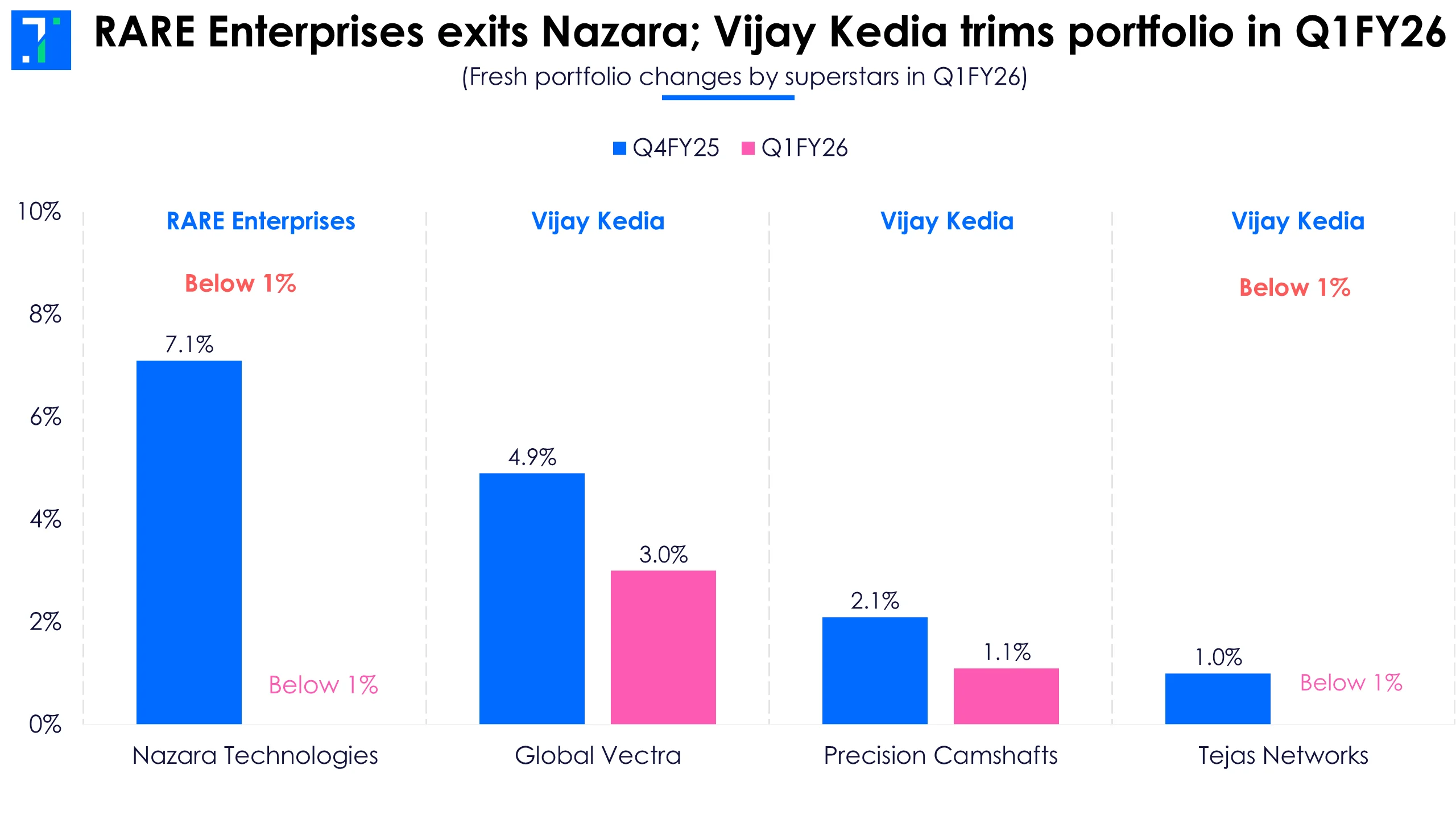

Superstar investors scaled back their portfolios in the first quarter of FY26 amid market uncertainty and a muted outlook overall. Rakesh Jhunjhunwala’s portfolio, currently managed by Rekha Jhunjhunwala and RARE Enterprises, sold its entire 7.1% stake in gaming and esports firm Nazara Technologies during the quarter.

RARE Enterprises exits Nazara; Vijay Kedia trims portfolio in Q1FY26

The portfolio had been steadily reducing its holding in the company since Q3FY23. Jhunjhunwala had invested Rs 180 crore in Nazara Technologies during 2017–18, and the full stake sale is estimated at around Rs 770 crore, a return of nearly 4X.

Over the past year, the stock gained 51.1%, outperforming its industry by 10.5% points. However, Trendlyne has low scores for both its Durability and Valuation, due to a high PE ratio compared to the industry and an erratic net profit trend.

RARE Enterprises also sold a minor 0.02% stake in Valor Estate. Following these changes, the portfolio now consists of 26 stocks with a total net worth of Rs 61,424 crore.

Vijay Kedia trims holdings in three stocks, dips below 1% in one

Vijay Kedia made several changes to his portfolio in Q1, cutting stakes in multiple companies. He reduced his stake in Global Vectra Helicorp by 1.9%, bringing it down to 3%. Trendlyne classifies the stock as ‘Slowing Down’ due to its bearish Momentum score and moderate Durability and Valuation scores. The stock has declined 21.8% over the past year and currently has a negative price-to-earnings (PE) ratio.

Kedia also trimmed his holding in Precision Camshafts by 1%. He held 2.1% in Q4FY25. This auto parts maker has declined marginally by 0.2% in the past year, underperforming both Nifty and Sensex returns.

The ace investor sold his stake in Tejas Networks to below 1% in Q1, after holding 1% in the previous quarter. The stock has fallen over 54.3% in the past year and hit a new 52-week low on July 29. It ranks low on the Trendlyne checklist and has weak scores for Durability, Valuation, and Momentum.

During the quarter, he also made a minor reduction of 0.05% in Elecon Engineering Co. With these changes, Kedia now publicly holds 14 stocks, with a total portfolio value of Rs 1,224 crore.

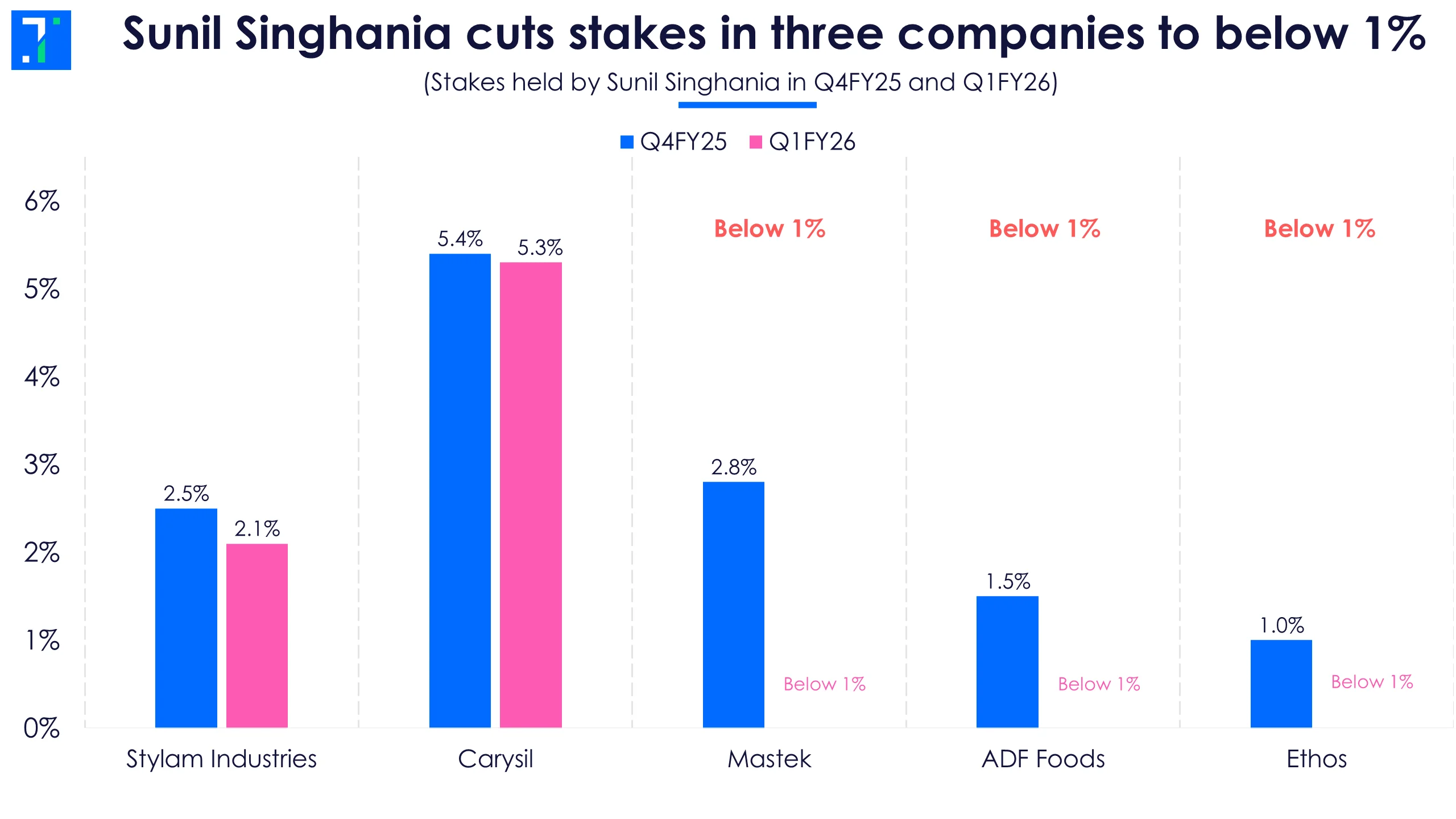

Singhania cuts holdings in five stocks in Q1FY26

Sunil Singhania cut his stake by 0.4% in Stylam Industries and by 0.1% in Carysil during Q1FY26. He now holds 2.1% in Stylam and 5.3% in Carysil. Both companies show up in a screener of stocks with expensive valuations based on their valuation scores.

Over the past year, Carysil has gained 12.8%, while Stylam has declined by 8.7%. However, both stocks have underperformed their respective industries.

Sunil Singhania cuts stakes in three companies to below 1%

During Q1, Singhania also reduced his stake in three companies to below 1% — Mastek, ADF Foods, and Ethos. He held a 2.8% stake in Mastek at the end of Q4FY25. During the quarter, promoters also lowered their shareholding in this IT consulting firm.

In ADF Foods and Ethos, he brought down his holdings to below 1% from 1.5% and 1%, respectively, in the previous quarter. Both stocks are currently in the PE Sell Zone. ADF Foods has risen 14.9% in the last year, while Ethos has declined 11.4%.

Additionally, Singhania made small stake reductions in J Kumar Infraprojects, Jubilant Pharmova, Ion Exchange, and Sarda Energy & Minerals. After these changes, his portfolio now consists of 19 publicly held stocks with a total value of Rs 2,267 crore.