By Divyansh PokharnaThe Nifty 50 nosedived sharply by 2.4% last week, weighed down by a downward revision in full-year GDP growth estimates, rising oil prices, and consistent FII selling amid reports of Human Metapneumovirus (HMPV) cases in India. The GDP growth forecast for FY25 is now pegged at 6.4%, falling short of the RBI’s 6.6% projection and the government’s 6.5-7% range outlined in the Economic Survey.

FIIs extended their selling streak, offloading equities worth Rs 16,854.4 crore during the week. Meanwhile, DIIs maintained a positive outlook, investing Rs 21,682.7 crore.

However, IPO activity remains steady - eight companies debuted last week, eight are set to list this week, and four other IPOs are opening for subscription.

Let’s take a look at fresh IPO activity

Eight new companies debuted on the bourses in the past week

The stock market saw eightIPOs debut last week, with six from the SME segment and two in the mainline category.

All companies except Davin Sons Retail list at a premium

Fabtech Technologies Cleanrooms, a medical equipment maker, debuted on January 10 with a 90% premium over its issue price of Rs 85. The Rs 27.7 crore IPO, a completely fresh issue, was oversubscribed 688.2 times, with the HNI category subscribing 1,974.4 times. Despite a 21.6% YoY decline in FY24 revenue and a 27.4% YoY drop in net profit, the IPO witnessed strong demand.

Indobell Insulation, an industrial products company, listed on January 13 at a 90% premium to its issue price. The Rs 10.1 crore fresh issue IPO was subscribed 51.5 times the total shares on offer.

Davin Sons Retail, a Delhi-based readymade garment manufacturer, received 114.8 times bids for its shares but listed at a 20.2% discount. The company plans to use the IPO proceeds for purchasing a warehouse, meeting working capital requirements, and general corporate purposes.

Three SME IPOs—Parmeshwar Metal, Leo Dryfruits & Spices Trading, and Technichem Organics—listed at premiums of 38.5%, 30.8%, and 4.2%. Parmeshwar Metal and Leo Dryfruits dropped 7.2% and 3.9% post-listing, while Technichem Organics rose 4.4%.

Two mainline IPOs, Standard Glass Lining Technology and Indo Farm Equipment, listed at 22.9% and 19.1% premiums, respectively.

Eight new IPOs are lined up for listing this week

This week will see the listing of eight IPOs, including five in the SME category and three in the mainline segment.

Delta Autocorp and B.R. Goyal Infra see strong HNI demand

Delta Autocorp, a 2/3-wheeler manufacturer operating under the ‘Deltic’ brand, garnered a strong subscription of 309X for its Rs 54.6 crore IPO, with HNI bids reaching 806.9X. The company manufactures and sells EV two-wheelers & three-wheelers and is set to debut on the NSE SME platform on January 14. Its post-IPO price-to-earnings (P/E) ratio of 24.1 is notably below the industry average of 35.8. (The post-issue P/E ratio is based on the issue price divided by post-issue EPS, calculated from annualized FY earnings as of March 31, 2024, as per the RHP).

Two additional IPOs, B.R. Goyal Infrastructure, a construction & engineering firm, and Avax Apparels and Ornaments, a textiles company, will also list on January 14 on the BSE SME platform. These IPOs were subscribed 109.9X and 247.2X, respectively.

Meanwhile, two IPOs opened for subscription on January 10—Sat Kartar Shopping, a pharmaceutical firm, and Barflex Polyfilms, a packaging company. These offerings received subscriptions of 3.5X and 1X by the end of Day 1. Sat Kartar will list on January 17, and Barflex is scheduled to debut on January 20, both on the NSE SME platform.

During the past week Quadrant Suture Tek witnessed strong subscriptions across different investor categories.

Quadrant Future Tek witnesses strong investor demand

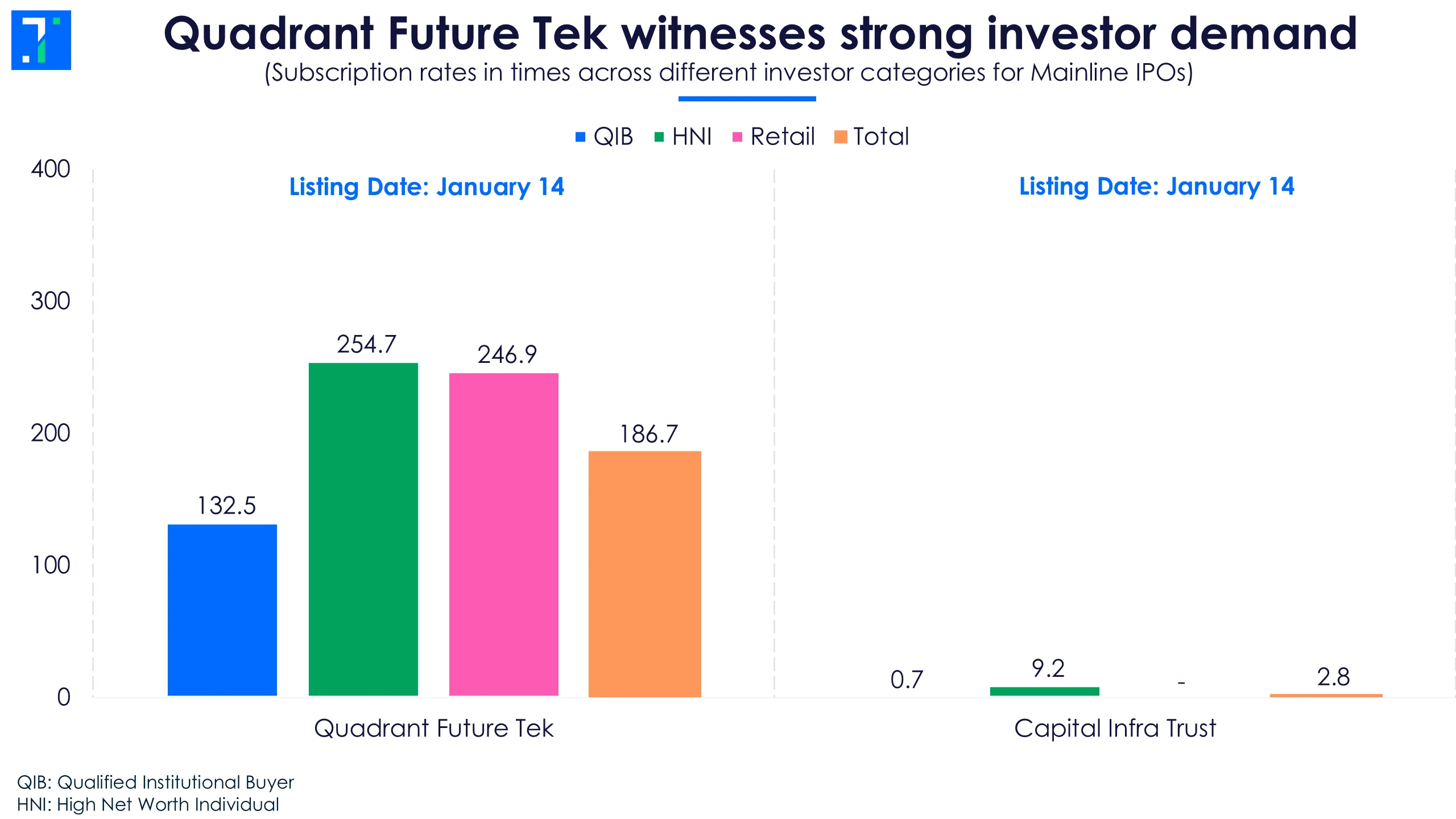

Quadrant Future Tek, an electrical equipment manufacturer, attracted strong investor interest, with its Rs 290 crore IPO receiving bids for 186.7X the shares on offer. The company sells wires and cables, develops train control and signaling systems which contributes to the Indian railways' KAVACH project. The listing is scheduled for January 14.

In contrast, Capital Infra Trust, a roads & highways developer, witnessed lukewarm demand, with its IPO subscribed 2.8X overall. Notably, the QIB segment was subscribed 0.7X, while the retail category saw no bids. In FY24, the company's revenue declined by 38.7% YoY, and net profit fell sharply by 74.8% YoY. The IPO is set to debut on January 14.

Laxmi Dental, a healthcare supplies firm, launched its Rs 698.1 crore IPO on January 13, with listing set for January 20. The company offers custom crowns, clear aligners, thermoforming sheets, and pediatric dental products. It plans to use its IPO proceeds for debt repayment, purchase of new machinery, and capital expenditure for its subsidiary, Bizdent Devices.

Upcoming subscriptions: Four new offerings to open this week

Four IPOs are scheduled to open for subscription this week, all in the SME segment.

Rikhav and Landmark Immigration lead in terms of revenue growth

Rikhav Securities: This capital markets company, engaged in providing brokerage, investing, and banking services in India, is set to launch its Rs 88.8 crore IPO. The subscription window will open on January 15 and close on January 17, with the listing scheduled for January 22 on the BSE SME platform.

In FY24, the company recorded a significant revenue growth of 104.2% YoY and a net profit increase of 123.2%. The IPO proceeds will be utilized to meet incremental working capital requirements, fund capital expenditure for IT infrastructure, and address general corporate purposes.

Landmark Immigration Consultants: This travel support services company, specializing in global consultancy services, will launch its IPO of Rs 40.3 crore on January 16, closing on January 20, with the listing scheduled for January 23 on the BSE SME platform.

In FY24, the company experienced a 71.4% YoY revenue growth and a 150.7% increase in net profit. It provides education consultancy for students aiming to study abroad and immigration consultancy for various visa services, primarily targeting Canada.

The IPO funds will be utilized for setting up new branches, increasing brand visibility through advertising, pursuing acquisitions for inorganic growth, and addressing general corporate purposes.

EMA Partners India: This misc. commercial services company will open its IPO of Rs 76 crore on January 17, closing on January 21, and listing on January 24 on the NSE SME platform.

In FY24, the company’s revenue grew 34.8% YoY, while its net profit surged 364.8%. EMA Partners India provides specialized leadership hiring solutions to clients across various sectors, recruiting business and functional leaders globally.

The IPO proceeds will be used to enhance the leadership team, upgrade IT infrastructure, repay or prepay loans related to office premises, and for general corporate purposes and potential inorganic acquisitions.

Kabra Jewels: This gems & jewellery company is engaged in the retail jewellery business, offering a diverse collection of gold, diamond, and silver ornaments. The Rs 40 crore IPO will open on January 15, close on January 17, and will list on January 22 on NSE SME platform.

The funds raised will be used for repayment of certain borrowings, meeting working capital requirements, and general corporate purposes. In FY24, the company’s revenue grew 34.3% YoY, while net profit rose 113.9% YoY.