By Divyansh Pokharna

The Indian stock market ended last week with a 2.7% decline in the Nifty 50, marking its biggest weekly loss in eight weeks. Persistent FII selling, uncertainty over US tariffs and weak corporate earnings have pressured the market.

Additionally, higher-than-expected US inflation at 3% in January reduced hopes of a Federal Reserve rate cut, keeping interest rates in the US high, and pulling international investors to the US market. Fed Chair Powell said that officials want to see inflation drop more, before moving ahead with cuts.

This week, markets are focusing on the Federal Open Market Committee (FOMC) and RBI minutes, Ukraine-Russia peace talks, and manufacturing and services PMI (purchasing managers' index) flash data.

IPO activity remains steady, with eight companies set to list this week, three opening for subscription, and six that debuted last week.

Most IPOs listing this week see tepid investor demand

The upcoming week will witness the listing of eight IPOs on the bourses, with two in the mainline category and six in the SME segment.

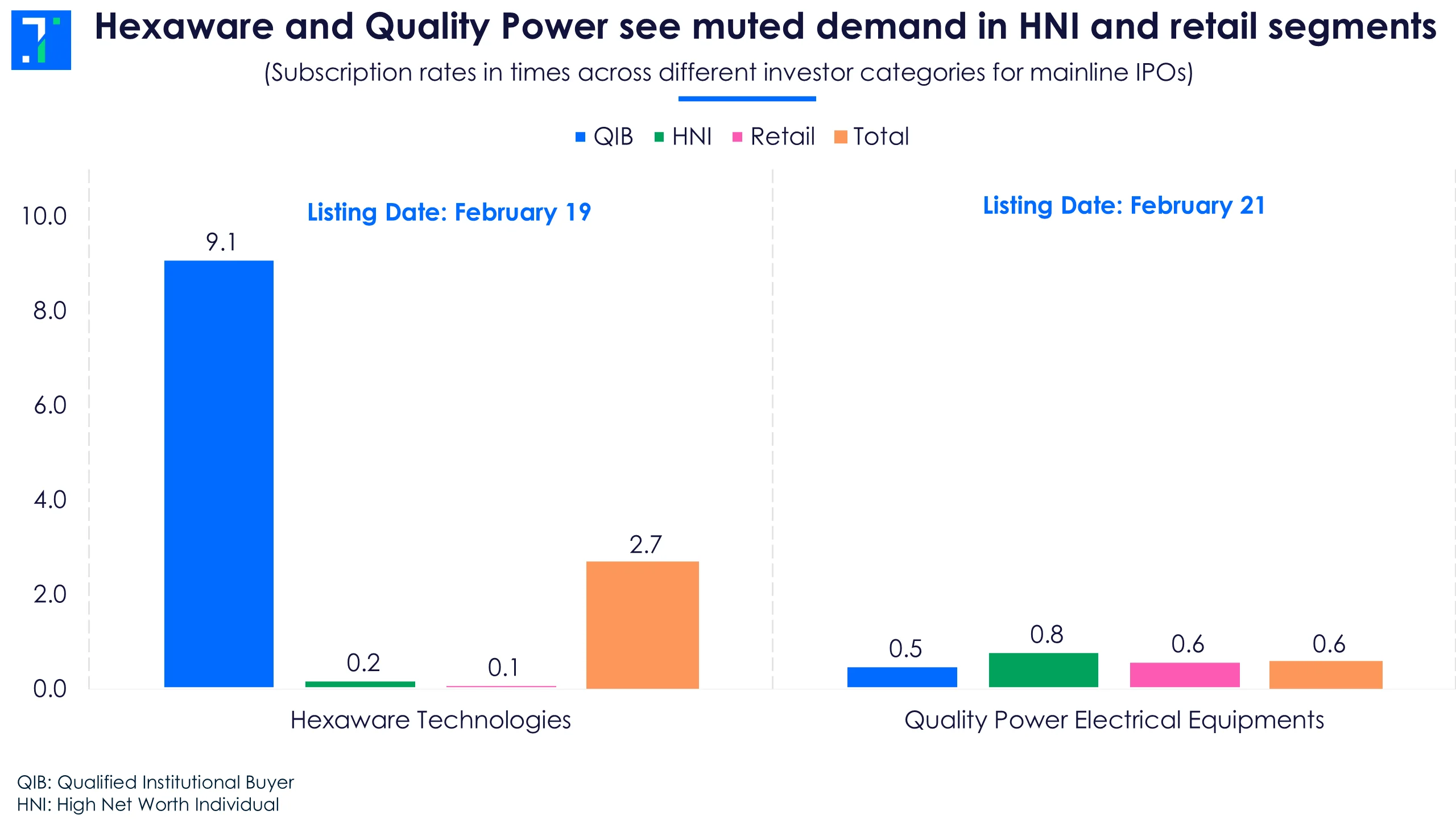

Hexaware and Quality Power see muted demand in HNI and retail segments

Hexaware Technologies: This IT software company received 2.7X subscription to its issue overall, with subscriptions driven by the QIB segment, and retail and HNI categories subscribing only 0.1X and 0.2X.

The Rs 8,750 crore IPO, entirely an offer for sale, closed on February 14 and is set to list on February 19. In CY23, revenue grew 11% YoY to Rs 10,389 crore, while net profit rose 13% to Rs 998 crore. For 9MCY24, the company reported a 13.6% YoY revenue increase, with net profit up 6%.

The company offers AI-driven solutions in cybersecurity, data analytics, automation, and cloud computing. It serves clients in the financial services, healthcare, manufacturing, banking, and transportation sectors through specialised digital platforms like RapidX and Tensai.

Quality Power Electrical Equipments: This heavy electrical equipment company opened for subscription on February 14 and will close on February 18, with the listing set for February 21. It received 0.6X bids on day 1.

The firm operates in the energy transition and power technology sector, offering high-voltage electrical equipment and grid connectivity solutions. It focuses on power products for generation, transmission, distribution, and automation.

The Maharashtra-based firm aims to raise Rs 858.7 crore through its IPO, including a Rs 225 crore fresh issue. It plans to use Rs 117 crore for acquisitions and fund capex for plant and machinery. In FY24, revenue grew 21% YoY to Rs 331 crore, while net profit rose 39% to Rs 56 crore.

Additionally, six SME IPOs are set for listing this week

PS Raj Steels and Voler Car lead in terms of HNI subscription

Three SME IPOs closed on February 14 and are set to list on the NSE SME platform on February 19.

- PS Raj Steels saw a 9.2X subscription, with the HNI segment at 28.6X, while the QIB category remained undersubscribed at 0.6X.

- Voler Car received bids for 12.4X, with HNIs leading at 24.6X.

- Maxvolt Energy Industries was subscribed 3.1X, with the HNI segment at 2.4X, the lowest among the three.

Here are the other SME IPOs scheduled to list this week, with Tejas Cargo set to list on February 24.

- Shanmuga Hospital received a 1.2X subscription by day 2, with HNI bids at just 0.3X.

- LK Mehta Polymers saw an 8.4X subscription by day 2, with retail at 11.3X.

- Royal Arc Electrodes remains significantly undersubscribed at 0.1X on day 1.

- Tejas Cargo, a logistics firm, opened its IPO on February 14 and is set to close on February 18, with a listing set for February 24. The IPO has received bids for 0.3X the total shares on offer so far.

Three SME IPOs to open for subscription this week

Swasth Foodtech: This food processing company is launching its IPO on February 19, closing on February 21, with a listing date set for February 27 on the BSE SME. The Rs 14.9 crore issue is a completely fresh issue, priced at Rs 94 per share. The company specializes in processing rice bran oil for sale to oil manufacturers and packers.

Beezaasan’s revenue declines in FY24, while HP Telecom & Swasth post growth YoY

Beezaasan Explotech: This industrial products company will open its IPO on February 21 and close on February 25, with a listing date set for March 3 on the BSE SME platform. The Rs 59.9 crore IPO is completely a fresh issue, priced between Rs 165-175. The company manufactures and supplies explosives and explosive accessories.

HP Telecom India: This specialty retail firm will open its IPO on February 20 and close on February 24, with a listing date set for February 28 on the NSE SME platform. The Rs 34.2 crore IPO is a complete fresh issue, priced at Rs 108. The company distributes mobile phones, accessories, and related products, holding exclusive distribution rights for Apple, Nothing, and other brands in multiple states.

Ajax Engineering lists at a discount on market debut

Ajax Engineering listed at an 8.4% discount on February 17, below its issue price of Rs 629. The commercial vehicle maker’s weak debut may be attributed to its Rs 1,269.4 crore IPO being a complete offer for sale (OFS), meaning it will not receive any proceeds.

Ajax Engineering lists at a discount; Chamunda Electricals & Solarium lead SME listings

Ajax Engineering manufactures concrete equipment, specializing in self-loading concrete mixers (SLCM). In FY24, its revenue surged 52% YoY to Rs 1,780 crore, while net profit rose 66% to Rs 225 crore.

Meanwhile, seven SME IPOs listed on the stock exchange, with three debuting at a premium, one at its issue price, and three at a discount.

Eleganz Interiors, Ken Enterprises, and Amwill Health Care listed at discounts of 6.2%, 9.6%, and 20%, respectively, with Ken Enterprises falling the most to 22.4%.