By Melissa Koshy

Indian stock benchmarks bounced back last week, with the Nifty 50 gaining 1.3%. While supported by GST rate changes and lower oil prices, global trade tensions and persistent foreign selling capped market gains.

India's GST Council announced a major tax overhaul at its 56th meeting, and narrowed the existing four-tier system into two main rates: 5% and 18%. The Council introduced a new 40% GST rate for sin goods and luxury products – high-end cars, tobacco, and cigarettes – effective September 22, 2025.

Siddhartha Khemka, Head of Research at Wealth Management at Motilal Oswal Financial Services, said, "Global trade uncertainties and tariff hikes remain a key risk. But the simplified GST framework combined with positive domestic economic factors should support market momentum in the near term."

The IPO market continues its strong activity this week, with eleven new issues set to open, including three from the mainboard segment. Additionally, seven companies will make their stock market debut, following 11 listings last week.

Eleven new companies debuted on the bourses over the past week

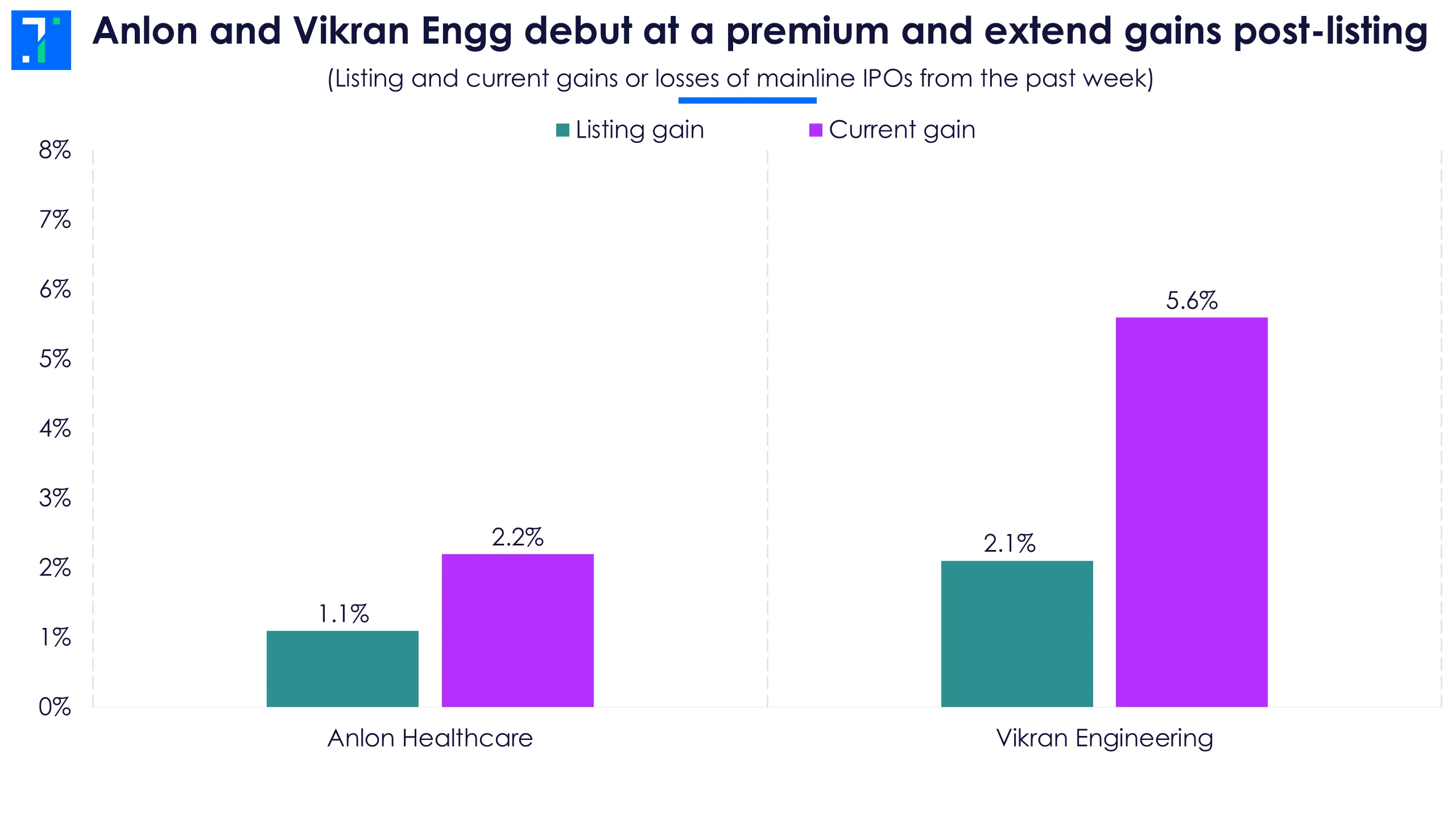

Two mainline IPOs debuted last week: Vikran Engineering and Anlon Healthcare. Vikran opened at a 1.1% premium and now trades 5.6% above its issue price. Anlon Healthcare had a slightly higher debut at a 2.1% premium, with shares now trading 2.2% higher. Vikran Engineering’s IPO was subscribed 23.6 times, while Anlon Healthcare was subscribed 7.1 times.

Anlon and Vikran Engg debut at a premium and extend gains post-listing

Current Infraprojects and Sattva Engineering stood out among the SME debuts, listing at 90% and 26.8% premiums to their issue prices. Current Infra’s IPO was subscribed 308.4 times, while Sattva saw 132.3 times. Both companies currently trade above their issue prices.

Oval Projects Engineering debuted with a modest subscription, receiving bids for 1.6 times the shares offered. Oval Projects currently trades at a 9.7% discount to its issue price. Meanwhile, Snehaa Organics had a flat debut at Rs 122 and is now down 9.8% from its issue price.

Globtier Infotech, Abril Paper Tech, and Rachit Prints all listed at a 20% discount to their issue prices. These companies are now trading 38.1%, 18.4%, and 24% below their issue price. Suggs Lyod also listed at a discount after its IPO was subscribed by 3.1X. The company is currently trading 4.1% above its issue price.

Eleven offerings open for subscription; three from the mainline category

The biggest IPO this week, Urban Company, offers a tech-enabled platform that provides a range of home and beauty services—from cleaning and repairs to grooming and home massages—all delivered by trained professionals. The company has also expanded into home solutions, launching its own line of water purifiers and electronic door locks under the brand ‘Native’.

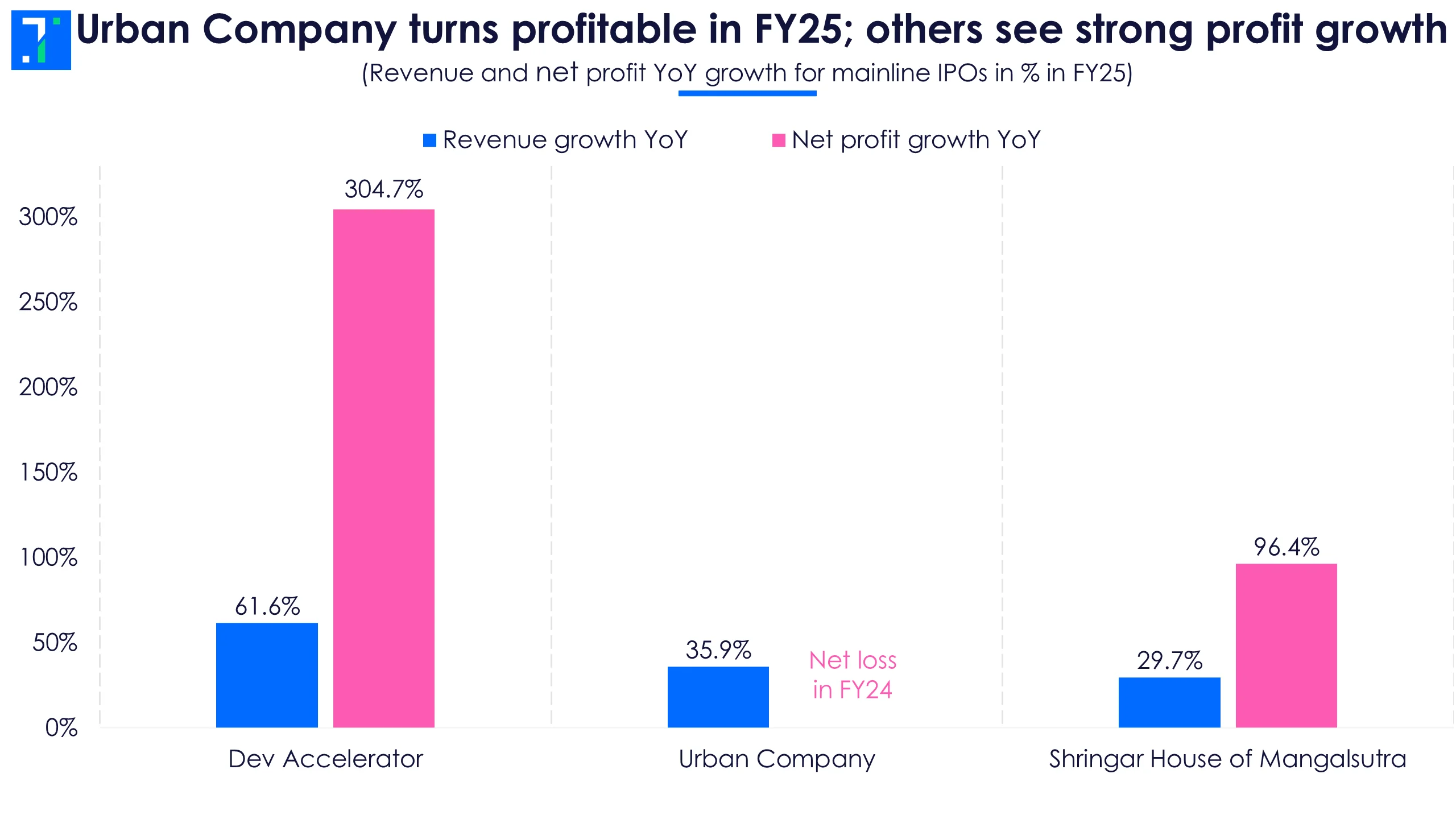

Urban Company turned profitable in FY25, reporting a net profit of Rs 240 crore, a major turnaround from last year's loss. The gain was mainly driven by a Rs 211 crore deferred tax credit.

Shringar House of Mangalsutra designs and manufactures a wide variety of Mangalsutras with stones like American diamonds and pearls. The gems & jewellery maker sells its products to corporate clients, wholesale jewellers, and retailers nationwide.

Urban Co and Shringar will open their IPOs on September 10, close on September 12, and list on September 17. Urban Co aims to raise Rs 1,900 crore, with a price band of Rs 98-103 per share. Shringar plans to raise around Rs 401 crore via a fresh issue, with a price band of Rs 155-165 per share.

Urban Company turns profitable in FY25; others see strong profit growth

Dev Accelerator is a special consumer services company that provides flexible office spaces, including coworking environments. It has a presence in major cities, including Delhi-NCR, Hyderabad, Mumbai, and Pune. Its IPO will also open for subscription on September 10, close on September 12, and list on September 17. The company aims to raise Rs 143.4 crore through a fresh issue, with a price band of Rs 56–61 per share.

The company plans to use the IPO funds for capital expenditure, repayment or prepayment of borrowings, and general corporate purposes.

Eight SME IPOs are also opening for subscription this week.

- Nilachal Carbo Metalicks and Krupalu Metals launched their IPOs on September 8, will close on September 10 and list on September 15. Nilachal aims to raise Rs 56.1 crore for Rs 85 per share. Krupalu plans to raise Rs 13.5 crore at Rs 72 per share.

- Karbonsteel Engineering and Taurian MPS will open on September 9, close on September 11, and list on September 16. Karbonsteel aims to raise Rs 59.3 crore with a price band of Rs 151–159, while Taurian MPS plans to raise Rs 42.5 crore with a price band of Rs 162–171.

- Galaxy Medicare and Jay Ambe Supermarkets are set to open their IPOs on September 10, will close on September 12, and list on September 17. Galaxy Medicare plans to raise Rs 22.3 crore at Rs 51-54 per share, while Jay Ambe aims to raise Rs 18.5 crore at Rs 74-78 per share.

- Airfloa Rail Technology will open on September 11, close on September 15, and list on September 18. It plans to raise Rs 91.1 crore, with a price band of Rs 133-140 per share. Following that, L.T.Elevator will open on September 12, close on September 16 and debut on September 19. It aims to raise Rs 39.4 crore at a price band of Rs 76-78 per share.

Amanta Healthcare and six SME firms are lined up for listing this week

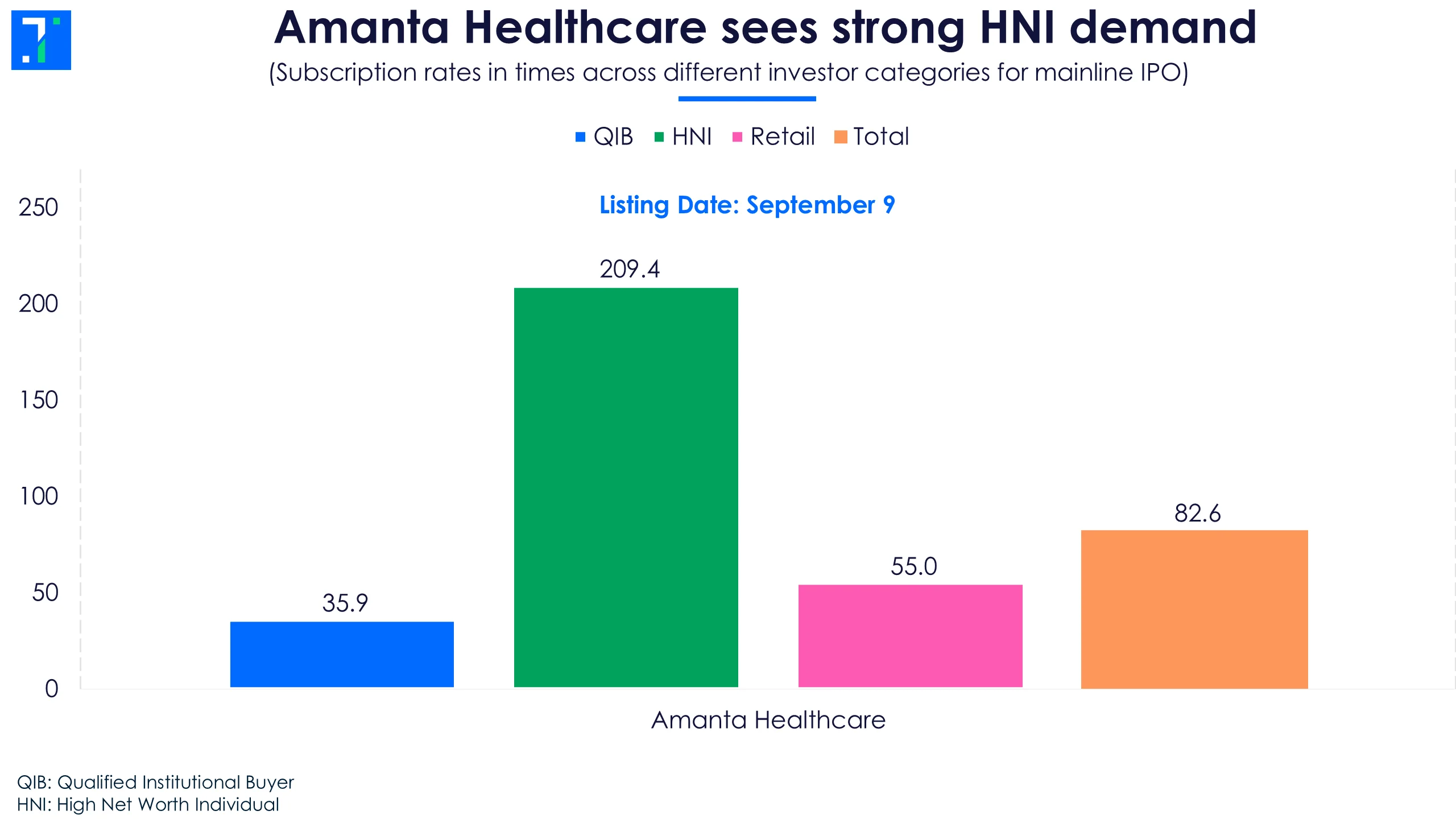

Amanta Healthcare is the only mainline IPO listing this week. It received bids for 82.6X the shares on offer, with HNIs showing the strongest demand at 209.4X, while QIBs subscribed 55.0X. The company will list on September 9. Amanta Healthcare is a pharmaceutical company that makes sterile liquid medicines, mainly injections. The company also makes medical devices.

Amanta Healthcare sees strong HNI demand

Six SMEs are lined up for listing this week:

- Optivalue Tek Consulting and Goel Construction will list on September 10. Optivalue was subscribed 60X, while Goel Construction was subscribed 115.8X. Both companies witnessed strong interest from the HNI category.

- Austere Systems will close its IPO on September 9 and list on September 12. It saw a strong subscription of 63X at the end of day 3.

- Sharvaya Metals and Vigor Plast India will also close their IPOs on September 9 and list on September 12. Sharvaya's IPO has been subscribed 1.6X, while Vigor Plast remains undersubscribed at 0.7X at the end of day 2.

- Vashishtha Luxury Fashion will close on September 10 and list on September 15. As of day 1, its subscription stood at just 0.1X.