The sun has gone behind the clouds this August, and the stock market is feeling it. After the pain of July’s 2.9% drop, there was some early good news as Q1 earnings came in. But a news cycle filled with Trump threats has kept volatility up, and the momentum score for the Nifty right now is underwhelming.

Still, one green signal keeps flashing: retail investors. While FIIs have been running for the exits, Indian retail investors haven't blinked and are still betting big on the India growth story.

Equity mutual funds saw a a record Rs 42,702 crore in inflows in July - an 81% jump from June, says AMFI.

OmniScience Capital’s CEO and chief investment strategist said, “This indicates that the investor seems to be following a policy of buying more on dips and continuing with their SIPs. Investors are allocating to all categories of equity MFs, though bias is still more towards smallcaps”.

As retail investors continue to buy, how have superstar investors moved in the past quarter? Let’s take a look.

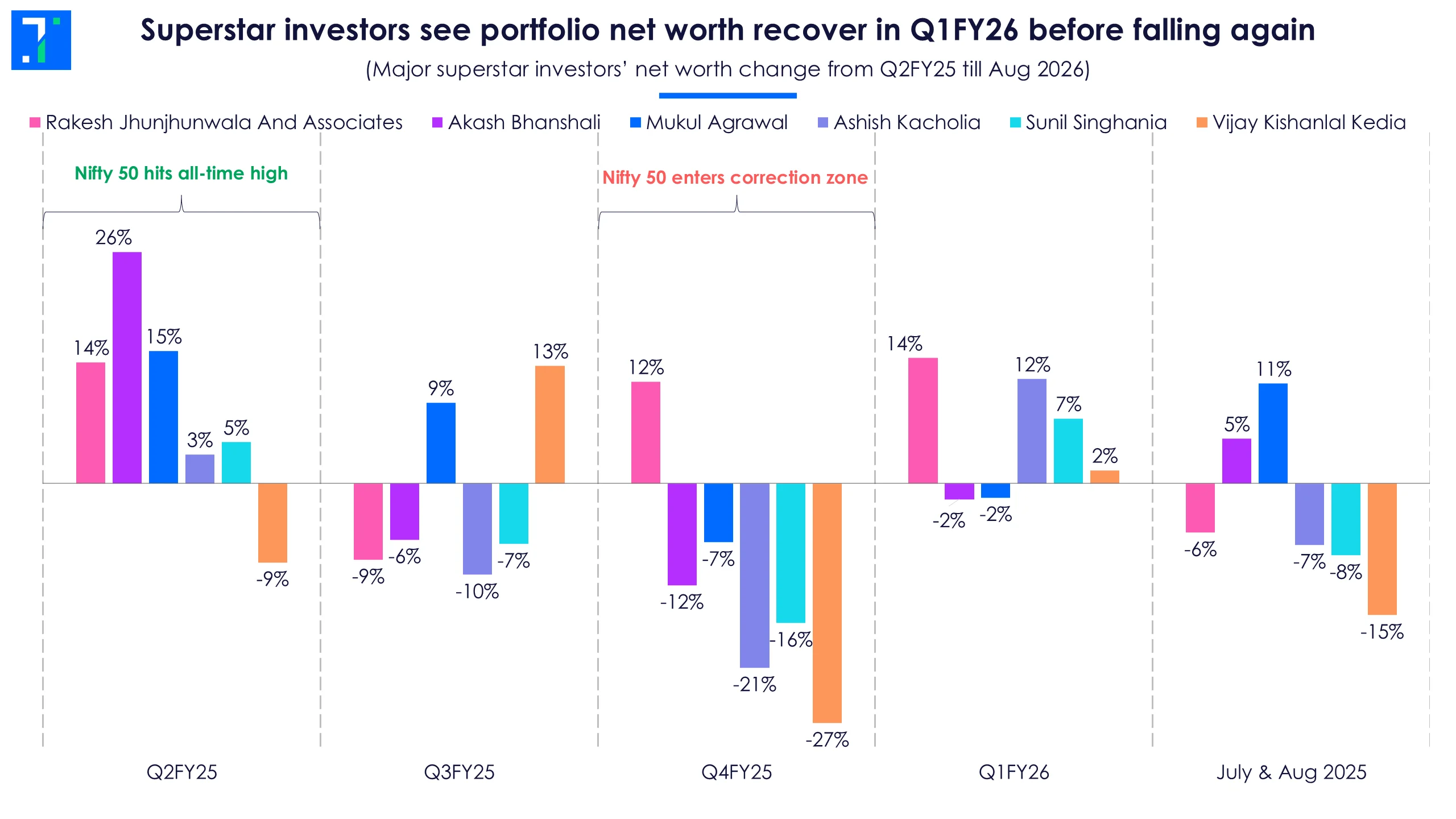

Sharp teeth: Superstar investors bounce back in Q1FY26, but volatility bites

The Richie Rich investors have become a little poorer. The second half of FY25 was an especially rough ride for superstar investors, as markets slid from record highs into correction territory. The last quarter of FY25 hit net worth the hardest, with FIIs selling and weak earnings.

How is the story changing now? Nilesh Shah, Managing Director of Kotak AMC, said, “Upcoming meetings involving Trump, Putin, and the US delegation visiting India are expected to influence market movements significantly. The imposition of a 50% tariff by the US is seen as a trade embargo, impacting several Indian industries. These geopolitical developments will drive market sentiment going forward.”

For superstar investors, the mood had brightened in Q1FY26, with portfolios rebounding on the back of rising share prices and fresh fund infusions. Rakesh Jhunjhunwala & Associates' (managed by Rare Enterprises) and Ashish Kacholia’s holdings jumped in double digits—Star Health and Allied Insurance powered Rare’s gains, while Balu Forge Industries lifted Kacholia’s.

Superstar investors see portfolio net worth recover in Q1FY26 before falling again

But the comeback was short-lived. Volatility and new tariffs have limited the recovery, pushing investors back into wait-and-watch mode. Superstar net worth is well below their peak levels, a reminder that even the sharpest minds can’t escape the market’s swings.

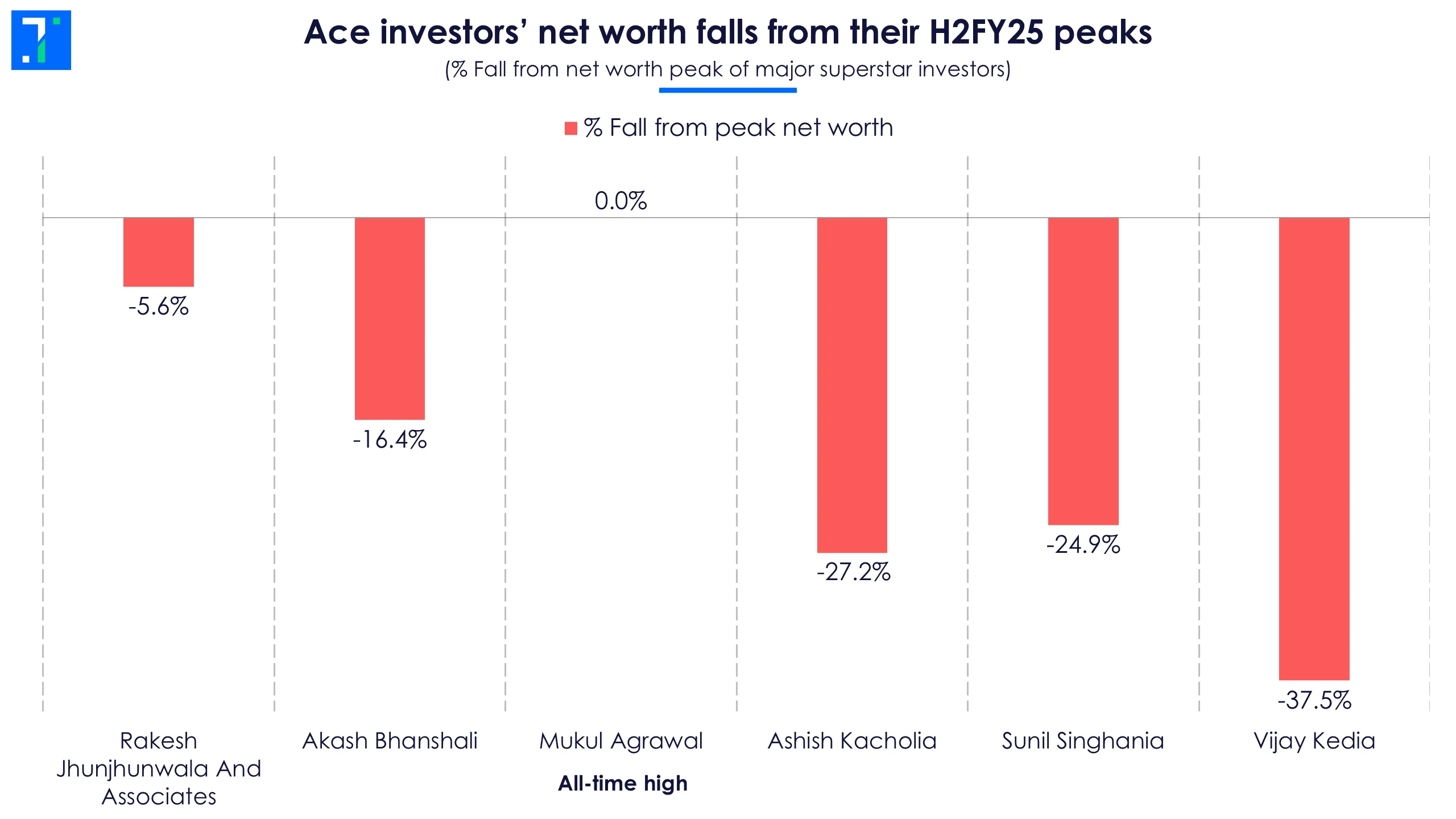

Ace investors’ net worth falls from their H2FY25 peaks

Rakesh Jhunjhunwala & Associates and Mukul Agrawal’s portfolio are the exceptions here. But it comes with a caveat. Both these superstars have infused fresh funds into their holdings, which has increased their net worth.

While others trimmed or held their positions in Q1, Mukul Agrawal went the other way — buying aggressively.

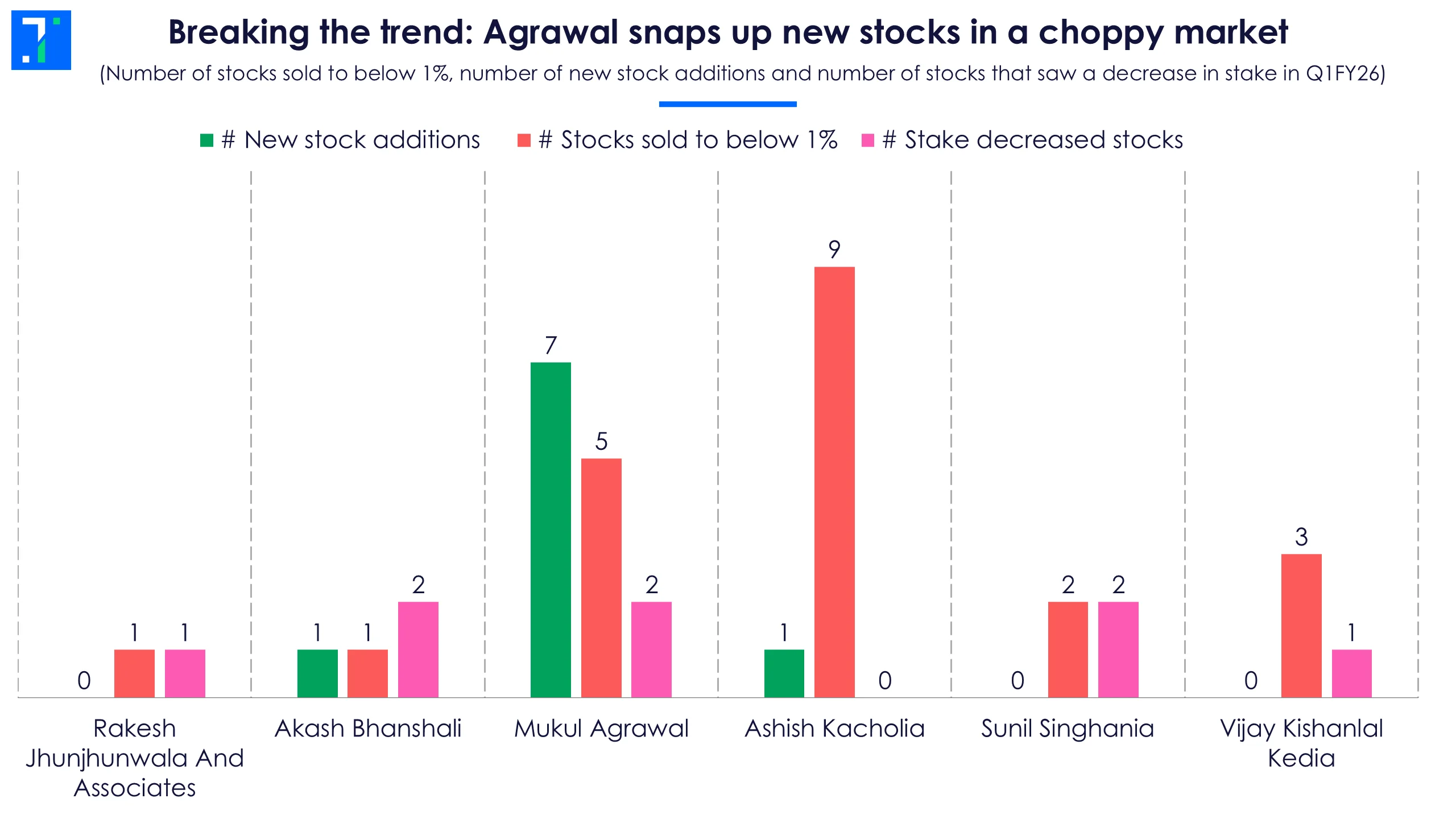

Breaking the trend: Agrawal snaps up new stocks in a choppy market

Agrawal picked up stakes in seven new companies, a sharp pivot from the prior quarter when he sold 13 holdings and added just one new name. Agrawal seems to be shifting quickly between offence and defence as market tides change.

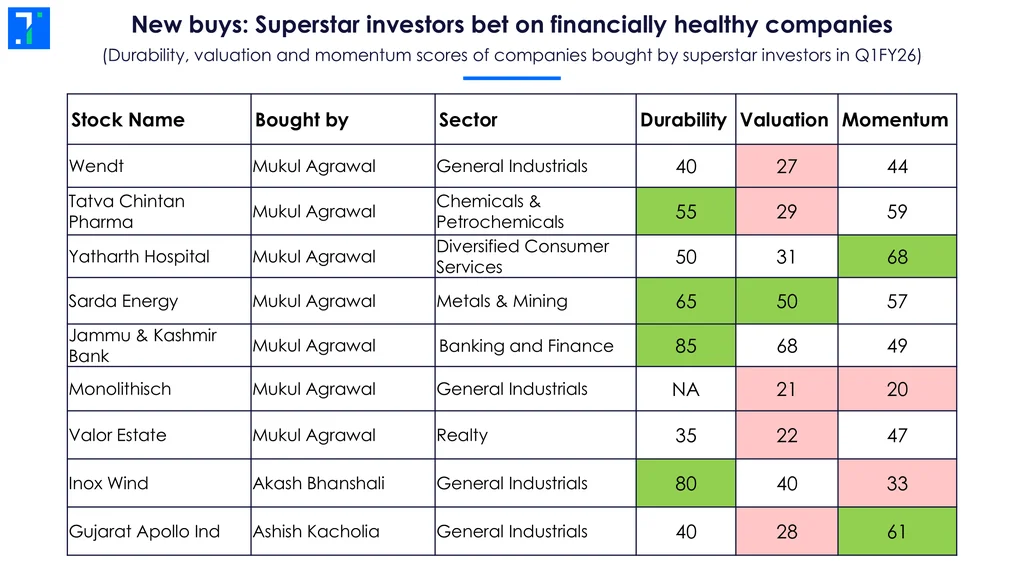

Expert investors buy new stakes in financially strong companies

A few superstars bought new stakes in nine companies in Q1, mainly in the small-cap space. Seven of these buys were by Mukul Agrawal.

Two patterns stand out. First, seven of the nine picks have outpaced the benchmark over the past quarter. Second, these stocks boast solid fundamentals, reflected in strong Trendlyne Durability scores.

New buys: Superstar investors bet on financially healthy companies

General Industrials emerged as a clear favourite, featuring across portfolios. The standout performer was Monolithisch, which debuted on June 19 with a 61% listing gain; Agrawal’s stake in the SME company is now worth Rs 20.3 crore.

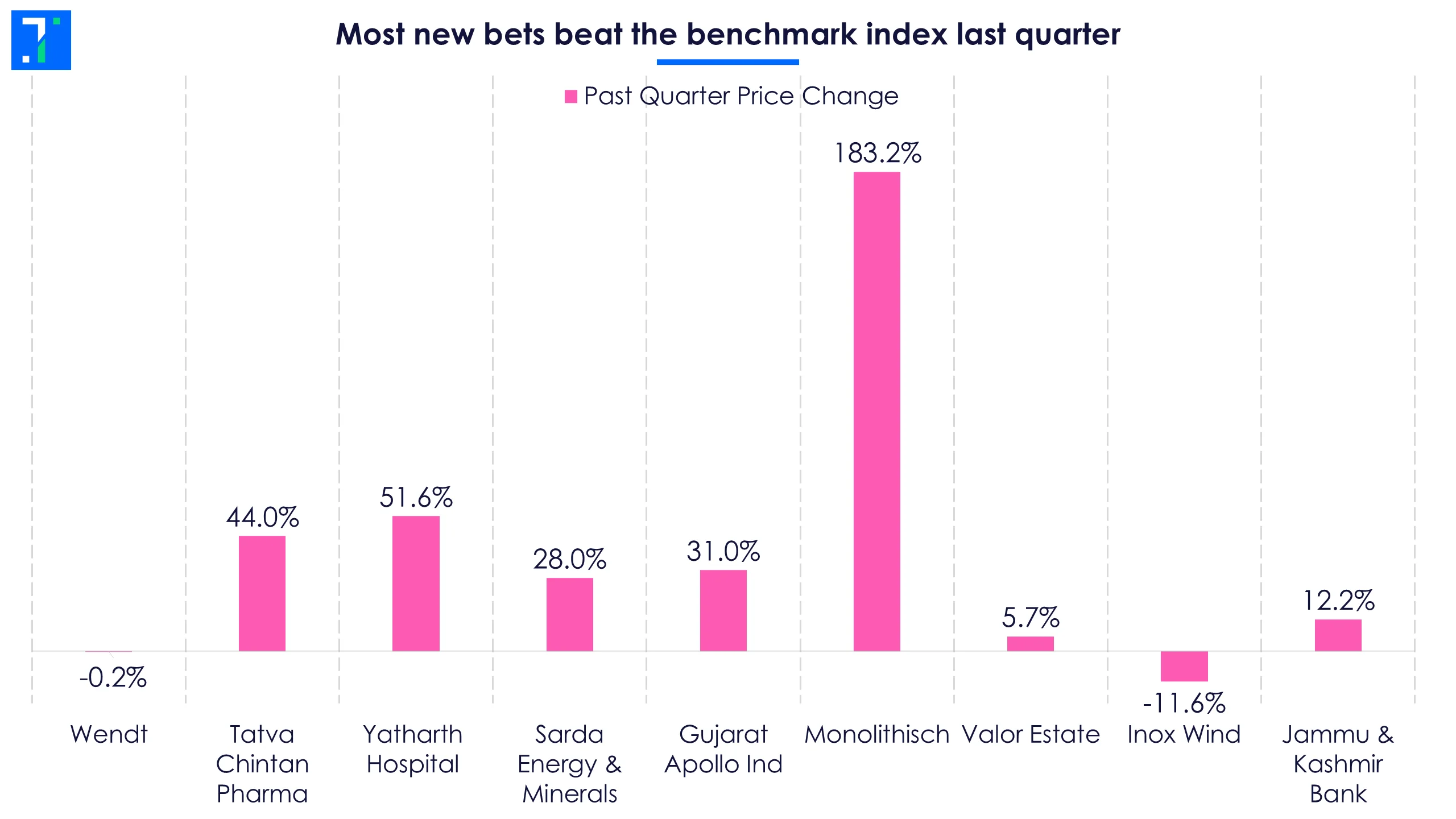

Most new bets beat the benchmark index last quarter

Not every bet paid off—Inox Wind and Wendt, bought by Akash Bhanshali and Agrawal, respectively, lagged the market. But other names shone bright, with Ashish Kacholia’s Gujarat Apollo Industries surging 31% in the same period.

Big names cut ties with some longtime winners

A few old favourites were shown the exit in Q1. Vijay Kedia parted ways with his multibagger Tejas Networks, a stock that has halved in value over the past year.

Rare Enterprises cut its stake in a once-favourite, Nazara Technologies, from 7.1% to under 1%—despite the stock’s 26% rally in the past quarter. The internet and software company has reported YoY profit declines in two of the past four quarters.

Top investors sell stakes in old favourites

Sunil Singhania also exited his 2020 pick, ADF Foods, which has a low Trendlyne Durability score and is tagged as an ‘Await Turnaround’ company. Meanwhile, Akash Bhanshali pared his holding in Welspun Corp—owned since 2018—to below 1%.

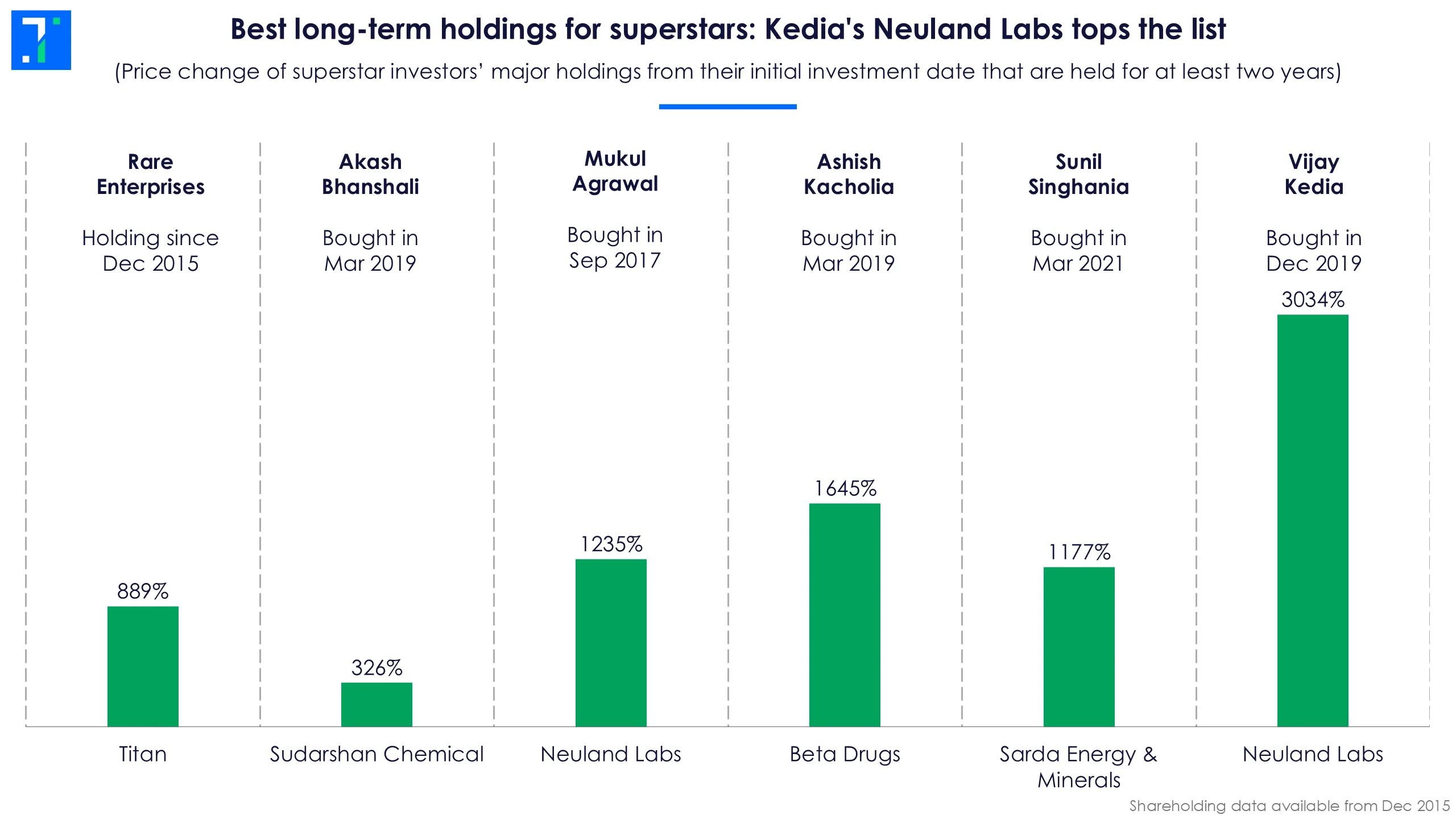

Vijay Kedia’s 2019 bet Neuland Labs shines in long-term growth

Neuland Labs, the pharma player, stands out as the best-performing long-term bet for both Vijay Kedia and Mukul Agrawal. However, Kedia has outpaced Agrawal in returns, thanks to his timely entry in 2019 when the stock was trading at lower levels.

Best long-term holdings for superstars: Kedia's Neuland Labs tops the list

Akash’s long-term bet, Sudarshan Chemicals, lags compared to other superstar investors’ top long-term performers. His biggest holding, Gujarat Fluorochemicals (30% of his portfolio), has underperformed the benchmark index. However, Bhanshali's net worth has almost tripled in the past two years due to high performance in their other holdings and fresh buys in new stocks.

See the complete list of superstar buys here, and their sells here.