The IT services industry is at a crossroads, with the rise of new technology like artificial intelligence, and a slowdown in traditional spending from banking and financial clients. The Q4FY24 earnings of five major IT firms - Tata Consultancy Services (TCS), Infosys, HCL Technologies (HCL Tech), Wipro, and Tech Mahindra have shown a marked slowdown in their topline. Cuts in discretionary spending, project exits, and cost optimization measures by clients have hit revenue growth.

Clients have cut spending significantly in BFSI, communication, and Hi-Tech verticals. Manufacturing, utilities, and automobiles are making new tech investments, partially offsetting the loss of revenue from traditional streams for IT companies. Higher interest rates, delayed decision-making and impending elections in the US have also taken a toll on BFSI spending.

K Kritivasan CEO of TCS said, “Clients are seeing rapid changes in technology – in artificial intelligence, cybersecurity, and multi-cloud systems. Geopolitical tensions have also led clients to reevaluate their IT spending in core areas. So there is a delay in decision making as clients want to build their technology systems which sustain these changes”.

While the industry has expressed cautious optimism, things are expected to pick up only post Q3FY25, after elections and expected interest rate cuts. Major IT firms have narrowed their guidance. Infosys slashed the revenue growth guidance for FY25 from 4-7% a year ago to 1-3% amid a challenging macro environment. TCS and HCL Tech are expected to grow around 4-5% in FY25, while Wipro is expected to increase its revenue by 1-1.5%.

While the revenue guidance has been lowered, IT giants are seeing traction with big deals. Tech firms are also working on improving margins by consolidating vendors, negative employee additions, and higher productivity.

Infosys beats profit estimates, while Tech Mahindra and HCL Tech disappoint

In the face of current challenges in the IT sector, Indian software companies have seen negative returns in the past quarter. Infosys and HCL Tech have underperformed benchmark indices over the past quarter. The sectoral Nifty IT index dropped by 13.6% and the broader Nifty 50 gained by 1.3% in the same period.

Only Tech Mahindra gives positive returns in the past quarter

Most of the IT firms reported revenues in line with Forecaster estimates, but Infosys has been an outlier. The outperformance of Infosys is on account of higher than expected other income. Infosys received a tax refund of Rs 1,935 crore in the quarter helping it to beat the Forecaster estimates.

Only Infosys significantly outperforms Forecaster’s profit estimates

Tech Mahindra’s profit was lower than Forecaster estimates as one of its clients reported bankruptcy. Tech Mahindra incurred losses due to the abrupt closure of the client account.

BFSI slowdown dampens growth, Wipro underperforms peers

IT services firms have reported muted growth in Q4FY24, due to the slowdown in key sectors like BFSI, communications, and retail. Sectors like manufacturing, utilities, and automobiles have seen increased spending activity. However, most of the IT spending has been towards high-return and cost cost-efficiency projects.

The US in particular has scaled back IT spending, while Europe has seen spending in the manufacturing segment. UK projects are primarily in cost optimization. Indian IT majors are also exploring new markets in Africa and Asia to reduce their dependence on the US.

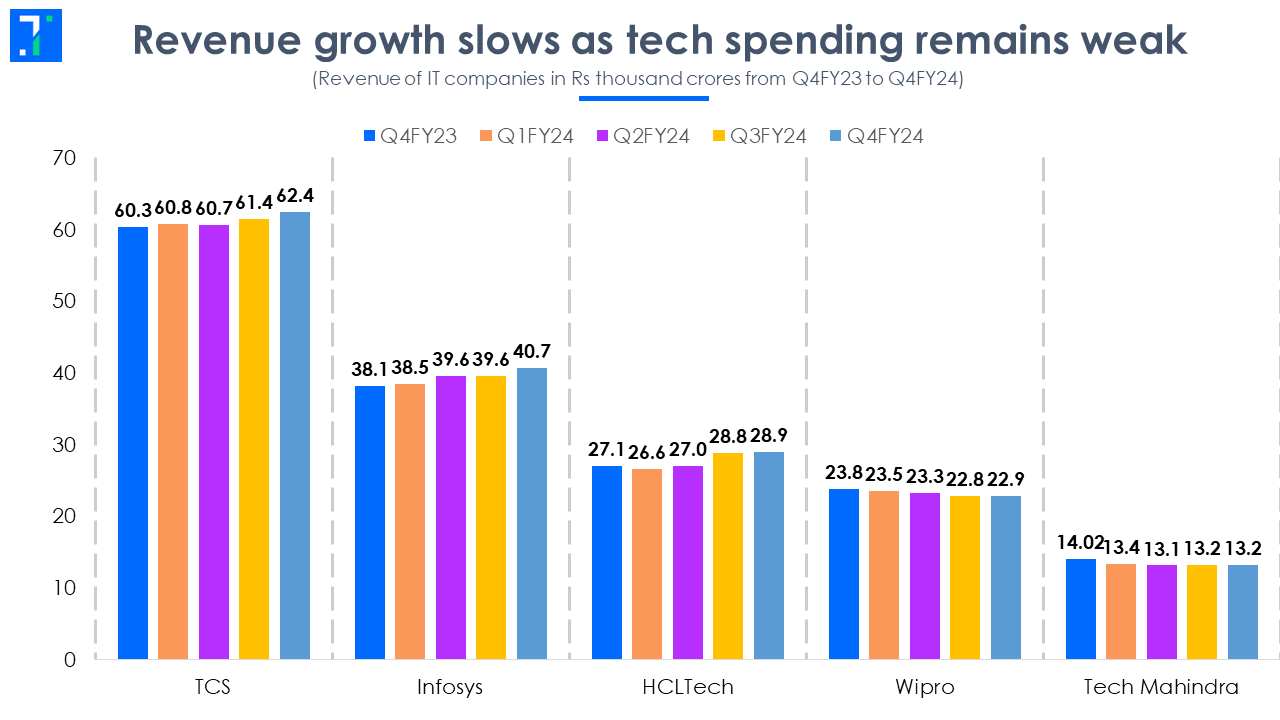

Revenue growth slows as tech spending remains weak

To help revenue growth, IT firms with large cash on their balance sheets are looking at acquisitions. For instance, Infosys acquired In-Tech (for Euro 450 million), an engineering R&D service provider with clientele in the European automotive sector. Wipro also acquired a 60% stake in US-based insurance technology firm Agnee for $66 million. The acquisitions are expected to provide a platform for deal wins in these segments along with added revenue growth.

Deal pipeline remains steady backed by large orders

Deal wins for the quarter have been strong for the quarter. Q3 was a dull quarter due to furloughs, and most orders got postponed to Q4. The quarter saw many large deal signings. Nearly 40 - 45% of deals signed are new deals, while the remainder are towards extension/renewal of the old deals. According to Infosys CEO Salil Parekh, “Most of the large deals have been towards cost reduction, increasing efficiency, and product consolidation”.

Deal pipeline steady for large IT firms in Q4FY24

TCS secured deal wins through vendor consolidation in the BFSI and communication segment, while Wipro gained new orders from its recent acquisitions, including Capco, Rizing, and Designit. Infosys deal wins have been in services like SAP S4 and Hana implementation.

Lower attrition rates and negative employee additions help in margin expansion

As revenue streams tighten, firms are looking at cutting down on costs. The attrition rate which was a major concern at the start of FY24, has seen a significant drop in the second half of FY24. Firms are retaining in-house talent by offering them added benefits and promoting them to newer positions.

Attrition rates decline for top tech players

This quarter saw a notable drop in attrition rates across most firms, with an average decline of around 36 bps QoQ. Firms like Infosys have seen a net negative employee addition in FY24 for the first time in the past 23 years. Infosys and Wipro have seen a decline in campus placements in FY24.

HCL tech sees positive employee addition in Q4FY24

While lower attrition rates and negative additions can benefit margins, they also highlight the underlying problem of constrained revenue streams in the industry.

Firms stress margin expansion and cost optimization measures

As the topline slows down, IT firms are working towards increasing profitability by margin expansion. Firms are undertaking vendor consolidation and lowering subcontractor costs to help margin growth. However, these measures may have reached optimum levels, with limited room for further cost cuts. Some margin expansion is expected from higher resource utilization and improved on-site mix. Infosys has improved its resource utilization from 80 bps QoQ to 82.5% and is expected to reach around 84-85% in FY25.

EBIT margins improve for TCS, Wipro, fall for HCL Tech

Infosys margins were impacted by 100 bps due to the renegotiation of a large deal. HCL Tech margins saw contraction on account of seasonality and wage hikes.

Firms like Infosys and Wipro expect margins to expand further by another 100 - 200 bps, while TCS expects it to be range-bound. Tech Mahindra is expected to double its margins in the next three years.

The first half of FY25 will be challenging amid weak macros

Earnings for top IT firms in Q4FY24 have indicated a slowdown in the top line. The trend is expected to continue further into the first half of FY25 until the rate-cut cycle begins. The BFSI segment is expected to see traction after the rate cuts. Firms are looking at alternative business segments but the momentum has been in terms of small deals.

According to Mohit Joshi, CEO of Tech Mahindra, “It's important to look for other sub-verticals that are doing good at the moment. Asset management, wealth management, digital payment systems, etc are expected to be new growth drivers”

Even TCS is looking at new segments like generative AI, cybersecurity, embedded finance, and green transition to offset the slowdown witnessed in its BFSI segment. They are also tapping into newer markets in Asia, Africa, and the Middle East for projects.

While a focus on new verticals might not result in any immediate relief, it may help in scaling revenues in the longer term. Operational efficiencies may boost margins as well. But the sector is clearly in cost control mode as its traditional cash cows are not delivering as much as they used to. The players are hunkering down amid rising interest rates, impending elections, geopolitical tensions, and the emergence of new technologies like AI.