China and Hong Kong just delivered the best weekly performance for their indices in 16 years, fueled by Beijing’s boldest stimulus package since the pandemic. It was rolled out just ahead of the Golden Week holidays. The surge has investors buzzing—but what does this mean for Indian markets? Is what is good for China, bad for India?

India and China are seen as the two great rising rivals of this century. Much ink has been spilled on comparing the two. The Dragon versus the Tiger, etc etc. In recent months, China's star had dimmed somewhat, with a recession, a real estate bust, and US sanctions. The stimulus however has put China back in the spotlight - for now.

With many analysts seeing Indian stocks as overvalued, there’s growing concern that global money managers might trim Indian holdings to make room in their portfolios for surging Chinese stocks. DBS Bank predicts that Indian equities could face headwinds, underperforming their Chinese counterparts in the near future.

One game-changer for investors eyeing India would be a strong set of Q2FY25 earnings. An upbeat earnings season would boost valuations, easing concerns that the Indian market is too pricey right now. So all eyes are on the upcoming results season.

Which stocks are poised to shine brightest in Q2FY25? We pick five contenders that could deliver a strong performance.

In this week’s Analyticks,

- Q2 pre-results special: Five companies that could deliver high growth in the September quarter

- Screener: Stocks where Q1FY25 revenue growth outperformed their sectors, with high Forecaster estimates for revenue growth in Q2FY25

The big winners: Five stocks expected to stand out in the Q2FY25 results season

Heading into the Q2FY25 results, we shortlisted five stocks from the Nifty 500 that are predicted to post high revenue and net profit growth YoY and QoQ in Q2FY25, according to Trendlyne’s Forecaster. What’s more? These companies already set the bar high with strong results in Q1FY25.

Zomato and Kaynes Tech’s revenue and net profit to rise sharply in Q2FY25E

All five stocks in focus, Zomato, Kaynes Technology India, Kalyan Jewellers India, KEC International and Bharat Electronics are from different industries. All these stocks have not only risen sharply over the past year but have also outperformed the Nifty 50 by a huge margin.

Only Bharat Electronics lags Nifty 50 in the past quarter

As a result of the share price rise, Trendlyne’s Momentum scores for these companies have ranged from neutral to high, indicating buying interest in the market. However, low Valuation scores (except KEC International) signal that they may be expensively priced. But these companies boast of high earnings growth.

All stocks in focus have good Durability scores with strong fundamentals

These companies have high durability scores, thanks to strong financials and management stability.

Zomato zooms in the past year, but will Swiggy spoil the party?

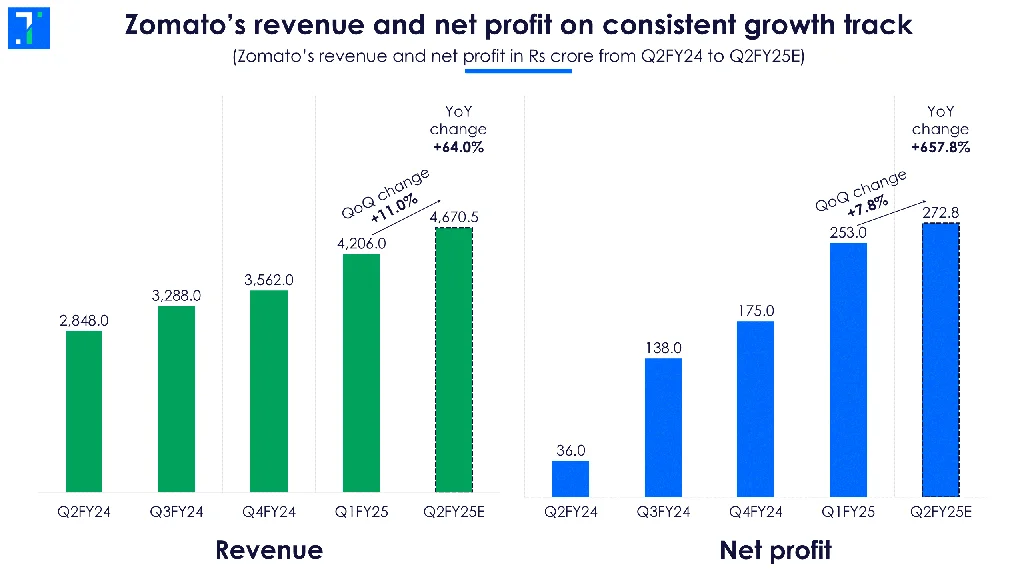

Zomato’s net profit and revenue have risen QoQ every quarter since it posted profit for the first time five quarters ago. Analysts expect the company’s top line and bottom line to rise 64% and 657.8% in Q2FY25.

Zomato’s revenue and net profit on consistent growth track

Blinkit, Zomato’s quick commerce platform, remains the fastest-growing vertical for the company. Blinkit’s gross order value jumped 130% YoY in Q1, while the food delivery segment rose around 26%.

Axis Securities believes Zomato has built a resilient business model by securing multiple strategic verticals across food delivery, dining out, Blinkit and Hyperpure. Zomato acquiring Paytm’s entertainment and ticketing business has added to this.

This food delivery company is in focus after its rival Swiggy filed its updated DRHP for a Rs 3,750 crore fresh issue. Zomatos shares closed 2.3% lower on the same day. While Zomato recorded a profit of Rs 351 crore in FY24, Swiggy reported a loss of Rs 2,350.2 crore in the same period. However, Swiggy managed to reduce its losses by 43% in FY24.

Kaynes Tech on the growth track, enters the semiconductor industry

Kaynes provides design solutions and manufactures advanced electronic modules. Kaynes’ revenue and net profit have been on the rise for the past seven quarters and analysts expect this streak to continue in Q2FY25.

Industrials (including EVs) and automotive are the two major revenue segments driving the company’s top line. These two segments contribute to 85% of the total revenue. Revenue from Industrials (including EVs) and automotive jumped 2.7 times and 56% YoY respectively in Q1FY25.

Industrials (including EVs) and automotive segments drive revenue higher

Management expects revenue to surpass Rs 3,000 crore in FY25 and exceed the previous guidance of 60% YoY growth driven by rising orders from these two major segments.

The company has also forayed into the semiconductor space by setting up a manufacturing unit in Gujarat with an investment of Rs 3,300 crore. Chief Financial Officer Jairam Sampath said, “We get 75% subsidies on plant and machinery from central and state governments. For every rupee of capex, the revenue potential is between Rs 1 to Rs 1.5”. The management expects the first revenue from this plant by Q4FY26.

Kalyan Jewellers’ expansion push drives revenue jump

This gems and jewellery stock has jumped over 10X in the past three years. In 2022, the company started to expand its footprint rapidly in the industry through the Franchise Owned Company Operated (FOCO) model.

Kalyan Jewellers has outperformed its competition by gaining market share on the back of aggressive consumer offers (discount on making charges), higher ad spending and faster retail expansion. Analysts expect the company’s revenue and net profit to rise 31.5% and 44.3% respectively in Q2FY25.

New store additions to drive Kalyan Jewellers’ revenue in Q2

In Q1FY25, its Indian business revenue growth came in at 26.5% YoY, driven by an acceleration in store expansion and same-store sales growth (SSSG) of 12% YoY.

The company added 24 stores in Q1, taking the total count to 241 stores in India. It plans to open 35 Kalyan and 20 Candere stores before Diwali to capitalize on the festival season this year.

T&D emerges as the star segment for KEC International

This engineering, procurement and construction (EPC) company has been on the rise thanks to the capex push by the Centre. The company’s transmission and distribution (T&D) vertical is the major revenue driver. In Q1FY25, the T&D segment grew 17% YoY with its new orders doubling to Rs. 5,000 crore.

T&D and civil segment expected to improve KEC’s profitability

The T&D segment is experiencing significant traction driven by the energy transition. The management anticipates Rs 70,000 to 80,000 crore in opportunities from the integration of 500GW of renewable energy. This segment is projected to grow 25% YoY revenue CAGR over the next 4-5 years.

On September 25, KEC rose 3.7% after the company launched its qualified institutional placement (QIP) issue to raise Rs 4,500 crore.

High order inflows, better execution drive Bharat Electronics’ revenue

Bharat Electronics Ltd. (BEL) is a Navaratna enterprise that has a 37% market share in Indian defence electronics. This stock debuted on the headline Nifty 50 index on 30 September as part of the benchmark index’s rejig.

However, this is the only company among the five that has fallen in the past quarter. But, it has still managed to outperform its industry (Defence) by 4.2%.

Analysts are positive about the company on the back of high order books and revenue visibility. The current order backlog is at Rs.76,705 crore (3.3x FY25E revenue), providing strong visibility for the next 3 to 4 years.

Bharat Electronics’ revenue and net profit to rise in Q2FY25

The company maintains its order inflow guidance of Rs 25,000 crore annually in FY25E & FY26E. This defence electronics manufacturer’s revenue and net profit are expected to rise due to better execution & improving profitability.

Screener: Stocks where Q1FY25 revenue growth outperformed sector averages, with high Forecaster estimates for revenue growth in Q2FY25

Forecaster expects banking & finance stocks’ revenue to grow the most in Q2

As Q2FY25 comes to an end, we look at the best-performing stocks that are expected to continue the growth trend. This screener shows stocks where Q1FY25 revenue growth outperformed sector averages, with high Forecaster estimates for revenue growth in Q2FY25. These stocks have also risen in the past quarter.

The screener is dominated by stocks from the banking & finance, software & services, consumer durables, and pharmaceuticals & biotechnology sectors. Most notable stocks that feature in the screener are BSE, Dixon Technologies (India), ICICI Securities, Multi Commodity Exchange of India, Trent, Eris Lifesciences, 360 One Wam, and Jubilant Foodworks.

BSE appears in the screener with a 158.3% YoY rise in revenue to Rs 674.3 crore in Q1FY25, outperforming the banking & finance sector by 140 percentage points. This helped the stock price to surge by 49.1% in the last quarter. Forecaster expects this exchange company’s revenue to grow by 86.6% YoY in Q2FY25. Analysts at Motilal Oswal believe that the company’s market share will continue to grow, driven by continued momentum in its MF business, and improvement in the cash & derivatives segment.

Trent’s revenue increased by 56.2% YoY to Rs 4,150.1 crore in Q1FY25, outperforming the retailing sector by 42.6 percentage points. Forecaster expects this department stores stock’s revenue to grow by 48.2% YoY in Q2FY25. Axis Direct expects Trent’s sales growth to continue, owing to its focus on rapid store expansion and plans to add new products to its portfolio for the winter season.

You can find some popular screeners here.