By Tejas MD

Share buybacks have become a popular way for companies to reward their shareholders, particularly in the IT sector. However, like all expenses, a share repurchase has opportunity costs, which represent the potential benefits a company misses out on when choosing one option over another. Huge and consistent share buybacks for example, could signal that the company lacks new projects to invest its surplus cash in.

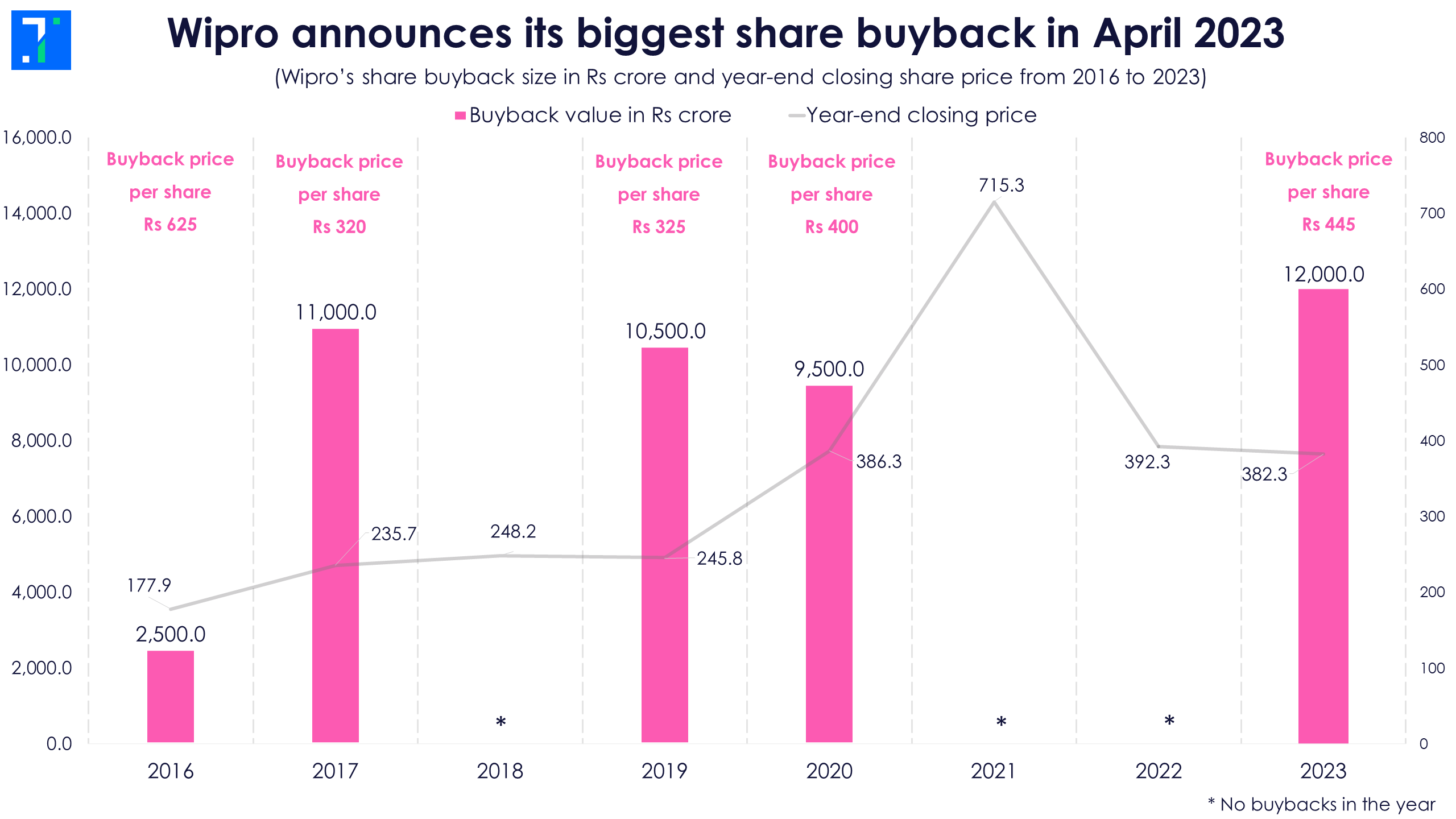

Wipro has taken the buyback route often. On April 28, 2023, the IT company’s board announced a whopping Rs 12,000 crore share buyback, its fifth in seven years. The management claims that the buyback is aligned with their payout strategy. But it also added that buybacks of this size will be “infrequent”.

With this, the IT firm will buy back 4.91% of its outstanding shares at Rs 445 each, indicating a premium of around 15.6% as of May 9. However, with rising competition in the slowing IT space, investors may question whether this is the best use of surplus cash.

With this, the IT firm will buy back 4.91% of its outstanding shares at Rs 445 each, indicating a premium of around 15.6% as of May 9. However, with rising competition in the slowing IT space, investors may question whether this is the best use of surplus cash.

This share buyback comes at a time when IT companies are grappling with a slowdown in revenue growth and struggling to secure deals in western markets, where Indian IT companies get the majority of their revenue from. In reaction, Nifty IT has fallen over 25% in 2022 and is down around 11% in the past year. Similarly, Wipro’s share price also took a hit - the stock went down 22% during the same period.

Considering the bleak outlook, Wipro needs to focus on deeper interventions and diversify its clients to catch up to its peers. While top and mid-tier companies like TCS and Persistent are still winning large deals in a difficult environment and posting QoQ revenue growth, Wipro is struggling.

Considering the bleak outlook, Wipro needs to focus on deeper interventions and diversify its clients to catch up to its peers. While top and mid-tier companies like TCS and Persistent are still winning large deals in a difficult environment and posting QoQ revenue growth, Wipro is struggling.

Share buybacks may temporarily put a floor under the share price, but it is only a band-aid in the longer term. Instead, Wipro will have to demonstrate consistent growth in both top and bottom lines for long-term shareholders to reap the benefits.

Wipro’s Q4 results disappoint those hoping for a recovery

Compared to its peers like TCS, Infosys and HCL Technologies, Wipro has historically lagged behind both in revenue growth and share price appreciation. In Q4, Wipro was the only top IT company to post a QoQ fall in revenue, and its revenue grew at the slowest rate YoY among the top four.

One silver lining for Wipro is the 28.7% YoY increase in its total contract value (TCV). But the conversion of TCV to revenue has not been optimal. HDFC Securities says that the disconnect is due to a possible high deal termination or higher-than-usual leakage between bookings to revenue.

One silver lining for Wipro is the 28.7% YoY increase in its total contract value (TCV). But the conversion of TCV to revenue has not been optimal. HDFC Securities says that the disconnect is due to a possible high deal termination or higher-than-usual leakage between bookings to revenue.

Another worrying factor for IT companies is their inability to recover EBIT margins to expected levels. Barring TCS, margins of the top four IT companies fell QoQ.

Employee costs continue to rise and companies are taking drastic steps to bring it under control. Wipro's Chief Financial Officer, Jatin Dalal, said that 90% new recruits had agreed to join the company at half the initial salary of Rs 6.5 lakh per year. The decision to reduce the package was attributed to the “changing macro environment”.

Employee costs continue to rise and companies are taking drastic steps to bring it under control. Wipro's Chief Financial Officer, Jatin Dalal, said that 90% new recruits had agreed to join the company at half the initial salary of Rs 6.5 lakh per year. The decision to reduce the package was attributed to the “changing macro environment”.

Finding new avenues of growth is critical for Wipro to compete with top IT firms

Wipro can potentially catch up to its competitors by investing in growth and innovation to drive revenue growth. Instead, the focus seems to be on huge share buybacks. It is worth noting that Wipro is the only top IT company whose PEG (price/earnings-to-growth) ratio is in the negative, indicating that its earnings growth is in the red.

Though major IT players like TCS and Infosys resorted to buybacks in 2022, Wipro’s closest competitors, HCL Tech and Tech Mahindra, have bought back shares less frequently. The last buyback by HCL Tech was in 2018 and Tech Mahindra’s was in 2019.

Wipro’s buyback has depleted its cash on hand considerably. But the management has said it will still have $1.5 billion (net of debt) left after the buyback and intends to use it for inorganic growth opportunities.

Wipro’s buyback has depleted its cash on hand considerably. But the management has said it will still have $1.5 billion (net of debt) left after the buyback and intends to use it for inorganic growth opportunities.

Though Wipro’s cash flow from operations and cash on hand remain healthy and at comfortable levels, consistent cash outflows to repurchase shares can hinder its ability to grow, be it through organic means or acquisitions.

One way Wipro can use its surplus cash is by investing in different projects and diversifying from its Banking, Financial Services and Insurance (BSFI) business vertical. This segment constitutes 34.5% of the total revenue.

One way Wipro can use its surplus cash is by investing in different projects and diversifying from its Banking, Financial Services and Insurance (BSFI) business vertical. This segment constitutes 34.5% of the total revenue.

Due to the economic slowdown and banking crisis in the West, Wipro’s revenue from its BFSI segment fell 2.5% QoQ. The management is also not optimistic about a recovery in the next two quarters and has guided for -3% to -1% growth in Q1FY24 amid macro uncertainties. According to Trendlyne’s Forecaster, Wipro’s revenue is expected to fall QoQ for a second straight quarter in Q1FY24.

Due to the economic slowdown and banking crisis in the West, Wipro’s revenue from its BFSI segment fell 2.5% QoQ. The management is also not optimistic about a recovery in the next two quarters and has guided for -3% to -1% growth in Q1FY24 amid macro uncertainties. According to Trendlyne’s Forecaster, Wipro’s revenue is expected to fall QoQ for a second straight quarter in Q1FY24.

The BFSI segment is likely to see lower technology spending and delays in closing deals in the North American and European markets. This could negatively impact revenue growth in Q1FY24 as well. The uncertain economic conditions and high-interest rates could lead to reduced spending across other business verticals as well.

The BFSI segment is likely to see lower technology spending and delays in closing deals in the North American and European markets. This could negatively impact revenue growth in Q1FY24 as well. The uncertain economic conditions and high-interest rates could lead to reduced spending across other business verticals as well.

The road to recovery is long, and analysts expect Wipro’s margins to be under pressure due to the increased risk profile of its business verticals. According to Trendlyne’s Forecaster, the consensus recommendation on Wipro is ‘Hold’, with a share price target of Rs 394, indicating an upside of around 2%.