Is Wipro's revolving door for top executives spinning too fast? Wipro, the fourth largest Indian IT company by market cap, is back under scrutiny. Jatin Dalal, Chief Financial Officer of the company, became the 14th high-level executive to exit in the last one year, when he resigned on September 21. Dalal was with Wipro for over two decades and served as CFO for eight years, so his exit was a shock. Stepping into the void is Aparna Iyer, but her entry comes at a turbulent time.

The market didn't take kindly to Dalal’s abrupt exit, and Wipro’s stock tumbled over 3.5% in the following three trading days. The company has also underperformed the Nifty IT index by over 15 percentage points in the past year. Concerns over sluggish growth, a poor demand environment and high-level exits have played spoilsport.

Key business heads leave to seize opportunities elsewhere

Many of Wipro’s divisional heads and key executives have moved on to senior positions in rival, mid-level tech companies over the past year. For instance, Angan Guha, who was the CEO of Wipro’s 'Americas 2' unit, left in November 2022 to become the CEO of Birlasoft. Sanjeev Singh, Wipro’s Chief Operating Officer, exited in January 2023 to take up the role of CEO at CMS Infosystems.

More recently, in June 2023, Mohd Haque and Ashish Saxena, who headed Wipro’s healthcare and hi-tech business divisions respectively, also left the company. Reports suggest that these sudden exits may be linked to the internal reorganisations introduced in the past three years and the management style of the current CEO.

Culture-shift: Is Delaporte’s drive for leaner operations to blame?

Between FY15 and FY20, Wipro was stuck in a low-growth zone, trailing behind its peers. By FY19, HCL Technologies had already overtaken Wipro in terms of revenue, moving into the No. 3 spot among the IT services majors, behind TCS and Infosys. It was at this point Thierry Delaporte took the helm as CEO, to steer the company into the fast growth lane.

Wipro grew the slowest among peers before Delaporte assumed charge

Delaporte's immediate priorities were building a leaner business, winning large client deals, and using acquisitions to drive growth. In January 2021, he introduced a new structure with four strategic business units, based on geographies and two global business lines. This was a drastic change from the previous setup, which had around 26 business segments.

In another round of restructuring in April 2023, Delaporte further divided the global business lines into four units. After this move, Rajan Kohli, the head of the ‘iDEAS’ business line, left the company. Reports suggest that at least 250-300 executives at the general manager level and above were asked to leave between 2020 and 2022, after the initial restructuring.

Delaporte prefers lateral hires to revive Wipro’s growth. This ideology reflects in his comment on the recent wave of management exits at the company: “If you want to change an organisation, you have to bring in new talent. Applying the recipe to the same people won’t deliver different results. We are retaining the talent we need to retain.”

The entry of a new CEO into an established business is rarely smooth. But Wipro’s case is still unusual. Delaporte's changes have reportedly not been well-received by Wipro’s senior management.

Despite these internal tensions, he received the highest compensation among IT sector executives in FY23. Wipro’s promoters, which consists of Azim Premji and family, have high hopes for Delaporte, counting on him to turn the company around. And he is certainly shaking things up.

Delaporte tops the list as the highest-paid IT executive in FY23

But the question remains: is Delaporte’s approach working to Wipro’s advantage so far?

Stumbling growth and declining margins: Wipro falters in FY23 and Q1FY24

After a robust revenue growth of over 25% in constant currency terms in FY22, driven by heightened demand for digital transformation and the acquisition of Capco, Wipro’s performance slowed down considerably in FY23. Despite securing $4 billion in new deals during the fiscal year, a 74% YoY increase, the company still lagged behind its peers.

Wipro underperformed its peers in revenue growth in FY23

Analysts from firms like Motilal Oswal and HDFC Securities suggest that Wipro’s deals are not being converted into higher revenue, potentially due to deal terminations or poor execution issues. Given the subdued macro environment globally, the company’s topline growth has weakened over the past three quarters. Its nearly 35% exposure to the weakening BFSI segment, and slowing consulting revenue haven’t helped matters.

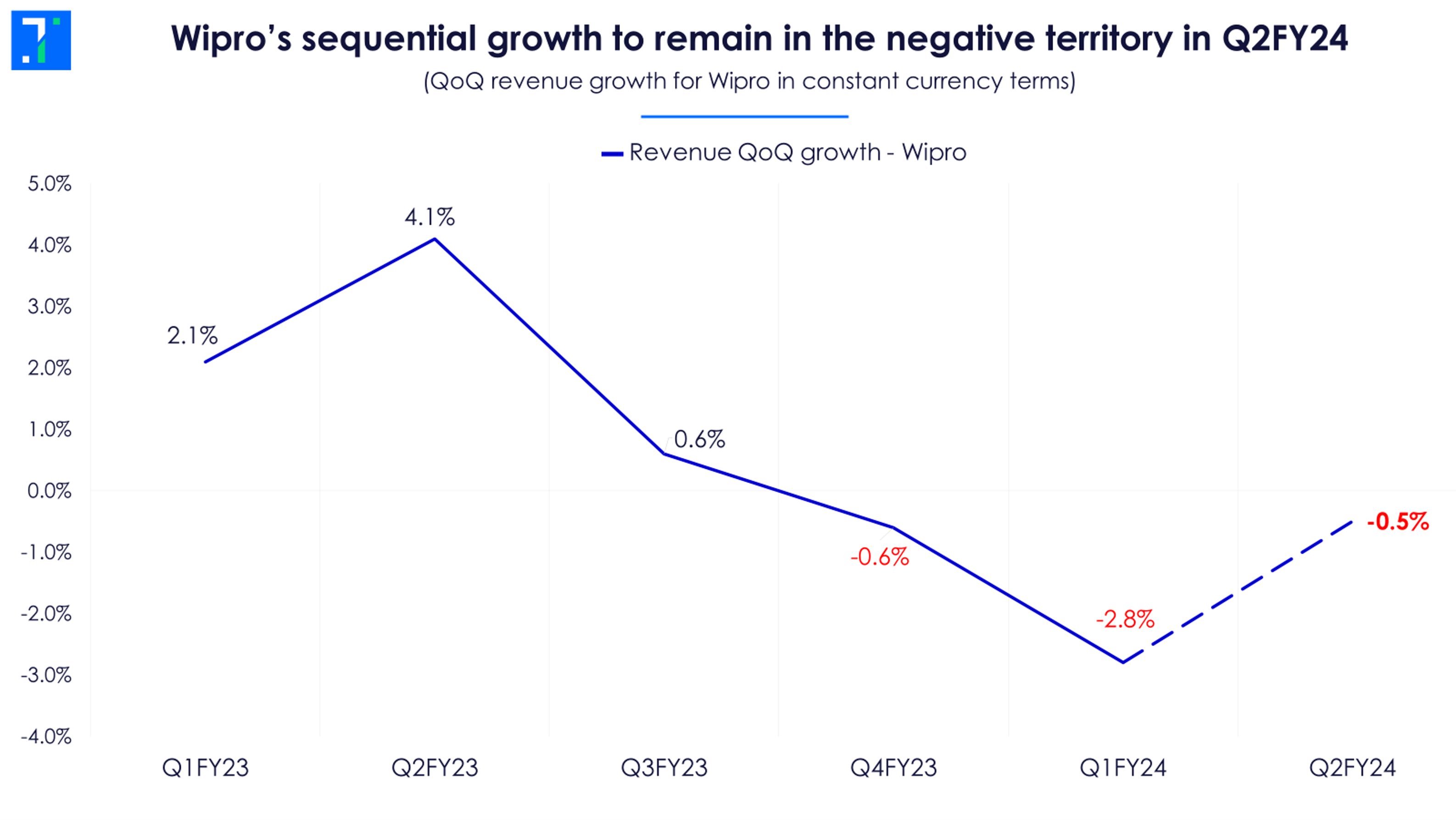

Wipro’s sequential growth to remain negative in Q2FY24

The situation is also grim on the margin front. Wipro saw a near five-percentage-point contraction in margins in FY23 compared to FY21. This dip is due to higher packages for lateral hires, promotions, multiple acquisitions, and a rise in travel and software licensing costs. It currently has the lowest margins among the top players in the sector.

Wipro saw the biggest drop in operating margins over the past two years

Hurt by falling margins, Wipro’s net profits also took a hit in FY23. Its stock price fell by 46% from its peak in January 2022 to the end of June 2023. To prop up share prices, the company executed a share buyback at the end of June.

Outlook bleak for the top-tier IT pack, especially Wipro

With the earnings season set to kick-off in October, subdued top-line growth is expected across the IT industry in Q2FY24. Sluggish discretionary demand in key end markets like the US and Europe are hurting Indian IT services, and worries about a recession in the US haven’t helped. Wipro’s management has guided for a negative average QoQ growth in the September quarter.

Persistent weakness in the banking, hi-tech and telecom sectors in Q1 add to Wipro's woes, according to its management. While analysts foresee a moderation in revenue growth for top-tier IT companies over the next two years, Wipro is likely to trail behind its peers.

Large IT players face slowdown, Wipro expected to underperform its peers

However, some analysts still project a decent bottom-line growth for the company, anticipating a modest rise in EBIT margins. But these levels are likely to be lower than the management’s medium-term aim of 17-17.5%.

Wipro’s profit growth trajectory projected to recover in the next two years

Overall, FY24 seems to be a forgettable year for the Indian IT sector. Foreign and domestic brokerages have contrasting views for the following year.

Morgan Stanley is bullish, predicting a demand uptick and double-digit revenue growth for tier-1 companies from Q1FY25. Nirmal Bang, on the other hand, foresees the US economy entering into a recession in 2024, projecting only mid-single-digit growth for the IT sector in FY25. So far, the broader commentary favours the latter view, with many analysts concurring that a US recession is likely in early 2024.

Aparna Iyer is stepping up in this challenging environment, as she assumes her role as the new CFO. Previously the CFO of Wipro's FullStride Cloud division, she brings significant experience to the table. However, strengthening the company’s growth in a weak global economy and alongside a new CEO won’t be easy. It remains to be seen if Delaporte, currently the Wipro family’s golden boy, will be able to deliver in a challenging environment or will lose some of his shine.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.