Just when you thought it was safe to check your portfolio, Donald Trump reclaimed his title as the market’s main character.

It was a week of drama. On Friday, his tariff threat against China tanked the markets; by Monday, a breezy assurance of “All will be fine” sent them rallying back. All this played out in the wake of the Nobel Peace Prize announcement, an award everyone except Trump knew he wouldn't win.

Volatility rules in 2025. Fear gauges like Nifty VIX are surging, and the earnings season promises more twists.

On the upside, our Diwali discounts are live, giving you access to a subscription that helps you improve your portfolio returns even in a moody market.

The real challenge now isn't predicting Trump's next tweet, but finding companies that are seeing momentum and likely to post strong results. Let's dig them out.

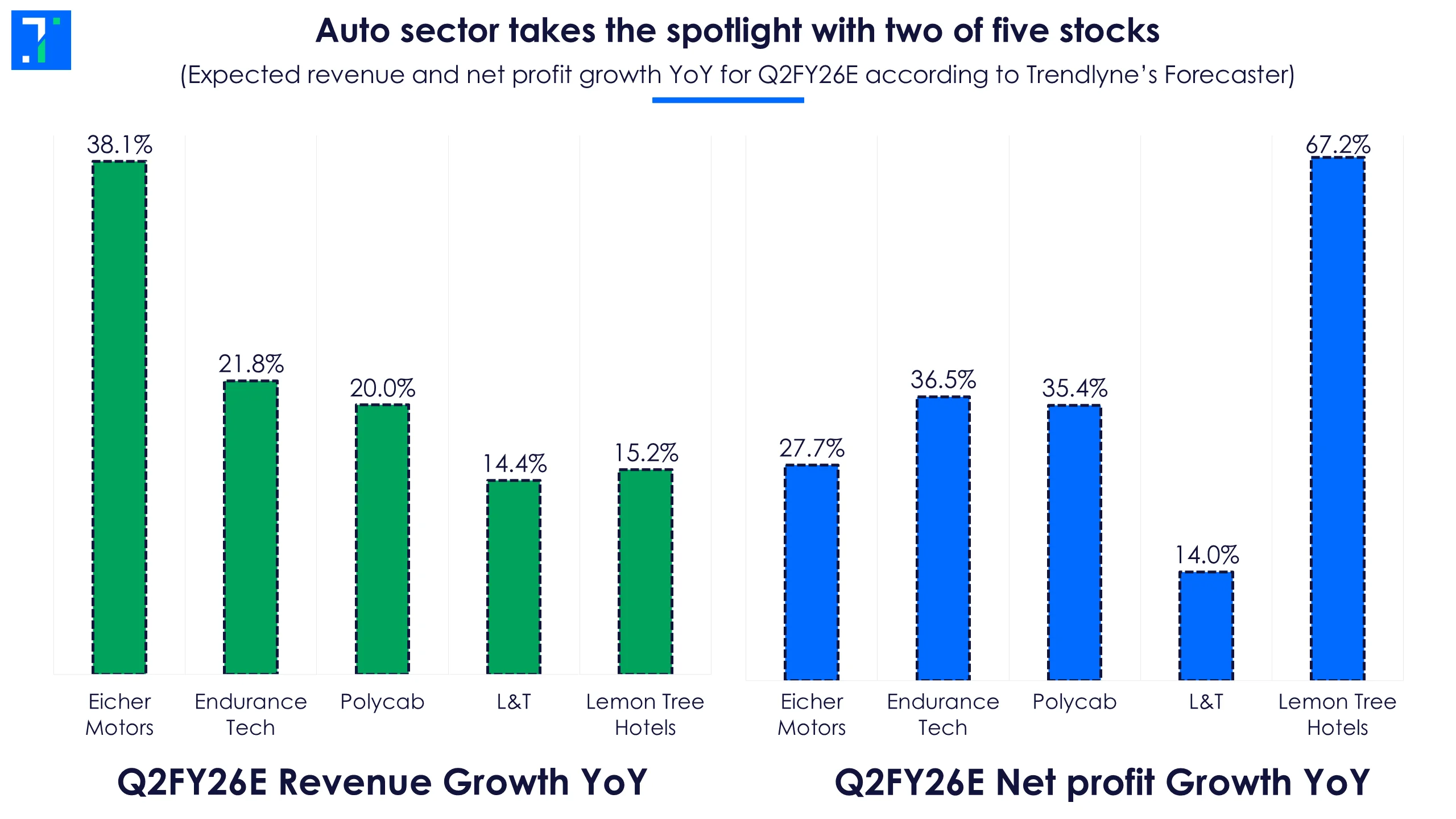

Potential winners from analysts: Five stocks expected to shine in Q2FY26

As we kick off the Q2FY26 results, we shortlist five stocks from the Nifty 500 that are expected to post high revenue and net profit growth, according to Trendlyne’s Forecaster.

These companies have already set the bar high with strong results in Q1FY26.

Auto sector takes the spotlight with two of five stocks

The spotlight is on the auto sector, with two of the five stocks—Eicher Motors and Endurance Tech — leading the charge. Other stocks include the wires biz Polycab, infra bigwig Larsen & Toubro, and the hotels company Lemon Tree Hotels.

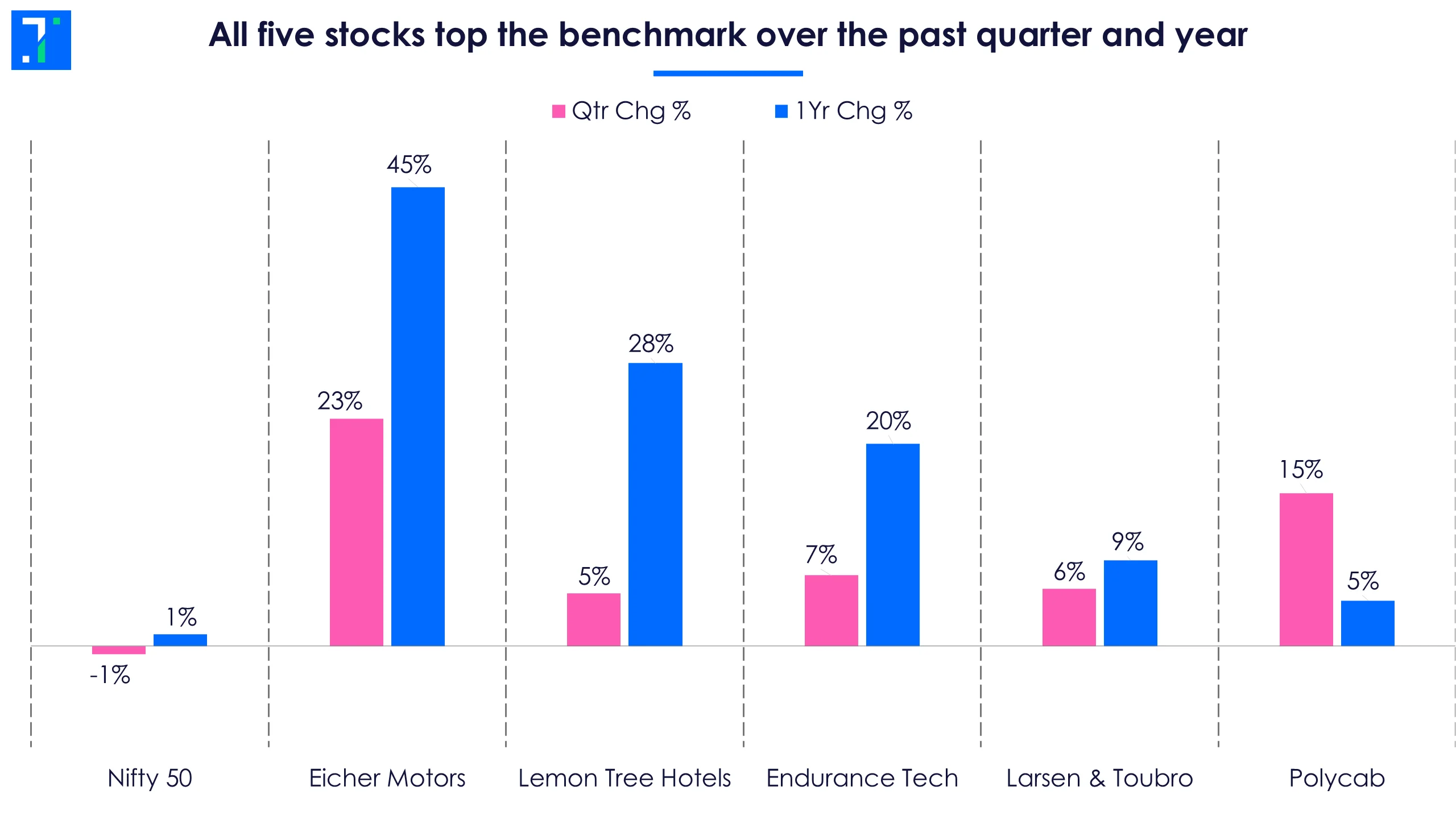

All five stocks have outpaced the Nifty 50 over the past quarter and year.

All five stocks top the benchmark over the past quarter and year

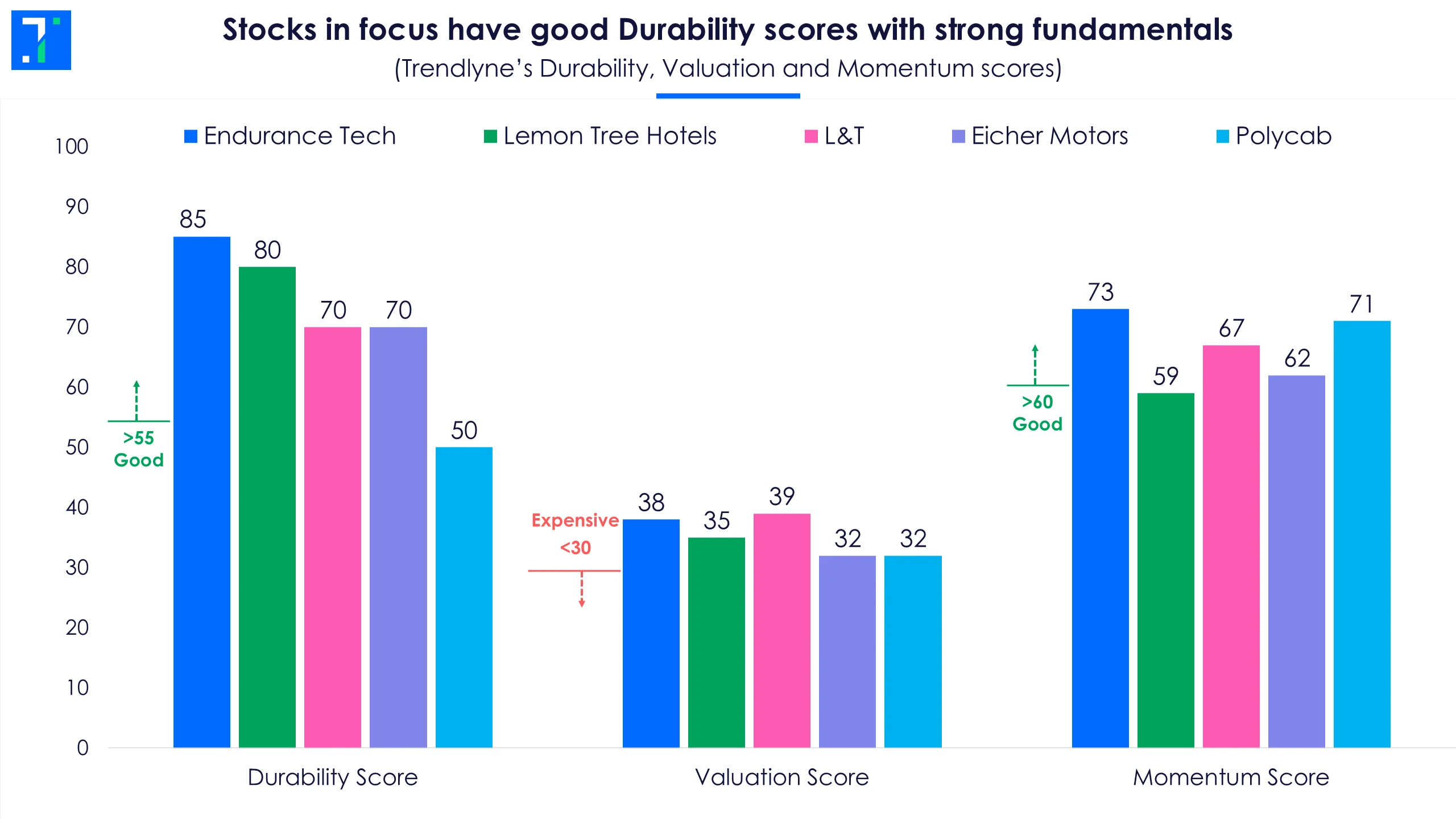

The stocks in focus have either ‘Good’ or ‘Medium’ scores across the Durability, Valuation, and Momentum categories. Endurance Tech stands out here with high Durability and Momentum scores, with a DVM classification of ‘Strong Performer, Getting Expensive’.

Stocks in focus have good Durability scores with strong fundamentals

Consumption-focused sectors like auto, consumer durables and hotels are expected to see strong results on the back of GST cuts. Rising disposable incomes and festive season tailwinds are fuelling growth. Meanwhile, infra companies like L&T are riding the wave of higher government spending on infra projects, an renewable energy spends.

Endurance Technologies pumps the accelerator on global EV growth

Endurance Technologies, a major auto components player in India and Europe, supplies aluminium castings, suspensions, transmissions, braking systems, and battery systems.

Its revenue driver is India’s two and three-wheeler segments, boosted by new model launches. A rising focus on EV components, combined with the upcoming ABS mandate for two-wheelers, effective from January 2026, is expected to drive growth.

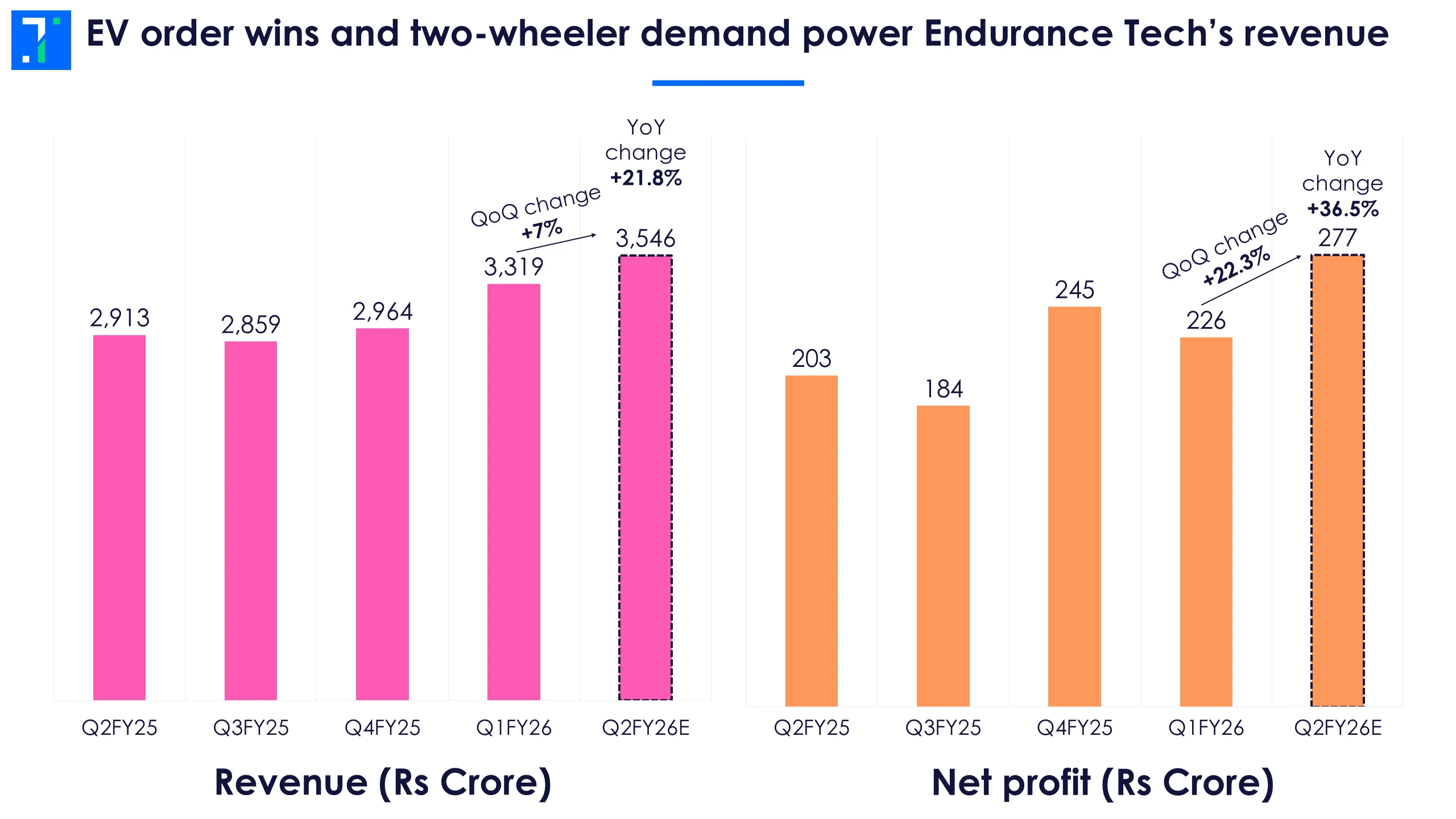

EV order wins and two-wheeler demand power Endurance Tech’s revenue

The company has a significant presence in Europe, which now contributes 30% of its revenue. Q1FY26 Europe sales rose 28.5% despite a weak market, driven by the Stöferle acquisition, robust new orders, and electric and hybrid vehicle component sales.

Tariffs remain a challenge for exports. On Europe’s outlook, Massimo Venuti, CEO of Endurance Overseas, said, “In this moment, it is very difficult to predict the next 18 months. Spain is the only market growing in double digits because of government incentives. Everybody in Germany, France, and Italy is waiting for this incentive, which would be a growth booster.”

Larsen & Toubro rides the wave on strong global orders

Larsen & Toubro (L&T), India's engineering and infrastructure giant, reported strong revenue growth in Q1FY26, driven by solid execution across key sectors including Hydrocarbon, Precision Engineering, and Heavy Engineering. International revenues now make up a big portion of total revenue, highlighting L&T's expanding global footprint.

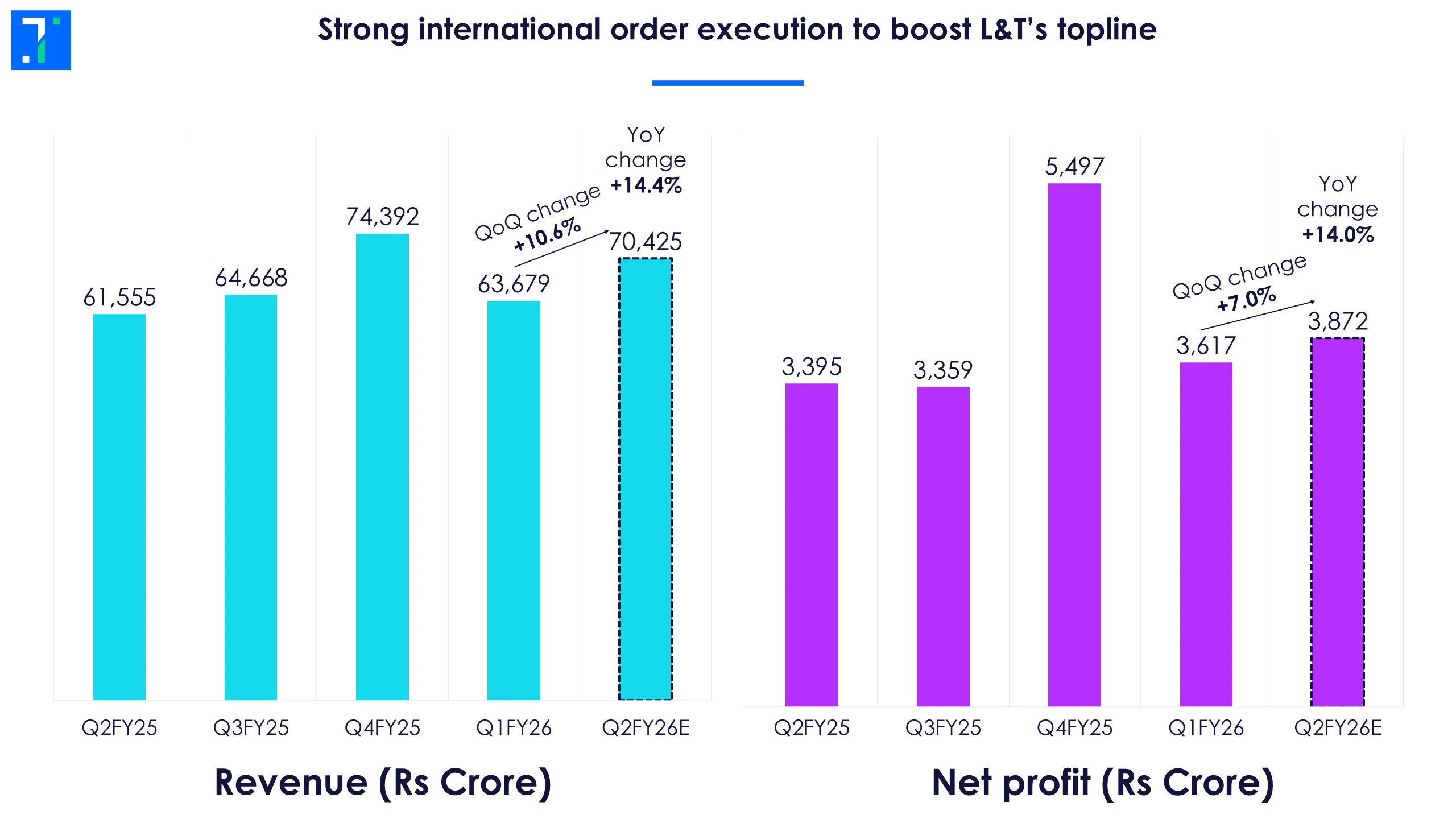

Strong international order execution to boost L&T’s topline

The company recently won a landmark 'ultra-mega' order (Rs 15,000 crore) for the development of a Natural Gas Liquids (NGL) plant and associated infrastructure in the Middle East.

Analysts expect revenue and profit to grow YoY and QoQ in Q2FY26, driven by execution in the international order book.

Lemon Tree Hotels makes lemonade from rising travel demand

Strong demand from corporate and leisure travel is set to boost Lemon Tree Hotels’ Q2 revenue, driven by new properties, higher occupancy, and rising average room rates.

Recent additions, including Lemon Tree Suites in Nashik, a 135-room property in Maharashtra, Lemon Tree Premier in Surat, and Keys Lite in Kharar, are expected to boost the company’s presence and revenue in the coming quarters.

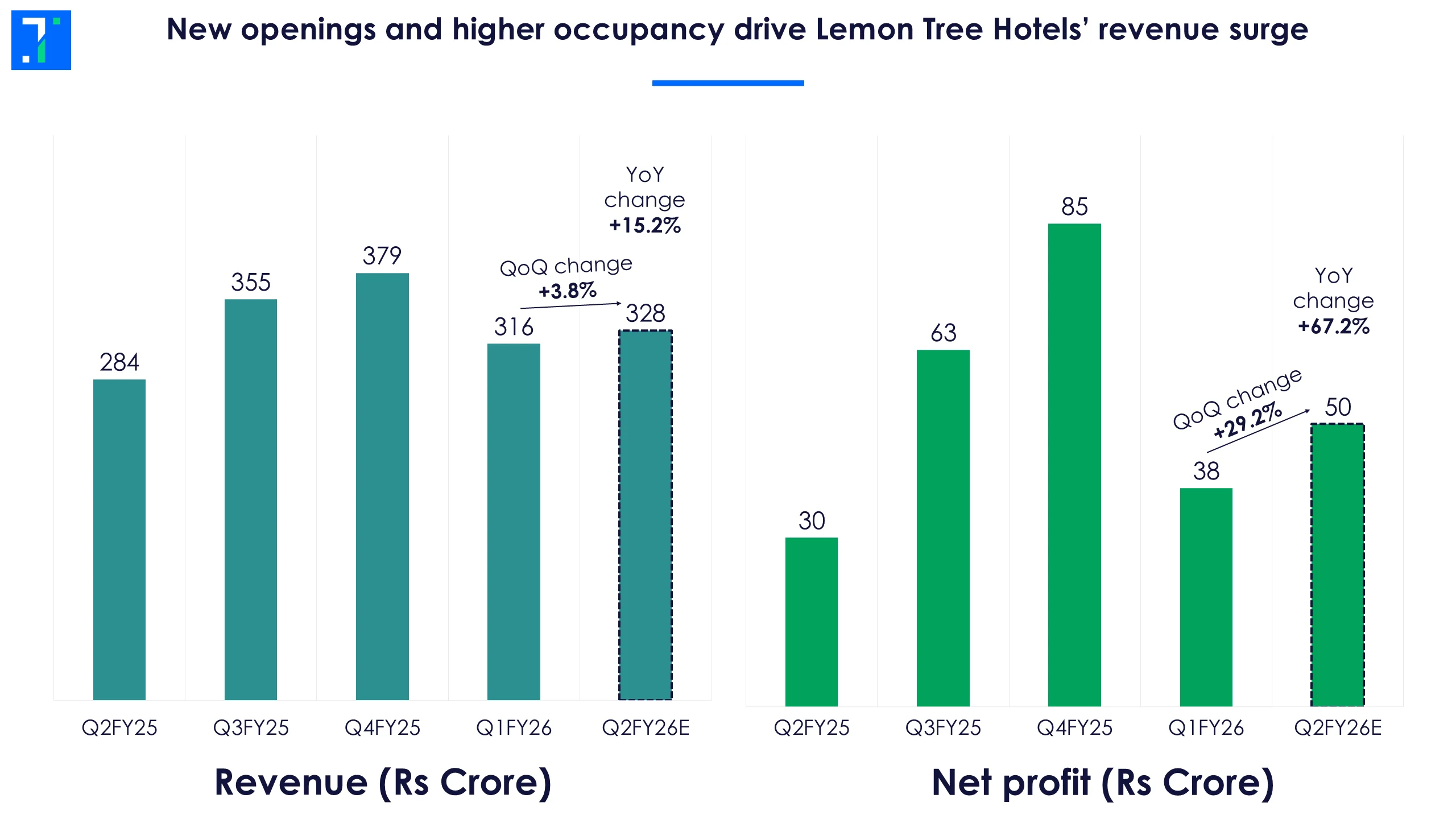

New openings and higher occupancy drive Lemon Tree Hotels’ revenue surge

Average revenue per available room (RevPAR) rose 19.4% YoY in Q1, while occupancy improved six percentage points to 72.5%.

On expanding into villas and the alternate luxury segment, Patanjali G. Keswani, MD, said, “We are in the mid-market. We want to focus on the 2.5-star to 4.5-star segment. That means mid-scale, upper mid-scale, and upscale. The opportunity in India is so big that we do not want to dabble in other areas or pivot our business model.”

Eicher Motors shifts gears with pricing and GST boost

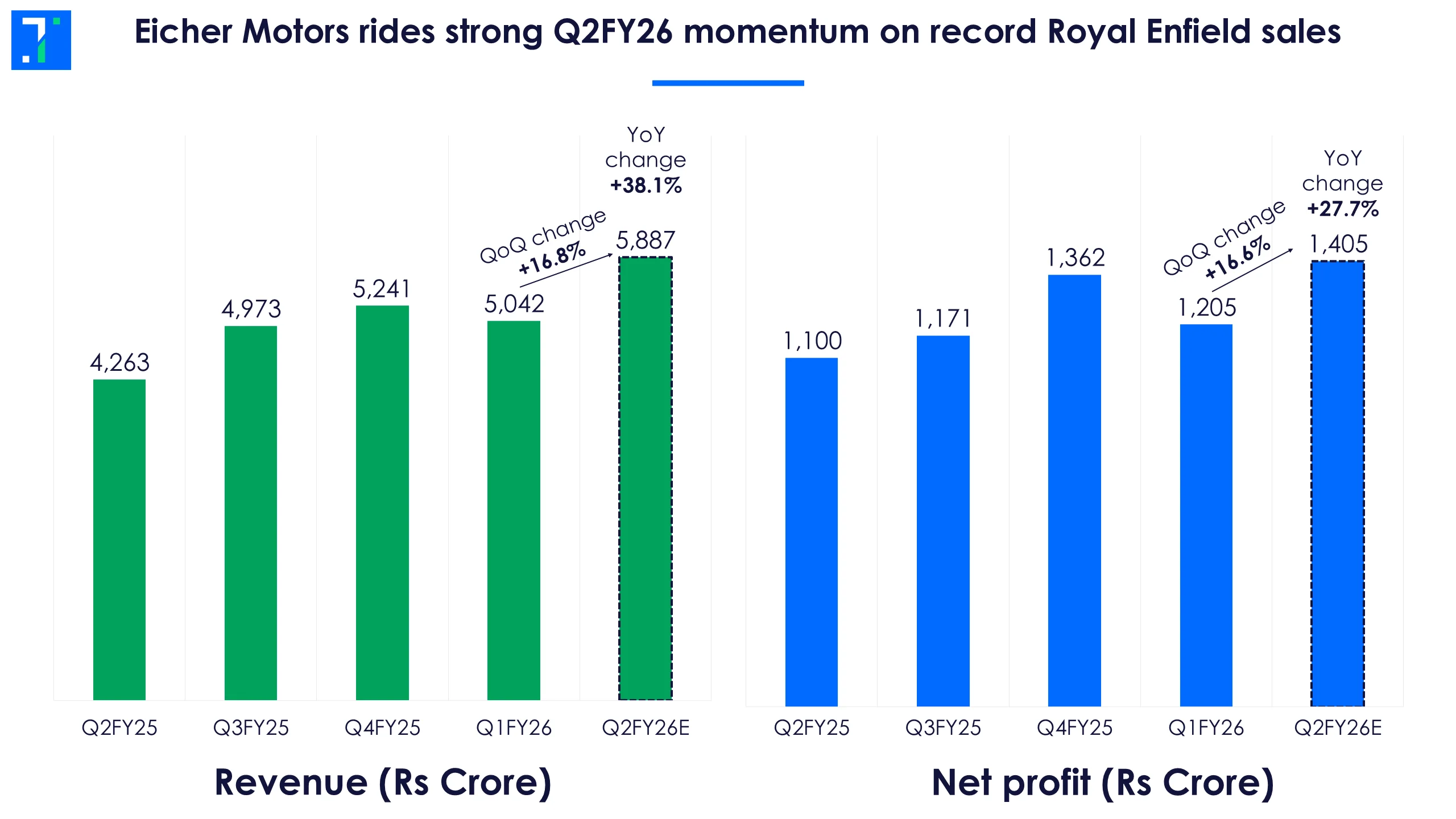

Eicher Motors enters Q2FY26 on strong momentum, driven by record-breaking sales and strategic pricing. In September 2025, Royal Enfield posted its highest-ever monthly sales, delivering 1,24,328 motorcycles—a 43% year-on-year rise—boosted by the GST cut on bikes up to 350cc, which lowered taxes from 28% to 18% and spurred demand.

Eicher Motors rides strong Q2FY26 momentum on record Royal Enfield sales

However, premium motorcycles above 350cc, including the Himalayan and 650cc models, now attract a 40% GST, raising costs for buyers. Strategic pricing and promotional offers are helping sustain demand in this segment.

Speaking about the GST increase for >350cc motorcycles, Eicher Motors Executive Chairman Siddhartha Lal, said, "Lowering GST for less than 350cc will help broaden access, but raising GST for over 350cc would damage a segment vital to India's global edge”.

Polycab India: Charging ahead on renewables and export demand

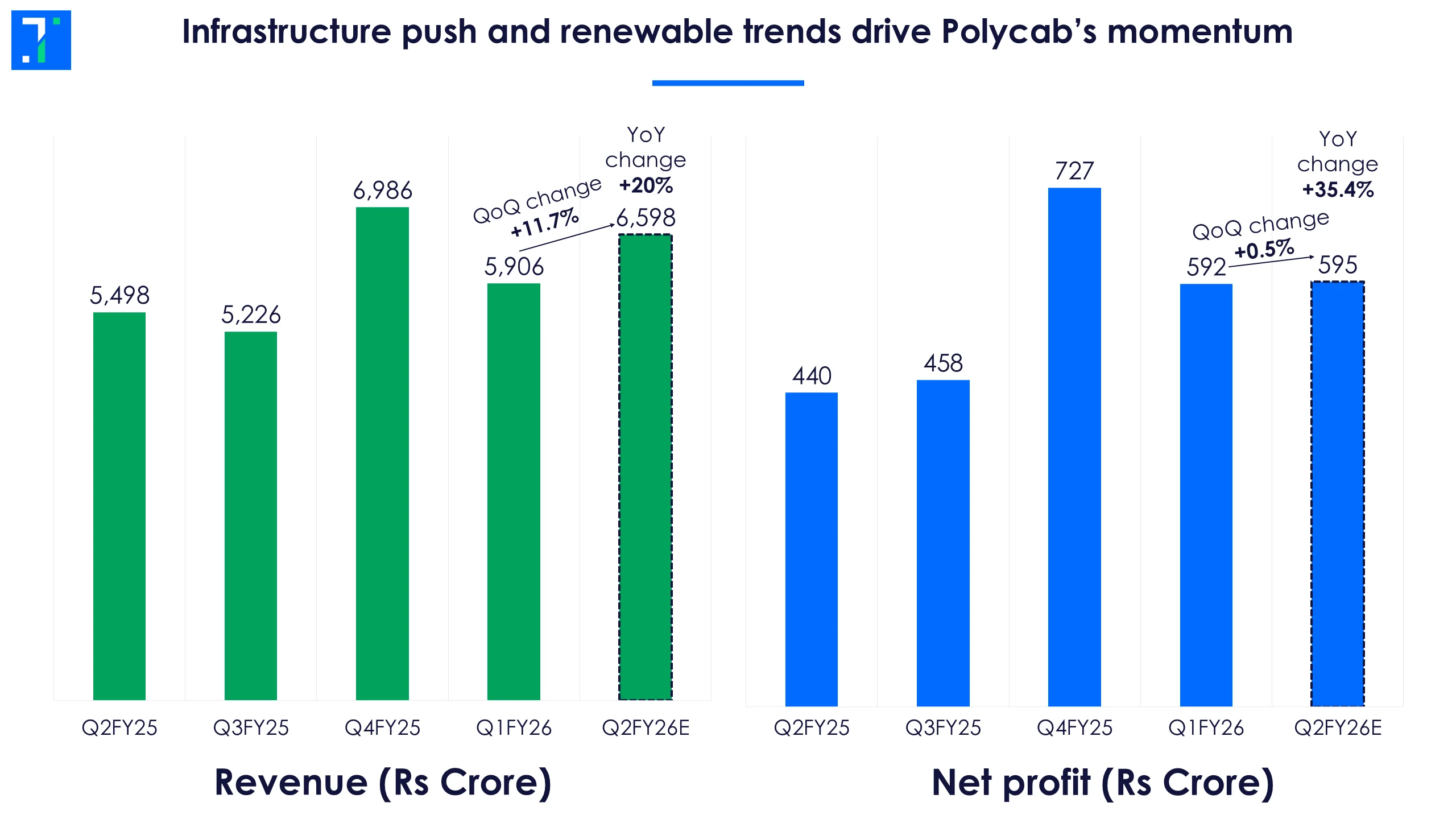

Polycab India is set for growth in Q2FY26, driven by demand across its segments. The Wires & Cables division, which makes up around 88% of sales, is expected to see momentum from infrastructure development and increased government spending.

Infrastructure push and renewable trends drive Polycab’s momentum

The fast-moving electrical goods (FMEG) segment, including solar products, is also growing. On the export front, one-third of Polycab’s shipments go to the US. Recent tariff increases on Chinese products could provide a competitive tailwind, boosting Polycab’s positioning in key markets.

Analysts remain optimistic. Jefferies has a ‘Buy’ rating on the stock with a target of Rs 8,180 per share, citing the company’s diversified revenue streams and strong market fundamentals.

Follow live Q2 results here.