but the premium has narrowed. Its PE has dropped 19% over the past year as earnings have finally caught up.

A big driver has been strong quarterly results from companies such as Hindustan Petroleum, Biocon, Suzlon Energy and ACC, all of which delivered solid profit growth, pulling valuations back to earth.

In contrast, the Nifty 50 and Nifty Smallcap 100 were held back by softer earnings performance, and have not seen big moves in their PE ratios.

Growth momentum also favours midcaps. In Q2FY26, midcap companies reported 9.6% YoY revenue growth, outpacing both the Nifty 50’s 5% and the Smallcap 100’s 7.2%.

All three indices currently trade below their 1-year forward PEs, but once again, midcaps stand apart. The Nifty Midcap 100 is trading below its forward PE, and also below its long-term historical averages, offering investors growth and relative valuation comfort.

It also boasts the lowest PEG ratio, making its valuations look even more attractive once expected earnings growth is factored in.

The Nifty 50 continues to offer a low PE, but it sits close to its historical averages, leaving limited valuation upside. Meanwhile, the Smallcap 100 is expected to see a sharp PE correction next year as earnings growth is set to pick up—but that improvement is still ahead.

Standing alone: Only one multibagger this year

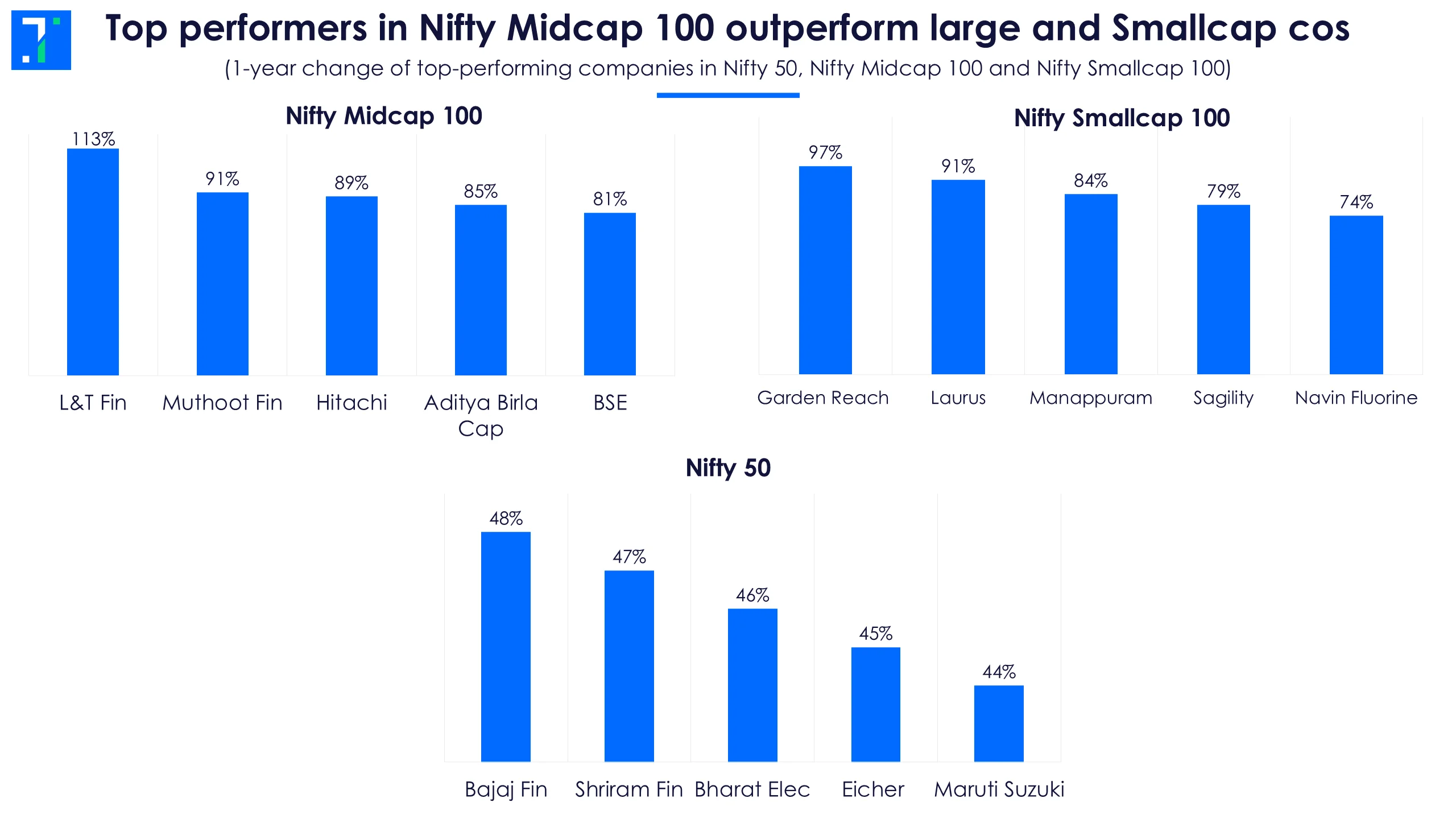

Across all three indices, only one stock has delivered triple digit returns in the past year: L&T Finance from the Nifty Midcap 100. That’s how selective and choppy this market has been.

Bajaj Finance, on the other hand, is on track to become the Nifty 50’s top performer for 2025, adding to its history of standout years (it was the index’s best performer for three consecutive years from 2017 to 2019).

A clear theme emerges: the banking and finance sector continues to dominate, making up 7 of the 15 top performers across indices.

Another interesting factor is the churn. Since we looked at the top performers earlier in February, only three names have managed to hold on to their spots today — BSE in the Midcap index, Garden Reach Shipbuilders in the Smallcap index, and Bajaj Finance in the Nifty 50. The leaders have changed rapidly in a volatile year like 2025.

The laggards of 2025

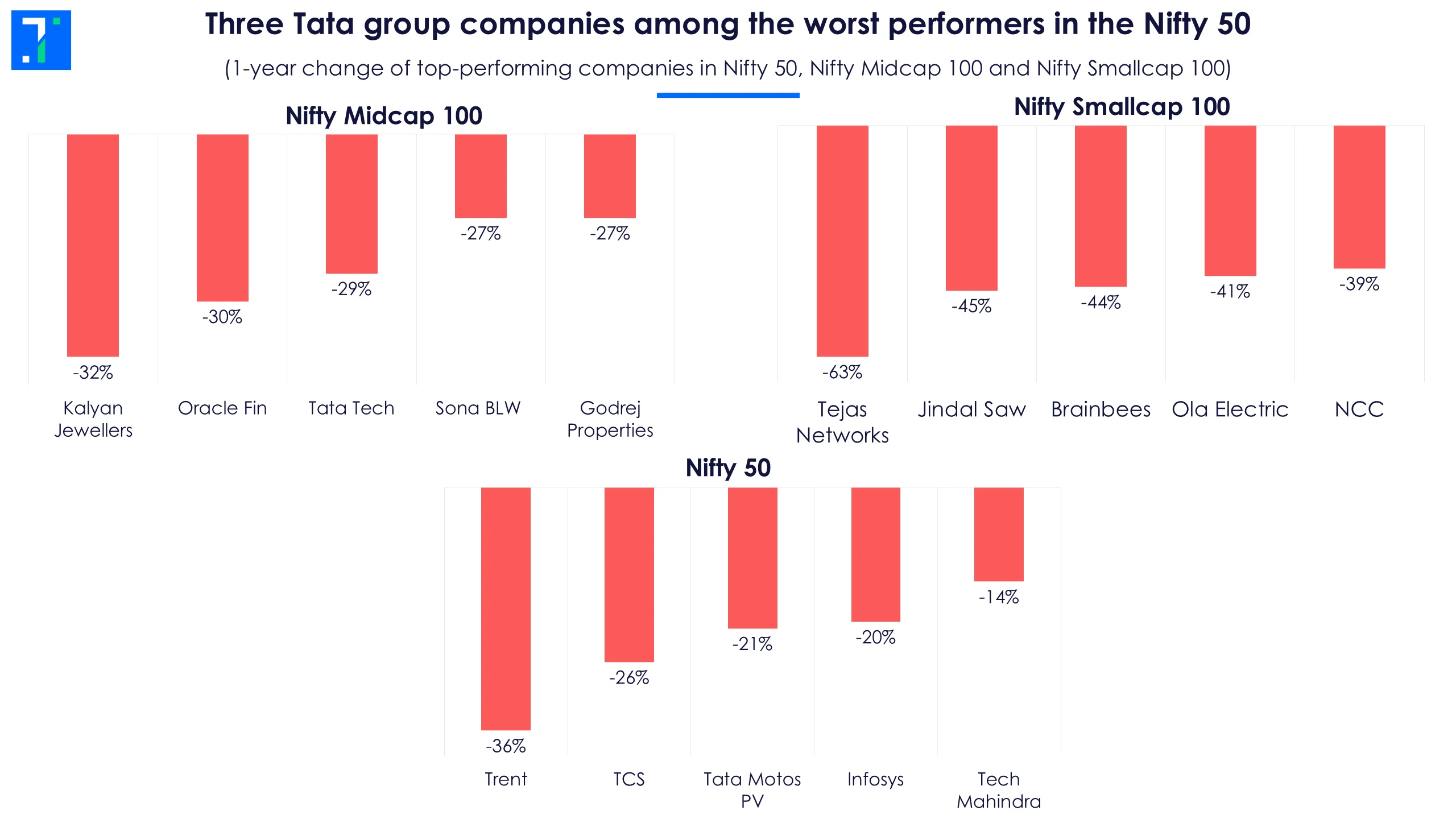

While some stocks raced ahead, others struggled. Tata Group companies, in particular, have had a tough run, with three names among the worst performers in the Nifty 50. After two years of exceptional gains, Trent has dropped more than 35% in the past year, while Tata Motors PV, TCS, Tejas Networks and Tata Technologies have also fallen.

The broader software and services space has been weak as well, with three of the five worst-performing sectors in the Nifty 50 in this space.

Still, sentiment around Indian equities has been warming again. HSBC now sees India as a natural hedge for investors rebalancing away from AI-heavy portfolios. After underperforming Asia over the past twelve months, the worst may finally be over for Indian markets.

Motilal Oswal is similarly upbeat, especially on midcap companies, citing strong earnings momentum and improving valuation trends.

There are some ifs. If earnings continue to surprise on the upside, the Central Bank pushes rate cuts, FIIs return with conviction, and India–US trade negotiations make further progress, then Indian markets could be setting up for their next big sprint.

Signing off this week,

The Trendlyne Team