By Melissa Koshy

Indian stock markets climbed for the third straight week, with the Nifty 50 index gaining nearly 0.9%. The rally was fueled by consistent buying from domestic institutional investors, a slowdown in selling by foreign investors, and optimism for a strong festive season following recent GST changes. A recent interest rate cut by the US Federal Reserve and positive news on India-US trade talks also boosted market sentiment.

However, the gains were capped, with the benchmark index closing 0.5% lower on September 22, after the Trump administration announced it would raise the fee for H1-B visas to $100,000, creating pressure on Indian IT stocks.

"The focus now shifts to sectors that could benefit from the latest GST reforms as we enter the festive season," said Ajit Mishra, Senior VP of Research at Religare Broking. "We'll also be closely watching for any change in strategy from foreign institutional investors after the Fed's rate cut."

It's set to be a blockbuster week for the IPO market, with 29 new public offerings aiming to raise around Rs 7,500 crore. In addition, eight companies are scheduled to make their stock market debut, following 12 listings last week.

12 new companies listed last week

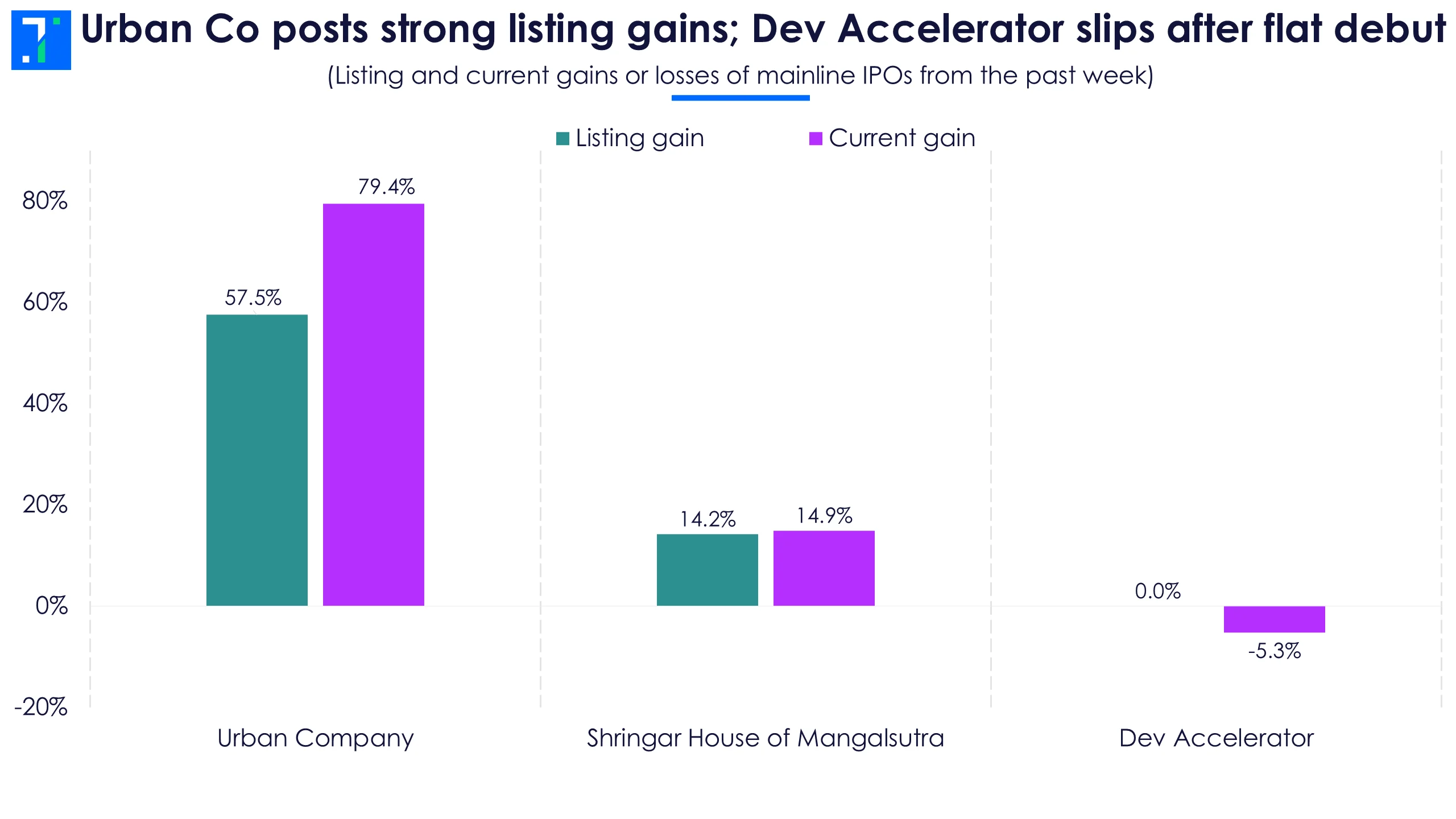

Last week saw three mainline IPO debuts: Urban Company had a stellar opening, listing at a 57.5% premium. The stock is now trading 79.4% above its issue price after its IPO was oversubscribed by more than 103X.

Shringar House of Mangalsutra debuted at a 14.2% premium and is currently up 14.9% from its issue price. Dev Accelerator had a flat debut and is now trading 5.3% below its initial price.

Urban Co posts strong listing gains; Dev Accelerator slips after flat debut

Among SME debuts, TechD Cybersecurity, Airfloa Rail Technology, and L.T.Elevator were the top performers. TechD and Airfloa both listed at 90% premiums and L.T.Elevator debuted at a 74.5% premium. TechD’s IPO saw strong demand, with a subscription of 668X, AirfloaTek saw 281X oversubscription, while L.T.Elevator’s shares were subscribed 170.3X. All three companies are trading well above their issue prices.

Taurian MPS debuted at a 22.8% premium after bids for 9.9X the shares offered. It currently trades 56.7% above its issue price. Karbonsteel Engineering listed at a 16.4% premium, and is now trading 19.6% above its issue price.

Jay Ambe Supermarkets debuted at a 1.3% premium and is trading 19.9% above its issue price. Its subscription stood at 59.8X. Galaxy Medicare made a flat debut at Rs 54 after its IPO was subscribed 1.8X. It currently trades 18.4% below its issue price.

Meanwhile, Nilachal Carbo Metalicks and Krupalu Metals both listed at a 20% discount and are currently trading below their issue price.

IPO rush: 28 issues set to open this week

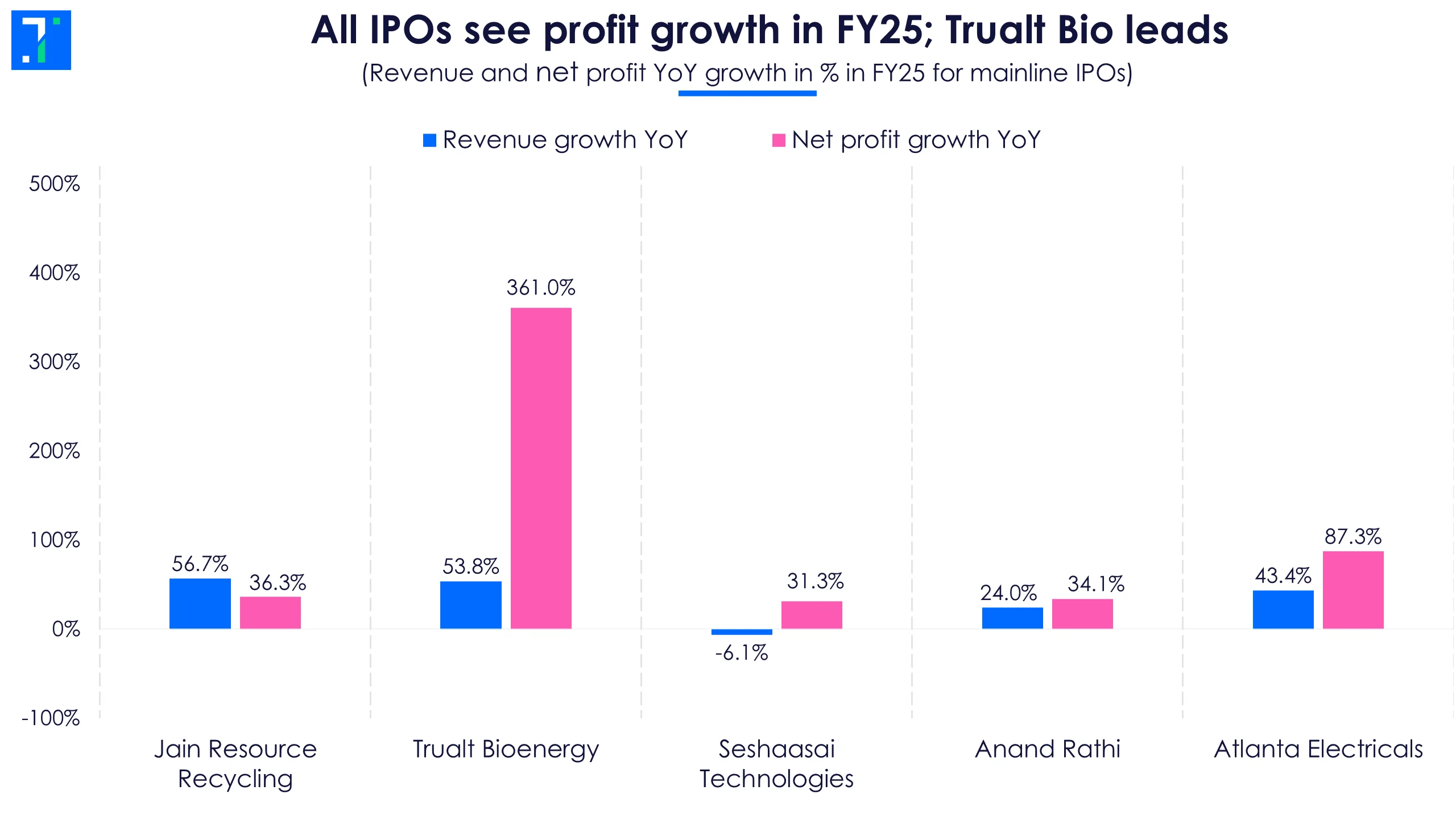

This week's largest public offering comes from Jain Resource Recycling, a company that recycles and manufactures non-ferrous metal products. The company plans to raise Rs 1,250 crore with a price band of Rs 220-232. Its IPO will be open from September 24-26, and will list on October 1.

Trualt Bioenergy is involved in the production of biofuels, with a focus on the ethanol sector. Its Rs 839.3 crore issue will open on September 25, close on September 29 and will list on October 3. The price band is set at Rs 472-496 per share.

Seshaasai Technologies is a technology solutions provider offering payment and communication solutions to the banking, financial services, and insurance (BFSI) industry. Its IPO will open on September 23, close on September 25, and is set for listing on September 30. The company aims to raise Rs 813 crore at a price band of Rs 402-423 per share.

Brokerage firm Anand Rathi, which offers investment options in equity, derivatives, commodities, and currency markets, will be open from September 23-25, and will list on September 30. The company plans to raise Rs 745 crore via a fresh issue. The price band is set at Rs 393- 414.

Atlanta Electricals manufactures power, auto and inverter duty transformers. Its IPO opened on September 22 and will close on September 24, with the listing scheduled for September 29. It aims to raise Rs 687 crore at a price band of Rs 718-754.

In addition, another six mainline IPOs are also opening this week.

- Ganesh Consumer Products opened its IPO on September 22, will close on September 24, and list on September 29. It aims to raise Rs 409 crore with a price band of Rs 306-322.

- Jaro Institute of Technology Management & Research’s IPO will be open from September 23-25, and will list on September 30. It plans to raise Rs 450 crore at a price of Rs 846-Rs 890 per share. Solarworld Energy Solutions’ Rs 490 crore IPO will also open on September 23, close on September 25, and list on September 30.

- BMW Ventures and Epack Prefab Technologies’ IPOs will be open from September 24-26, and will list on October 1. BMW Ventures aims to raise Rs 231.7 crore with a price band of Rs 94-99. Epack plans to raise Rs 504 crore, with a price range of Rs 194-204.

- Jinkushal Industries’ IPO will be open between September 25-29, with the listing on October 3. Jinkushal plans to raise Rs 116.2 crore.

All IPOs see profit growth in FY25; Trualt Bio leads

The primary market action gets hectic as 18 SME IPOs are also on tap this week.

- Solvex Edibles and Prime Cable Industries opened their IPOs on September 22, will close on September 24, and list on September 30. Solvex aims to raise Rs 18.9 crore, while Prime Cable plans to raise Rs 40 crore.

- IPOs of Ecoline Exim, NSB BPO Solutions, and Matrix Geo Solutions will be open from September 23-25, and are set for listing on September 30. The issue sizes of these IPOs are Rs 76.4 crore, Rs 77.9 crore, and Rs 40.2 crore, respectively.

- True Colors, Aptus Pharma, and BharatRohan Airborne Innovations will also open for subscription between September 23-25, with listing set for September 30.

- Praruh Technologies, Gurunanak Agriculture India, and Riddhi Display Equipments will open on September 24, close on September 26, and will list on October 1. Praruh aims to raise Rs 23.5 crore, Gurunanak Agriculture will raise Rs 28.8 crore, while Ridhi Display plans to raise Rs 24.7 crore.

- Justo Realfintech and Systematic Industries will also be open between September 24-26, and list on October 1.

- Chatterbox Technologies and Telge Projects will be open for subscription from September 25-29, with listing set for October 1.

- Bhavik Enterprises, DSM Fresh Foods and Gujarat Peanut & Agri Products’ IPOs will open on September 25, close on September 30, and will list on October 6.

Five mainboard and three SME firms are lined up for listing this week

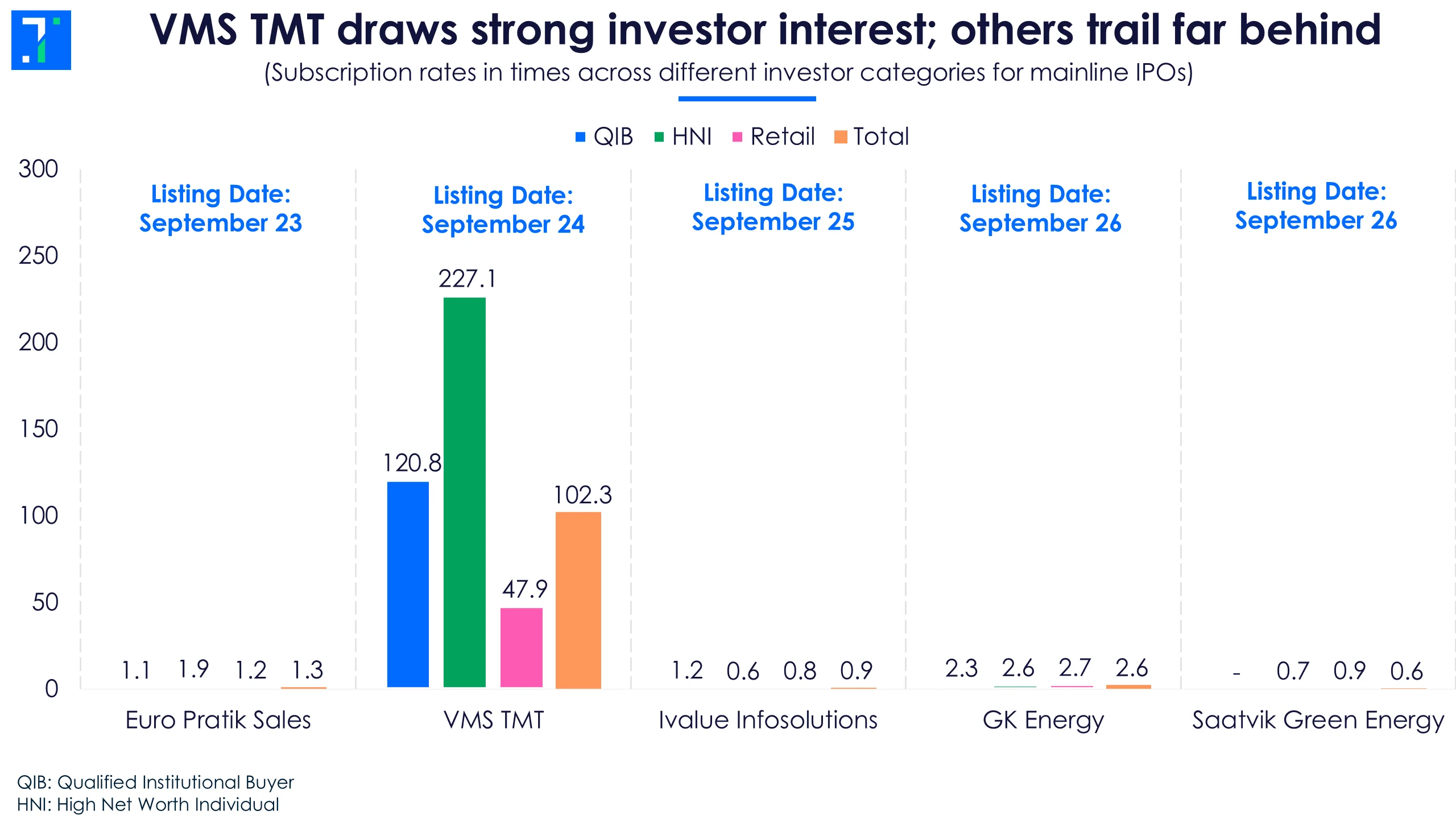

Among mainline IPOs, VMS TMT stood out as it received bids for 102.3X the shares on offer, with HNIs showing strong interest at 227.1X. The company is set to list on September 24. VMS TMT manufactures and sells thermo-mechanically treated (TMT) bars. It also deals in scrap and binding wires, distributing products in Gujarat and other states.

Euro Pratik Sales received bids for 1.3X the shares on offer. The company is set to list on September 23. Euro Pratik Sales designs and sells wall panels and laminates. The company offers eco-friendly, durable alternatives to traditional wall coverings.

iValue Infosolutions is set for listing on September 25. The IPO of this technology services and solutions provider was underscribed at 0.9X as on day 2.

Meanwhile, GK Energy and Saatvik Green Energy are scheduled for listing on September 26. GK Energy’s IPO received bids for 2.6X the shares on offer, while Saatvik Green’s remained undersubscribed by 0.6X as on day 2.

VMS TMT draws strong investor interest; others trail far behind

Three SMEs are also lined up for listing this week:

- Sampat Aluminium is set for listing on September 24. Its IPO received bids for 153.8X the shares on offer.

- JD Cables’ IPO closes on September 22 and will list on September 25. Its IPO was subscribed 8.2X on day 2. Meanwhile, Siddhi Cotspin will close on September 23, and will list on September 26. Its IPO received bids for 2.0X the shares on offer on day 1.