It's been foggy days for Q4 results. The results so far aren’t giving us a clear, one-size-fits-all headline. Some sectors are riding strong on demand, while others are battling cost pressures, weak spending and project delays.

Analyst views are also all over the place. Crisil projects that overall revenue growth for Q4 will be flat at about 5-6%, but that profitability may improve. But Morgan Stanley expects a single-digit decline in profits, hitting a 19-quarter low due to weak revenues and falling margins.

This quarter matters more than most. It gives us an early sense of how India Inc. is preparing for FY26 in an uncertain global environment.

While results so far have been mixed, most results are still not out. So we decided to take a look at what institutional analysts are predicting, with the help of Forecaster. This tells us the numbers Nifty 500 companies are likely to see across revenues, earnings, margins, and capex in this quarter's results.

The indicators we use here are: Q4 estimated revenue growth (YoY%), Q4 estimated earnings per share growth (YoY%), expected change in EBITDA Margin from Q3FY25 to Q4FY25 (percentage points), and FY25 capex growth (YoY%).

Let's dive in!

Revenue winners and losers: Strong numbers look likely for some, with pockets of weaknesses

This quarter looks like a good one for consumer-focused and manufacturing companies. These businesses could see revenues go up from strong demand and new product lines, while infra, energy, and NBFC players grapple with regulatory issues, cost and execution headwinds.

Elara Securities expects consumer electronics companies to benefit from increased local manufacturing, and consumer durable firms to gain from festive demand. In real estate, top developers are likely to see growth from demand in major cities and premium launches, while smaller players face challenges.

Among individual companies, Inox Wind is forecast to deliver strong revenue growth thanks to robust sales of its new 3MW wind turbines. Suven Pharma is expected to benefit from rising CDMO (Contract Development and Manufacturing Organisation) demand and recent acquisitions like Cohance and NJ Bio.

In electronics, Dixon Technologies continues to be a star player, and should see higher revenues from increased mobile manufacturing, growth in its iSmartu brand, and strong refrigeration sales.

Sobha in real estate is likely to gain from over 20% higher bookings in Q4, while Bharat Dynamics in defence may grow with the execution of pending MRSAM (Medium Range Surface to Air Missile) orders.

On the other hand, NBFC revenues may drop due to weak demand, higher credit costs, and stress in microfinance, with net interest margins (NIMs) expected to shrink because of slow rate cuts. Aditya Birla Capital for example, could face topline pressure from regulatory tightening and weak credit growth.

The energy sector may face revenue pressure due to low crude price realisation and high LNG costs. Gujarat State Petronet may be hit by lower LNG production, costly imports and weak pipeline utilisation. Infra and industrial firms like KNR Constructions, PNC Infratech and Siemens see struggles ahead with project delays and a weaker government capex.

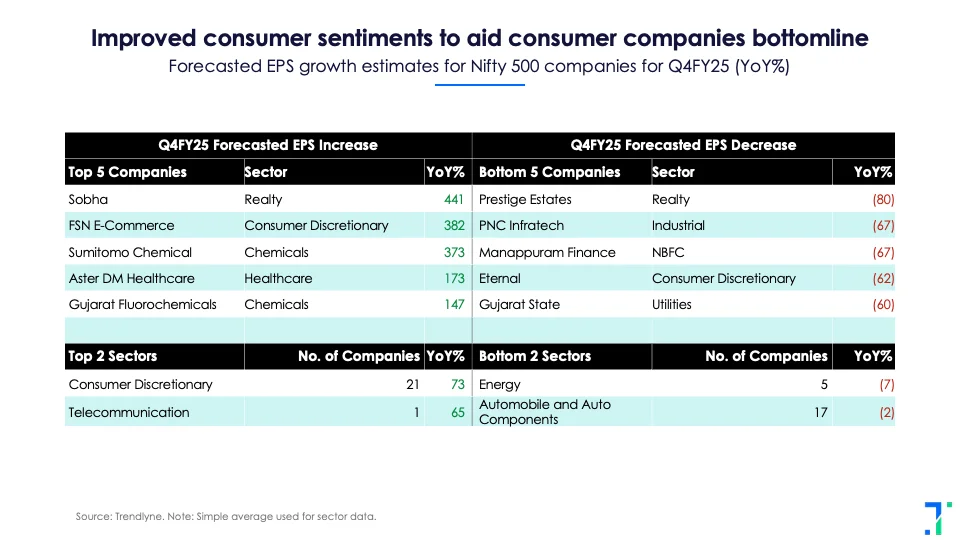

EPS (Earnings Per Share) winners and losers: Consumer players shine, while Energy and Auto are under pressure

HDFC Securities is expecting a profitable quarter for the retail, jewellery and durables sectors, driven by improved consumer sentiment, stable raw material costs and rising temperatures.

Sobha is set to benefit from strong bookings, while FSN E-Commerce (Nykaa)’s growing beauty segment and reduced fashion losses are expected to give its profits a boost.

Another potential winner is Sumitomo Chemical, which should gain from a favourable rabi season, solid exports, and stable costs.

Post its Gulf exit, healthcare company Aster DM Healthcare could improve profitability through cost optimisation and network expansion. Gujarat Fluorochemicals could benefit from industry tailwinds and recovering refrigerant gas prices.

On the flip side, Prestige Estates could see earnings pressure due to a high base and project delays. For Manappuram Finance, rising defaults in its microfinance book remain a concern. Meanwhile, Eternal's aggressive push to scale Blinkit might continue to weigh on profitability.

The revenue headwinds for PNC Infratech and Gujarat State Petronet mentioned earlier are also likely to spill over into its earnings.

At the sector level, consumer discretionary earnings are expected to rise, led by platforms like Swiggy and Nykaa, as well as jewellery firms gaining from elevated gold prices.

In contrast, EPS for the energy sector may fall due to weaker marketing margins and LPG under-recoveries. Similarly, auto could see muted earnings, with pressures from low operating leverage, intense passenger vehicle competition, and rising input costs, especially in natural rubber.

A margin squeeze comes for everyone

On the margin front, Q4FY25 is shaping up to be a challenging quarter, with a sequential decline expected across all sectors. Morgan Stanley writes, “Indian corporates' margins are likely to contract for the first time in two years.”

However, among the few companies that stand out, DLF could post margin gains from a larger share of high-margin, super-luxury residential projects and robust NRI demand. Balrampur Chini and Triveni Engineering in the sugar sector are also expected to expand margins, supported by higher sugar prices amid lower cane availability and increased ethanol diversion.

Natco Pharma could see better margins thanks to a favourable business mix between domestic and US markets, while Bharat Dynamics should benefit from strong revenue traction.

On the red side, Sun TV could suffer from slower FMCG ad spending and a soft theatrical release pipeline. Delays in delivering orders have likely dragged margins for Data Patterns, too. Kansai Nerolac might also see margin compression due to muted demand and intensified competition, while rising operating costs and fewer days in the quarter are expected to impact Airtel's margins.

Weaker government capex has compressed the margins of industrials like KNR Constructions. These two sectors - telecom and industrials - could report the highest sequential declines in margins this quarter.

Capex and private sector spending may finally see some pickup

On the capex front, FY25 is shaping up to be a year of strong private investment across sectors, even as government capex shows signs of slowing. The Ministry of Statistics highlights this trend, noting: “Despite challenges like weak demand, geopolitical tensions, and high borrowing costs, about 30% of firms plan to invest in upgradation in 2024–25, supporting the sharp increase in capex for that year. The slightly lower intended capex for 2025–26, though still above 2023–24 levels, reflects caution after a strong 2024–25”.

Leading the capex charts is the telecom sector, thanks mainly to Vodafone Idea. The company has rolled out a massive Rs. 50,000–55,000 crore investment plan over the next three years to upgrade its 4G and launch 5G services, out of which Rs. 10,000 crore is set to be spent in FY25 alone. Real estate is another sector making big investment moves, with Brigade and DLF leading the charge through expansion into new regions and a push to complete ongoing projects.

Among other sectors, IndiGo is focused on expanding its international footprint and upgrading its fleet, while Eternal's Blinkit wants to proliferate its dark stores and warehouses network.

However, a few companies are hitting the brakes. Inox Wind and Godrej Properties are expected to adopt a more conservative stance, focusing on executing existing projects, managing debt, and optimising cash flows. Similarly, Ramkrishna Forgings and Lemon Tree Hotels are looking to consolidate after recent expansion, while Bikaji Foods plans to prioritise higher utilisation of its current capacity before committing to new investments.

Across the board, most sectors are leaning toward higher capex in FY25, signalling growing confidence in the business cycle recovery and future demand prospects.

Some clear signals are emerging

Q4FY25 is expected to be a quarter of contrasts, with strong revenue momentum in consumer-facing sectors, but margin and earnings pressures for industries linked to energy and autos. On the upside, capex plans are ambitious across key sectors, pointing to long-term growth optimism.