By Vivek Ananth

HCL Tech had a tough Q4FY21. There is no other way to skirt this fact. It paid out a one-time bonus to employees worth 10 days' salary after crossing $10 billion revenues, and took another one-time hit to its bottom line due to changes in tax laws.

Although it is couched in celebration, the one-time bonus to employees was to …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

HCL Tech had a tough Q4FY21. There is no other way to skirt this fact. It paid out a one-time bonus to employees worth 10 days' salary after crossing $10 billion revenues, and took another one-time hit to its bottom line due to changes in tax laws.

Although it is couched in celebration, the one-time bonus to employees was to keep its flock intact. Talent with good skills is scarce, and every IT services company wants to keep its attrition low as the Indian tech sector boosts hiring. The company has managed to cap its attrition at 9.9% (yearly basis) at the end of March 2021 quarter.

As they say, the stock price is the best indicator of what is to come. Over the past one week, HCL Tech’s stock price fell 5.6% in anticipation of bad results. The company’s net profit fell to Rs 1,111 crore compared to Rs 3,977 crore. The one-time bonus (Rs 243 crore in Q4) and tax expenses, deferred and current (Rs 1,333 crore in Q4), due to reversal of a tax law that allowed goodwill on mergers and acquisitions to be amortised, led to a significant fall in the company’s net profit.

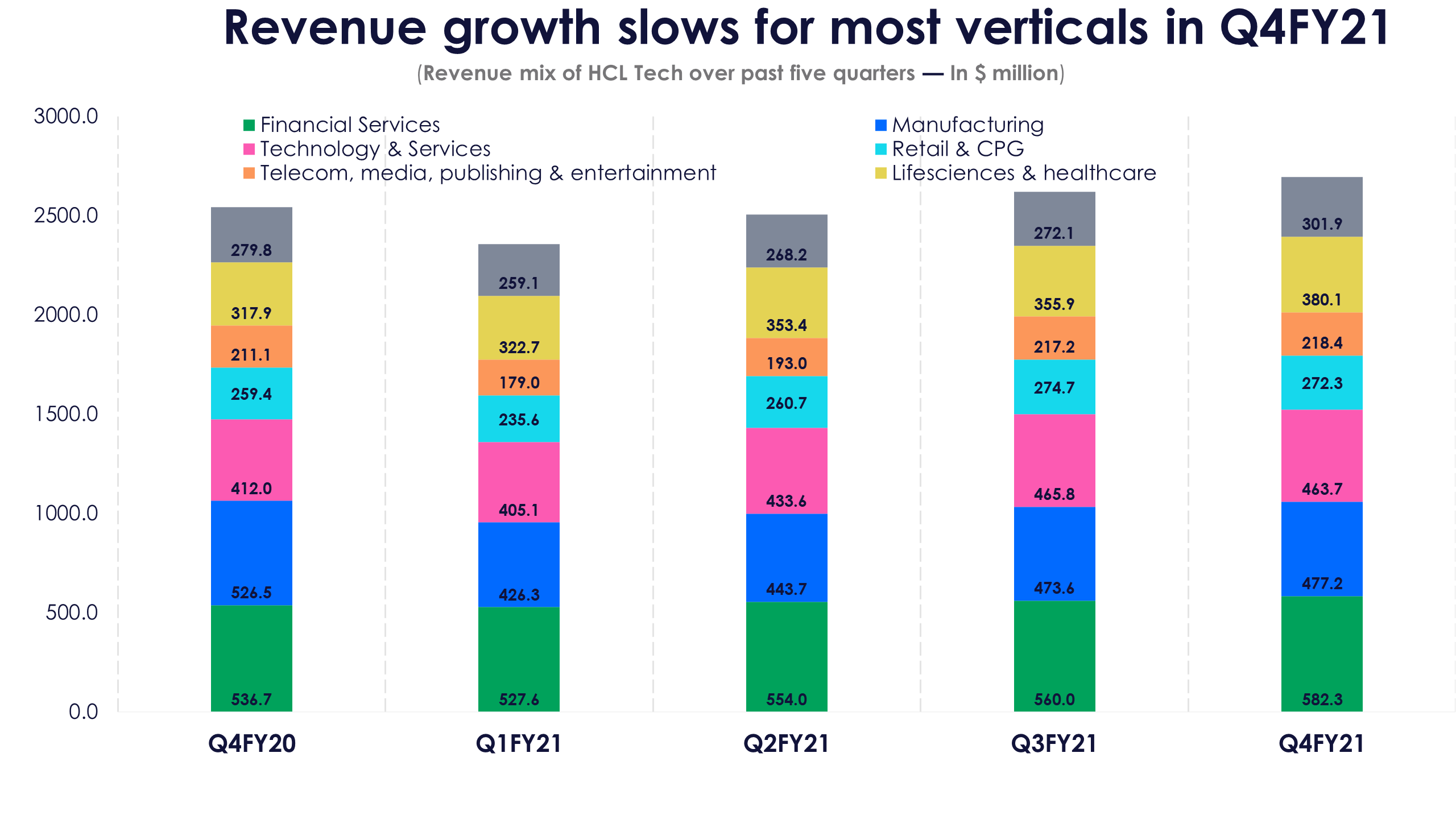

Tepid revenue growth from many verticals

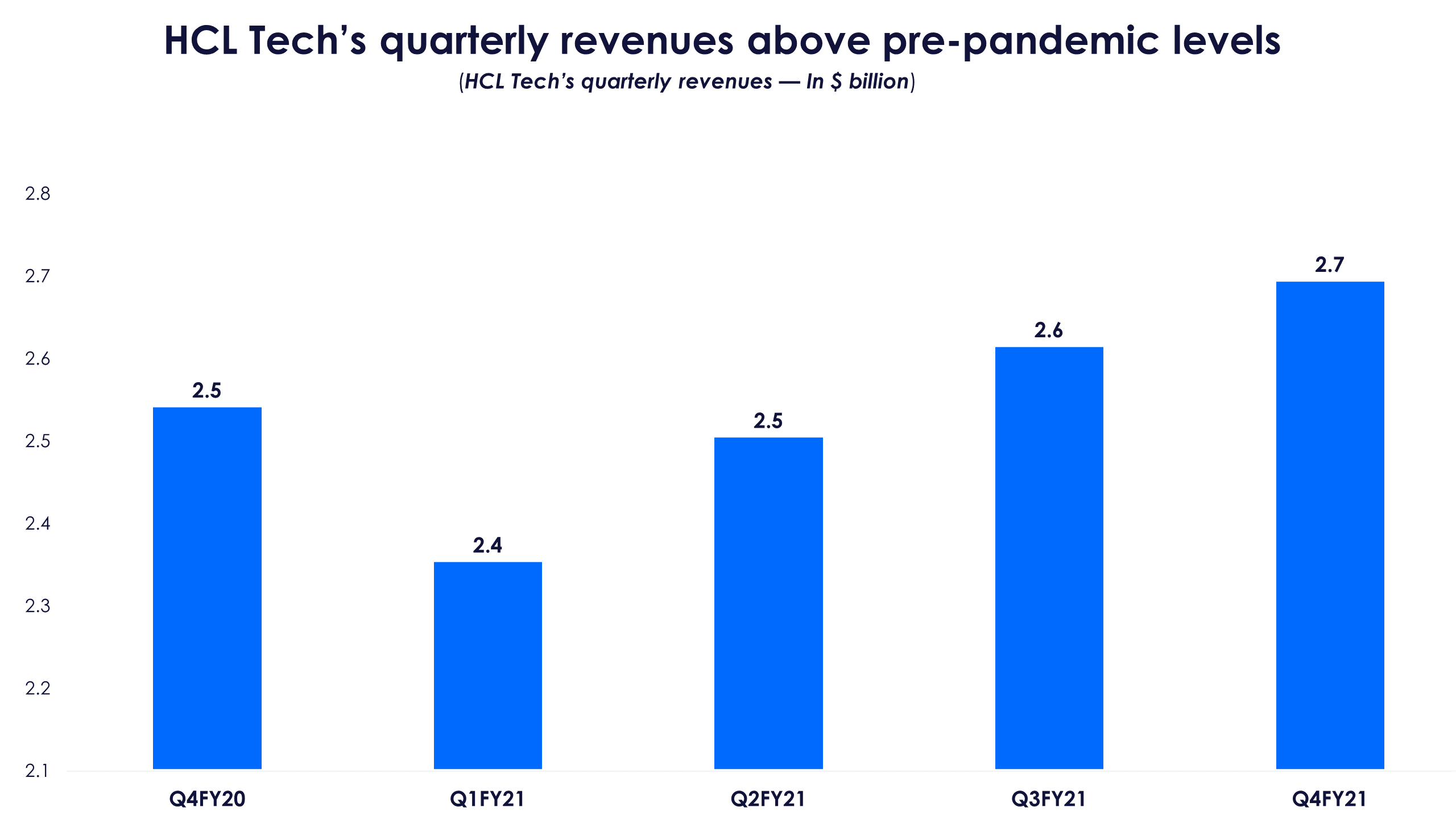

HCL Tech managed to meet the midpoint of its quarterly revenue guidance in constant currency terms at 2.5% (constant currency eliminates effects of currency rate changes). In pure dollar terms, this works out to around 3% QoQ growth. Its Q4FY21 revenue is higher than Q4FY20 by around 6%, showing resilience in the business.

The fact that the company managed to meet its revenue growth guidance despite Q4 being a seasonally weak quarter, is commendable This seasonal weakness has been especially visible in its products and platforms business. This being a high-margin segment, higher revenues aid rise in profitability. The revenues from this business almost doubled in seven quarters till Q3FY21 (vis-a-vis Q1FY20). Q4FY21 though, saw revenues in dollar terms fall nearly 5% sequentially in Q4FY21.

The fact that the company managed to meet its revenue growth guidance despite Q4 being a seasonally weak quarter, is commendable This seasonal weakness has been especially visible in its products and platforms business. This being a high-margin segment, higher revenues aid rise in profitability. The revenues from this business almost doubled in seven quarters till Q3FY21 (vis-a-vis Q1FY20). Q4FY21 though, saw revenues in dollar terms fall nearly 5% sequentially in Q4FY21.

What is worrying though is that except for financial services, life sciences & health, and public services verticals, all others saw revenues fall or remain flat. The management attributed this to seasonality.

On the road to double-digit growth in FY22, but how much?

On the road to double-digit growth in FY22, but how much?

It is not all gloomy however for HCL Tech. The company has bagged the highest ever new deals of $3.1 billion. This gives it a good runway for future growth in FY22. The management also indicated that they expect revenues to grow in double-digits in FY22 over FY21 (in constant currency terms).

But management didn’t specify a range or a band. This left analysts confused during HCL Tech’s post earnings conference call. An analyst from UBS pressed for more clarity. The company’s management explained that they still have to ‘work out the contours’ of the various deals they have won and the acquisitions that they made during Q4.

However, they expressed confidence in posting double-digit revenue growth in the coming financial year. From the over $10 billion revenues that it has posted in FY21, a 10% rise can lead to a minimum additional $ 1 billion topline.

New investments dent margin guidance

What might leave investors bemused is the muted margin guidance of 19-21% the company has given for FY21. After reporting above average margins for most quarters in FY21, HCL Tech’s guidance for FY22 might leave investors wanting more.

The long wait for parity of HCL Tech’s valuation with its peers like TCS, Infosys and now Wipro, will persist for sometime at least. This is what we saw in the company’s share price taking a beating before its results were announced.

The gains in margins due to savings in costs due to cost control measures will be reinvested in future growth. The company’s CEO told analysts that “this is not the time to maximise profits”. What he didn’t say was his sole focus seems to be on targeting large growth opportunities.

HCL Tech’s management says that they are making investments in various new geographies in Asia, after spending a few years ramping up its presence in Europe. The investments in France and Germany have paid off, the management said. It will be interesting to see how this strategy plays out over the next 12 months.

HCL Tech’s management says that they are making investments in various new geographies in Asia, after spending a few years ramping up its presence in Europe. The investments in France and Germany have paid off, the management said. It will be interesting to see how this strategy plays out over the next 12 months.

The company has also launched a CloudSmart business which will leverage its expertise in the technology infrastructure management space to take advantage of the cloud services space. The management said this opportunity is expected to be worth $ 300 billion till 2023. The idea is that HCL Tech uses its expertise in various verticals and industry to develop HCL Now, to bring all its bouquet of services into a single cloud-based offering.

Analysts had been pointing to this opportunity in vague terms in their earnings preview notes. The company’s announcement is just confirming this. But, everyone is talking about cloud services opportunities over the next few years.

Be it HCL Tech’s peers, or mid tier IT services companies. It would be interesting to see how HCL Tech manages to ride this wave of investments that are expected across various industries in cloud-based services.

Although it’s in the pole position in terms of ability and experience (due to its expertise in infrastructure management services), the company will have to compete in the marketplace for both talent and new deals. This is what puts the CEO’s comment about profitability in perspective for investors. The CFO committed to paying Rs 6 per share dividend every quarter, up from the previous norm of around Rs 2 per share.

Whether all this manages to bridge the gap in terms of valuation, and reward existing shareholders adequately in the future remains to be seen.