By Melissa Koshy

The market continued its upward journey for the fourth consecutive week, with the Nifty 50 rising marginally by 0.3%. However, geopolitical tensions and a sharp 7.6% weekly rise in oil prices, following fresh US and EU sanctions on Russian oil majors, have weighed on overall market sentiment.

On the positive side, record festive sales, optimism around a possible India–US trade deal, and expectations of stronger earnings growth in the coming quarters have supported the market. Analysts at Motilal Oswal Financial Services expect Indian equities to remain range-bound, influenced by global cues, upcoming Q2 results, and macro-economic data. They note, "FII inflows and upbeat management commentaries could help sustain positive market momentum, though intermittent profit booking cannot be ruled out.”

IPO activity is picking up after being relatively quiet for the last few weeks. There are three new mainline offerings, following the one that listed on October 24.

Midwest makes a positive debut

Last week saw just one mainboard listing: Midwest.

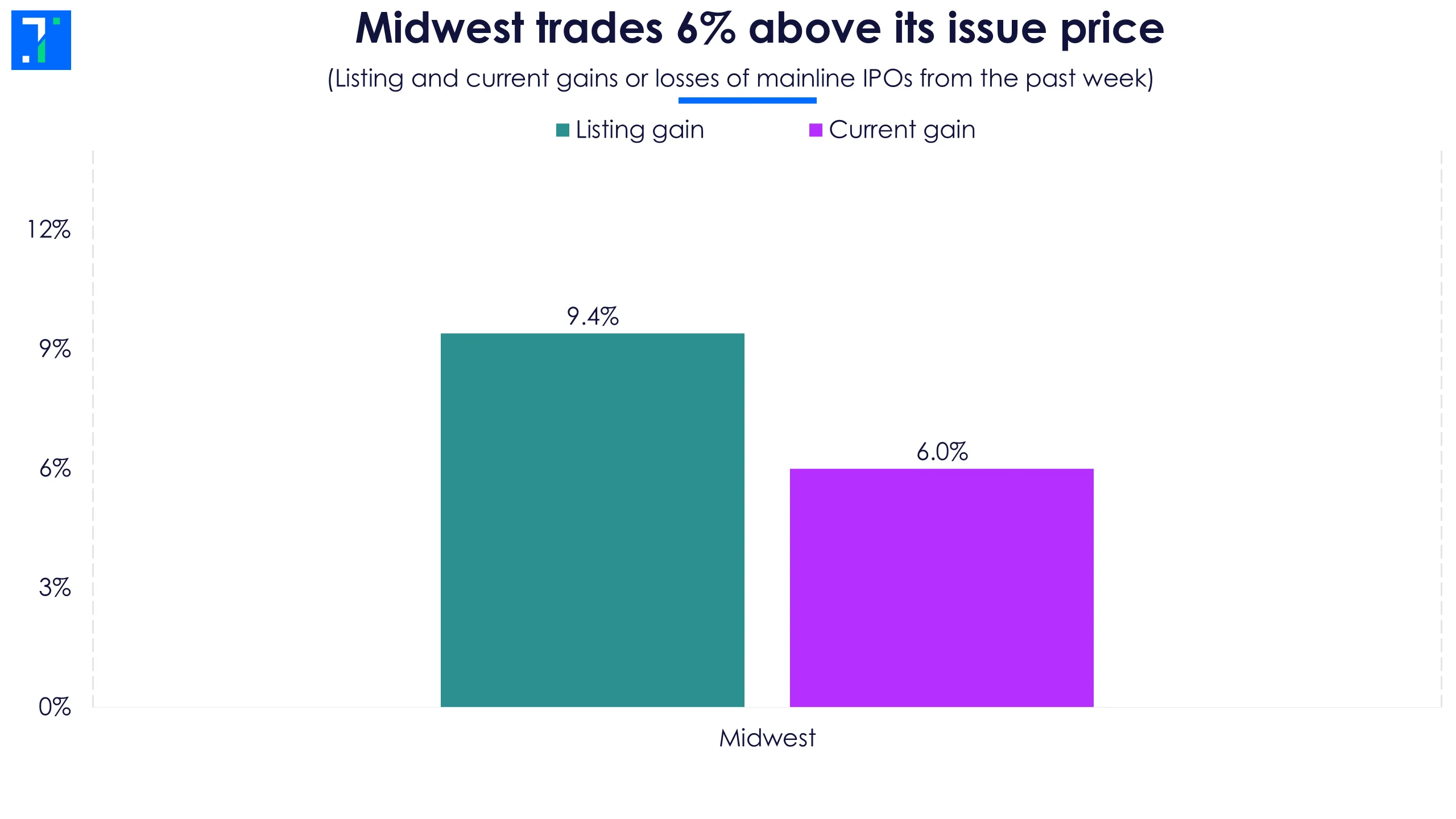

Midwest trades 6% above its issue price

Midwest, a construction materials maker, listed on October 24 at a 9.4% premium to its issue price of Rs 1,065. Its Rs 451 crore IPO drew strong demand, with an oversubscription of 87.9X, while the HNI category saw bids for 168.1X the shares on offer. The company is currently trading 6.1% above its issue price.

Midwest is a leading producer and exporter of natural stones, specialising in Black Galaxy Granite, a unique variety known for its sparkling golden flakes. The company is involved in every stage of the business, from exploration and mining to processing and distribution.

Three new mainboard IPOs are launching this week

The Indian primary market will be back in action, with Lenskart and two other mainline IPOs.

Lenskart Solutions, a tech-driven eyewear company, is launching this week’s biggest IPO. It designs, manufactures, and retails eyeglasses, sunglasses, contact lenses, and accessories under its own brands and sub-brands, serving all age groups and price segments through a direct-to-consumer model.

Lenskart plans to raise Rs 7,278 crore, with a price band of Rs 382-402 per share. The IPO will be open for subscription from October 31 to November 4, with the listing scheduled for November 10.

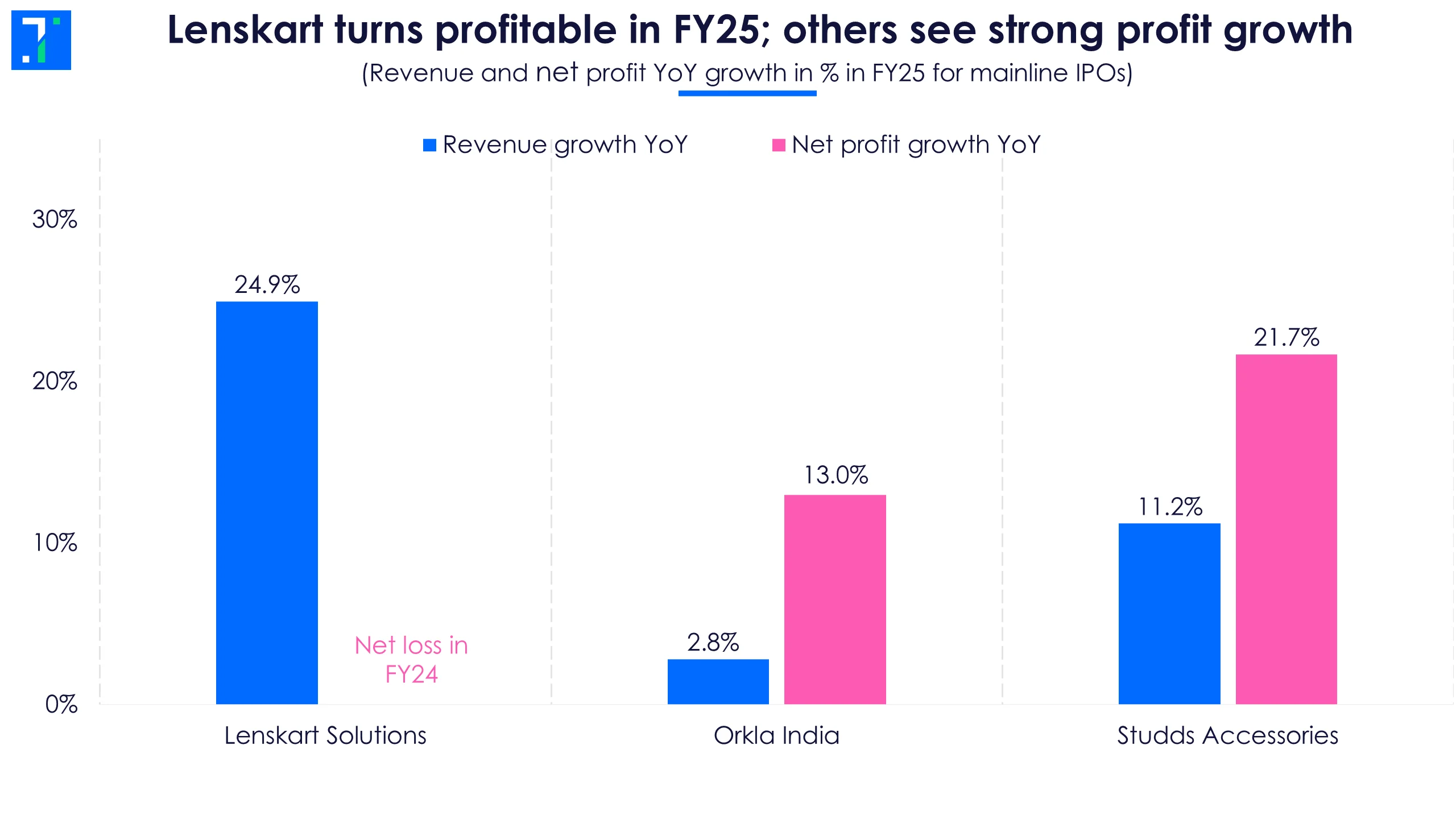

The company turned profitable in FY25, reporting a net profit of Rs 297.3 crore, a major turnaround from last year's loss. But this gain was mainly driven by a Rs 143.5 crore deferred tax credit.

Lenskart plans to use the IPO proceeds for setting up new stores, lease and rental payments, technology and cloud investments, and brand marketing and business promotion.

Lenskart turns profitable in FY25; others see strong profit growth

Orkla India offers a wide range of food products, from breakfast to lunch and dinner, snacks, beverages, and desserts. It houses iconic brands such as MTR Foods, Eastern Condiments, and Rasoi Magic. The company serves customers across the country with a significant presence in Karnataka, Kerala, Andhra Pradesh and Telangana.

Orkla aims to raise Rs 1,667.5 crore, with a price band of Rs 695-730 per share. The IPO will be open between October 29 and October 31, with the listing scheduled for November 6. The issue is entirely an offer for sale.

It plans to use the IPO proceeds for lead manager fees, advertising and marketing, processing and brokerage commissions, and other related expenses.

Studds Accessories manufactures two-wheeler helmets and motorcycle accessories under the “Studds” and “SMK” brands. Its products include helmets, two-wheeler luggage, gloves, helmet security guards, rain suits, riding jackets and eyewear.

Studds plans to raise Rs 455.5 crore, with a price band of Rs 557-585. Its IPO will open on October 30, close on November 3, and will list on November 7. The issue is entirely an offer for sale.

Three SME IPOs will also be open this week:

Logistics solutions provider Jayesh Logistics plans to raise Rs 28.6 crore, with a price band of Rs 116-122 per share. The IPO opened on October 27, will close on October 29, with the listing scheduled for November 3.

Fabrics maker Game Changers Texfab plans to raise Rs 54.8 crore through a fresh issue, with a price band of Rs 96-102 per share. The IPO will be open for subscription from October 28 to October 30, and will list on November 4.

Safecure Services is a leading security and facility management company that provides services such as private security and e-surveillance. The company aims to raise 30.6 crore through a fresh issue, with a price of Rs 102 per share. The IPO will be open between October 29 and October 31, with the listing scheduled for November 6.