By Divyansh Pokharna

The Nifty 50 declined by 0.7% last week as investors reacted to a slow start to the June quarter earnings and uncertainty around global tariffs. Foreign investors continued to sell, pulling out over Rs 6,670 crore from Indian equities during the week. However, domestic investors stepped in, buying shares worth over Rs 9,490 crore, which provided some support to the market.

Two major banks, HDFC and ICICI, reported their quarterly results over the weekend and opened higher on July 21 after posting net profits that exceeded Forecaster estimates. On the downside, Reliance Industries opened lower despite reporting better-than-expected profits. Infosys, Kotak Mahindra Bank, Bajaj Finance, and Eternal are expected to announce their results this week.

Vinod Nair, Head of Research at Geojit Investments, said, "If the US-India mini trade deal is settled positively, it could improve the outlook for export-focused sectors and make India more attractive to global investors. Also, strong earnings growth is vital to justify India's premium valuations."

Primary market activity is picking up again, with eleven IPOs set to open this week, including five mainboard IPOs, one of which is a real estate investment trust (REIT). Monika Alcobev is scheduled to list on the stock exchange next week, while five others made their debut last week.

Five new debuts over the past week, two from the mainboard

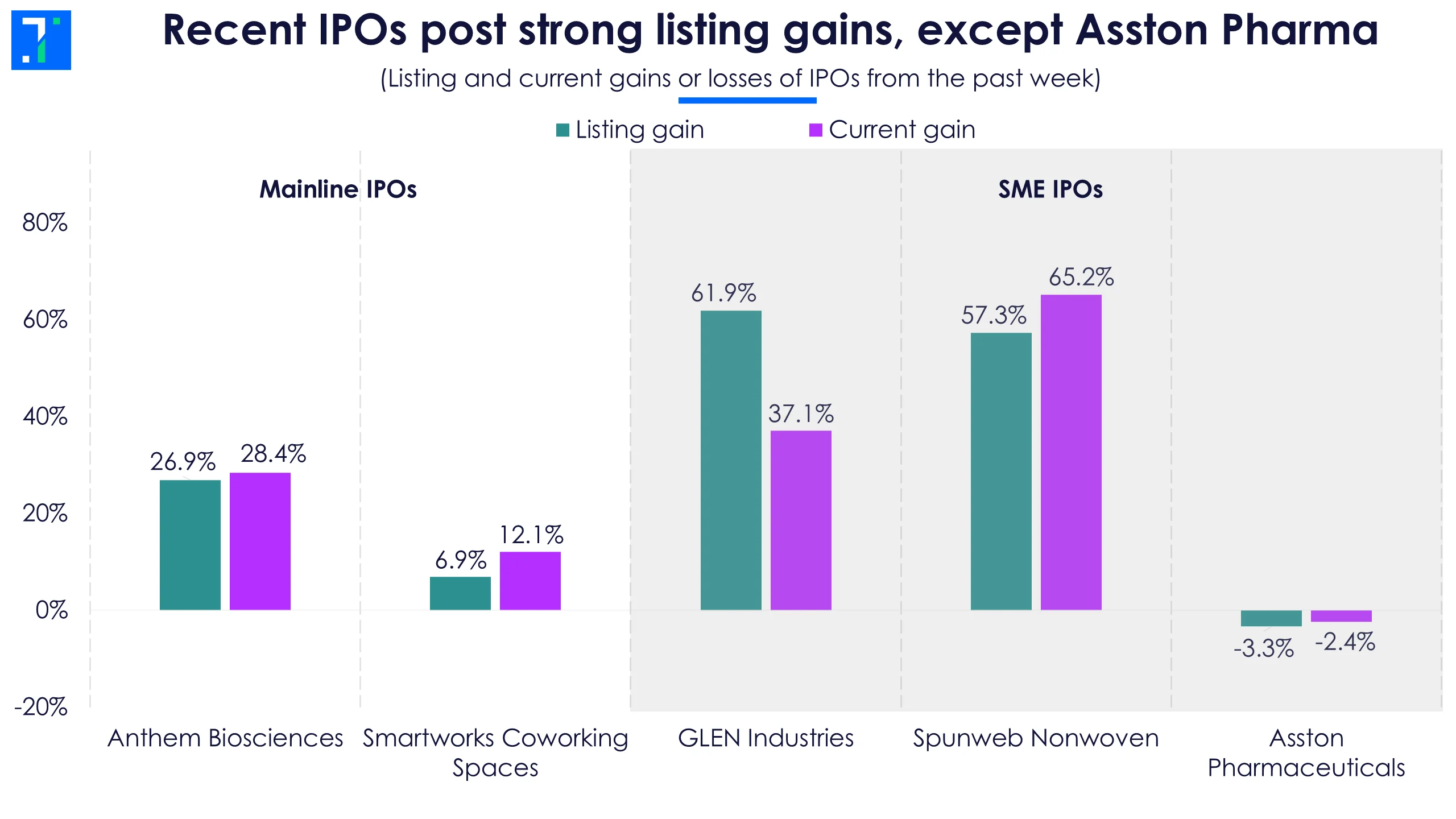

Anthem Biosciences, a pharma company, made a strong debut on July 21, listing at a 26.9% premium over its issue price of Rs 570. The IPO saw huge demand, especially from HNIs and retail investors, with subscriptions of 484X and 333.9X, respectively. The stock is currently trading 28.4% above its issue price.

Smartworks Coworking Spaces had a more modest listing on July 17, opening 6.9% higher. The IPO was subscribed 13.4X, and the stock has since moved up further, now trading 12.1% above its issue price.

Recent IPOs post strong listing gains, except Asston Pharma

In the SME segment, GLEN Industries and Spunweb Nonwoven saw strong interest. GLEN saw a 242.3X subscription and, despite dipping after listing, is now trading 37% higher. Spunweb, on the other hand, gained after listing and is currently trading 65.2% above its issue price.

Asston Pharma made a weak start, listing at a 3.3% discount despite being subscribed 173.5X. The stock is now trading 2.4% below its issue price.

Primary market gears up with eleven launches lined up this week

Property Share Investment Trust, a SEBI-registered REIT focusing on small and medium-sized properties, opened its Rs 473 crore IPO on July 21, which will close on July 25. The issue is priced between Rs 10 lakh and Rs 10.06 lakh per share, with listing scheduled for August 4.

The high issue price compared to regular IPOs is because each unit represents a share in a large, income-generating commercial property, not just a small equity stake like in most traditional company IPOs. The investors expect a 9% annual yield, which is derived from the rent paid by tenants occupying the property. It is distributed regularly and works like a dividend, giving investors a share of the rental income generated by the commercial asset.

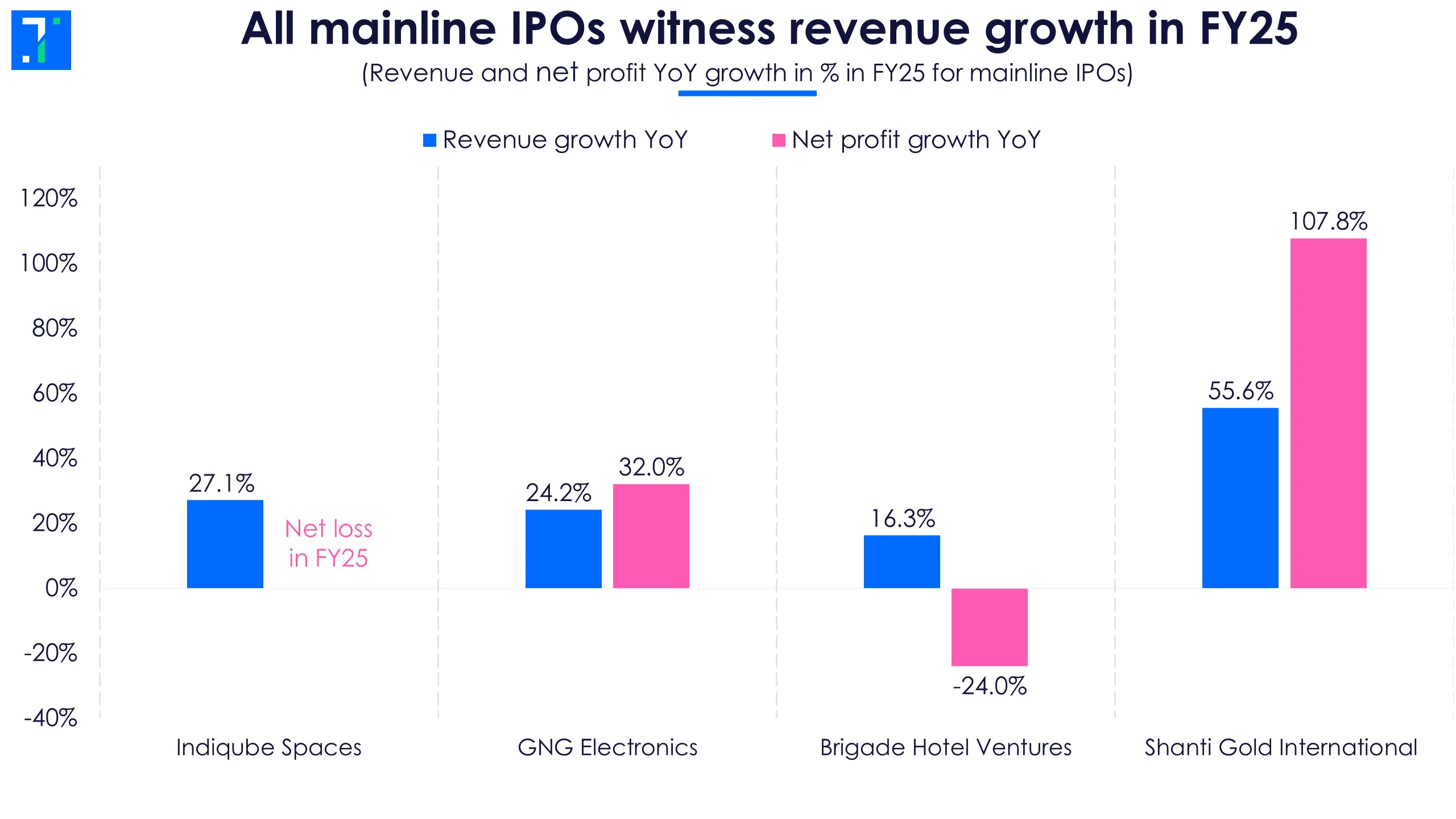

All mainline IPOs witness revenue growth in FY25

Indiqube Spaces, a workspace solutions provider, will open its IPO on July 23 and close it on July 25. The shares are priced between Rs 225–237 each, and the company plans to raise Rs 700 crore, of which Rs 650 crore is a fresh issue and the rest is an offer for sale. The stock is expected to debut on the exchange on July 30.

Indiqube offers fully-equipped, plug-and-play offices and workspace services to businesses. In FY25, it reported a net loss of Rs 139.6 crore, narrowing from Rs 341 crore in FY24.

GNG Electronics, a computer hardware company offering refurbishing services for laptops, desktops, and other ICT devices in India and abroad, will open its Rs 460.4 crore IPO on July 23. The issue will close on July 25 and list on July 30. Of the total size, Rs 400 crore will come from a fresh issue. The price band is set at Rs 225 to Rs 237 per share.

Brigade Hotel Ventures, a wholly-owned subsidiary of Brigade Enterprises, is coming out with a Rs 759.6 crore IPO consisting entirely of a fresh issue. The IPO is set to open on July 24 and close on July 28, with the listing scheduled for July 31. The company develops and operates hotels across key cities in South India.

Shanti Gold International, a manufacturer of gold jewellery, will open its IPO on July 25 and close it on July 29. Listing is expected on August 1. The company specialises in making 22 karat casting gold jewellery, focusing on quality craftsmanship and design.

Two SME IPOs opened for subscription on July 21 and will close on July 23, with listing scheduled for July 28.

- Swastika Castal is looking to raise Rs 14.1 crore through a fresh issue, with shares priced at Rs 65 each.

- Savy Infra & Logistics plans to raise Rs 70 crore through a fresh issue, offering shares in a price band of Rs 114–120.

Three more SME IPOs are set to open this week.

- Monarch Surveyors & Engineering Consultants will open its IPO on July 22 and close on July 24, aiming to raise Rs 93.8 crore in a price range of Rs 237–250. Listing is scheduled for July 29 on BSE SME.

- TSC India will launch its Rs 25.9 crore IPO on July 23, close on July 25, and list on July 30 on NSE SME. The shares are priced in the range of Rs 68–70.

- Patel Chem Specialities and Sellowrap Industries will open their IPOs on July 25 and close on July 29. Patel Chem aims to raise Rs 58 crore with a price band of Rs 82–84 per share, while Sellowrap’s pricing details are yet to be announced. Both companies are expected to list on August 1.

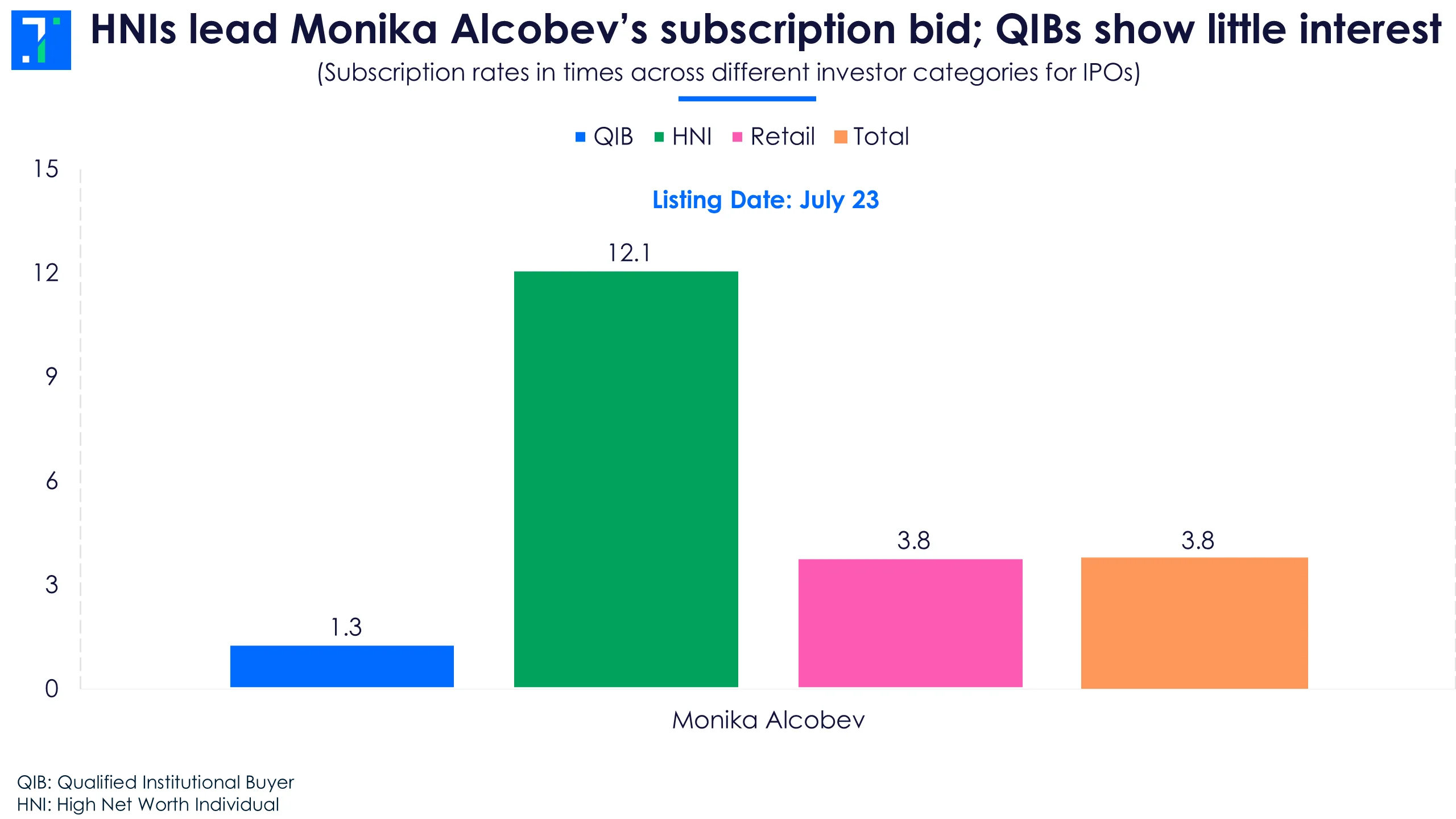

Moderately subscribed Monika Alcobev to list on July 23

Monika Alcobev, an importer and distributor of premium alcoholic beverages across India and nearby regions, launched its IPO on July 16, which closed on July 18. The stock is scheduled to list on the BSE SME platform on July 23. The IPO was subscribed 3.8X overall, with the HNI portion seeing the highest demand at 12.1X.

HNIs lead Monika Alcobev’s subscription bid; QIBs show little interest

The company plans to use the funds to meet working capital needs, repay certain loans, and for general corporate purposes. In FY25, its revenue rose 25% to Rs 238 crore, while net profit grew 39%