Pharmaceutical companies had a dream run in FY21 and some are expected to carry that momentum into FY22. Cipla is one of them because of its strong respiratory drug portfolio. With its goal of being the ‘lung leader’ in the industry, Cipla was well poised in FY21 both in India and abroad to handle the Covid-19 pandemic.

As Cipla enters FY22 amid a second wave in the country, investors are optimistic. The second wave, unfortunate as it is, has put Covid-19 drug producers back in the spotlight. Cipla accounts for 20% of India’s remdesivir production capacity and it has ramped up production by 5X in Q1FY22. But Cipla’s sales in the Indian and US markets fell sharply in Q4, and there is unlikely to be a bounce back in Q1FY22.

Will the poor sales in two of Cipla’s biggest markets dampen its FY22 performance, or can the Covid-19 drug portfolio make up for this expected decline?

Revenues decline after two quarters, net profits take a beating

In Q4, Cipla’s revenues grew by 7% YoY to Rs 4,585 crore. However, after three quarters of consistent revenue growth (from Q1FY21-Q3FY21), revenues declined in Q4 by 11% QoQ. This was due to a high base in Q3 because of strong demand in the US markets for Cipla’s respiratory drugs and a revival in the Indian market as doctor and clinic visits increased. Net profits grew by 72% YoY in Q4 to Rs 411 crore due to a lower tax rate in FY21.

Cipla entered the albuterol market two years ago and had a pricing advantage. This advantage was however, wiped out in FY21 as Swiss pharma company Novartis entered the US albuterol market. Novartis’ priced its albuterol drugs 18% lower than Cipla. This forced Cipla to write off inventories worth Rs 113 crore in Q4FY21, to make up for Novartis’ pricing advantage. Since Cipla took this price cut in Q4, inventory expenses rose 3x QoQ. EBIT margins were 18.7%, higher by 180 basis points YoY.

Albuterol US market share likely to erode in FY22

Albuterol US market share likely to erode in FY22

In the US, Cipla has a 16% share in the albuterol market and an 85% share in the proventil market. Proventil is the generic version of albuterol, a respiratory drug used to treat asthma and chronic pulmonary diseases. Cipla’s market leadership position in the US market in albuterol and proventil helped it record a 17% YoY growth in US sales to Rs 1,006 crore in Q4. But from Q1FY21 to Q4FY21, Cipla’s US revenues from albuterol declined by 2%, and its US market share in albuterol grew by 10 percentage points in that time.

Cipla’s albuterol dominance in the US market in FY21 has not added to its revenues, and the entry of new competitors is forcing it to take price cuts. In Q1FY21, Lupin launched albuterol, forcing Cipla to cut prices for the first time in FY21. Then, in March 2021, Novartis’ US subsidiary Sandoz launched albuterol, forcing Cipla to cut prices again.

The management stated that the pricing pressure from Sandoz’s entry into the US albuterol market will remain stable in FY22. However, concerns remain about pricing pressures in Cipla’s US market for albuterol. Brokerages suggest that if new players launch albuterol and proventil, Cipla will likely cut prices again in FY22.

While the management refrained from providing any revenue guidance for the US market, they said the Q4FY21 number (Rs 1,000 crore) would be the base in each quarter of FY22, backed by new albuterol launches. However, Umang Vohra, CEO at Cipla said in the Q4 earnings call that Cipla will prioritize new drug launches in FY23, not FY22, in the US albuterol market.

India revenues decline sharply in Q4

Cipla entered Q4FY21 on the back of a steady recovery in Indian sales in the previous quarter. This was due to doctor and clinic visits picking up as outdoor movement increased. Cipla’s domestic sales in Q3 grew by 18% YoY and by 21% from pre-Covid levels. Indian sales made up nearly 40% of Cipla’s FY21 revenue.

In Q4, India sales were Rs 1,807 crore, higher by 4% YoY. On a QoQ basis, Indian sales declined by 19% as the quarter ended March 2021 is a seasonally weaker quarter compared to Q3 due to warmer weather conditions.

The only positive in the Indian operations was its Covid-19 portfolio. Cipla produces three Covid-19 drugs - remdesivir, tocilizumab, and favipiravir which are used to treat mild to moderate cases of Covid-19. Cipla’s remdesivir production capacity was 7.6 lakhs vials a month which is 20% of India’s total remdesivir production capacity as of March 2021. Due to the second Covid-19 wave, the demand for remdesivir increased in late Q4FY21 and in Q1FY22. In order to cater to this demand, Cipla increased its remdesivir production capacity by 5x to nearly 35 lakh vials a month in April 2021.

In addition to this, Cipla expanded its Covid-19 drugs portfolio. In April and May 2021, Cipla secured approvals from foreign drug makers to produce and distribute molnupiravir, (an oral antiviral drug), baricitinib (a rheumatoid arthritis treatment drug), and antibodies casirivimab and imdevimab in partnership with MSD Pharmaceuticals, Roche, and Eli Lilly. On May 24, Cipla launched the antibody mix of casirivimab and imdevimab in partnership with Roche, priced at Rs 59,750 per dose.

In Q4FY21, Cipla’s revenues from Covid-19 drugs were Rs 137 crore (5% of total sales), a decline of 46% from Rs 256 crore in revenues in Q3. The share of the Covid-19 portfolio in Cipla’s Indian sales is expected to increase because of rising demand, increase in remdesivir production, and the portfolio’s expansion. Kedar Upadya, Cipla’s Chief Financial Officer in the Q4 earnings call said Covid-19 tailwinds will “play out in Q1 and onwards” expecting a surge in demand for remdesivir, casirivimab, and imdevimab due to the second Covid-19 wave.

Cipla cuts remdesivir price, expected growth priced in

The management expects Cipla’s Covid-19 drug portfolio to grow in Q1FY22 given strong demand, but this growth is unlikely to add to its bottom line.

In April, during the peak of the second wave, Cipla decreased the remdesivir price by 25% to Rs 3,000 per vial from Rs 4,000 per vial in Q4FY21. All seven domestic remdesivir companies (Cipla, Cadila Healthcare, Syngene International, Dr. Reddy’s Laboratories, Mylan Laboratories, Jubilant Ingrevia, and Hetero Drugs) slashed their remdesivir prices on the central government’s orders. However, Cipla’s cut prices the least among remdesivir makers.

The demand for remdesivir continues to stay elevated in Q1FY22, as it did in Q4FY21 because of increasing Covid-19 cases in India. But brokerages expect increased sales of remdesivir will not boost Cipla’s EBIT margins for three reasons. First, the price cuts will decrease any margin growth from the Covid-19 drugs portfolio. Second, the Covid-19 drugs are low margin products because Cipla has to pay a licensing fee to foreign pharmaceutical companies to produce them. Third, because of the higher demand for remdesivir globally, there is a decrease in the supply of its raw material beta cyclodextrin.

The demand for remdesivir continues to stay elevated in Q1FY22, as it did in Q4FY21 because of increasing Covid-19 cases in India. But brokerages expect increased sales of remdesivir will not boost Cipla’s EBIT margins for three reasons. First, the price cuts will decrease any margin growth from the Covid-19 drugs portfolio. Second, the Covid-19 drugs are low margin products because Cipla has to pay a licensing fee to foreign pharmaceutical companies to produce them. Third, because of the higher demand for remdesivir globally, there is a decrease in the supply of its raw material beta cyclodextrin.

While the increased remdesivir production does bode well for the Covid-19 situation, Cipla’s stock is unlikely to see any boost. Even before Cipla expanded its remdesivir production capacity, the markets turned optimistic on the stock. This led to a 25% rise in Cipla’s stock price in March and April 2021. As cases began to decline in May, so did Cipla’s stock, declining by 8% since the high last month. Motilal Oswal, in a note, said any upside from higher Covid-19 drug sales is already priced in.

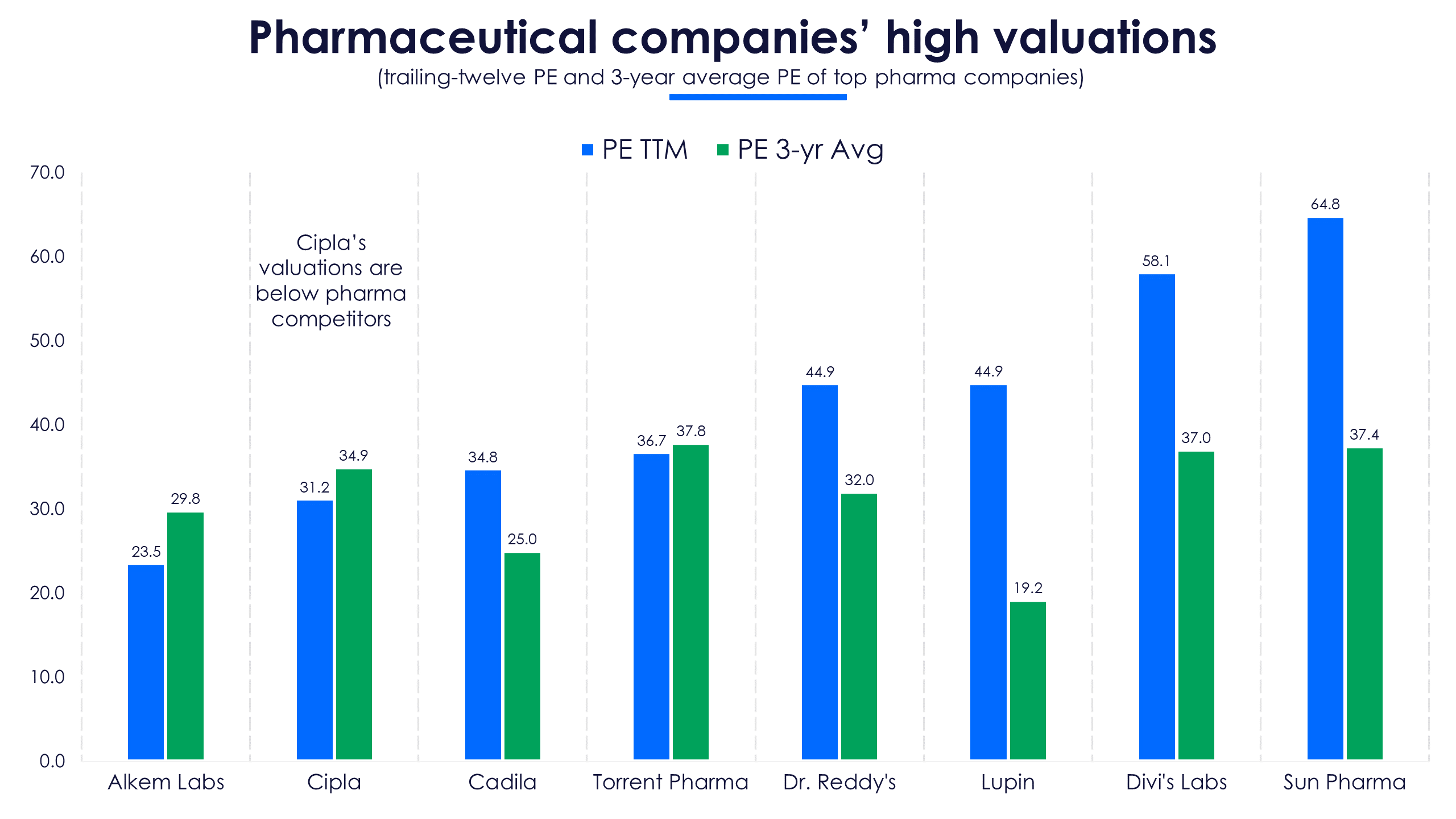

Cipla’s trailing 12-month (TTM) price-to-earnings (PE) ratio is nearing its three-year average but remains below other companies in the Nifty Pharma index.

Cipla is heading into FY22 with reducing sales momentum. The India business’ revenues are falling. The second Covid-19 wave will decrease doctor and clinic visits and hence sales are expected to be lower in Q1FY22, compared to Q4FY21. The albuterol market share gain is not adding to revenues because of pricing pressure. Lastly, the Covid-19 drug portfolio is expanding but it still remains insignificant (3% of total revenues) and is unlikely to add to the company’s margins. With these factors at play, investors in this respiratory drug maker may be short of breath in FY22.