Later this month, Finance Minister Nirmala Sitharaman will present the Budget.

The optics may be the same -- the pink briefcase, the handloom sari -- but this time the FM is presenting a Budget on behalf of a coalition government, with somewhat different priorities.

As a result, we have three new themes that are in focus this year for the government and investors. They are 1) the rural sector 2) renewables and 3) major companies from a particular state - Andhra Pradesh.

India's changed political economy is influencing two themes in particular: rural players, and Andhra Pradesh stocks. Coalition politics and upcoming state elections are pushing the government to address rural distress. Second, Andhra Pradesh has entered the spotlight with the Telugu Desam Party's (TDP) rising power at the centre and state, and its involvement in a few businesses.

And renewables is one space where reform momentum from the previous government is likely to continue, despite coalition politics.

In this week's Analyticks:

- Three themes: Rural, renewables and AP stocks are in focus for investors

- Screener: Stocks in this list likely to outperform, according to analysts

Let's look closer.

Are we set for a rural rebound in FY25?

The rural economy has been taking some punches: a below-normal monsoon last year, falling agricultural growth, lower wages. The government took steps before the budget to boost this sector, by increasing MSP for crops and removing fertilisers from the GST ambit.

The forecast this year is for a normal to above normal monsoon. So its worth keeping an eye on rural-linked sectors such as fertilisers, agrochemicals, two-wheelers, tractors, and FMCG.

But government action and a good monsoon are the only hopes at the moment for rural stocks. If things don’t work out here, all the gains will be wiped out. For example, although a normal monsoon was predicted, June had a deficient rainfall of around 20%.

The hoped-for rural revival: Is a turnaround ahead for agrochem?

In the case of fertilizer stocks, Anand Rathi Institutional believes that the recent rally has already priced in everything – normal monsoon, GST, and subdued raw material prices. But Chambal Fertilisers, whose net profits grew double digits when its peers saw a decline, has managed the market better than others.

Analysts like ICICI Securities are also expecting a turnaround in agrochemicals stocks. FY24 saw an industry-wide drop in agrochemical prices and destocking in international markets. Destocking is expected to continue till the first half of FY25 in the US & Europe, and so the outlook on the domestic business is more promising than exports.

Therefore, domestic-oriented businesses with strong fundamentals and valuations, such as Insecticides India are on the radar for analysts.

Tractor sales are closely tracked when talking about the rural economy. But the year to date sales growth in FY25 up to May are flat. So although many analysts are optimistic, it may be too early to ride on this segment. Rajesh Jejurikar, ED & CEO, Auto & Farm Sectors, M&M, in its Q4 earnings call, said, “Cash will not come back so quickly right now, given they are coming off negative from last 4-5 months of rabi output. But there is a lot of optimism about how the second half can bounce back very strongly.”

However, Bajaj Auto, one of the leading two-and-three-wheelers companies, is getting a boost on the valuation front amid rising two-wheeler sales.

In the rural theme, the FMCG sector has always been one investors track when monsoons are good. In terms of strong fundamentals, Colgate-Palmolive, Emami, Nestle and Britannia top the list. And when most FMCG companies were complaining about the rural slowdown, Colgate and Emami still saw strong rural demand. Their performances could improve even further with a rural turnaround.

Can we light up the market with renewable energy?

Investors cannot ignore renewable energy generation, whose demand is rising sharply with a rise in electricity consumption and the goal of becoming net zero by 2070.

India’s renewable energy capacity is estimated to reach 180 GW by 2026 from 130 GW in FY24, requiring an outlay of Rs. 3 lakh crores, according to Crisil.

The sector is also attractive because of the PLI scheme for solar PV module manufacturing. These facilities with a combined capacity of 39,600 MW will be operational by April 2026 in three stages. Private-sector participation through government support will keep rising in the next few years.

However, the sector has seen some policy flip-flops. Slow progress on the rooftop solar scheme, rising import duties on raw materials and policy changes in ALMM (Approved List of Models and Manufacturers) have created challenges for manufacturers. The export market is also a tough nut to crack: here India-made products have to compete with cheaper Chinese options, limiting market share internationally.

Renewable players that analysts are bullish on

Utility stocks have had a handsome run over the past few years. However, only one stock looks well-positioned to take advantage - Tata Power.

Analysts are bullish on both solar and wind energy. However wind power by itself is unlikely to be an attractive proposition anytime soon, overshadowed as it is by solar and its broader applicability. Tata Power’s diverse portfolio of renewables is therefore, hard to beat. Currently, 40% of its capacity constitutes clean and green energy (solar 24% and wind 7%) and it aims to increase it to 70% by 2030. It has a Rs. 13000 crores+ order book in the solar utility EPC business. It’s also ramping up solar cell and module production capacity by another 4GW. It is a leader in the rooftop solar market with a 13% share.

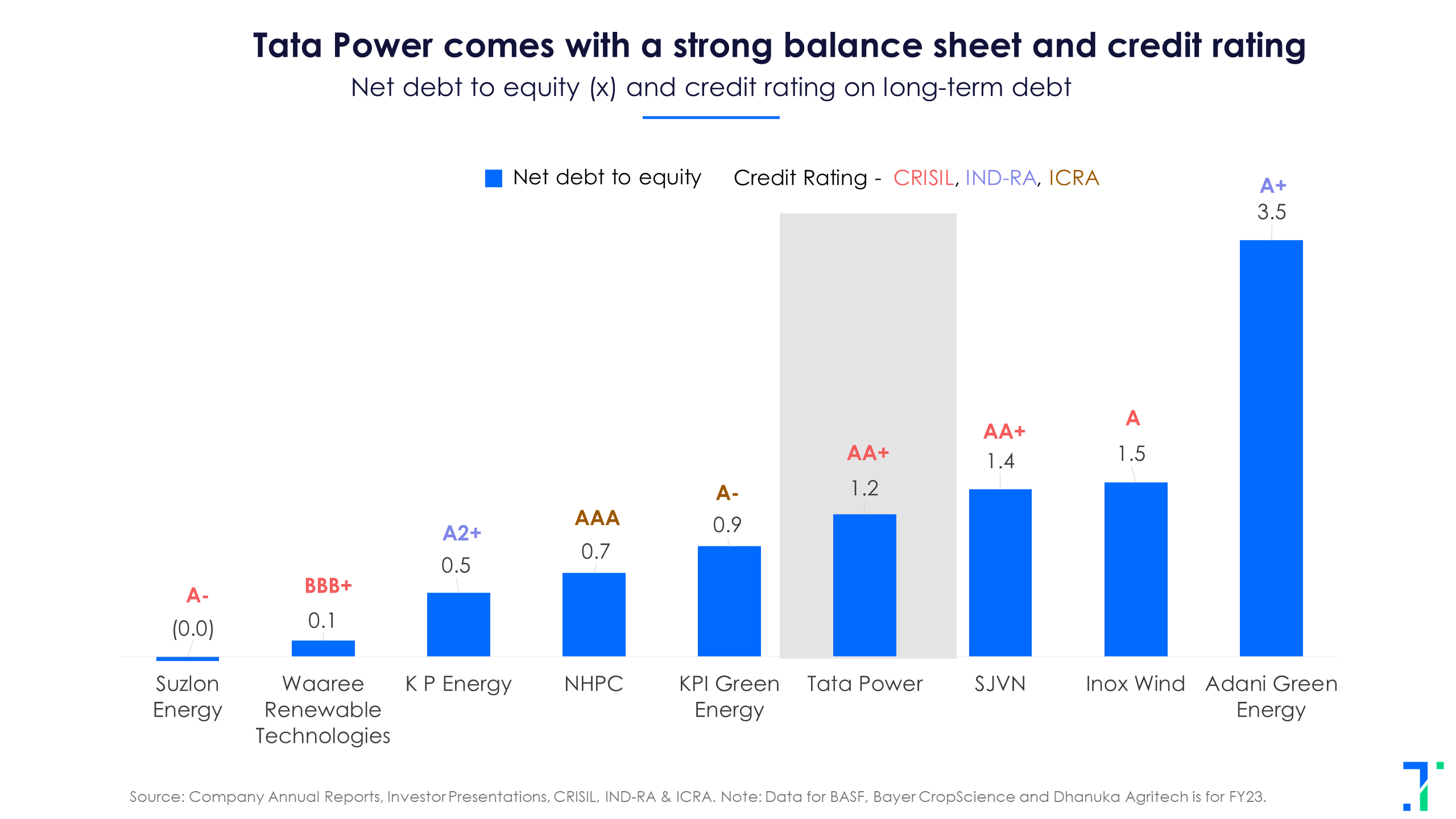

One thing to watch for is the debt levels of renewable energy players. Of Rs. 3 lakh crores of capex required for increasing India’s renewables capacity, ~70% is estimated to be met by debt funding. Tata Power’s balance sheet and credit rating would support additional borrowing, if needed.

The kingmakers: Andhra Pradesh is in the spotlight

When the Andhra Pradesh party TDP became a coalition partner in the new government, Economic Times mentioned a few key stocks with AP connections. The list included Heritage Foods, Amara Raja Energy, Aurobindo Pharma, Avanti Feeds, Sagar Cement, Godrej Agrovet, KNR Construction, Likhita Infra and KCP.

TDP chief Chandrababu Naidu’s son is a promoter of Heritage Foods. Former TDP MP Jay Dev Galla leads Amara Raja. The other stocks are based out of, or have significant operations in the state. We took a closer look at these players. It's worth keeping in mind that policy and political missteps could turn these companies sour for investors.

AP-linked stocks on the radar

Amara Raja became a stock market darling over the last month, gaining ~40% driven by election results and a deal signing with GIB. Compared to its peers, it is an outlier -- although it has long-term growth drivers, its valuation is high.

Within Andhra’s cement sector, KCP has emerged as strong performer, followed by NCL Industries. Both have lower valuations and higher EBITDA margins compared to Sagar Cements, the other Andhra-based cement company.

In heavy-engineering companies KNR Constructions has been a performer. These three companies also have lower debt, as their debt-to-equity ratios are below 1 (0.3x, 0.3x, and 0.4x, respectively).

Food companies like Heritage Foods and Avanti Feeds, and pharma company Natco Pharma have the edge over others in their sectors so far, based on analyst estimates, scores and FY24 ROE.

Stock markets don't come with guarantees. But these three themes have emerged as interesting ones as India's political and economic winds shift. The focus of the Budget will also determine how much these are worth following in the coming months.

Screener: Rural, Andhra-linked and renewables stocks that are rising, with high Forecaster growth estimates in FY25

FMCG stocks have risen the most in the past quarter

We look at stocks from the three themes – rural, Telugu Desam Party (TDP)-linked, and renewables stocks – which have risen over the past quarter with analyst forecasts for strong growth in FY25. This screener shows these stocks that have risen over the past quarter with high Forecaster YoY growth estimates for revenue and EPS in FY25.

Major stocks that appear in the screener are Heritage Foods, Emami, Chambal Fertilisers & Chemicals, Insecticides (India), Natco Pharma, Avanti Feeds, Tata Power, and Colgate Palmolive (India).

Emami has risen by 64.5% over the past quarter. Forecaster estimates the stock’s revenue and earnings per share (EPS) will grow by 9.5% YoY and 6.1% YoY, respectively in FY25. Brokers like Sharekhan believe this packaged goods company has a strong brand portfolio, and its focus on product launches, distribution expansion, a strong pipeline of direct-to-consumer (D2C) brands, and international business will help drive growth.

Tata Power also features in the screener with its stock price rising 6.3% over the past quarter. Trendlyne’s Forecaster estimates this electric utilities company’s revenue and EPS to grow 10.9% and 28.9%, respectively in FY25. Geojit BNP Paribas expects the company’s performance to improve due to rising demand, capacity expansion, and promising opportunities in the rooftop solar business, renewables, and generation segments.

You can find more screeners here.