By Divyansh Pokharna

The market ended its six-week losing streak, with the Nifty 50 gaining 1.1% last week. This rise was driven by DII inflows, bringing relief after Trump’s tariff moves against India drove markets down.

India’s retail inflation fell to an eight-year low, thanks to a sharp decline in food prices such as vegetables and pulses. Retail inflation slowed to 1.6% in July, down from 2.1% in June. However, the fall in prices has hurt farmers’ earnings.

Prime Minister Narendra Modi also announced key GST reforms in his Independence Day speech. Anuj Gupta, Director at Ya Wealth, said, “The Government of India has proposed moving nearly 99% of goods from the 12% GST slab to 5%, and a similar shift from the 28% slab to 18%. This may lead to strong buying in consumption-oriented sectors like FMCG, consumer durables, and agriculture.”

Looking ahead, investors await the US Federal Reserve minutes due on Wednesday. If the Fed hints at a rate cut, it could lift global market sentiment and possibly pause FII outflows, as lower US rates make emerging markets like India more attractive.

The IPO market will stay active this week, with ten issues worth over Rs 3,900 crore set to open, including five mainboard IPOs raising about Rs 3,685 crore. In addition, four companies will make their stock market debut, following nine listings last week.

Nine new debuts over the past week, four from the mainboard

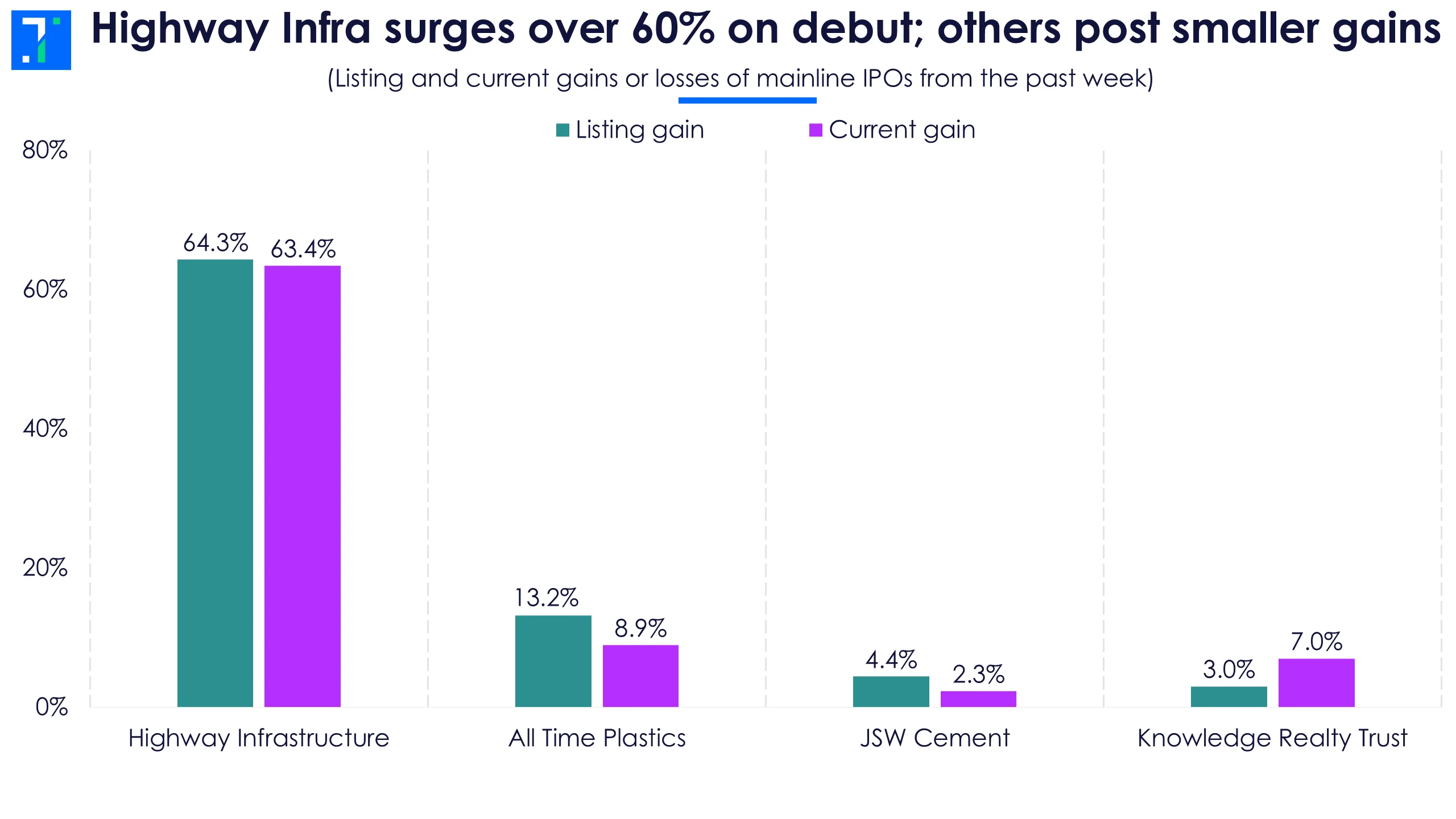

Highway Infrastructure topped last week’s mainboard listings with a 64.3% gain over its issue price of Rs 70. The highways developer saw heavy demand, with subscriptions of 447.3X in the HNI category and 420.6X by QIBs. The stock slipped slightly after listing but still trades 63.4% above its issue price.

All Time Plastics, a houseware products maker, listed at a 13.2% premium after its IPO was subscribed 8.3X. However, the stock fell after listing and is now up 8.9% from its issue price.

Highway Infra surges over 60% on debut; others post smaller gains

JSW Cement and Knowledge Realty Trust made moderate debuts after IPO subscriptions of 7.8X and 12.5X, respectively. JSW Cement is now trading 2.3% above its issue price, while Knowledge Realty Trust (REIT) is up 7%.

Among SMEs, Sawaliya Food Products stood out with a strong listing, debuting 90% higher after its IPO was subscribed 12.4X. Connplex Cinemas also listed on August 14 at a 10.2% premium, with its IPO subscribed 33.3X.

Three SME IPOs listed on August 18 - Medistep Healthcare, Star Imaging Path Lab, and ANB Metal Cast. Medistep and ANB Metal debuted above their issue price, but Star Imaging had a flat listing and has since slipped 3.5% below its issue price.

Primary market prepares for ten launches lined up this week

The primary market will see ten IPOs this week, including five from the mainboard category. Four of the five IPOs are scheduled to open on August 19, close on August 20, and will list on August 26.

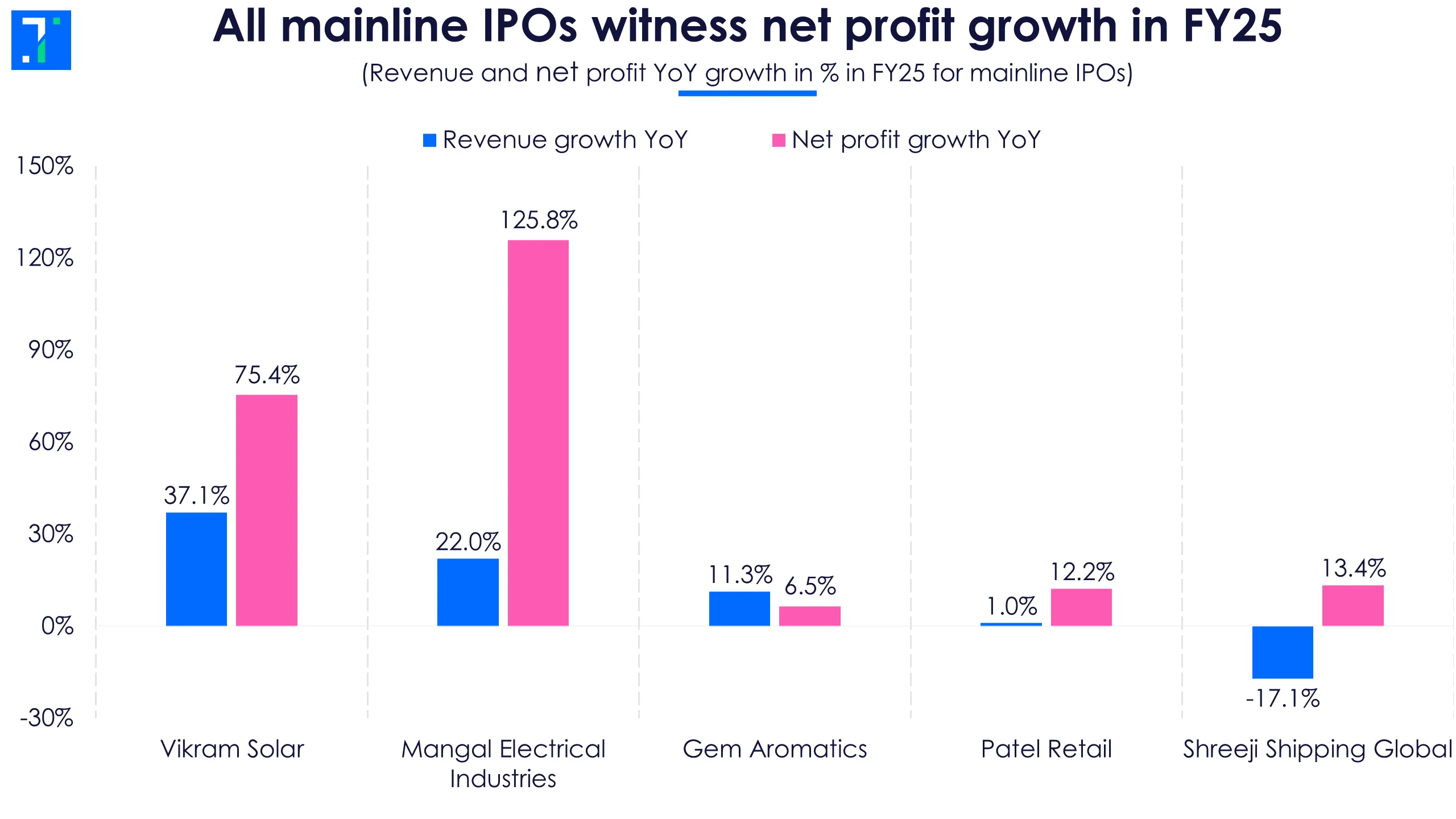

Shreeji Shipping Global: A logistics company that handles dry-bulk cargo at non-major (smaller) ports and jetties in India and Sri Lanka. It aims to raise Rs 410.7 crore via a fresh issue, in a price range of Rs 240–252. The IPO funds will be used to buy Supramax dry bulk carriers and repay borrowings.

Gem Aromatics: A chemicals manufacturer that produces essential oils, aroma chemicals, and other specialty ingredients. It plans to raise Rs 551.3 crore, including Rs 175 crore as a fresh issue, with a price band of Rs 309–325. IPO proceeds will go towards debt repayment for the company and its subsidiary, Krystal Ingredients.

Vikram Solar: A solar module manufacturer looking to raise Rs 2,079.4 crore, including Rs 1,500 crore as fresh issue. The price band is Rs 315–332. The company plans to use the funds for capital expenditure on its phase-I and phase-II projects and for general corporate purposes.

Patel Retail: A department store chain mainly serving tier-III cities and nearby towns such as Thane, Raigad, Ambernath, etc. It sells food, FMCG products, general merchandise, and apparel. The IPO aims to raise Rs 242.8 crore, including Rs 215.9 crore as fresh issue, with a price band of Rs 237–255. The company will use the IPO proceeds to repay debt and meet working capital needs.

All mainline IPOs witness net profit growth in FY25

Mangal Electrical Industries: The company manufactures transformers used in electricity distribution and transmission. It also makes key transformer parts such as laminations, coils, cores, and oil-immersed circuit breakers.

Its IPO will open on August 20, close on August 22, and list on August 28. The company is looking to raise Rs 400 crore via a fresh issue, in a price range of Rs 533–561 per share. The IPO funds will be used for debt repayment, expansion of its facility in Rajasthan, and working capital needs.

Along with the five mainboard IPOs, five SME IPOs are also lined up this week.

- Studio LSD opened its IPO on August 18, will close on August 20, and list on August 25. It aims to raise Rs 74.3 crore with a price band of Rs 51–54.

- LGT Business Connextions will open its IPO on August 19, close on August 21, and list on August 26. It plans to raise Rs 28.1 crore at Rs 107 per share.

- ARC Insulation & Insulators aims to raise Rs 41.2 crore with a price band of Rs 119–125. It will open its IPO on August 21, close on August 25, and list on August 29.

- Shivashrit Foods and Classic Electrodes will open their IPOs on August 22, close on August 26, and list on September 1. Shivashrit plans to raise Rs 70 crore, while Classic Electrodes aims to raise Rs 1.5 crore.

Four new IPOs are lined up for listing this week

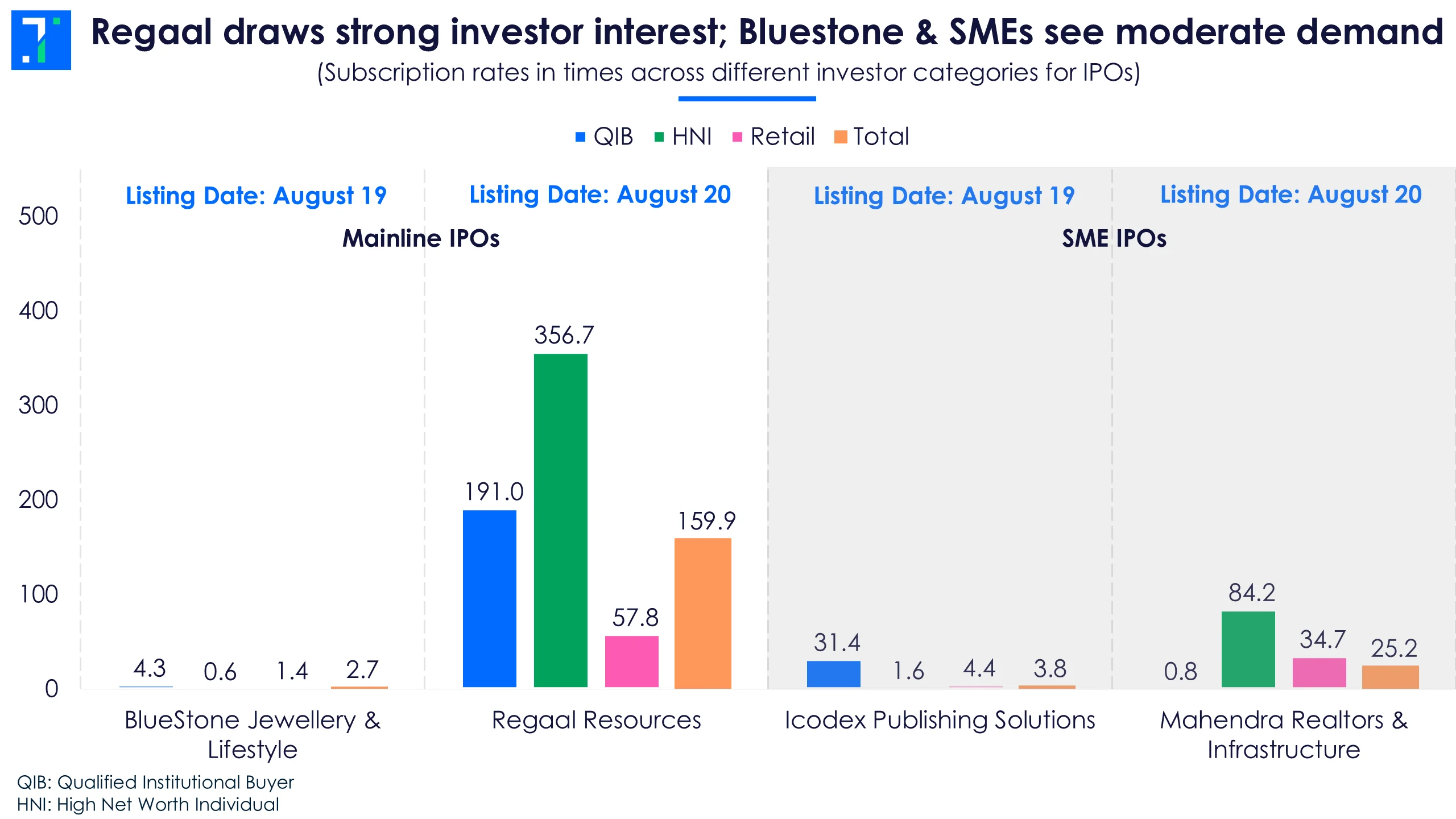

BlueStone Jewellery & Lifestyle received bids for 2.7X the shares on offer. The QIB category saw the highest interest at 4.3X, while the HNI portion was undersubscribed at 0.6X. The gems & jewellery company will list on August 19. This jewellery company sells diamond, gold, platinum, and studded jewellery, offering rings, earrings, necklaces, bangles, bracelets, and more across different price ranges.

Regaal draws strong investor interest; Bluestone & SMEs see moderate demand

Regaal Resources saw strong demand with its IPO subscribing 159.9X. The HNI category was the most active at 356.7X, while retail investors subscribed 57.8X. The company produces maize-based specialty products such as starch, modified starch, gluten, enriched fibre, and food-grade items like flour, icing sugar, custard powder, and baking powder. It will list on August 20.

Among SMEs, Icodex Publishing Solutions and Mahendra Realtors will list on August 19 and August 20, respectively. Their IPOs were subscribed 3.8X and 25.2X.