By Divyansh Pokharna

The Nifty 50 dropped marginally by 0.8% over the past week. According to the India Manufacturing PMI, India’s manufacturing activity declined to 56.4 in December, its weakest growth in 2024. This was due to slower growth in new output and orders.

FIIs extended their selling streak and offloaded equities worth over Rs 11,041.5 crore during the week, while DIIs maintained their optimistic stance and invested Rs 9,253.7 crore.

However, IPO activity remains steady as the new year kicks off - three companies debuted last week, eight are set to list this week, and seven other IPOs are opening for subscription.

Let’s take a look at fresh IPO activity

Three new companies debuted on the stock market last week

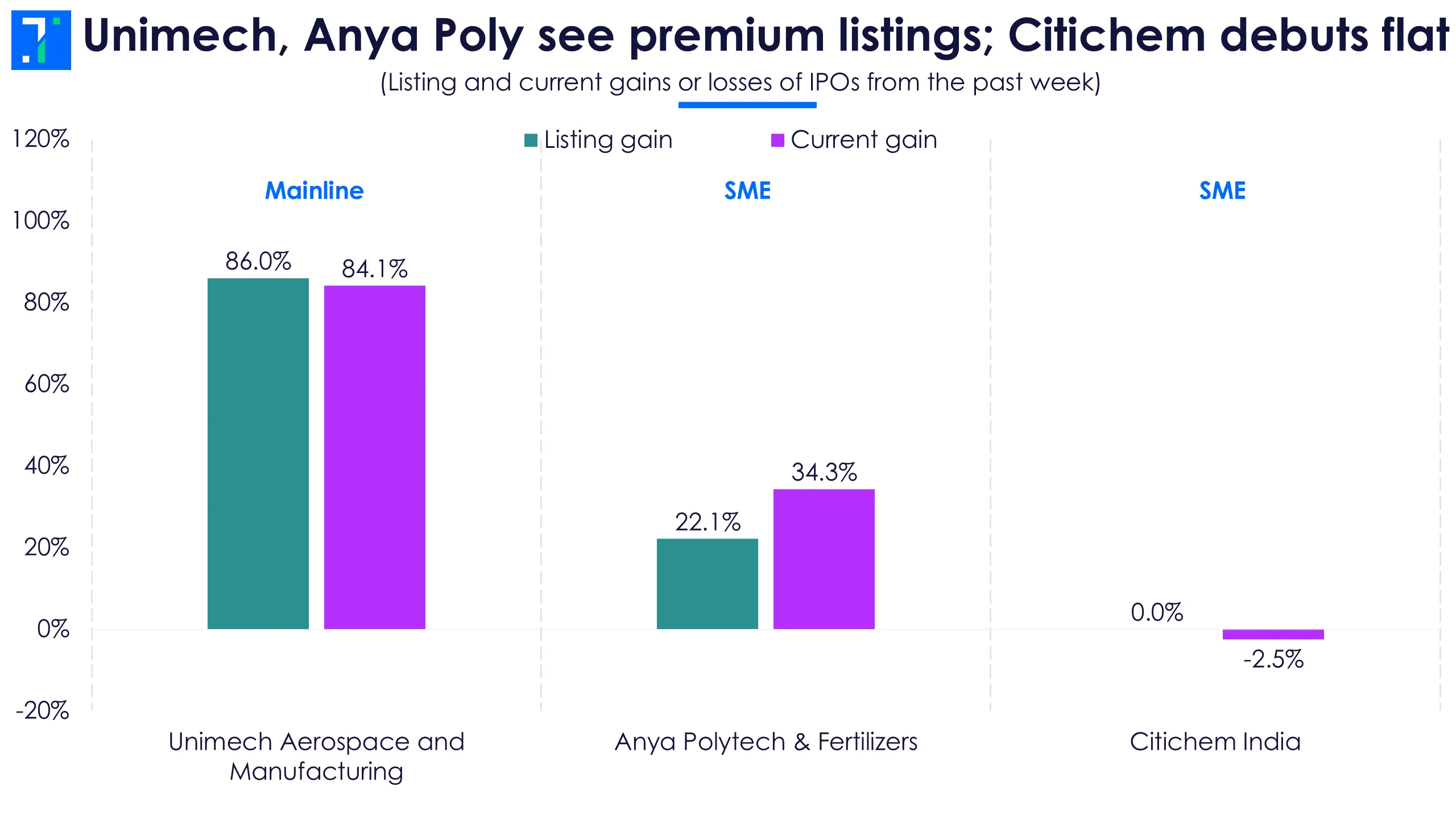

The stock market saw three IPOs debut last week, with one from the mainline segment and two in the SME category.

Unimech, Anya Poly see premium listings; Citichem debuts flat

Unimech Aerospace and Manufacturing, an industrial machinery manufacturer, listed on December 31 with an 86% gain from its issue price. The Rs 500 crore IPO was subscribed 175.3X, with the QIB category seeing a strong 317.6X subscription. For FY24, the company reported a 125% YoY increase in revenue and a 155% rise in net profit.

Anya Polytech & Fertilizers, a packaging company, listed with a 22.1% gain. The company is engaged in fertilizers, bag manufacturing, and environmental solutions, raising Rs 44.8 crore through a fresh issue. It saw a total subscription of 409.3X, with the HNI segment oversubscribed by 1,463.9X.

Citichem India, a commodity trading firm, listed at its issue price of Rs 70 on January 3, with no gains. The stock fell 1.4% during the day. For FY24, the company reported a 6% decline in revenue and a 208% increase in net profit. Citichem plans to use the IPO proceeds for capital expenditure, property acquisition, purchasing transportation vehicles and accessories, and general corporate purposes.

Eight new IPOs are lined up for listing this week

This week will see the listing of eight IPOs, including six in the SME category and two in the mainline segment

Technichem, Indo Farm, Leo Dryfruits see strong HNI demand

Technichem Organics, a specialty chemicals manufacturer, saw a subscription of 392.6X for its Rs 25.5 crore IPO, with HNI bids reaching 1,425X. The company is engaged in producing specialty chemicals, pigment and dye intermediates, & air oxidation chemistry and will list on the BSE SME platform on January 7. Its post-IPO price to earnings (PE) ratio of 20.2 is significantly below the industry average of 62.1. (The post-issue P/E ratio is calculated using the issue price divided by the post-issue EPS, based on annualized FY earnings as of March 31, 2024, from the RHP).

Indo Farm Equipment, a commercial vehicle company, and Leo Dry Fruits & Spices Trading, a food products firm, recorded subscriptions of 229.7X and 169.1X, respectively. Both companies saw HNI subscriptions exceed 500X. Indo Farm Equipment will list on January 7, while Leo Dry Fruits is set to debut on January 8.

On January 9, two IPOs, Parmeshwar Metal, and Davin Sons Retail, are set to list and have garnered subscriptions of 42X and 11.9X, respectively, by the end of Day 2. A medical equipment firm, Fabtech Technologies Cleanrooms, will follow on January 10 with a total subscription of 18.5X at the end of Day 1.

Indobell Insulation and Standard Glass Lining Technology, both other industrial products companies, will list on January 13. These companies opened for subscription on January 6. The industrial products industry has risen by 31.2% over the past year.

Upcoming subscriptions: Seven new offerings set to open this week

Seven IPOs are scheduled to open for subscription this week, including two in the mainline segment and five in the SME category.

All companies except Capital Infra see profit growth YoY in FY24

B.R.Goyal Infrastructure: This construction & engineering company is launching an IPO with an issue size of Rs 85.2 crore. The IPO will open on January 7 and close on January 9, with shares listing on January 14 on the BSE SME platform. The company specializes in constructing infrastructure projects such as roads, highways, bridges, and buildings.

In FY24, the company reported a 68.8% YoY increase in revenue and a 26.3% rise in net profit.

The proceeds from the IPO will be used to fund capital expenditure, working capital requirements, inorganic growth through acquisitions, and other strategic initiatives, along with general corporate purposes.

Sat Kartar Shopping: This pharmaceutical company specializes in Ayurveda healthcare, offering therapeutic and lifestyle products that promote a healthier lifestyle. The company is launching an IPO with an issue size of Rs 33.8 crore, opening on January 10 and closing on January 14, with a listing date of January 17 on the NSE SME platform.

The proceeds from the IPO will be used for an unidentified acquisition (in India or abroad), as well as for marketing, advertising, capital expenditure, and technology investments. In FY24, the company saw a 54.4% YoY increase in revenue, with net profit rising by 151.6%.

Avax Apparels And Ornaments: This textiles company, involved in wholesale trading and online retail of silver ornaments, is set to launch its IPO. The issue opens on January 7 and closes on January 9, with a listing date of January 14 on the BSE SME platform. The issue size is Rs 1.9 crore.

The company offers wholesale knitted fabric and a range of silver ornaments online, including rings, chains, and other jewellery, catering to major cities across India. The IPO proceeds will fund the company's working capital needs and general corporate purposes.

In FY24, the company reported a 50% YoY increase in revenue and a 99% rise in net profit.

Barflex Polyfilms: This packaging firm’s IPO opens on January 10 and closes on January 15, with the listing scheduled for January 20 on the NSE SME platform. The issue size is Rs 39.4 crore.

The company manufactures COEX films, laminates, and labels, producing flexible packaging materials for various industries, including FMCG, processed foods, adhesives, pharmaceuticals, cosmetics, and construction.

The proceeds from the IPO will be used to fund capital expenditure for purchasing additional plant and machinery, as well as for general corporate purposes. In FY24, the company experienced a 5.2% YoY increase in revenue, with net profit rising by 60.3%.

Delta Autocorp: This 2/3 wheeler manufacturer operates under the brand name "Deltic" and is engaged in manufacturing and sale of 2-wheelers and 3-wheelers electric vehicles (EVs). Initially focusing on developing electric 3-wheeler prototypes, the company aims to expand its EV offerings.

The IPO, valued at Rs 54.6 crore, will open on January 7 and close on January 9, with shares listing on January 14 on the NSE SME platform.

In FY24, the company saw a 0.8% YoY increase in revenue and a 60.1% rise in net profit. The proceeds will be utilized for establishing an electric three-wheeler fabrication and painting plant, new product development, working capital needs, and general corporate purposes, including offer expenses.

Quadrant Future Tek: This electrical equipment maker develops train control and signaling systems, contributing to the Indian railways' KAVACH project to enhance passenger safety and reliability. The company also operates a specialty cable manufacturing facility with an Electron Beam Irradiation Centre.

The Rs 290 crore IPO, is completely a fresh issue and will open from January 7 to January 9, with the listing scheduled for January 14.

In FY24, revenue declined by 0.7% YoY, while net profit increased by 5.8%. The IPO proceeds will fund long-term working capital requirements, capital expenditure for an Electronic Interlocking System, repayment of outstanding working capital term loans, and general corporate purposes.

Capital Infra Trust: This roads & highways developer, sponsored by Gawar Construction Limited, focuses on road and highway projects across 19 Indian states. Its sponsor specializes in executing projects for government bodies such as NHAI, MoRTH, MMRDA, and CPWD.

The IPO proceeds will provide loans to project SPVs for repaying external and unsecured borrowings, including accrued interest and prepayment penalties.

The Rs 1,578 crore IPO will open on January 7, close on January 9, and list on January 14. In FY24, revenue declined by 0.7% YoY, while net profit grew by 5.8%