Indian markets have been under pressure in the past few weeks, with US President Trump’s 50% import tariffs on Indian goods and a sell-off by foreign investors worried about high valuations and tepid earnings.

But the search doesn’t stop in a volatile market – investors and traders are always on the hunt for alpha, excess returns on their investments relative to the benchmark.

In an environment where sudden downturns can quickly erase short-term gains, the value of patience and a long-term outlook stands out more than ever. As legendary investor Peter Lynch put it, “The real key to making money in stocks is not to get scared out of them.”

This strategy of picking great stocks and then holding them through market cycles is exactly what the ‘DVM - High Performing, Highly Durable Companies’ screener is designed to help with. This screener evaluates companies on multiple factors—including management quality, financial health, valuation, and several dozen technicals— to find high-quality stocks built to deliver superior long-term returns.

In this edition of Chart of the Week, we analyse the historical performance of this DVM screener. The screener selects stocks from the ‘all stocks’ and Nifty 500 universe, with strong financial durability, reasonable valuation, and positive momentum scores. From the shortlisted companies, it chooses the top five stocks with the highest durability scores.

High DVM stocks from the all-stocks universe outperformed those from the Nifty 500 universe

We ran screener backtests for both the all-stocks universe and the Nifty 500 universe from March 2013 to August 2025. These backtests compared the quarterly performance of the strategies against the Nifty 500 benchmark.

The screeners delivered cumulative returns of 6,643.4% and 4,377.7% for all stocks and the Nifty 500 universe, with a CAGR of 40.3% and 35.8%. The time period was over 12 years and 5 months. In contrast, the benchmark’s CAGR stands at 13.7%. The portfolio update frequency chosen for this backtest is quarterly.

The heatmaps track quarterly returns from Q1FY14 to Q2FY26. The all-stocks universe posted positive returns in 30 of 50 quarters and beat the Nifty 500 index in 31 quarters. For the Nifty 500 universe, this strategy delivered positive returns in 34 of 50 quarters and outperformed the Nifty 500 index in 32 of them.

The strategy underwent a maximum drawdown of 55.4% December 2017 to March 2020 for the ‘all stocks’ universe. For the Nifty 500 selection, the strategy saw a maximum drawdown of 28.5% from December 2017 to March 2020. "Maximum drawdown" represents the largest observed loss from a portfolio’s peak to its lowest point before a new peak is attained.

This strategy is automated and does not have a set stop loss, so the drawdowns show the maximum loss potential under this approach. Introducing a stop loss can reduce periods of negative returns and lower maximum drawdowns.

The DVM screener for the all stocks universe currently includes stocks like Kwality Pharmaceuticals, Krishana Phoschem, TGV SRAAC, Khaitan Chemicals & Fertilizers and Infobeans Technologies. Meanwhile, the screener for the Nifty 500 universe has stocks such as GE Vernova T&D India, NAVA, DCM Shriram, Alkyle Amines Chemicals and RHI Magnesita India.

In the course of the backtest, for the all stocks selection, Aegis Logistics delivered the highest returns of 199.2%. Meanwhile, Butterfly Gandhimathi Appliances gave the highest losses of 51.8%. On the other hand, Ceat gave the highest returns of 428.8% for the Nifty 500 universe, while Triveni Engineering & Industries’ stock price had the highest fall of 48.8%.

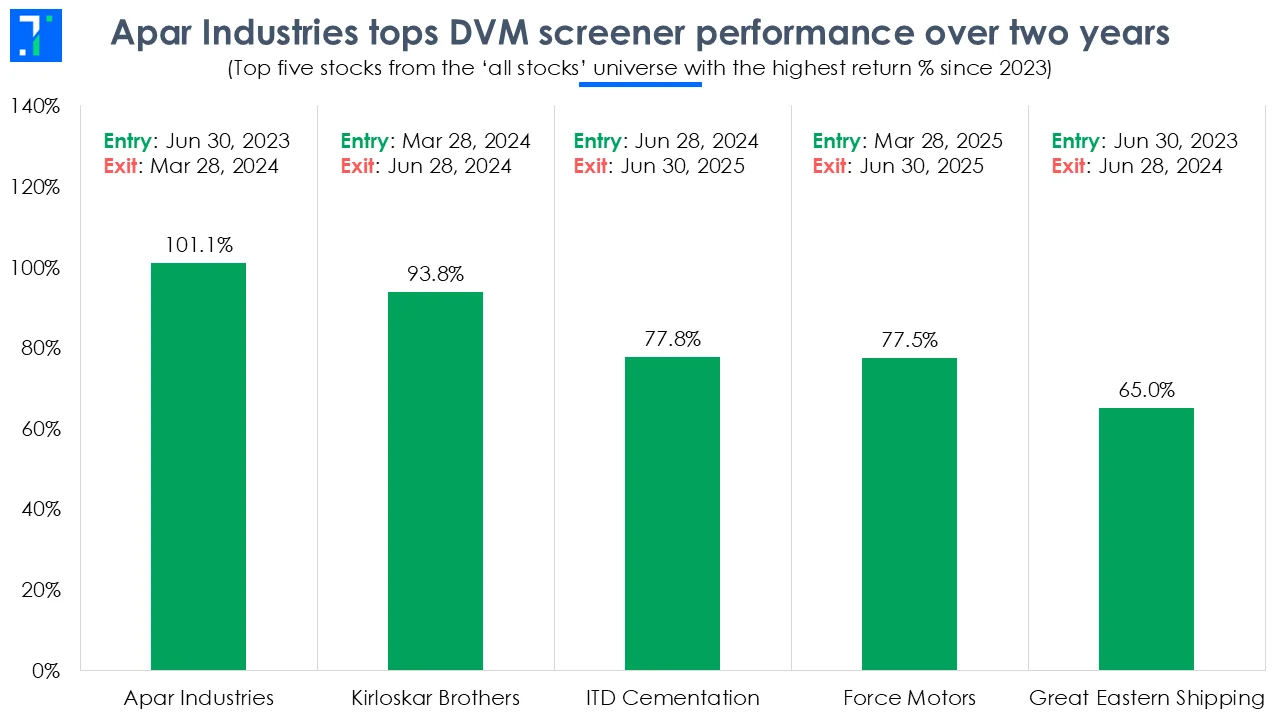

Let’s look at stocks with the highest returns over the past two years from the DVM screener’s backtest. Electrical equipment producer Apar Industries was part of the screener from June 30, 2023, to March 28, 2024. During this period, it delivered a return of 101.1%.

Apar Industries tops DVM screener performance over two years

Kirloskar Brothers, a compressors & pumps manufacturer, was active in the screener from March 28, 2024, to June 28, 2024. In these three months, the company gave a return of 93.8%. Improvements in the company’s financials in Q1FY25 on the back of strong demand in the domestic and export markets helped its stock price surge.

Similarly, Force Motors, a cars & utility vehicles manufacturer, was active in the screener from March 28, 2025, to June 30, 2025. In these three months, the company gave a return of 77.5%. The company secured a significant order to supply 2,978 Gurkha Light Vehicles worth Rs 2,500 crore to the Indian Army and Air Force in March. In Q1FY26, Force Motors’ net profit surged 52.4% YoY to Rs 176.3 crore, led by lower finance costs and an improvement in product mix to higher margin products.

ITD Cementation, a cement & construction company, was active in the screener from June 28, 2024, to June 28, 2025. During this period, the stock delivered a return of 77.8%.

Lastly, Great Eastern Shipping Company, which provides shipping and offshore business services to oil & gas companies, was active in the screener for a year. The stock delivered returns of 65% during the period starting June 30, 2023, to June 28, 2024.

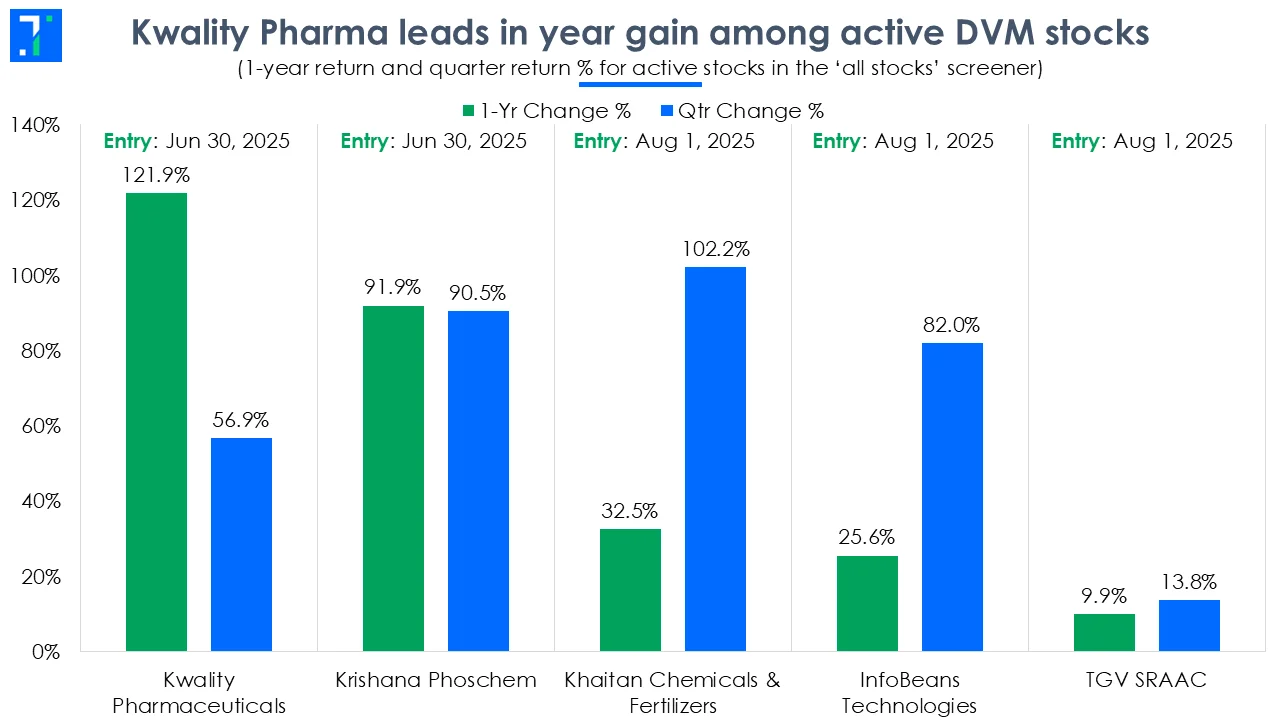

Kwality Pharma leads in year gain among active DVM stocks

Moving to the quarterly and yearly price change percentages of stocks currently active in the screener. Pharmaceuticals company Kwality Pharmaceuticals’ stock price rose by 56.9% in the past quarter and 121.9% in the past year. The company’s net profit increased by 42.7% YoY in Q1FY26, driven by lower inventory expenses.

Fertilizers manufacturer Krishana Phoschem saw its share price surge by 90.5% in the past quarter, with gains of 91.9% in the past year. The company’s revenue increased by 47.9% while net profit jumped 114% in FY25.

Meanwhile, Khaitan Chemicals & Fertilizers, which manufactures single super phosphate fertilisers, sulphuric acid and its variants, witnessed a 102.2% increase in share price over the past year and a 32.5% rise in the past quarter. Infobeans Technologies, on the other hand, saw an 82% uptick in its stock price in the past quarter and a 25.6% growth in the past year.

Lastly, TGV SRAAC saw its share price jump by 13.8% in the past quarter, with a 9.9% rise in the past year. This commodity chemicals manufacturer’s Q1FY26 net profit surged 182.6% YoY.

In summary, this DVM screener identifies stocks that offer medium to long-term gain potential with moderate risk. Despite uncertainties like the pandemic, global conflicts and import tariffs, the all stocks screener delivered a mean quarterly return of 10.6%. It consistently maintained an average of 4.9 stocks, indicating diversified investment, except for Q1FY21, when no stocks qualified. Comparing both universes, the Nifty 500 stocks achieved positive returns in 34 out of 50 quarters, while stocks in the all-stocks universe posted positive returns in 30 out of 50 quarters.

Past backtest returns are not indicative of future returns. This Trendlyne analysis is intended solely for investor education, helping you make informed decisions independently. It should not be interpreted as an investment recommendation