The first quarter of FY26 has brought fresh changes to the portfolios of top investors. Ashish Kacholia added Gujarat Apollo Industries, a small-cap industrial machinery maker, to his holdings during this period. He invested around Rs 5 crore for a 1.1% stake in the company.

As soon as the news broke, Gujarat Apollo Industries' stock jumped over 14.9% in a week and touched a new high of Rs 479.4 on July 21. FIIs also raised their stake in the company, from a mere 0.01% to 0.14% during the quarter. The stock appears in a screener of stocks that outperformed their industry during the quarter.

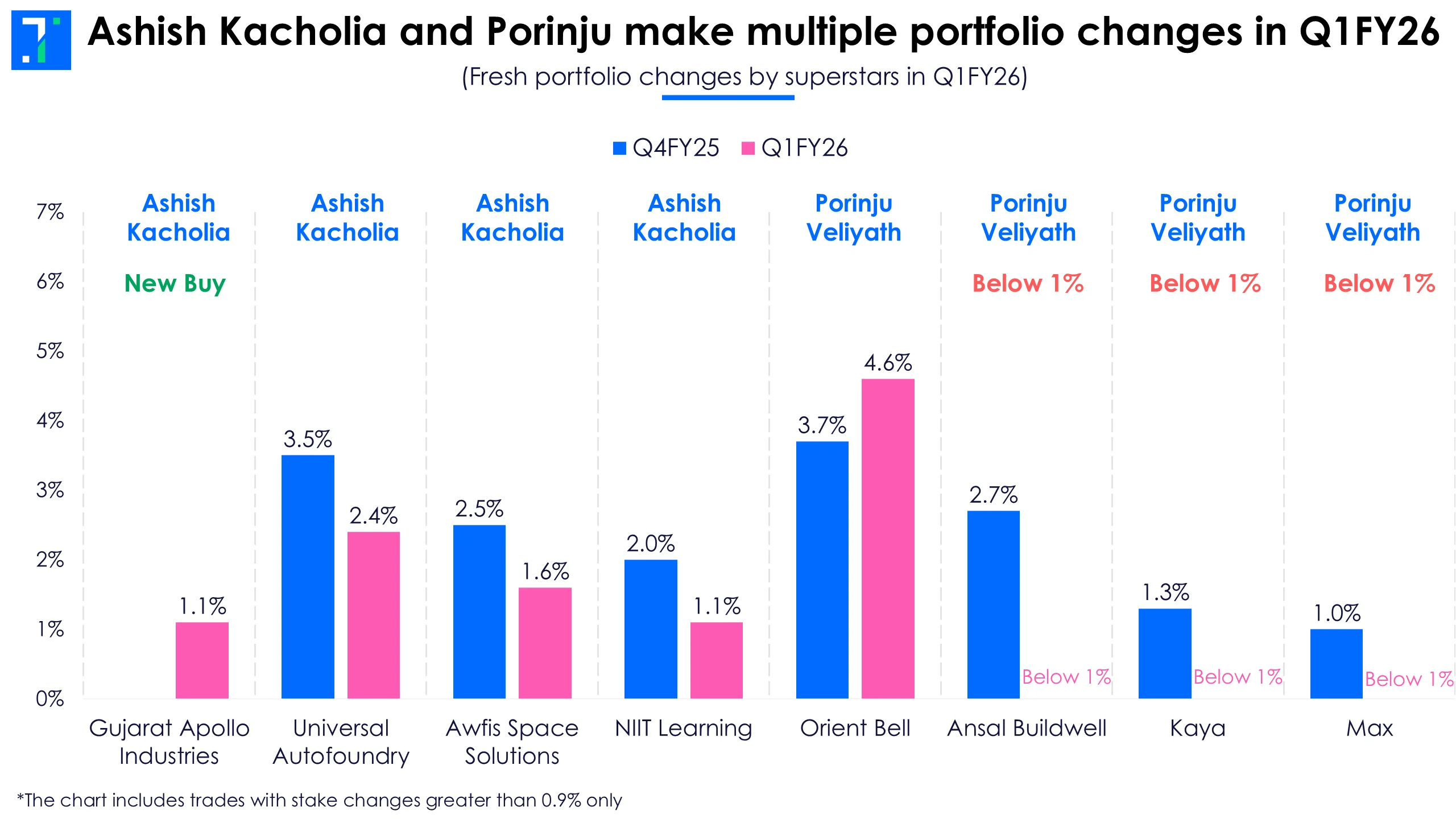

Kacholia and Porinju make multiple portfolio changes in Q1FY26

During the quarter, Ashish Kacholia sold a 1.1% stake in auto parts maker Universal Autofoundry, bringing his holding down to 2.4%. The stock is currently trading in the PE Buy Zone, indicating that it is trading at a cheaper valuation. Over the past year, it has declined by over 59%.

In Q4, Kacholia trimmed his holdings in Awfis Space Solutions and NIIT Learning by 0.9%. Notably, he has been steadily reducing his stake in Awfis since Q2FY25. He initially bought a 4.8% stake in Q1FY25 but now holds only 1.6%. In contrast, his stake in NIIT Learning has remained unchanged since Q1FY25.

He also reduced his stake in several other companies during Q4, including Jyoti Structures, Advait Infratech Transitions, and Acutaas Chemicals (each by 0.6%), and Thomas Scott (by 0.3%). Additionally, he marginally cut his exposure to Man Industries and Yasho Industries.

Kacholia also picked up a 0.3% stake in Agarwal Industrial Corp during Q1FY26. He also made small additions to his holdings in Tanfac Industries and Aeroflex Industries. With these changes, his portfolio now consists of 49 stocks, with a total net worth of Rs 2,753 crore.

Porinju Veliyath cuts stake in three firms to below 1% during Q1

Porinju Veliyath cut his holdings in Kaya, Ansal Buildwell, and Max to below 1% during the quarter. In Q4FY25, he held 2.7%, 1.3%, and 1% in these companies, respectively. All three stocks are listed in a screener of stocks with expensive valuations based on Trendlyne’s valuation score, and all have declined over the past year.

He also reduced his stake in Kerala Ayurveda by 0.7%. This marks the second consecutive quarter of trimming his position in the company. Trendlyne classifies this stock as being in a momentum trap.

In the June quarter, Porinju increased his stake in Orient Bell by 0.9%, taking his total holding to 4.6%. The stock has a strong Durability and Valuation score but an average Momentum score. While it has fallen 16.4% over the past year, it gained 29.4% in the last quarter. However, it underperformed its industry in both periods.

He also picked up a 0.4% stake each in Apollo Sindoori Hotels, and a 0.2% stake each in Sundaram Brake Lining and M M Rubber Company. With these changes, Porinju now publicly holds 11 stocks, with a total portfolio value of Rs 247.6 crore.

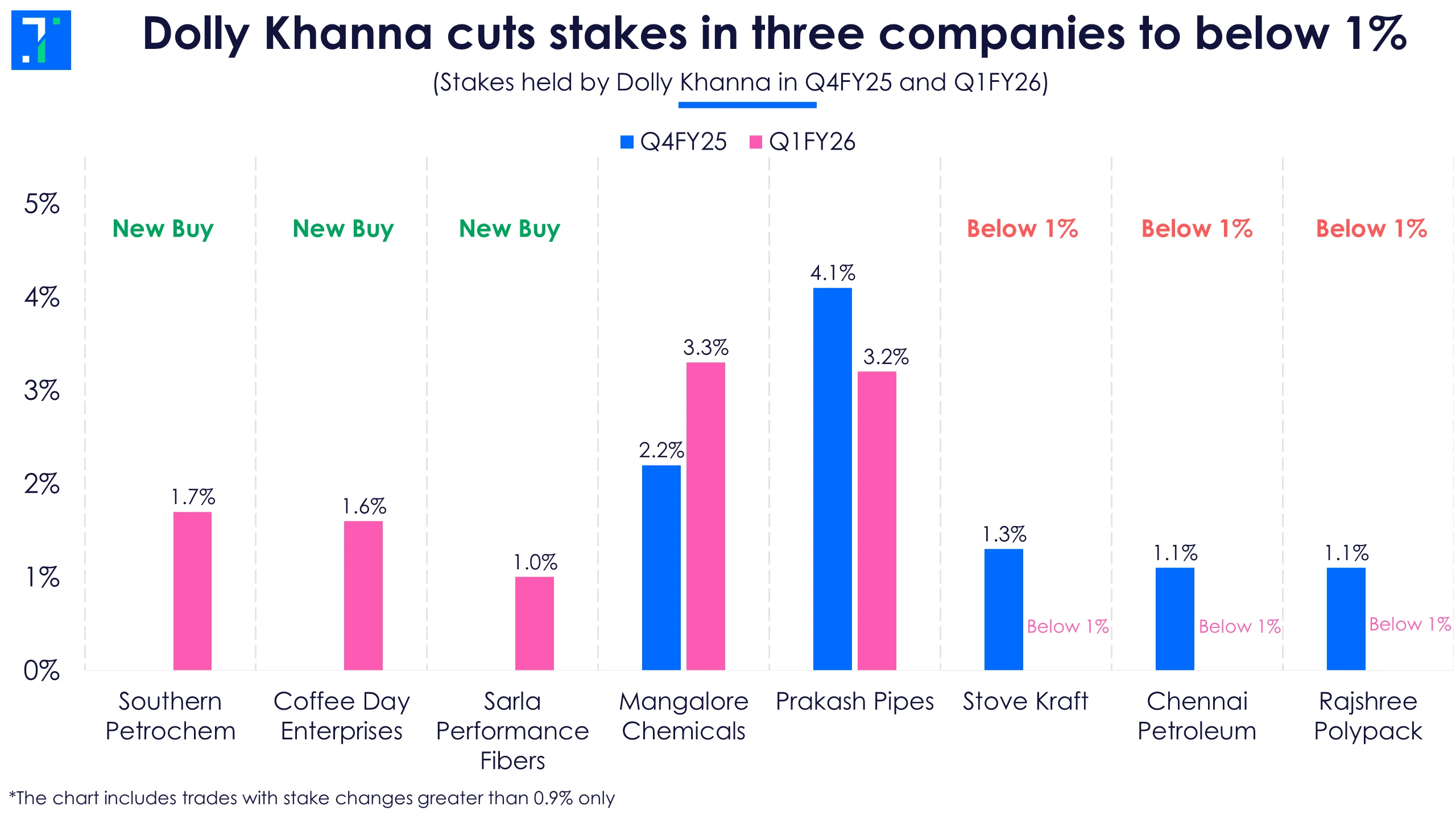

Dolly adds three new companies to her portfolio in Q1FY26

Dolly Khanna added three new companies to her portfolio in the June quarter. She picked up a 1.7% stake in Southern Petrochemicals Industries Corp, a fertilizer company, and a 1.6% stake in Coffee Day Enterprises, which operates coffee outlets.

Trendlyne classifies both companies as mid-range performers. Over the past year, Southern Petrochemicals has gained just 3.3%, while Coffee Day has fallen 24.9%.

She also bought a 1% stake in Sarla Performance Fibers, a textiles company. This stock has high Durability, Valuation, and Momentum scores, and ranks well on Trendlyne’s checklist. It has risen 19% over the past year.

Dolly Khanna cuts stakes in three companies to below 1%

Khanna increased her holding in Mangalore Chemicals & Fertilizers by purchasing a 1.1% stake, taking her total to 3.3%. It has surged 149.1% over the past year, outperforming its industry by 52.6 percentage points.

Khanna made some cuts as well. She trimmed her stake in Prakash Pipes, an SME plastic pipe maker, by 0.9%, reducing her holding to 3.2%. The stock has declined 18.1% over the past year, underperforming its industry by 10.3%.

She also reduced her holdings in Stove Kraft and Chennai Petroleum Corp to below 1%, after holding 1.3% and 1.1% respectively in Q4FY25. Both stocks are currently in the PE Sell Zone. They also appear in a screener of stocks with YoY declines in quarterly revenue and net profit.

Khanna trimmed her stake in Rajshree Polypack to below 1%. The packaging products maker has a bearish Momentum score and is currently in the PE Neutral Zone. She also reduced her holdings in Savera Industries, Polyplex Corp, Talbros Automotive Components, and Emkay Global Financial Services.

Additionally, Khanna picked up minor stakes in Som Distilleries (0.4%), 20 Microns (0.3%), and 0.2% each in Prakash Industries and Rajshree Sugars & Chemicals. She also made small purchases in KCP Sugar, Zuari Industries, and GHCL. Following these changes, Dolly Khanna’s portfolio now publicly holds 17 stocks, with a total value of Rs 568 crore.