Profits are up in Q2 results — out of 267 companies in the Nifty 500 that have reported results, 166 posted positive net profit growth. Portfolio trackers are finally giving people something better than red arrows to look at.

October was the best month for the Nifty 50 since March. But despite this, the index hasn't been able to break the psychological 26,000 barrier. It tried twice in October, stumbled both times, and now hovers below it, like a batsman stuck on 99 not out.

Superstar investors like Vijay Kedia are cautiously optimistic, cheering from the sidelines.

“Indian equities are poised to regain momentum by the end of 2025,” says Siddhartha Khemka, Head of Wealth Management Research at Motilal Oswal. “Valuations are normalising and earnings are expected to rebound sharply in FY27. The market is setting up for the rally.”

These are optimistic words, but they come with a reminder to be patient.

Retail investors often look up to superstar investors like Kedia for clues on when to hold and when to strike. So here, we take a closer look at how India’s superstar investors are playing the current market — who’s swinging for the fences, who’s holding their ground, and who’s pretending not to care (but definitely does).

Superstar investors eye a comeback in FY26

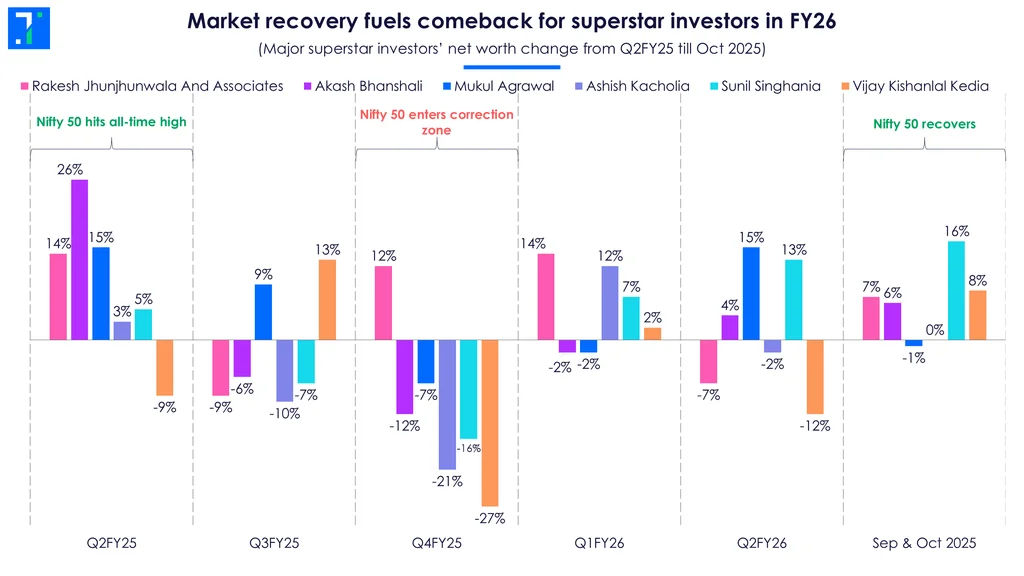

For India’s stock market celebrities, the past year has been a lot like a soap opera, with many ups and downs.

In September 2024, more than a year ago, markets and superstar portfolios were hitting record highs. But by March this year, FII outflows, weak earnings, and US tariff tantrums had sent portfolios tumbling.

Now, the market’s mood has flipped again from heartbreak to hopeful, thanks to rising share prices and fresh fund infusions.

Two big winners this quarter are Mukul Agrawal and Sunil Singhania. Both saw double-digit jumps in their holdings, thanks to some sharp stock-picking:

-

Neuland Laboratories kept Agrawal’s portfolio humming.

-

Sarda Energy & Minerals added spark to Singhania’s.

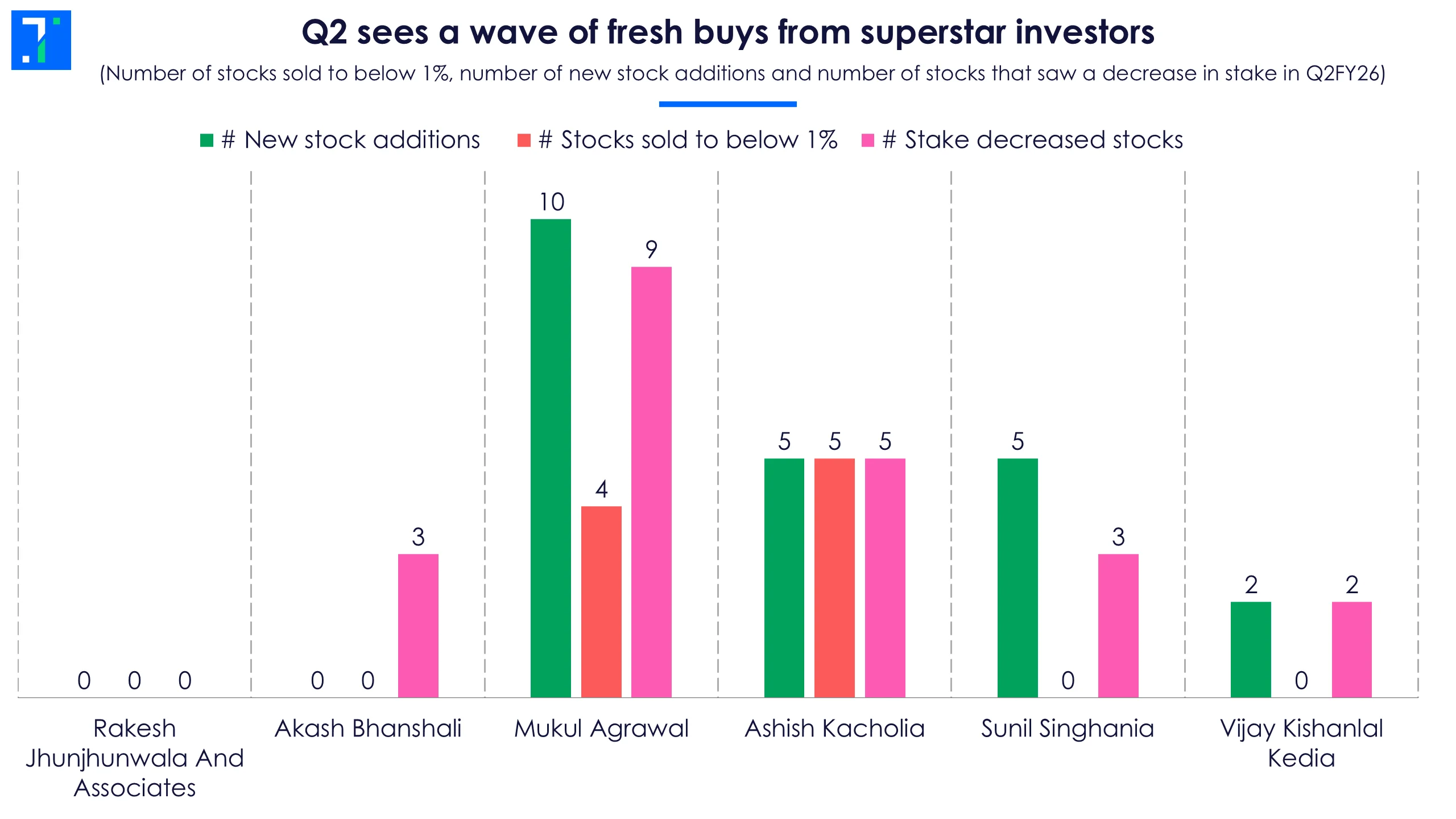

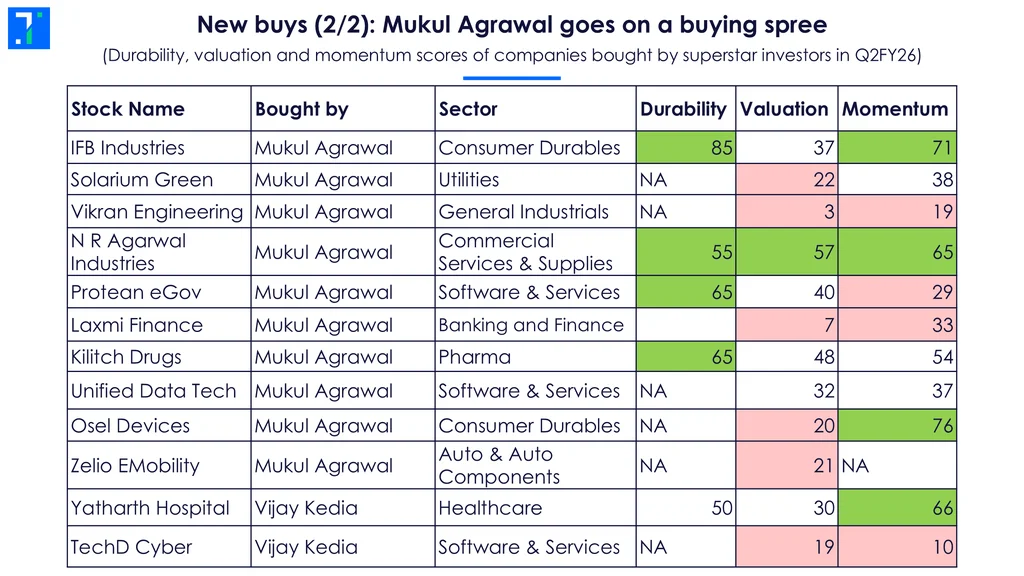

These two investors also went on a mini shopping spree. Agrawal picked up 10 new companies, while Singhania — who in previous quarters trimmed stakes in 14 companies and bought just one — made five new buys.

Vijay Kedia joined the action as well, adding stakes in two new companies after several quiet quarters where he only reduced positions.

Not everyone jumped in, though. Akash Bhanshali and Rakesh Jhunjhunwala & Associates (managed by Rare Enterprises) stayed on the sidelines, waiting for market volatility to ease up before making fresh moves.

What new stocks are superstar investors betting on?

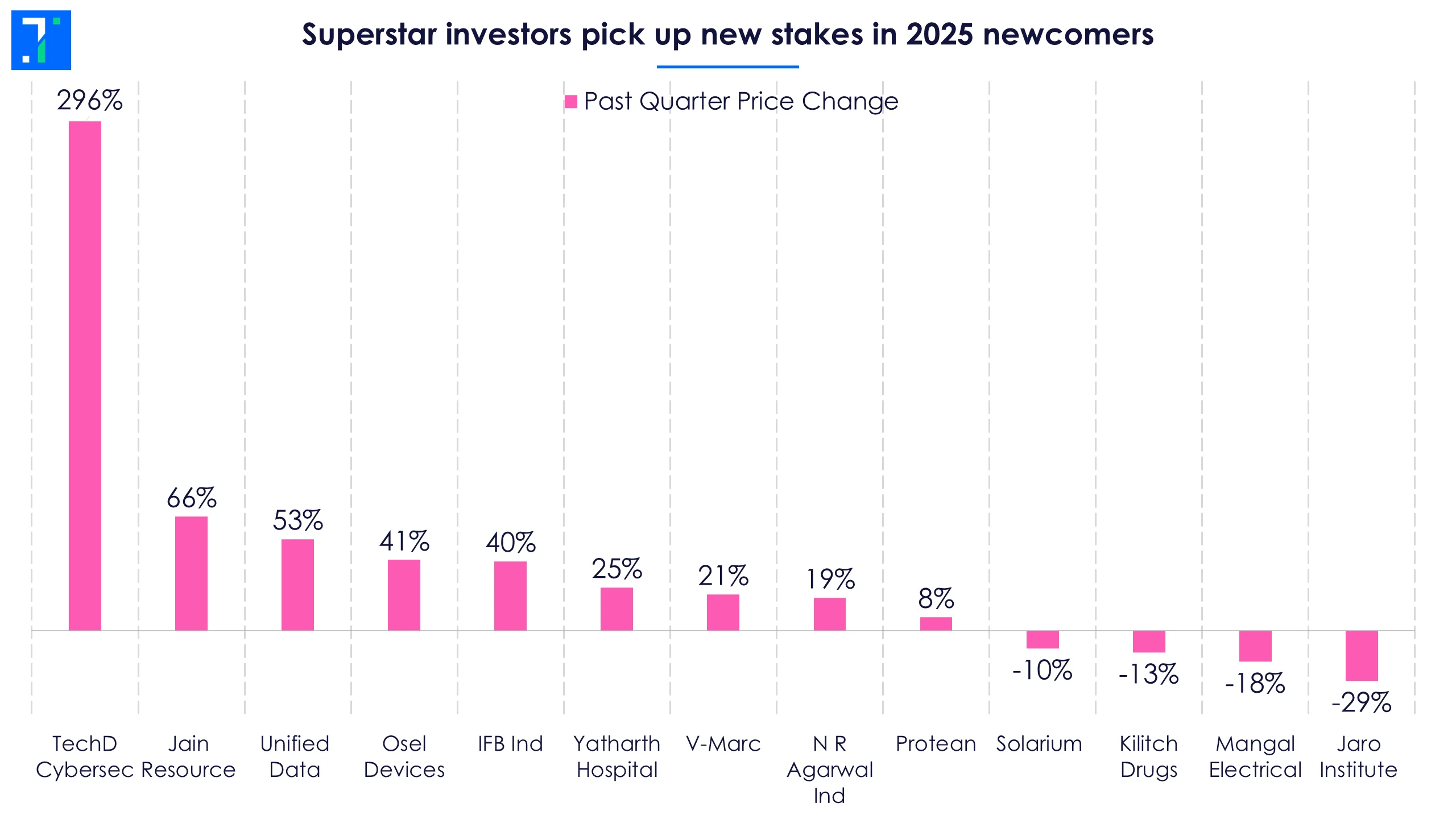

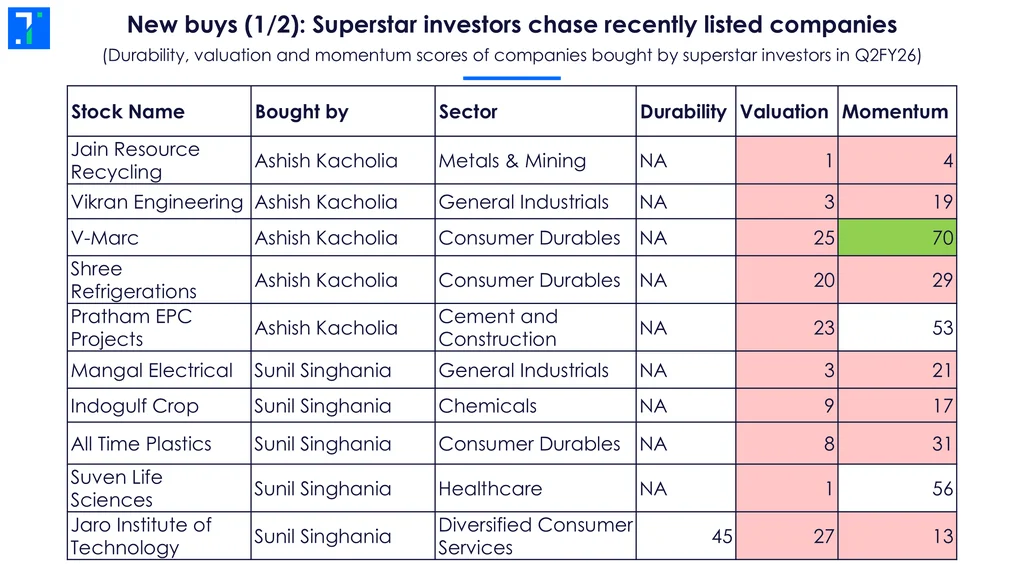

Superstar investors collectively bought new stakes in 21 companies in Q2. Only one company—Vikran Engineering—caught the fancy of more than one superstar, with both Mukul Agrawal and Ashish Kacholia picking it up.

Another clear trend here is that superstars are surfing the IPO wave. Out of those 21 new buys, 13 were newly listed in 2025, with nine debuting just last quarter.

Among the star attractions was TechD Cybersecurity, among the best-performing IPOs of the past quarter. Vijay Kedia wasted no time in grabbing a piece of it.

Since these are recently listed companies, many of the new buys in Q2 don’t necessarily have strong valuations or high durability scores.

Many of these newly listed companies may be short-term picks —"let's see how they do" kind of investments. We’ve seen superstars exit new listings quickly. Ashish Kacholia, for instance, held 4.8% in Awfis Space Solutions in Q1FY25 but has already cut his stake to below 1% this quarter.

Agrawal has focused on fundamentally strong companies. Among his Q2 buys, N R Agarwal Industries, a commercial services & supplies firm, scores high across Trendlyne’s DVM scores. Agrawal was a top buyer in the previous quarter as well, taking new positions in seven companies.

A sector catching many eyes? Consumer durables. From air-conditioners to appliances, this category features prominently in multiple superstar portfolios.

Mukul Agrawal and Ashish Kacholia stay nimble, cutting stakes in Q2

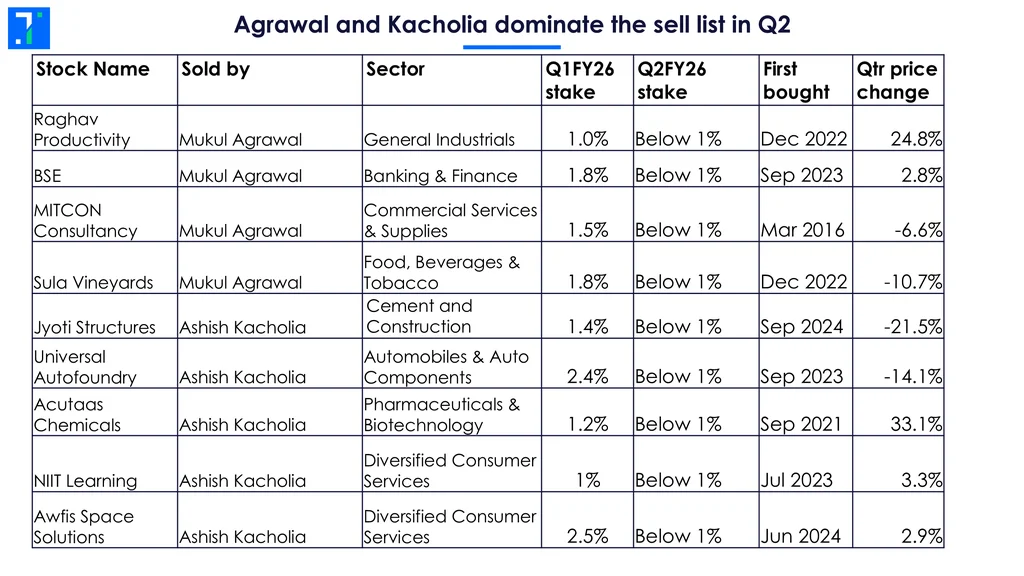

Among the six superstars tracked, nine stocks saw their holdings cut below 1%. All of these cuts came from Agrawal and Kacholia — both known for their swift, surgical exits when markets turn. Most of these stocks were laggards.

Jyoti Structures, offloaded by Kacholia, was the biggest underperformer, down over 20% in the quarter. Among the sells, only Acutaas Chemicals and Raghav Productivity escaped the red zone.

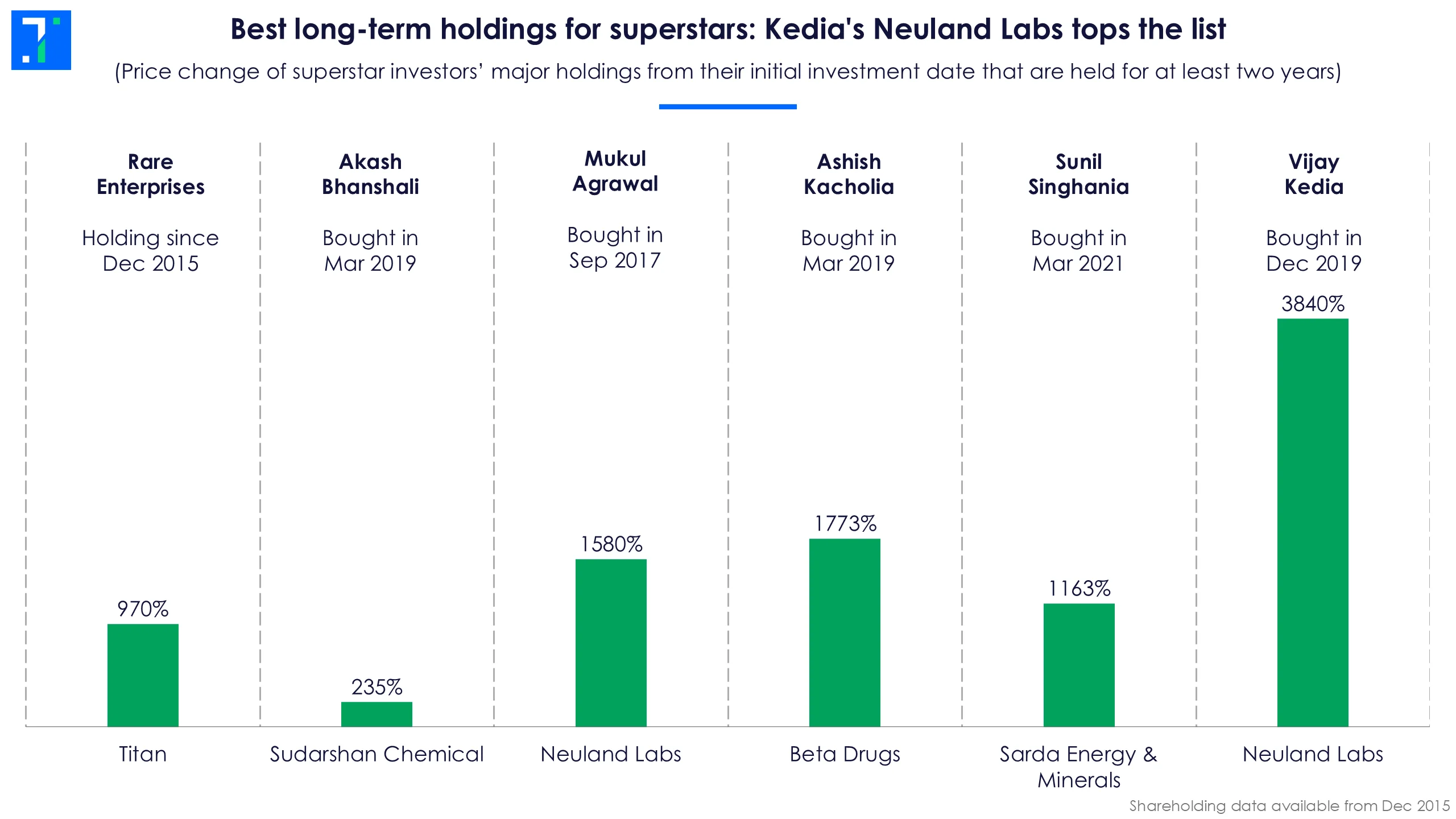

Vijay Kedia’s 2019 bet Neuland Labs leads the long-term winners

Neuland Labs, the pharma player and a multibagger held by both Vijay Kedia and Mukul Agrawal, stands out as the best-performing long-term bet. However, Kedia beat Agrawal in returns for this stock and is laughing all the way to his demat account, thanks to his timely entry in 2019 when Neuland was trading at lower levels.

On the other side, Akash’s long-term bet, Sudarshan Chemicals, lags compared to other superstar investors’ long-term performers. His biggest holding, Gujarat Fluorochemicals (30% of his portfolio), has underperformed the benchmark index. But Bhanshali's net worth has almost tripled in the past two years due to high performance in their other holdings and some well-timed stealth buys.

See the complete list of superstar buys here, and their sells here.