Almost a year has passed since the Nifty 50 touched its all-time high on September 27, 2024. Back then, the market looked unstoppable, breaking records week after week, and every investor felt like a stock-picking genius.

A year later, the thrill is gone. The market has cooled, and investors check their portfolios the way Bangaloreans check traffic on Google Maps—cautiously, knowing it’s rarely good news.

Superstar investor Vijay Kedia summed up the market sentiment: “I have never held more cash in my portfolio now than in my entire life. It is going to stay this way as long as the uncertainty remains.”

With the markets in neutral, we take a look at the multibagger trend. Are there sectors quietly defying the broader weakness?

Let’s dive in.

A fading bull run: Multibagger count in Indian equities sinks to record lows

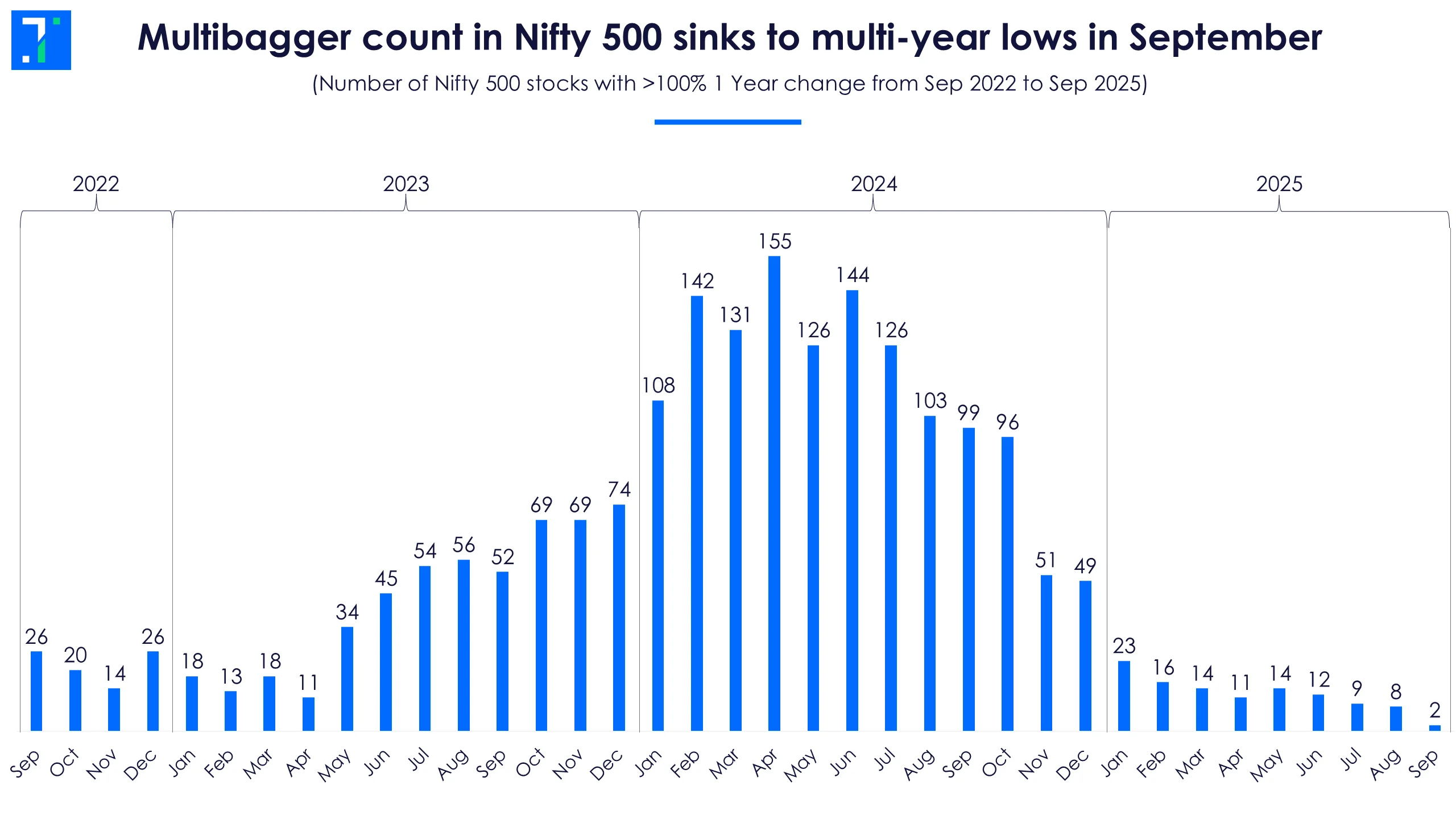

A year ago, the Indian stock market was on a roll. The Nifty 50 kept climbing until it hit an all-time high in September 2024, and investors saw a flood of “multibaggers”— stocks that had at least doubled in value in just a year.

By April 2024, one in three Nifty 500 stocks had delivered multibagger returns, and investors were enjoying one of the broadest market rallies in years.

Multibagger count in Nifty 500 sinks to multi-year lows in September

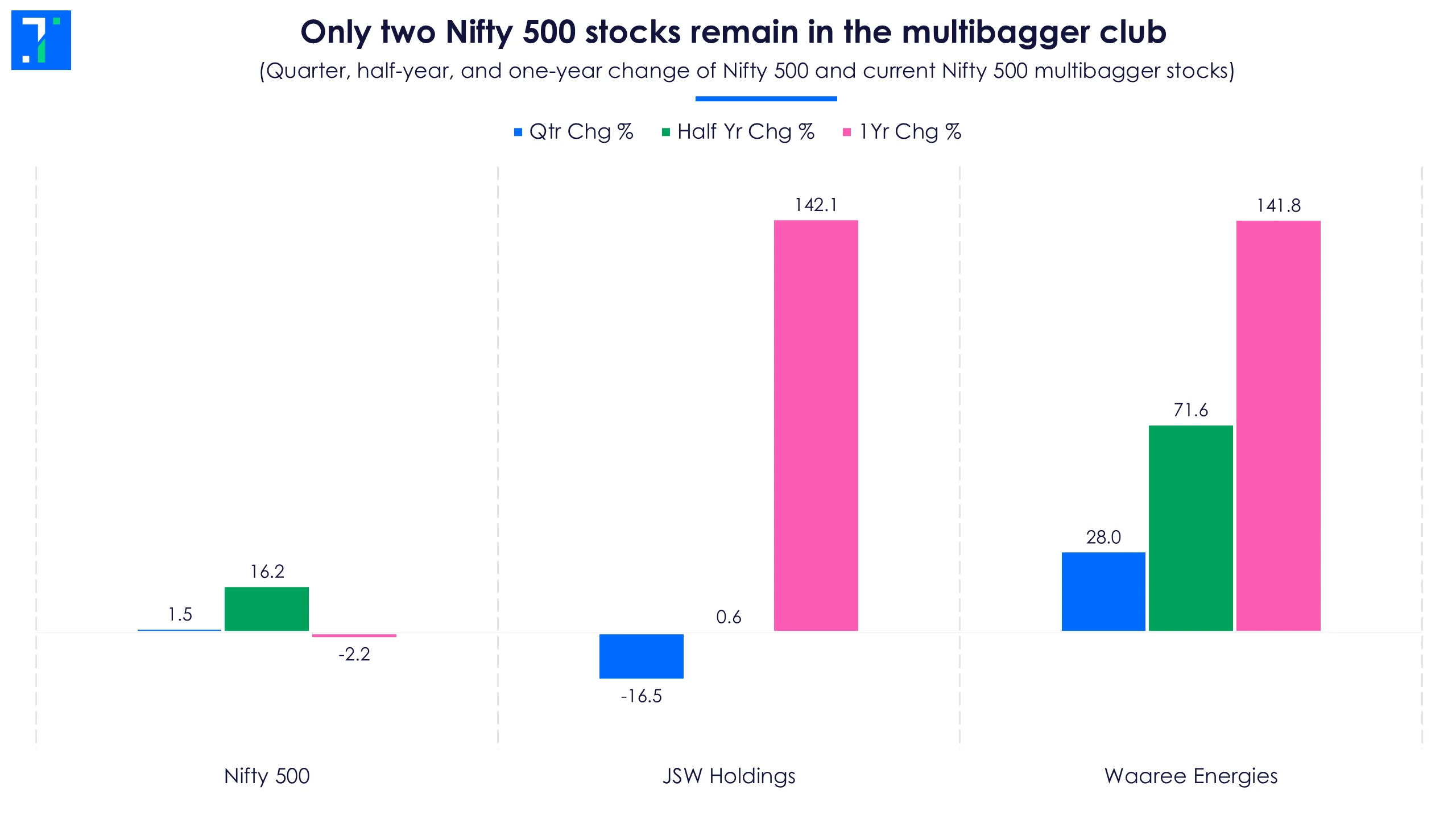

But fast forward to September 2025, and the momentum has all but disappeared. For three straight months, the count of new multibaggers has stayed in the single digits—a sharp contrast to last year’s frenzy. Today, only two names from the Nifty 500 make the multibagger cut: JSW Holdings and Waaree Energies.

Only two Nifty 500 stocks remain in the multibagger club

These two stocks are among the rare stocks that have posted multibagger returns in an otherwise quiet market. JSW Holdings is riding on the strong performance of its group companies, while Waaree Energies, listed in October 2024, has gained from investors betting on the rising demand for solar power equipment.

These are the exceptions, not the rule.

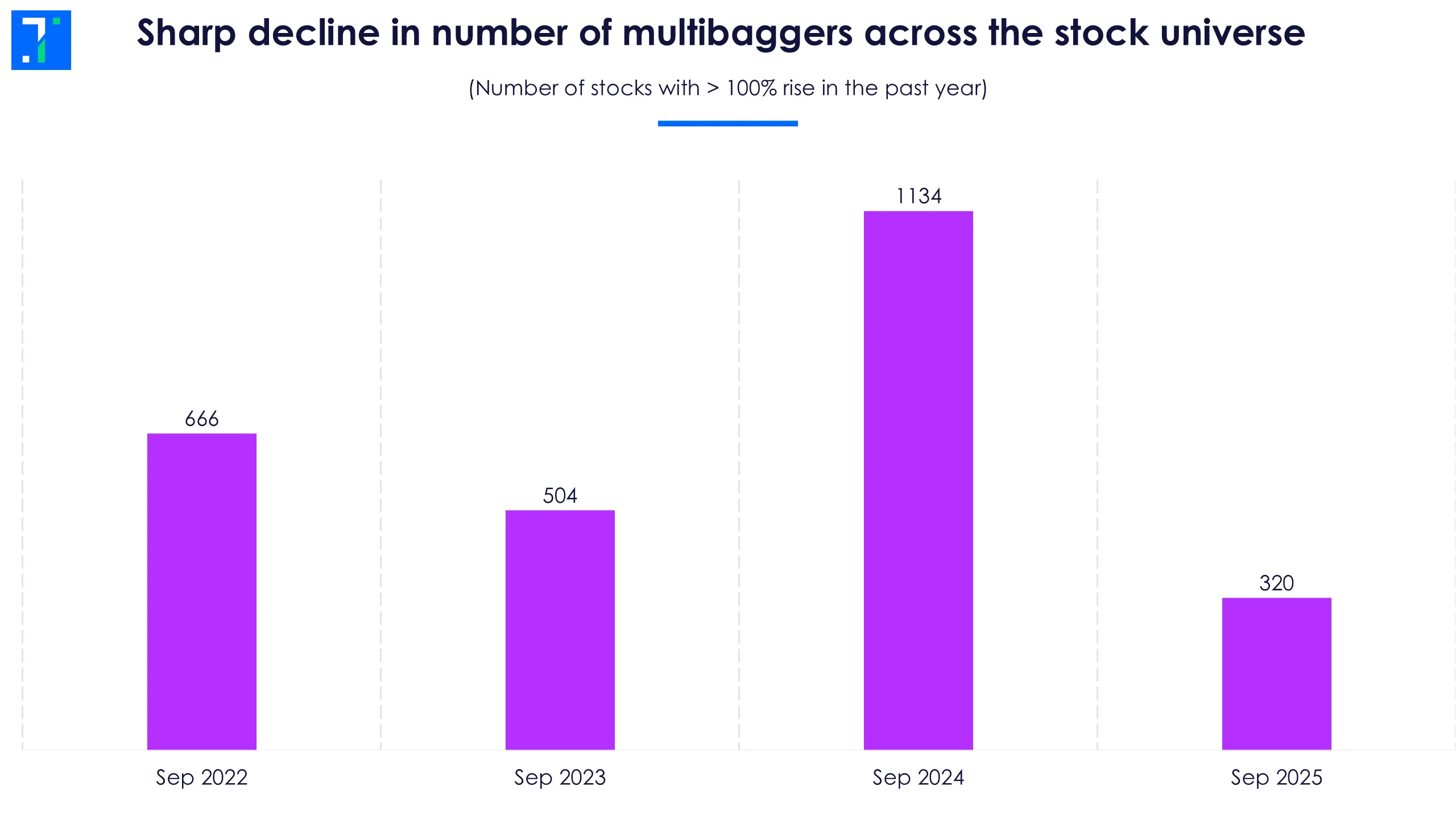

The number of multibaggers also declined across the entire stock universe, not just among Nifty 500 stocks.

Sharp decline in number of multibaggers across the stock universe

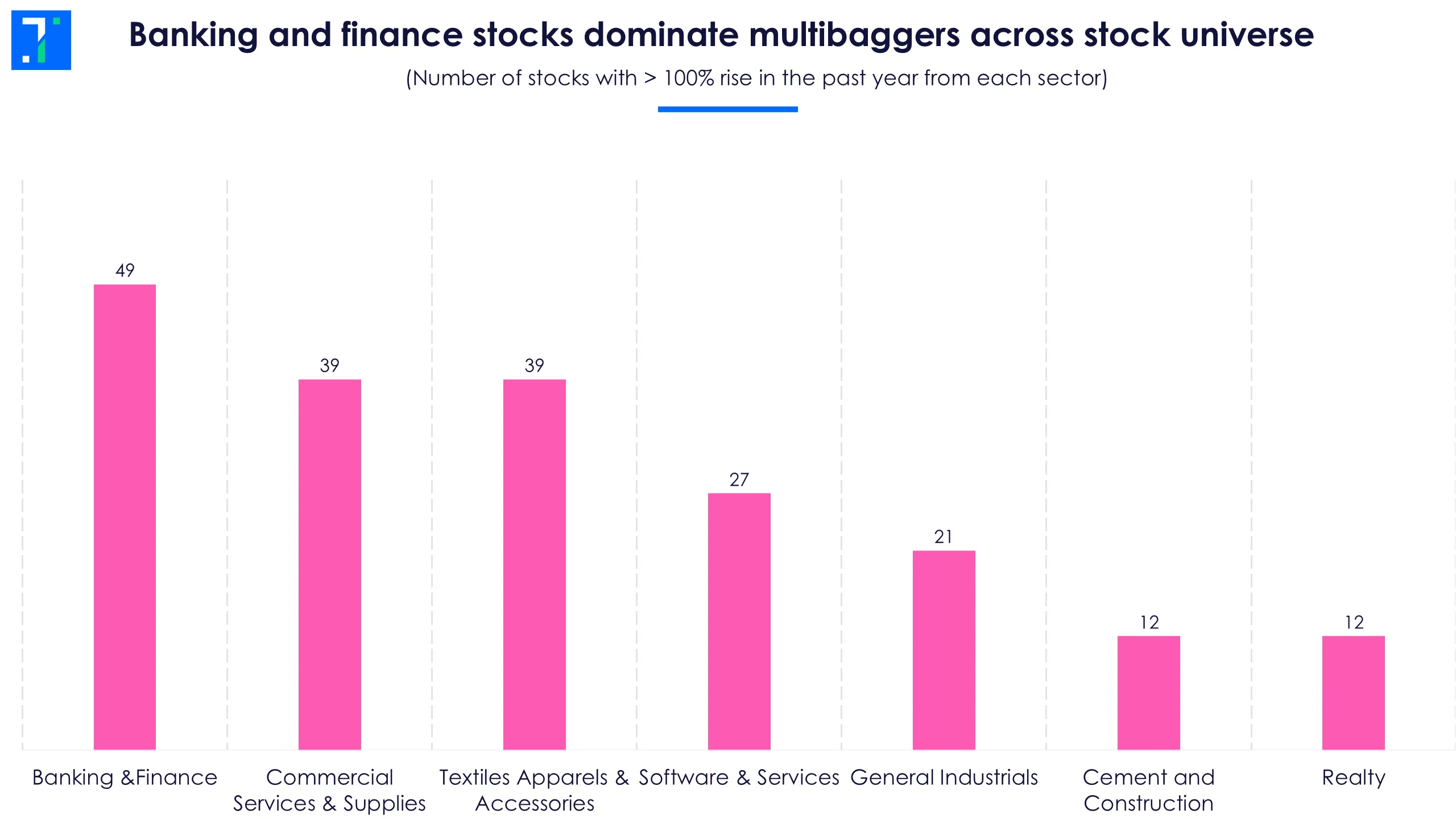

In the broader market outside the Nifty500, Bsome sectors continue to produce multibaggers. Banking and finance, commercial services & supplies, and textiles now account for 40% of all multibaggers.

Banking and finance stocks dominate multibaggers across stock universe

Banking and finance dominate this group. Recent RBI data shows that bank credit grew 9.5% YoY in Q1FY26, while deposits expanded by 10.1%, easing funding pressures for lenders. As a result, 49 out of 320 multibagger stocks belong to this sector, making it the single largest contributor.

Signs of caution: weaker market sentiment

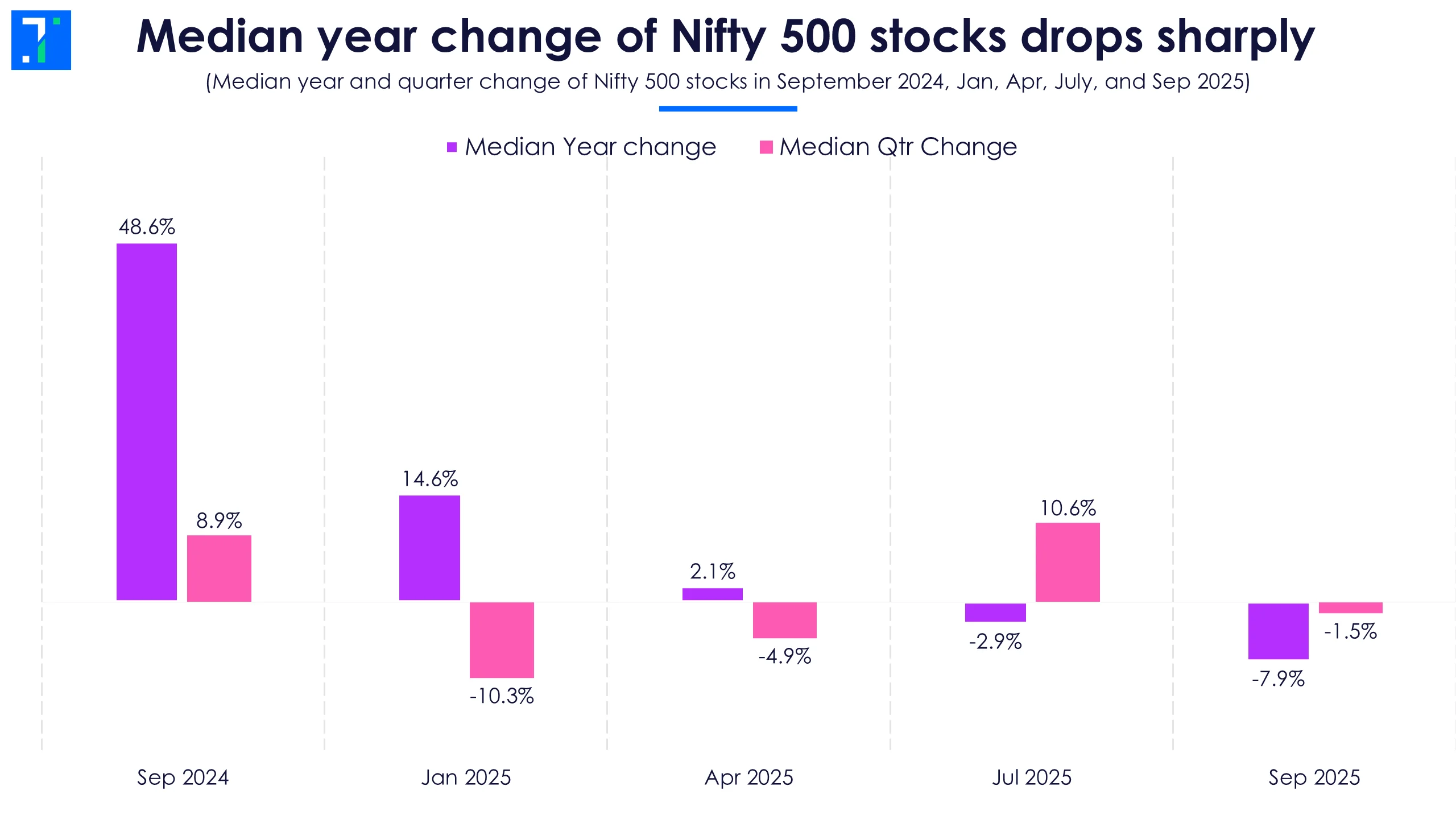

Several market indicators highlight the shift in sentiment. By September 2025, both one-year and quarterly median returns for Nifty 500 stocks turned negative.

Median year change of Nifty 500 stocks drops sharply

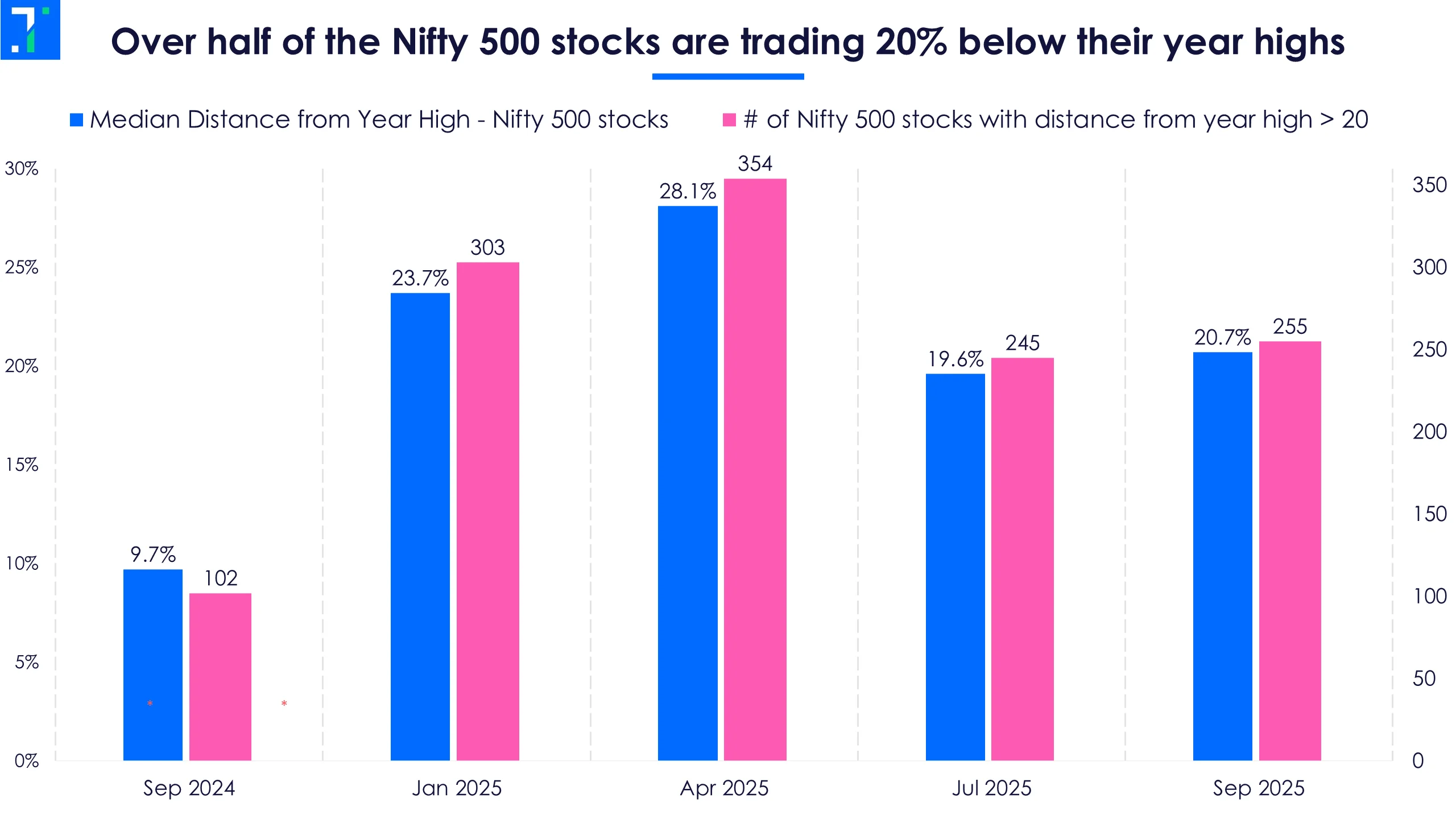

More than half of Nifty 500 companies are now trading at least 20% below their 52-week highs. This gap widened sharply in April this year as markets fell, narrowed in July during a partial recovery, but has barely improved since.

Over half of the Nifty 500 stocks are trading 20% below their year highs

A brief summer rally offered hope that a recovery was underway, but it quickly fizzled out.

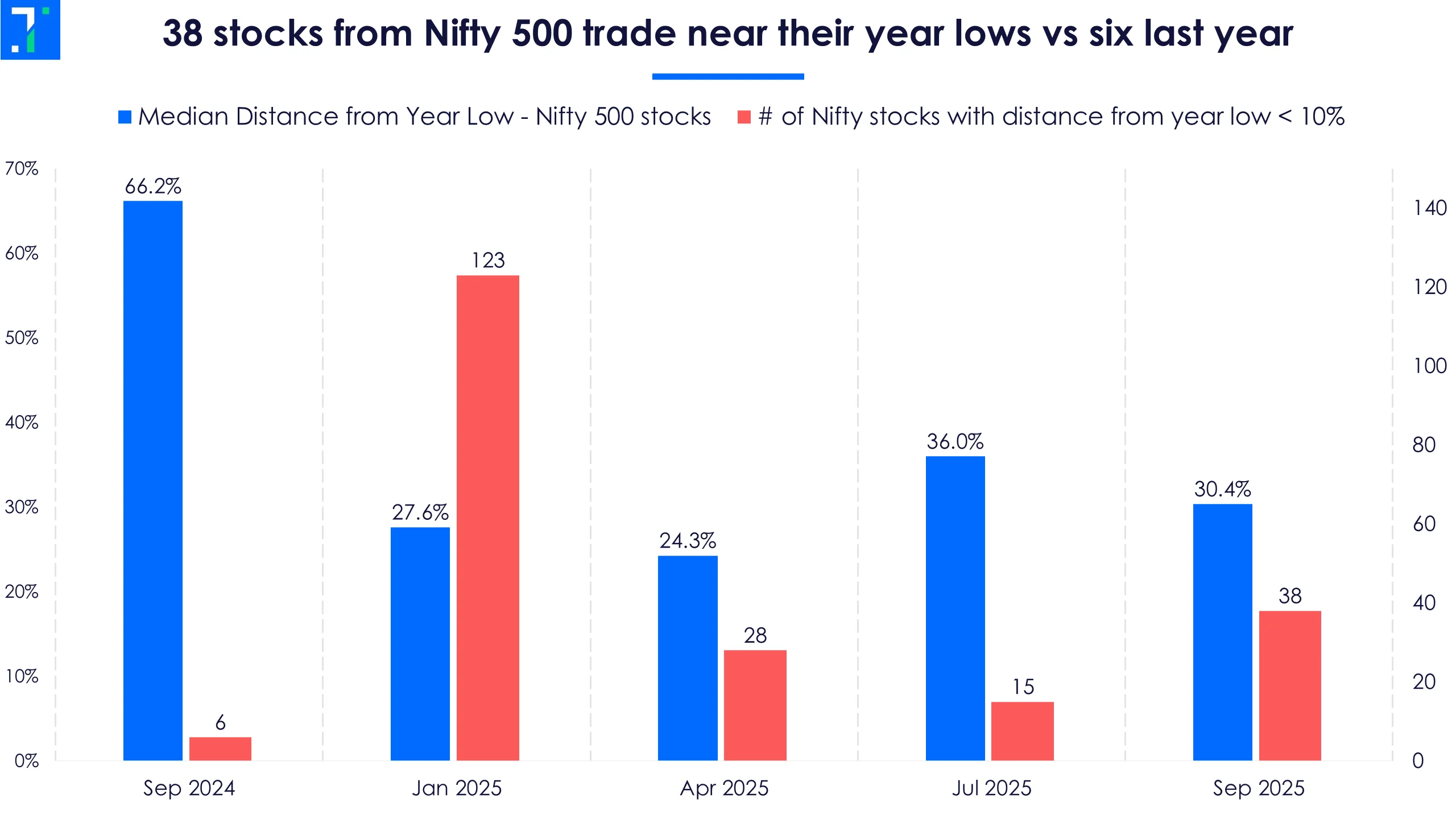

A year ago, the typical stock was 66% above its year-low. Today, it’s hovering just 30% higher, much closer to the ground. In fact, 38 companies are still trading near their year lows, highlighting a weakness that is both deep and widespread.

38 stocks from Nifty 500 trade near their year lows vs six last year

From vanishing multibaggers to stocks trading far below their peaks, the market has clearly shifted from confidence to caution. Investors aren’t chasing rallies anymore—they’re holding their breath and watching every policy move.

The focus now is on trend-changing events: a breakthrough in US-India trade talks, stronger-than-expected earnings in the September quarter, or a festive spending surge fueled by GST cuts. Any of these could bring the bulls back into play.