By Tejas MDRewind to July 2019: the rupee was trading at around Rs. 69 per dollar. Now, it is hovering around Rs. 80 per dollar.

The falling rupee has led to worries that India is going to import a lot of inflation, as everything we buy from abroad costs just a little bit more. While prices of crude oil and other commodities have cooled off, the depreciating rupee could “cancel out the fall in commodity prices”, says Aditi Nayar of ICRA.

But there may be a bright side to this–our exports are getting more cost-competitive. We look at one such Indian sector this week that could benefit from the rupee's weakening against the dollar.

In this week’s Analyticks,

Chemical companies see momentum in Q1FY23, but commodity prices may spoil the party

After the Covid pandemic, many international chemical buyers were saying "anyone but China" - and Indian players jumped at the opportunity.

The Indian chemical sector became a star player for investors over the past two years as international markets diversified away from Chinese companies. As exporters that see their costs in rupees and revenues in dollars, they are also benefiting from the weakening of the Indian currency.

Top listed chemical companies have continued their growth momentum in Q4FY22, with an average YoY revenue growth of about 23%. However, high raw material, energy, and logistics costs played spoilsport and impacted their bottom lines - net profits grew at a slower rate of 15%.

The main question investors now have is whether chemical companies can sustain the rapid revenue and profit growth of the past two years, going forward.

Price hikes look like the main driver for revenue growth

According to brokerages like ICICI Direct, Prabhudas Lilladhar, and Motilal Oswal, chemical companies are expected to post strong YoY revenue growth this Q1. The analysts also expect multiple price hikes to be a bigger factor (compared to demand increase) in offsetting the cost increases in raw material, energy and logistics.

In the commodity chemicals industry, Trendlyne’s Forecaster estimates show that Deepak Nitrite, Tata Chemicals, and Navin Fluorine International’s revenues are likely to rise YoY in the range of 15%-33%.

High refrigerant gas prices and strong demand in contract research and manufacturing services (CRAMS) could contribute to the revenue rise for Navin Flourine. Higher phenol price (up 21% YoY in Q1FY23) is expected to drive Deepak Nitrite’s phenolics segment’s revenue growth.

Due to capacity expansion and high utilization rates, net profit for commodity chemical companies may see a strong rise YoY in Q1FY23.

Praying for rain: Export focused agrochem in good shape, but India’s late monsoon could hit domestic topline

Agrochem CEOs pray for rain: their company fortunes are tied to it. Unfortunately major listed companies in the agrochemicals industry (UPL, PI Industries, Sumitomo Chemical India, and Bayer Cropscience) are expected to show subdued YoY revenue growth numbers, due to a delayed start of the southwest monsoon which postponed sowing activity by 15-20 days.

However, export focused companies such as UPL and PI Industries are in a better position with strong demand across geographies.

Agrochem companies’ revenue growth in Q1FY23 is likely to be driven by the multiple price hikes they took during the quarter. According toPrabhudas Lilladhar, companies may also hike prices next quarter in Q2 to pass on inflated costs Trendlyne’s Forecaster estimates show that UPL is expected to post a 14% YoY growth to Rs 15,861 crore on the back of sustained traction across geographies and multiple price hikes.

Trendlyne’s Forecaster estimates also suggest a 3.6% YoY decline in UPL’s net profit. This could be due to a deferred tax credit from Q1FY22, according to KRChoksey.

Trendlyne’s Forecaster estimates also suggest a 3.6% YoY decline in UPL’s net profit. This could be due to a deferred tax credit from Q1FY22, according to KRChoksey.

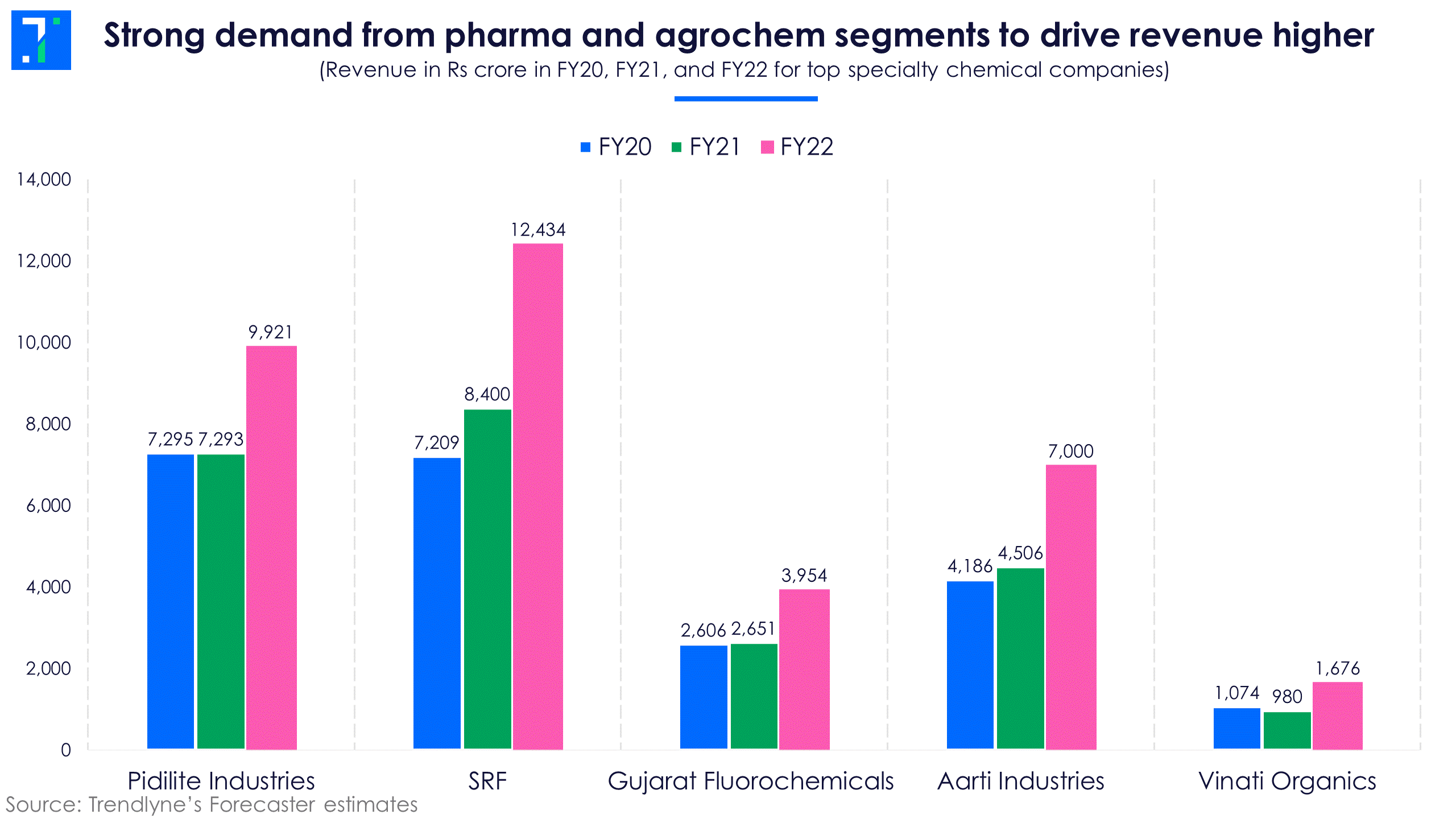

What about the cool kids of the chemical industry - the specialty chemicals players? Top companies in the specialty chemicals space include Pidilite Industries, SRF, Gujarat Fluorochemicals, Aarti Industries, and Vinati Organics.

Forecaster estimates show that these companies are expected to post strong YoY revenue growth in the range of 25%-45.5% in Q1FY23 due to a combination of price hikes and strong demand.

Due to strong demand from pharma and agrochem, Aarti Industries is expected to post YoY revenue growth of 45% in Q1FY23, according to Forecaster estimates. Gujarat Fluorochemicals is expected to post the highest net profit growth of 61.8%.

Due to strong demand from pharma and agrochem, Aarti Industries is expected to post YoY revenue growth of 45% in Q1FY23, according to Forecaster estimates. Gujarat Fluorochemicals is expected to post the highest net profit growth of 61.8%.

Like raw materials, prices of finished products in this segment are also volatile, leading to pressures on margins. Chemical makers have now resorted to increasing their raw material inventory to reduce the volatility in their input costs.

Raw materials for chemical companies include benzene, propylene, and ethylene, which are derivatives of crude oil, which remained expensive in Q1FY23. On average, Brent crude prices rose 62.3% YoY in Q1FY23. While crude palm oil rose 55% YoY, Caustic soda rose a staggering 136.2% YoY to 777 USD/MT.

With the increase in raw material costs and end product volatility in FY22, operating profit margins for several chemical companies may remain under pressure in Q1FY23. Companies are hoping that with the recent cooling of commodity prices, they will see margins improve in Q2FY23.

With the increase in raw material costs and end product volatility in FY22, operating profit margins for several chemical companies may remain under pressure in Q1FY23. Companies are hoping that with the recent cooling of commodity prices, they will see margins improve in Q2FY23.

The last two years were strong for chemical companies. What about the next two?

In the last two years, chemical makers’ revenue in India grew at a fast clip aided by an increase in exports, as global companies looked past China. Top chemical companies’ revenue rose by an average CAGR of 22.7% from FY20-22.

However, looking at Trendlyne’s Forecaster estimates for FY23 and FY24, the average two-year revenue CAGR for chemical makers might fall to 12.5%. This means chemical makers’ growth could slow considerably.

With expectations muted, the chemicals and petrochemicals sector lost about 4.2% in average share price over the past quarter. In the chemical sector, commodity chemical companies fell 9.4% while agrochemical companies fell 1.2% in the last quarter.

Despite Forecaster estimates pointing to slower revenue growth over the next two years, the outlook is strong for Q1FY23. Price hikes and high demand from segments like agrochemicals and pharmaceuticals are expected to save the day, despite margin pressures from commodity costs.

Screener: Companies with rising promoter and FII holdings

As foreign investors run for the door by selling Indian shares over the past weeks, there are some companies that saw foreign investors increase their holdings. Some promoters also bought additional shares. This screener shows companies that saw promoters and foreign institutional investors (FIIs) increase their stake over the past quarter.

The screener shows 16 stocks out of the Nifty 500 and two stocks out of the Nifty 50 index with FIIs or promoters buying. These companies range from sectors like automobiles & auto components, cement & construction, commercial services & supplies among others.

After Rakesh Jhunjhunwala sold a bulk of his stake in Delta Corp during Q1FY23, FIIs increased their holding by 1.5% to 7.7% in this stock despite its stock falling 37.5% over the quarter. Mastek saw the next highest addition by FIIs at 1.4% to 8% during Q1FY23 as they bought 4.2 lakh shares in the company. FII holding in the company is back to levels seen before the pandemic despite its stock falling 26.7% during Q1FY23.

UPL’s FII holding rose 1.2% to 36.4% as they bought 38.5 lakh shares in the company over Q1FY23. FIIs are increasing their holding in the company for the last three quarters. After a drop of 2.7% in FII holding in Q4FY22, NCC saw FIIs buying its stock with their holding rising almost 1% in Q1FY23 to 9.8%.

Escorts Kubota saw the largest percentage increase in promoter holding of 44.8% to 9.6 crore shares in Q1FY23. The rise in promoter holding comes due to a merger deal between Escorts and Kubota Corporation which increased the stakes of Kubota Corp to 44.8% while existing promoters, Nanda Family’s holding remained unchanged.

Poly Medicure comes in second highest increase in promoter shareholding at 8.7% increase in promoter holding to 5.1 crore shares in Q1FY23 with Zetta Matrix Consulting Group buying 83.2 lakh shares. NCC’s promoter group bought a 1.4% stake in the company taking the promoter holding to 22% at the end of Q1FY23.

Signing off this week,

The Trendlyne Team